Inflation is a period of rising prices. The primary policy for reducing inflation is monetary policy – in particular, raising interest rates reduces demand and helps to bring inflation under control. Other policies to reduce inflation can include tight fiscal policy (higher tax), supply-side policies, wage control, appreciation in the exchange rate and control of the money supply. (a form of monetary policy).

Summary of policies to reduce inflation

- Monetary policy – Higher interest rates. This increases the cost of borrowing and discourages spending. This leads to lower economic growth and lower inflation.

- Tight fiscal policy – Higher income tax and/or lower government spending, will reduce aggregate demand, leading to lower growth and less demand-pull inflation

- Supply-side policies – These aim to increase long-term competitiveness, e.g. privatisation and deregulation may help reduce costs of business, leading to lower inflation.

Video on reducing inflation

Policies to reduce inflation in more details

1. Monetary Policy

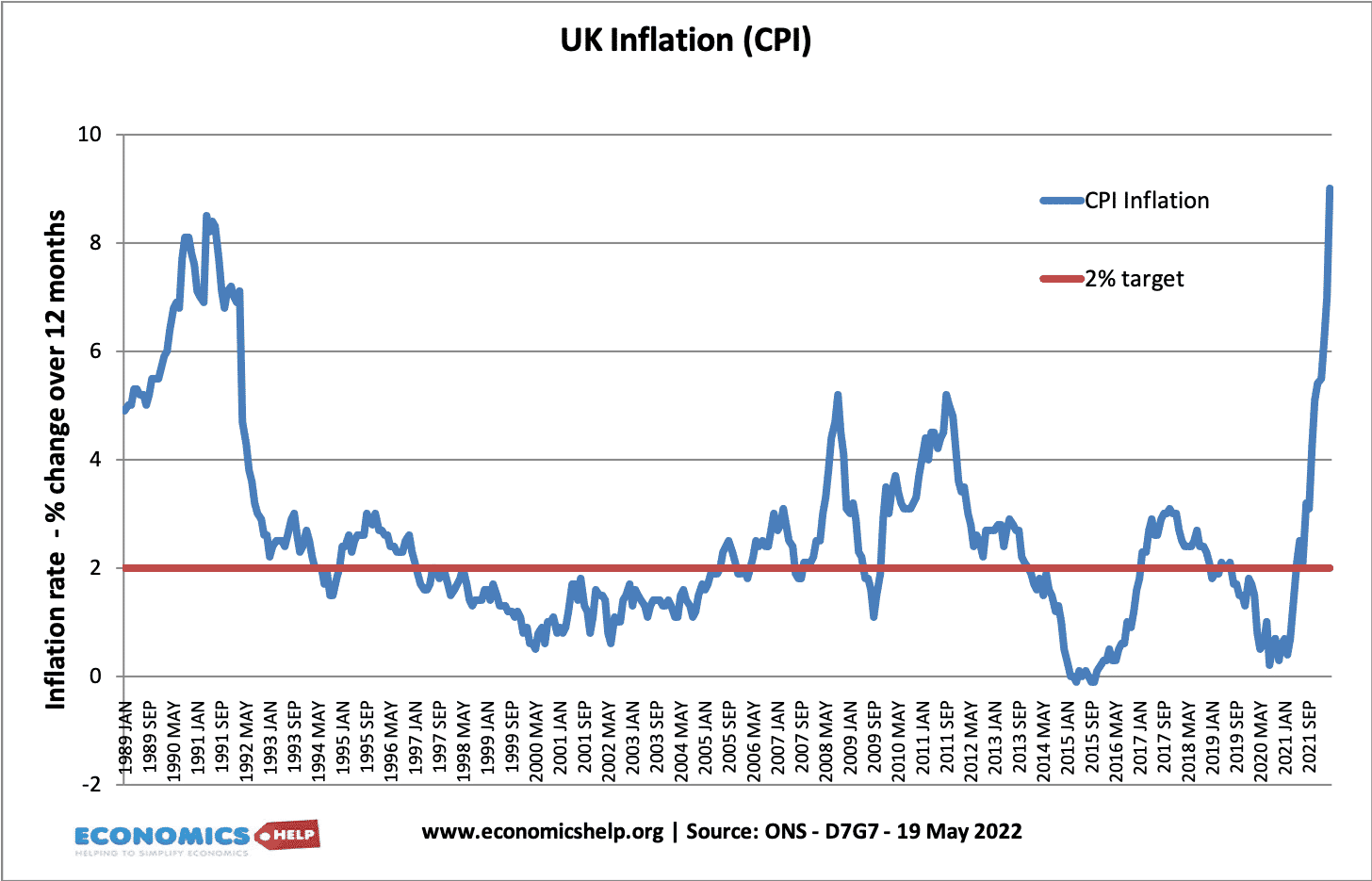

In the UK and US, monetary policy is the most important tool for maintaining low inflation. In the UK, monetary policy is set by the MPC of the Bank of England. They are given an inflation target by the government. This inflation target is 2%+/-1, and the MPC use interest rates to try and achieve this target.

