Three questions on quantitative easing, inflation and why inflation in the UK is high despite falling real incomes and lower consumer spending.

Readers Question: Isn’t the government (of UK) already printing lots of money?

The Bank of England have electronically created money and used this to buy government bonds from financial institutions. The Bank created around £200bn and used this to buy bonds both government and commercial bonds. The Bank of England is independent from the government, though they have to report to government if inflation misses the target.

And if it is not to pay off their debt, why are they printing more money?

1. Reduce interest rates on government and commercial bonds. By using electronic money to buy bonds, the price increases and the interest rate falls. The Bank estimated the £200bn QE programme was a factor in reducing government bond yields by 100 basis points (1%) and commercial bonds by 400 basis points [1. Bank of England QE One Year On – Speech by Spencer Dale] Lower interest rates in theory help promote economic growth and investment. (effect interest rates on economy)

2. Increase Bank Lending. It is hoped that using created money to buy government bonds from banks will encourage them to lend. When the Bank of England buys bonds from commercial banks it gives banks an increase in money reserves. This should encourage them to lend more to business, improving levels of investment and economic growth. In practice this has been limited

3. Confidence. Cutting interest rates didn’t cause an economic recovery. Quantitative easing is a signal the monetary authorities are committed to increasing economic growth (even at expense of inflation). This gives more confidence compare to say ECB where they prefer lower inflation to QE.

Also Why quantitative easing works

In addition, the pay freeze has forced people to save and not spend, so inflation should in theory be slowing (which is not), why is it not?

