Apologies for lower posting volume recently. I am writing a book, which will be published some time in 2017. Also, in the past week I have been in New York, which has been a harsh lesson in the impact of a falling value of the Pound. Though fortunately, I earn some money in US dollars from visits from Americans to economicshelp.org. Perhaps I will have to start writing more about the US economy in the future…

A good question is would the Pound have fallen even with a Remain vote?

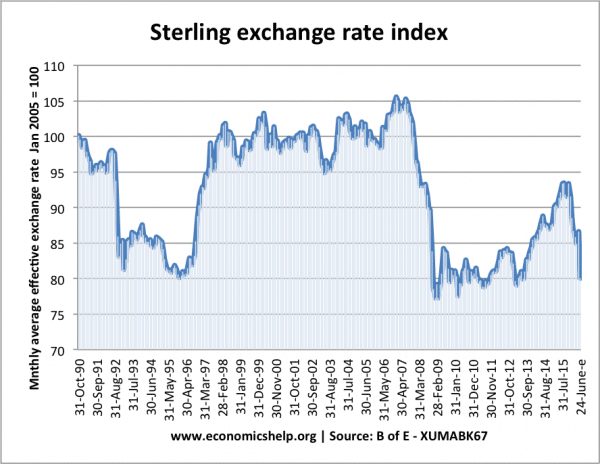

It is reasonable to point out that there were signs of the Pound being overvalued, even before the vote.

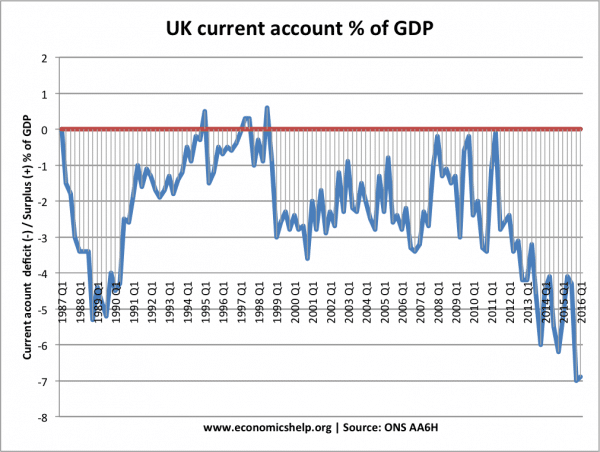

1. Current account deficit

The current account deterioration is a reflection of the UK’s unbalanced economy – importing more than we are exporting.

2. Overvalued. Back in 2014, the IMF reported it felt the Pound was overvalued by 5-15% because of “lack of competitiveness and limited export diversification”. On a personal anecdote level, I’m always surprised how much cheaper it would be to buy a new computer in the US than in the UK. Even after the depreciation post June, it is still cheaper to buy in US. When goods are relatively cheaper in the US, there is a tendency for imports to outstrip exports.

However, Brexit has changed the economic fundamentals.

One reason the UK has been able to run a persistent current account deficit is that the UK has attracted significant capital / financial flows. This includes both net inward investment and financial portfolio flows.

Post Brexit (and this now seems to involved losing access to Single Market) both these financial flows are likely to be negatively impacted.

Impact on FDI. Outside the Single Market, the UK is less attractive as a place for foreign investment. For example, car firms like Nissan who invested in the UK did so, assuming membership of the Single Market. If the UK leaves the Single Market, it will encourage investment elsewhere in the Single Market. It makes no sense to invest in the UK, if exports to the Single Market will be more difficult. In 2014, the value of accumulated FDI in the UK – exceeded £1 trillion. It is a significant flow of money.

Some argue that, even if we end up with WTO rules, tariffs will be quite low. But, tariffs are only part of the equation. It is also about harmonisation of rules, regulations, non-tariff barriers, and access to flexible labour market (including immigration).

City of London. The city will also be adversely affected by the UK’s exit from the Single Market. It looks likely that the City could lose out from loss of passporting rights. Even if some deal is reached (which may involve the UK paying a lot of money to the EU), it’s hard not to see the UK losing out – being seen as a less attractive place for financial investment.

Pound Sterling no longer a safe haven. The Brexit negotiations which could drag on for several years, mean there will be uncertainty over the UK economy, and the Pound will be less attractive as a safe haven currency.

Conclusion

It is not unreasonable to argue the Pound was overvalued before Brexit vote. There were signs of overvaluation – especially if you look at the current account deficit. But, at the same time, the Brexit vote and the future path of leaving the Single Market has fundamentally changed the valuation of the Pound. Outside the Single Market, the UK will attract less investment (FDI and portfolio) at least in the medium term. Of course, it is possible in the very long-run, the UK will adapt to the changed circumstances and develop a very different economy, but this is much easier said than done.

The worrying thing is how the depreciation of 2009 did so little to boost manufacturing exports.

Related