The first step is for the MPC to try and predict future inflation. They look at various economic statistics and try to decide whether the economy is overheating. If inflation is forecast to increase above the target, the MPC are likely to increase interest rates.

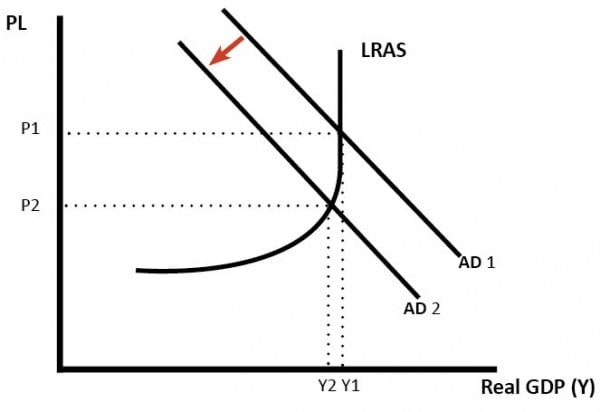

Increased interest rates will help reduce the growth of aggregate demand in the economy. The slower growth will then lead to lower inflation. Higher interest rates reduce consumer spending because:

- Increased interest rates increase the cost of borrowing, discouraging consumers from borrowing and spending.

- Increased interest rates make it more attractive to save money

- Increased interest rates reduce the disposable income of those with mortgages.

- Higher interest rates increased the value of the exchange rate leading to lower exports and more imports.

