Readers’ Question: What is the difference between the Monetary base and the money supply?

The monetary base is part of the overall money supply. The monetary base refers to that part of the money supply which is highly liquid (i.e. easy to use). The monetary base includes

- Notes and coins

- Commercial bank deposits with the Central Bank

The monetary base is also referred to as ‘narrow money’ because it is a narrow definition and doesn’t include more illiquid types of the money supply, such as time bank deposits.

The monetary base is also referred to as high-powered money. In the money multiplier model, an increase in the monetary base can lead to a bigger proportional increase in the overall money supply (broad money). This is because if banks see an increase in their deposits, they can lend out a bigger sum of money and keep the same proportion in reserve.

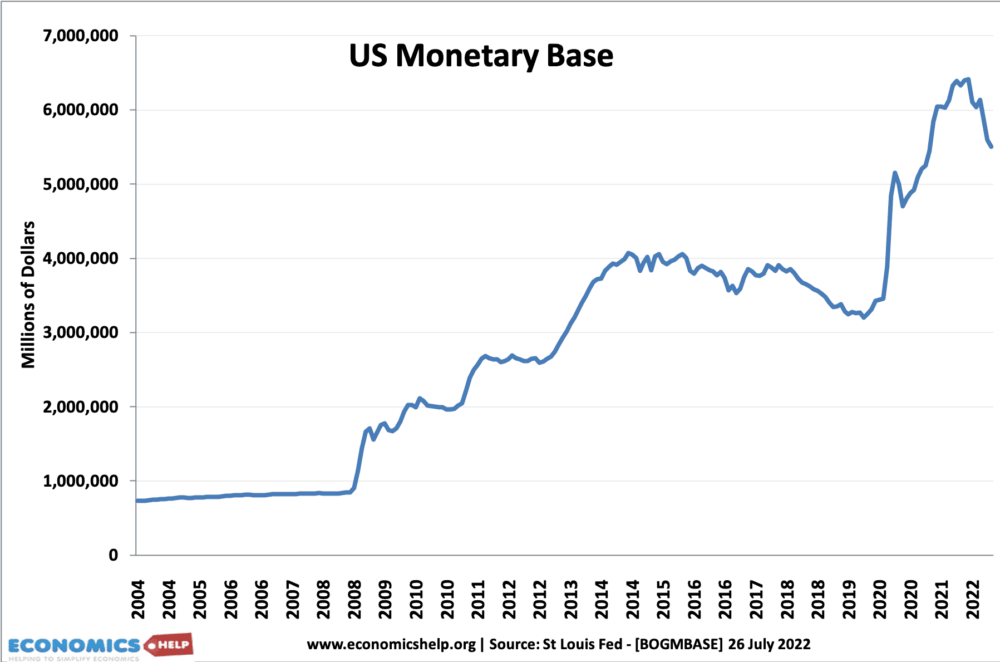

What is the total Monetary base in the US?

- In June 2022, the US monetary base (M0) was $5.5 trillion. (St Louis Fed)

