Movements in the stock market can be quite volatile and sometimes movements in share prices can seem divorced from economic factors. However, there are certain underlying factors which have a strong influence on the movement of share prices and the stock market in general.

Generally, shares will be in greater demand when investors have the prospect of earning more dividends. Therefore factors which make firms more profitable will tend to cause a rise in stock markets.

Underlying Factors affecting the Stock Market

- Economic growth. Higher economic growth or better prospects for growth will help firms be more profitable because there will be more demand for goods and services. This will help boost company dividends and therefore share prices.

- Interest rates. Lower interest rates can make shares more attractive for two reasons. Lower interest rates help boost economic growth making firms more profitable. Also, lower interest rates make shares relatively more attractive than saving money in a bank or holding bonds. If bond yields fall, it may encourage investors to switch into shares which give a relatively better dividend.

- Stability. Stock markets dislike shocks that could threaten economic stability and future growth. Therefore, they will tend to fall on news of terrorist attacks or spikes in the price of oil. They will also dislike political instability which may make it difficult to pursue strong economic policies.

- Confidence and expectations. A key factor is the mood of investors. If they receive economic news that gives optimism then they are more likely to buy shares. If they receive bad news they will sell. This is why in the depth of a recession, stock markets can start to rise. Investors are always trying to predict the future. Therefore if they feel the worst is over – the stock market can rally – even when economic fundamentals remain poor.

- Bandwagon effect. At times the stock market seems to over-react to certain events. For example, in 1987, relatively little bad news caused the stock market to fall 25%. Even today it remains a little mystery why the stock market fell so much – there was no economic problem. In fact, the stock market soon recovered it’s lost ground. Part of the issue is that people follow the mood. When prices fall, people may feel the need to follow suit and get out of the market.

- Related markets. Often investors have choices. For example, rather than investing in stock market, they could buy government bonds or commodities. If investors feel government bonds are overpriced and likely to fall, then the stock market can benefit as people move into shares.

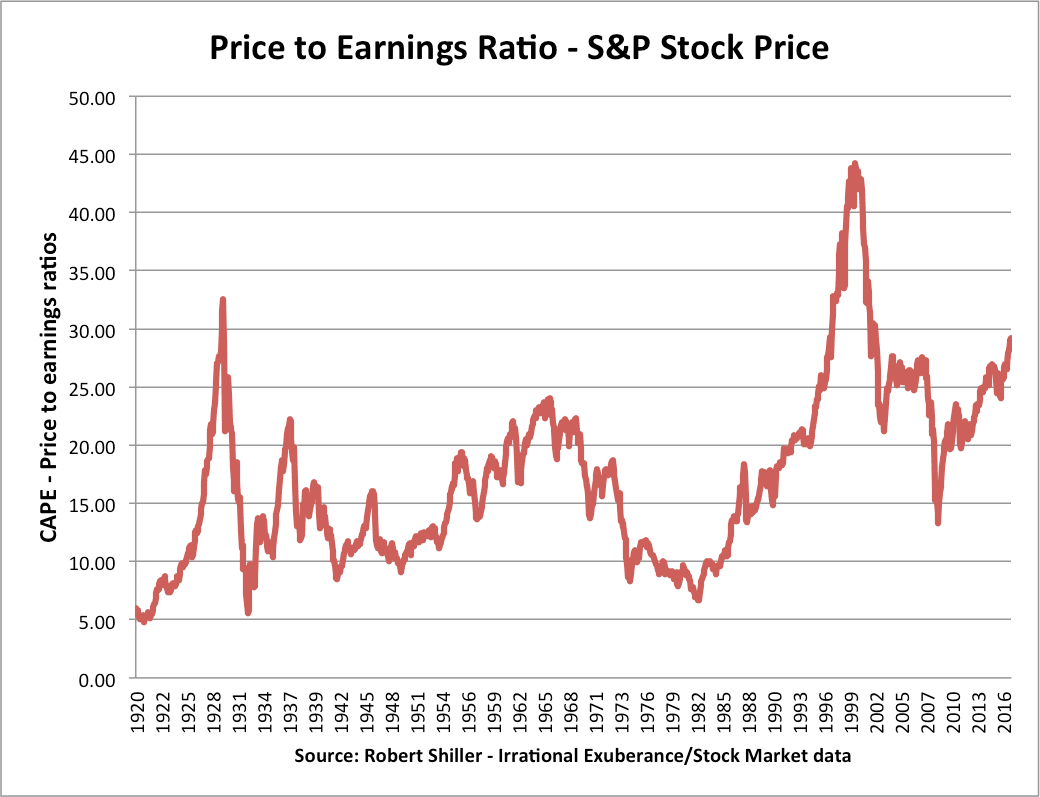

- Price to earnings ratios. Some investors and economists, such as Robert Shiller feel the best guide to the long-term performance of shares is their price to earnings ratios. If share prices rise significantly above historical averages, then this is a sign that shares are becoming overvalued and are due a correction at some point in the future.

In the boom period of the 1920s, there was a rise in the ratio of share prices to earnings. But, this rapid growth came to an abrupt end in 1929 – with Wall Street Crash. There was a remarkable bull run in the 1980s to 2000.

Over the past 100 years, the average ‘Price to earnings’ ratio has steadily crept up, so it is not an exact science to say what the long-term average of price to earnings ratios is.

Why can the stock market do well, when the economy is doing badly?

Sometimes we see the stock market increase during a recession but fall during economic growth. This is because many factors are affecting the stock market, apart from just the basic state of the economy. Part of the reason is that investors are always looking to the future. If they see signs the economy may turn the economy, they may buy shares, even though the economy is in a deep recession. For example, those who bought shares at the end of 2008 (when the recession was at its worst) would have made good profits during the recession years of 2009-2013. see: why stock market can do well when the economy is doing badly?

How will a rapid rise in inflation affect the stock market?

An unanticipated rapid rise in inflation would probably cause a fall in stock markets. A rise in inflation would probably lead to a greater chance of interest rises. This will reduce growth and profitability. Also, higher inflation may encourage investors to move into more inflation proof investments like gold.

However, during the hyperinflation of the 1920s in Germany, the stock market became one place to keep the value of your savings. Share prices soared as people put money into shares rather than just hold onto cash. The reason was that shares offered an opportunity to invest in firms with capital and assets. This was a way to secure some real value. If you put money in a bank, inflation made it worthless, but those who owned physical assets, such as factories, land and machines were able to maintain their wealth because assets were protected from the affects of inflation.

Example

You can never say a new hit the stock market,Investors are the drivers of stock market fluctuations . If they think the market will fall instead of it was meant to increase the market will follow the investors.