Diagram showing fall in AD to reduce inflation

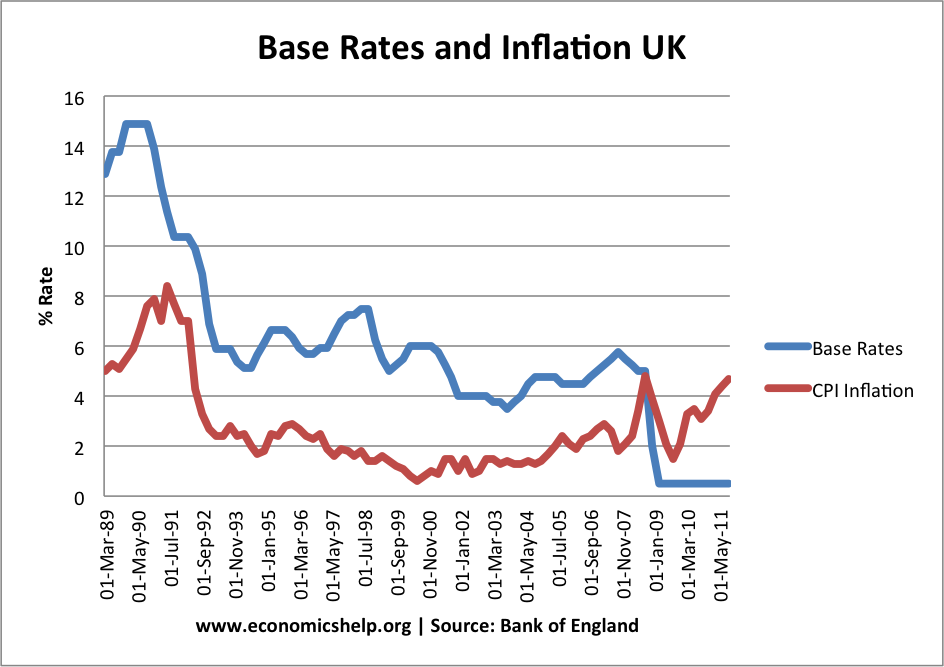

Base Rates and Inflation

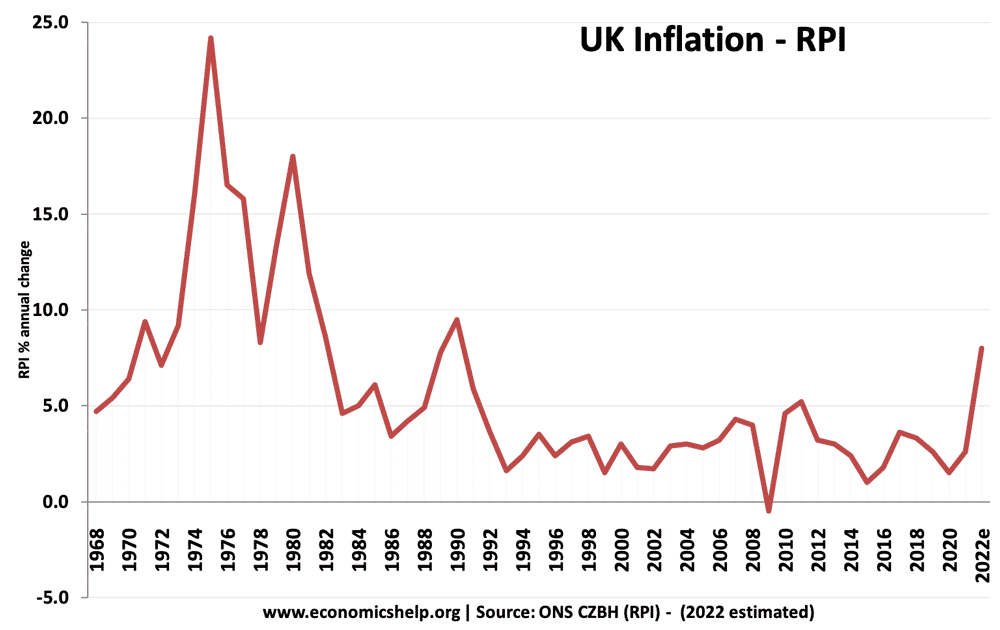

Base interest rates were increased in the late 1980s / 1990 to try and control the rise in inflation.

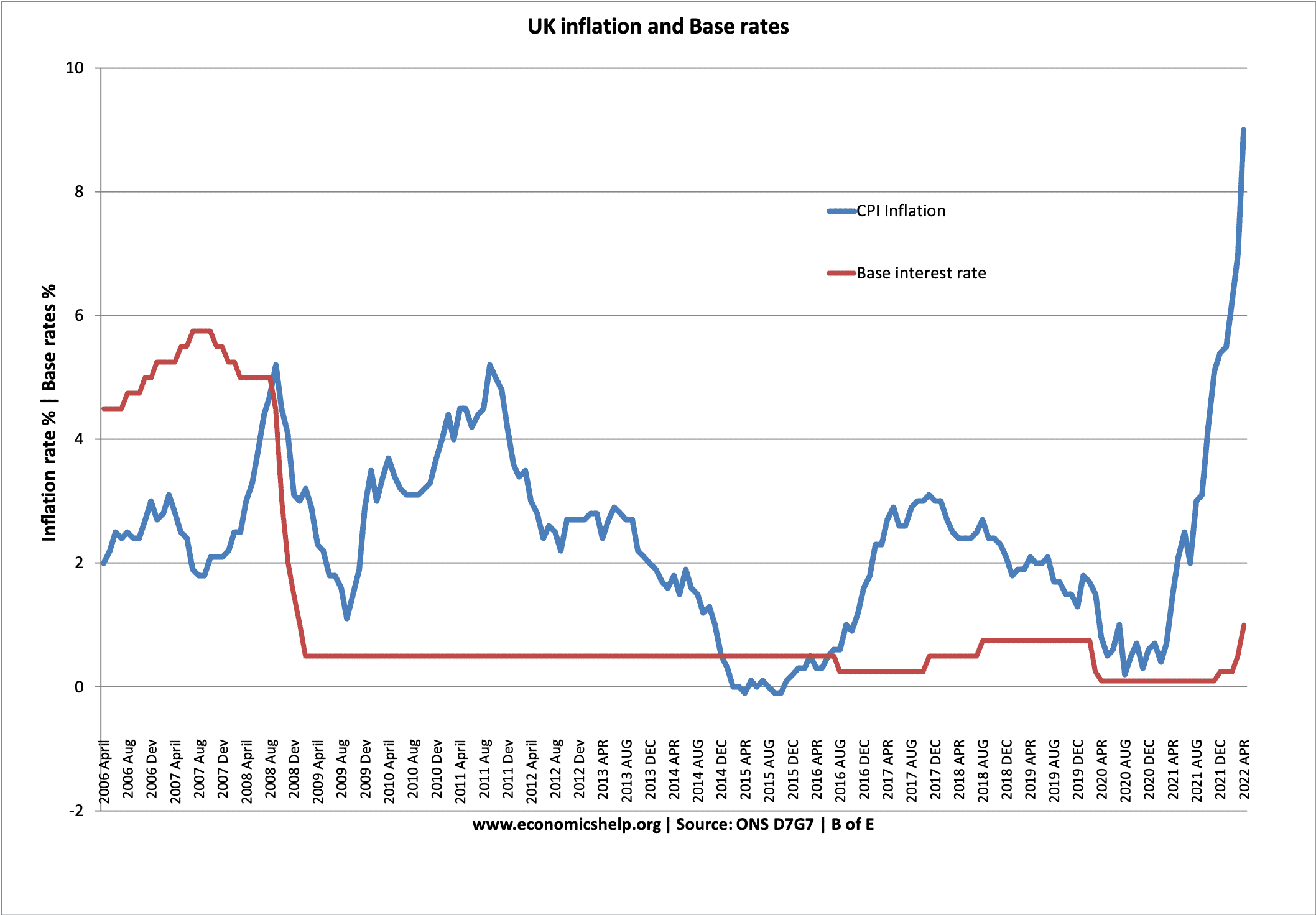

In 2022, there was a small increase in interest rates in response to the rapid rise in inflation.