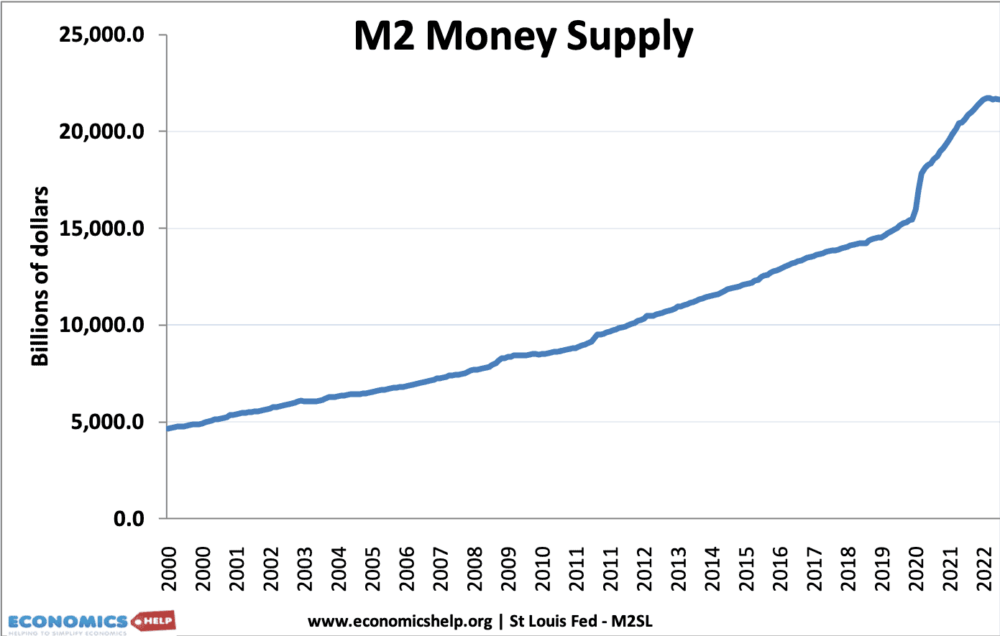

- (M2 was $21 trillion.)

Monetary Base and Quantitative Easing

The concept of the monetary base has frequently come up with regard to the monetary policy of Quantitative Easing (QE). QE leads to an increase in the monetary base.

The Central Bank create money to buy bonds (e.g. government bonds) from commercial banks. Commercial banks see an increase in their bank reserves. Thus there is an increase in the monetary base (M0). Typically, you might expect this increase in the Monetary base to lead to an increase in the broader money supply (e.g. banks lend out more so firms and consumers have more to spend and invest).

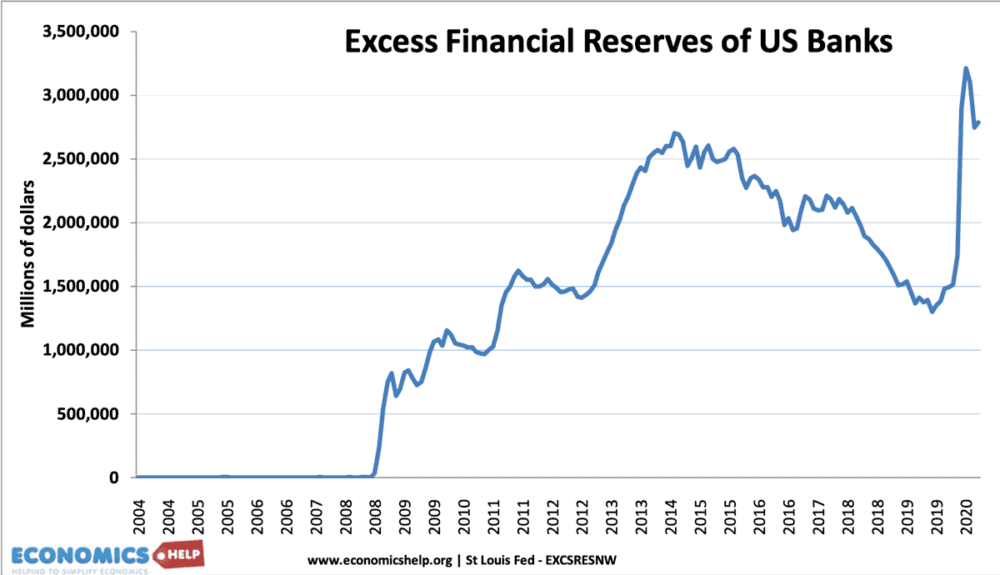

However, in the period 2008-11, banks have been reluctant to lend (because of a hangover from credit crisis and fears of a recession). Therefore, the increase in monetary base didn’t cause higher broad money supply. But it did lead to an increase in bank reserves.

