22 June 2016

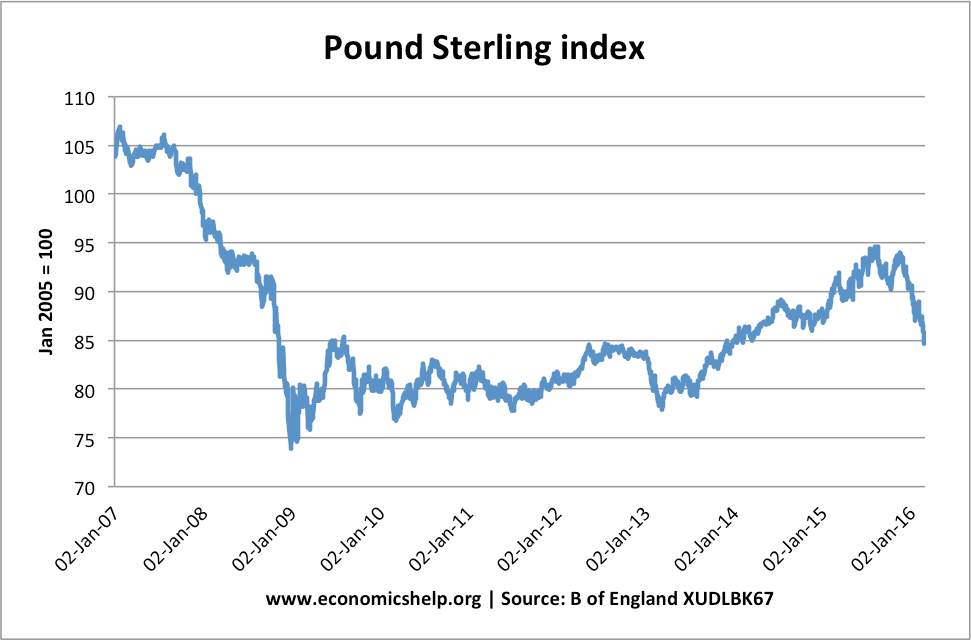

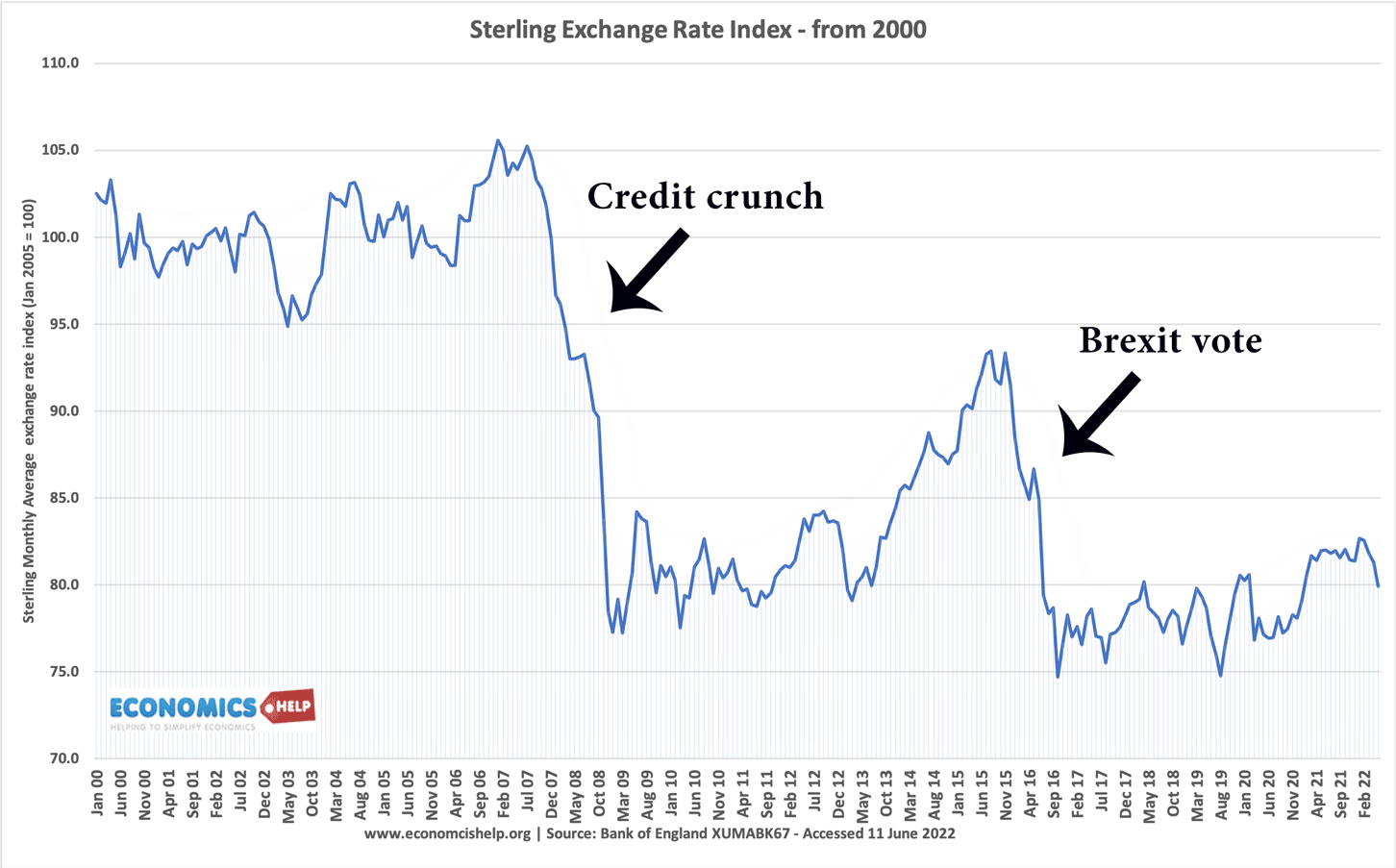

If the UK vote to leave the EU, many predict the Pound will fall significantly. Investor George Soros predicted it could be a bigger fall than in 1992 ERM crisis. Soros claims the Pound could fall by up to 20% (BBC) There are different reasons why the Pound may fall.

- Uncertainty. Leaving the EU would create uncertainty amongst investors. This would discourage both portfolio flows and inward investment.Therefore, there would be less demand for buying Pound Sterling to invest in the UK.

- Lower domestic investment. The uncertainty over the change in trading conditions may discourage domestic firms from investing, leading to lower economic growth. This lower economic growth could put downward pressure on Sterling, as lower economic growth could lead to even lower interest rates (0.5% to 0%) and further monetary easing. Lower interest rates would make UK less attractive place to save money and reduce demand for Sterling.