Monetary policy can have some limitations

- It is difficult to deal with cost-push inflation (inflation and low growth at the same time)

- There are time lags. It can take up to 18 months for higher interest rates to have an effect on reducing demand. (e.g. people with fixed-rate mortgage)

- It depends on confidence. If confidence is high, business and consumers may continue to spend – despite higher interest rates.

2. Supply-Side Policies

Supply-side policies aim to increase long term competitiveness and productivity. For example, it was hoped that privatisation and deregulation would make firms more productive and competitive. Therefore, in the long run, supply-side policies can help reduce inflationary pressures.

- However, supply-side policies work very much in the long term; they cannot be used to reduce sudden increases in the inflation rate. Also, there is no guarantee government supply-side policies will be successful in reducing inflation More details at Supply-side policies

3. Fiscal Policy

This is another demand-side policy, similar in effect to monetary policy. Fiscal policy involves the government changing tax and spending levels in order to influence the level of Aggregate Demand. To reduce inflationary pressures the government can increase tax and reduce government spending. This will reduce AD.

- Fiscal policy can reduce government borrowing but is likely to be politically costly as the public dislike higher taxes and cuts to government spending. This makes it a limited policy.

4. Exchange rate policy

In the late 1980s, the UK joined the ERM, as a means to control inflation. It was felt that by keeping the value of the pound high, it would help reduce inflationary pressures.

- A stronger Pound makes imports cheaper (lower cost-push inflation)

- Stronger Pound reduces domestic demand, leading to less demand-pull inflation.

- A stronger Pound creates incentives for firms to cut costs in order to remain competitive.

The policy did reduce inflation but at the cost of a recession. To maintain the value of the £ against the DM, the government had to increase interest rates to 15%, and this contributed to the recession.

See: ERM crisis 1992

The UK no longer uses this as an anti-inflationary policy.

5. Incomes Policies

Wage growth is a key factor in determining inflation. If wages increase quickly, it will cause high inflation. In the 1970s, there was a brief attempt at wage controls “Price and Incomes policies) which tried to limit wage growth. However, it was effectively dropped because it was difficult to enforce widely. See Price and incomes policies.

6. Targeting Money Supply (Monetarism) In the early 1980s, the UK adopted a form of monetarism, where the government sought to control inflation by controlling the money supply. To control the money supply, the government adopted higher interest rates and reduced budget deficit. It did bring inflation down but at the expense of a deep recession. Monetarism was effectively abandoned because the link between money supply and inflation was weaker than expected. See: UK economy 1979-84

Difficult types of inflation to control

- Cost-push inflation

In 2008 and 2022 the UK experienced cost-push inflation significantly above the target of CPI = 2%. However, the Bank of England didn’t alter its monetary policy. This was because:

- The inflation was expected to be temporary – caused by rising oil prices, rising tax rates and the impact of devaluation.

- Economy in recession. With the economy in recession, the Bank of England didn’t want to reduce aggregate demand because it felt it was more important to boost economic growth.

In these cases of cost-push inflation, it is harder to reduce inflation, and it is maybe better to let the temporary inflation factors come to an end.

Related

Inflation is needed in South Africa to help people learn how to tighten their belts by saving more often and persevering goods that are healthy to the people, walking instead of driving and eating at home instead of restaurant, and investing more time on increasing foreign interest rates by investing ideas and team building activities that will generate an influx in the economy such as hosting a international sport event and encouraging business man and women to boast the economy by being more resourceful and spending less yet gaining net profits , using technological means sparingly and using supplementary methods to better the economy and to also educate more and employ more youth development facilities without wasting money and making means to secure safety for foreigners.

wow someone’s a monetarist

So much educative,

If this is done it can reduce the quality standards of living And a reduction in the GDP of the economy in a long run. What the country needs is to subsidize firms that produce merit goods, which are goods that bring benefits to consumers and third parties to reduce thier cost of production therfore reducing price. And aid the society with the provision of information on the true value that must be placed in merit goods. Which is supposed to be high.

how do address inflation

Those who can seize the opportunity to walk in front of them will succeed in all likelihood

Educative

Great explanation

Very interesting article and educative

This has been a very simplified and better article especially for the beginners to read and understand ..

Thank you.

simple and straightforward

Need explanation on the specific policies that can be use to control;1 Excess Demand inflation, 2: Imported Inflation ,3:Cost Push inflation