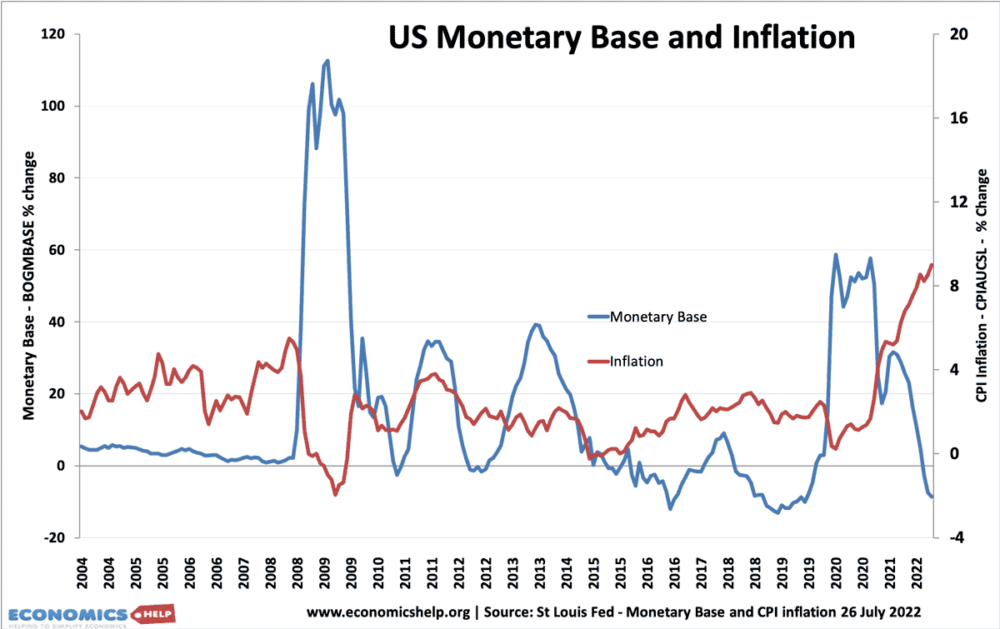

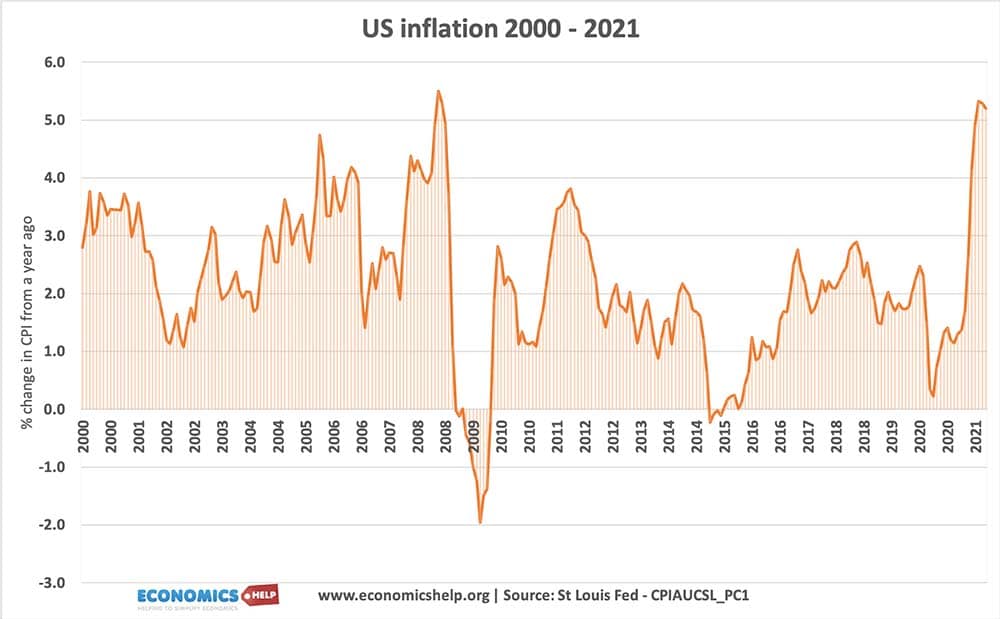

In 2009-10, the broad money supply M2 was quite even. Showing that the increase in monetary base didn’t translate into a broader increase in the money supply. Therefore, inflation remained low.

In 2020. The increase in the monetary base did lead to an increase in broad money in 2021 as the economy escaped the covid-recession.

Quantitative Easing and Inflation

Quantitative easing led to a big increase in the monetary base

The Federal Reserve created money to buy bonds from commercial banks. Banks saw a rise in their reserves.

However, commercial banks didn’t really lend this money out. Therefore the growth of the broader money supply didn’t change much and inflation remained very low in 2009.

What happened is that commercial banks merely oversaw a rise in their reserves

In 2009/10, the US inflation rate was largely unaffected by this increase in the monetary base. Stripping out volatile cost-push factors (food and fuel), core inflation remained below the 2% inflation target. However, in 2021/22, the rise in the monetary base did contribute towards higher inflation.

If the economy had been booming, and banks were confident to lend, then this increase in the monetary base may have caused an increase in the broader money and inflation.

Further reading