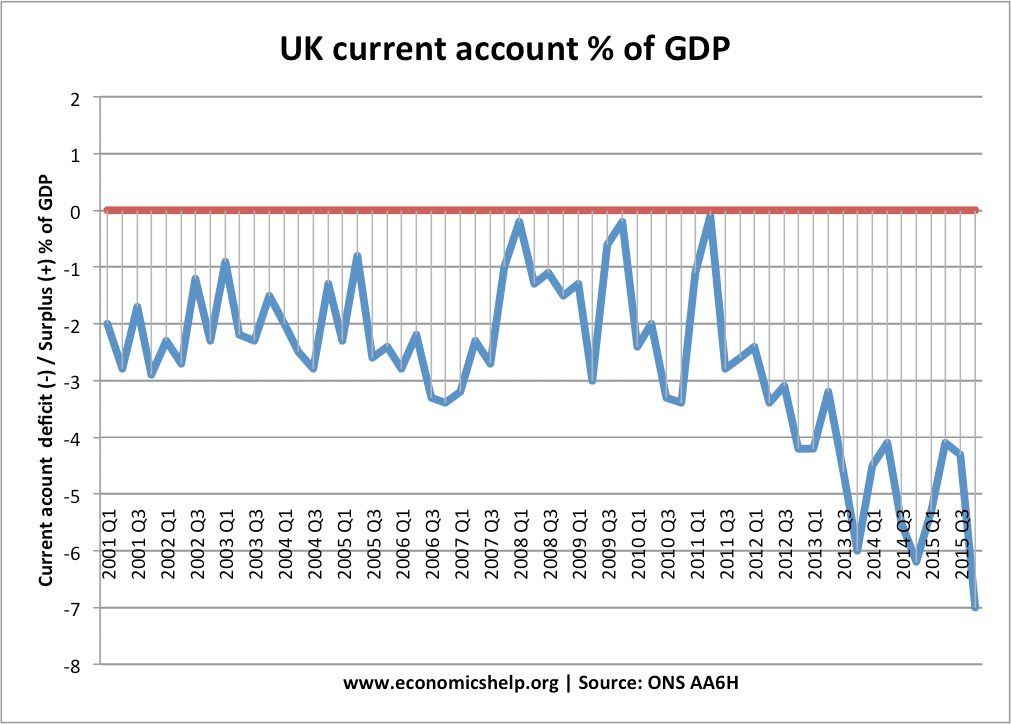

- UK current account. The UK has a large current account deficit, which is financed by net capital inflows, such as portfolio investment and capital investment flows. If these inward flows decline, the Pound will have to fall to correct the imbalance on the current account.

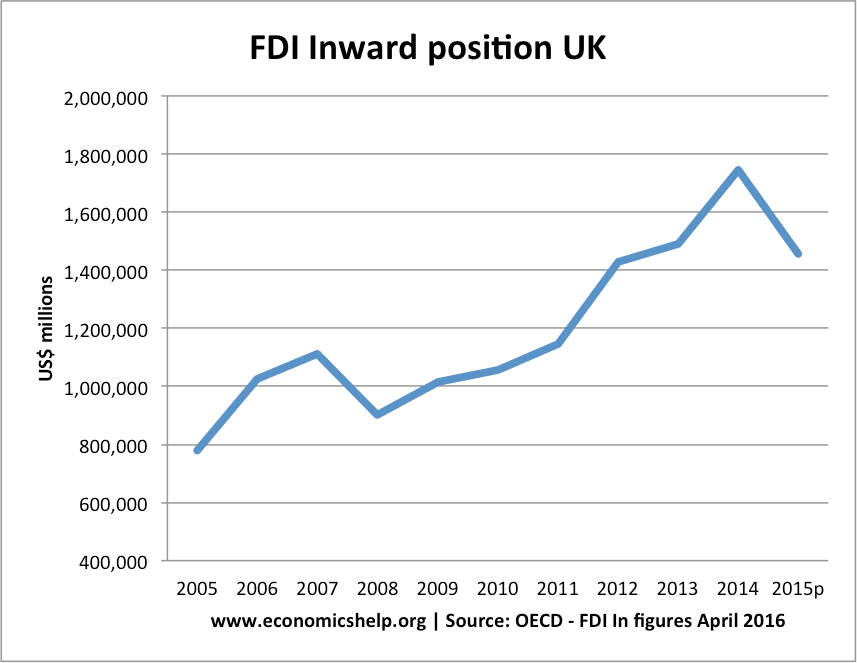

- Loss of access to Single Market. One of the attractions of the UK as a place to invest is access to the Single Market, which enables foreign companies to be able to export from UK to Europe without tariffs and non-tariff barriers. If the UK leave the Single Market, it may make it more attractive for companies to choose a country which is in the Single Market. This could lead to a relative decline in UK inward investment and reduce demand for Sterling.

- Inward investment is increasingly important to UK. The UK ranks as 3rd country in the world (behind only US and China) for a source of inward investment. This means the UK would be susceptible to any uncertainty and decline in inward investment. Therefore, the effect on Sterling could be pronounced.

