Two alternative views on UK’s debt problem.

Debt Hawk

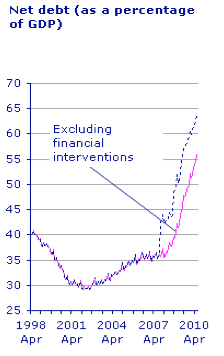

Source: ONS

The UK has seen a rapid deterioration in its budget deficit. At £146bn (12.5% of GDP) this is the biggest peace time budget deficit on record. (Apart from Greece) this leaves the UK with the largest annual budget deficit in the OECD. Given the recent European fiscal crisis (Greece, Spain, Ireland) e.t.c. and the nervousness of bond markets, this level of borrowing is unsustainable and likely to lead to a higher interest rates, a run on the pound and a long term undermining of the UK economy.

Debt Dove

The size of UK debt is mainly a rationale response to the Great Recession of 2008-09 and the realistic threat of the worst depression since the 1930s. Without allowing a rise in government borrowing to offset collapse in private spending and private investment, the UK would be facing a persistent fall in spending, output and even higher unemployment.

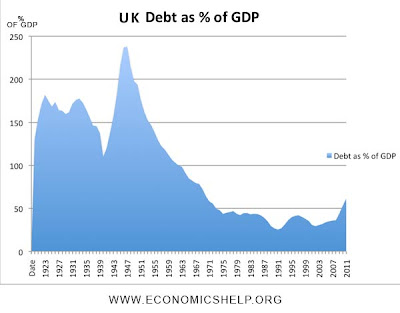

By historical standards, UK debt is significantly lower than previous periods when debt as a % of GDP was much higher (reaching over 200% of GDP in early 1950s). Compared to other countries, UK’s public sector debt as a % of GDP is not high – List of Countries debt as a % of GDP.

Furthermore, debt interest payments as a % of GDP (3-4%) are also low by UK’s historical standards (see: What Debt Crisis?).

In a liquidity trap, there is no reason why interest rates on debt will rise rapidly (they didn’t in 1940s and 1950s). To cut spending at the start of a fragile economic recovery will merely reduce economic growth and make it much more difficult to gain strong economic growth. It is a strong economic recovery which is the most important factor in reducing the long term debt to GDP ratio. The current austerity packages could easily be self-defeating like in Ireland and Greece (who have cut spending only to cause a fall in GDP) and the need for further cuts.

Which view do you prefer?

Are you a debt hawk or a debt dove?

Related

Thanks, but we’re changing societal dependencies here.

You stay in debt if you want to.

Can someone explain to me where I am wrong? The view amongst the people that I talk to is that recession was caused by the banking crisis, which itself was caused by bankers selling each other ‘packages’ of investments that they did not really understand, and which turned out to be ‘toxic debt’. So the Government had to bail out the banks – ie they lent the banks money, which they borrowed from……er ? …. the banks? So we have a large national debt because we have had to borrow money from the banks to lend to the banks.

So to try to pay off this national debt we are now going to cut all services for poorer people, while the people who got us into this mess, (the bankers in case you forgot) continue being supported by the government, and continue giving themselves unwarranted pay cheques.

Why can we not pay off the debt by asking for our money back from the banks, and if that is not enough, we put a high level of income tax so that the rich (ie bankers in case you forgot) contribute in a fair way.

Can you tell me what is wrong with the logic here?

Thanks

I think we’re whistling in the wind here. The government is going to do what it always does. Make a mess and leave it for the rest of us to clean up as they pop off on holiday with the bankers to discuss who will be funding the next election campaign or offering the best consulting package.

When are we going to waken up and realise, we’re just being exploited and that’s never going to change because for all the sword rattling by the MPs on all sides – they are all the same – gangsters in pinstripe.

First of all, the recession was caused by a false housing market bubble. The bankers were the politicians scapegoat following decades of unnecessary heavy regulation. The government had not regulated the banks to the degree it wished to do, hence why the banks now have some absurd levy in place.

Secondly, recession is inevitable and should be embraced, as it clears out businesses that has insufficient demand, and thus strangling an economy. If you simply nationalise a dying business, you’re only wasting tax payer’s money on an unwanted service. The biggest disaster was Northern Rock in this case.

The best way to deal with the debt? More austerity. The budget still has dangerously high amounts of unnecessary spending. The worst part of the budget? The absurd rise in VAT.

Again on banks, the levy and rise in VAT will only encourage bigger bonuses, legally or illegally. But I have no issue with bankers giving themselves bonuses at all.

Knew economy strategy to boom the world.

First we get 100 countries to sign up too new economy idea. Each country print’s up $35 billion dollars for export ships to be built asap and expand ports.

Second we make a new world dollar bank note that has a digital barcode on it. That barcode is scanned at 99% of shops and frude notes are a thing of the past “+” it’s technically digital note.

Now each country will buy $1 billion dollars of good off each other once a year for $2 trillion dollars their curracy.

Put it like this…..Australia buys $1 billion dollars of Russian oil for $2 trillion dollars of Australian bank notes. In return each year Russia buys $1 billion dollars or Australian iron metal rocks for $2 trillion pa.

Now every country does that and we each have a budget of $100 trillion dollars pa.

So we are talking about every country exporting mass food….pick the countries closest to you for that kind of fruit and veg….take 18 hours to 2 days to reach you or be shipped by truck/train’s.

Now to protect the wealthy and rich we make “what I call” cred bonds.

Cred bonds can be bort and have an minimum of $500,000 – $1,000,000,000 dollars to get.

Each one says if the dollar collapses, it can be printed up in new replacement dollar/currency…… Market won’t be flooded with cash because everyone will buy cred bonds and the market will see mass $100drs of trillions of dollars off the market sitting in banks.

Government’s start to hand out big bucks to the public like Cheque’s to build or buy your house, then cash for a green/car and cash to spend pa. means without cred Bonds the dollar would collapse because there is wayyyy to much if it on the market. Build a knew house is a cheque that will see a cred bond bort instantly….No huge sums if cash on the market.

So when you buy a car it’s with a gov cheque…. instant bank deposit that leads to a cred bond to protect your million or billions of dollars.

At the end off the day everyone will own a house car boat before the dollar collapses. If the dollar collapses houses are built structures that can only lose value for 20 years “but by that time” everyone owns a house car boat and anything.

The dollar won’t collapse because house builders are buying cred bonds for future security, taking massss trillions of dollars out of the market into banks.

Banks will probably charge us $1,000 a year to own an account that the government pays for anyway…..cash handouts of $100k a year. You work like mass people volunteer still, and you will be rich when you retire at 45 years old starting work at 18 years old.

I guess every countries government will invest in holidays/travel in Thier country as ligit knew revenue. ECT new ski resorts, walking trails, sports will pick up and everything.

The end