- The city and UK financial markets would lose out from UK leaving Single Market. The City of London would be less attractive as a place to deposit funds if the UK left the Single Market, it could see investors moving Euro bonds to Frankfurt and avoiding London and UK. This decline in deposits in UK, would weaken demand for Sterling.

Evaluation

- The Pound has already weakened in the past few months in anticipation of a possible Brexit. The market may already have priced in some of the expected falls.

- After initial fall due to short term concerns, underlying factors may increase demand for Sterling and help to correct a short-term reaction. A depreciation in Sterling will make exports more competitive and we could see a rise in export demand, helping to replace the falls in inward investment.

- It is not clear that leaving the Single Market will necessarily lead to a fall in inward investment. There are many factors affecting inward investment apart from access to the Single Market, some firms have not stated categorically what they will do.

- Supporters of Brexit are hopeful that the UK will be negotiate attractive trade deals with Europe, which will make the UK still an attractive place for firms wishing access to Europe.

- It is possible the UK could vote to leave Europe, but still remain in the Single Market, which would diminish many of the economic concerns.

Update

The UK ended up with the ‘hardest Brexit’ – leaving the customs union and single market. This has led to tariffs on UK exports to Europe in particular commodities with the risk of a trade war with Europe over NI Protocol. There has been strong negative effect on UK exports to Europe.

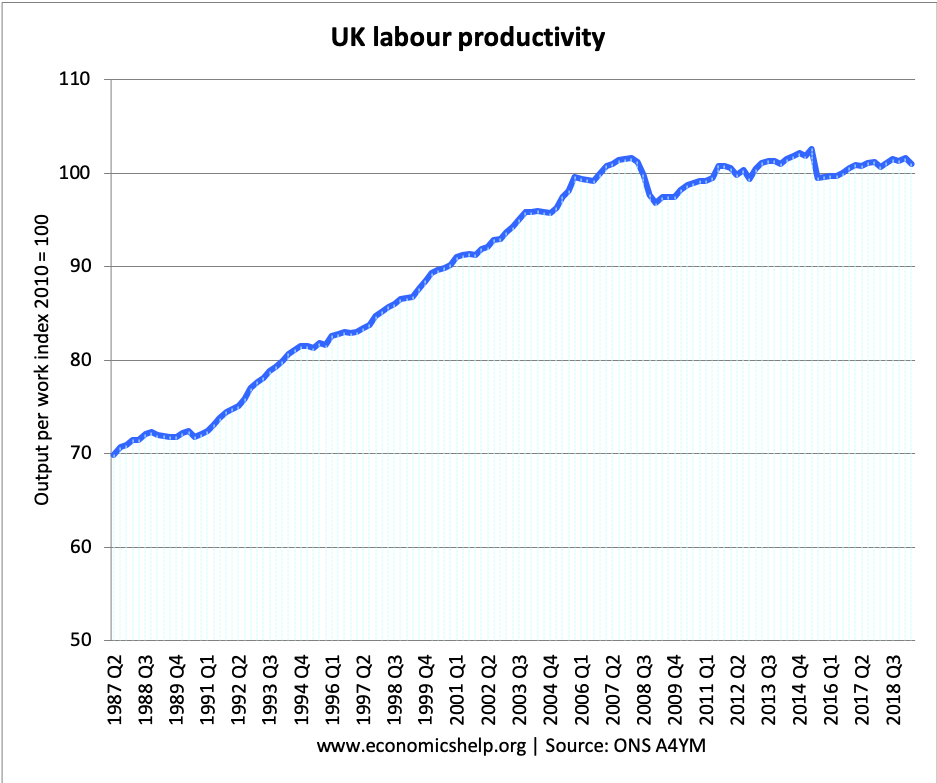

Poor productivity

Poor labour productivity has also led to worsening economic performance, with a combination of low growth and high inflation. The UK now has one of highest inflation rates in OECD.

June 2022

Related