There are different factors that cause inflation. Two main factors are

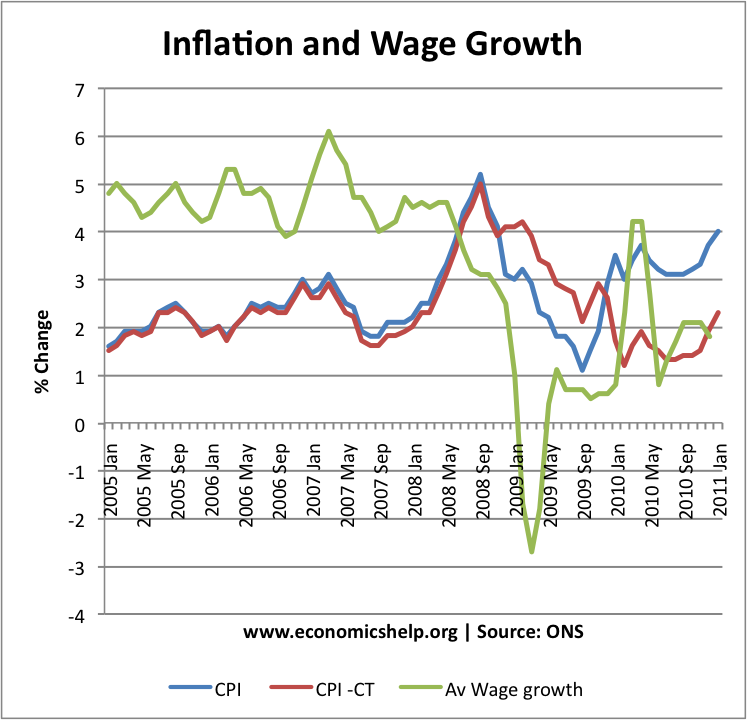

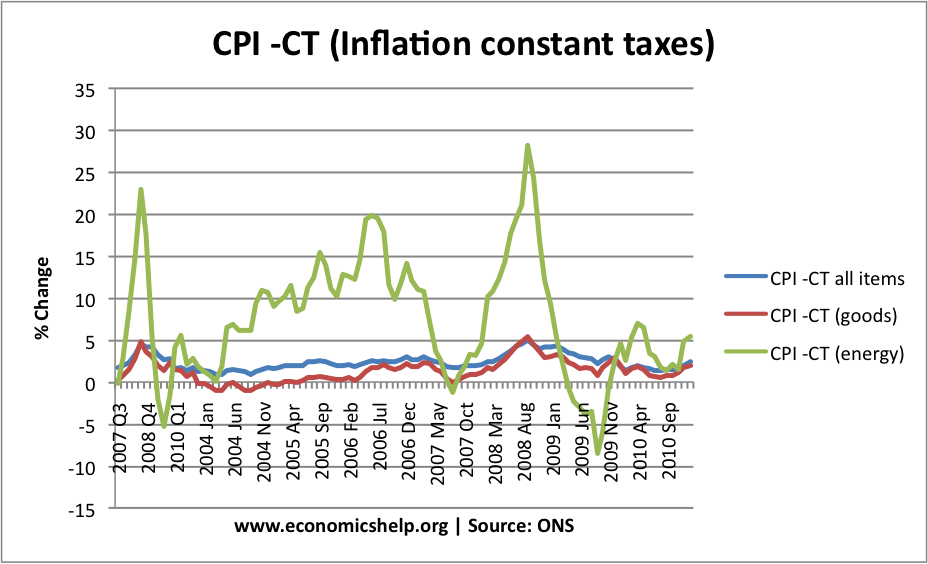

Graphs shows that excluding effect of taxes, CPI inflation is lower than headline rate

- Excess demand in the economy (demand pull inflation). If the economy grows too quickly, it tends to ‘overheat’ leading to higher prices. For example, in Lawson boom of 1980s, the UK experienced inflation of 10% because growth was too quick.

- Increase in price of commodities (cost push inflation). This occurs when the price of raw materials rises quickly. e.g. a rise in oil prices leads to higher prices.

In the UK inflation has been above the government’s inflation target for quite some time. The primary cause of this current inflation is cost push factors. In particular, inflation has been caused by

- Devaluation in Pound. This makes the price of imported goods more expensive

- Tax rises, e.g. VAT – this will be a one off increase

- Commodity price inflation, higher oil, gas, electricity and food prices

- Some estimate QE has contributed a little to a higher inflation rate. But, when these ‘temporary, short term factors are stripped out’ we will get a much lower inflation rate next year – probably around 1%.

Why is the US inflation rate at historically high levels?

-Supply chain disruptions from COVID have increased prices of raw materials like lumber and other commodities

-The Federal Reserve injected $2.3 trillion into the US economy to keep interest rates from rising, increasing the supply of money in the economy

-The federal government injected about $5 trillion in COVID stimulus to avoid recession, increasing the supply of money in the economy

-Inflation tends to be self-fulling: If people expect inflation to increase, they will buy goods now rather than wait, driving up prices

Why did supply chain disruptions from COVID increase prices of raw materials?

-A shortage of shipping containers increased the cost of shipping

-Bottlenecks at shipping ports increased the cost of shipping

-Disruptions from accidents and cyberattacks increased the cost of shipping

-Disruptions caused by the search for cleaner sources of energy increased commodities cost

Why was there a shortage of shipping containers during the COVID pandemic?

-A reduction in worldwide shipping activity from COVID stopped the usual flow of goods, resulting in empty shipping containers not being collected

-The inability to collect empty shipping containers resulted in too few in Asia and too many in North America

-Asian companies resumed operations earlier than other parts of the world, increasing their demand for shipping containers

Why was there a worldwide reduction in shipping activity during the COVID pandemic?

-Some destination ports disallowed ships from China, others imposed strict screening actions

-COVID restrictions resulted in absence of truck drivers taking goods to Chinese ports

-Shipping companies operated with reduced personnel due to self-isolation policies

-Reduced shipping staff levels resulted in interruptions, delays, and accumulation of cargo in shipping ports

Why did destination ports disallow or restrict ships from China during the COVID pandemic?

-To avoid spreading the COVID virus

-Nations focused on ships coming from China, the suspected origin of the COVID virus

-Destination ports restricted entry of ships from China until ship crews had been declared virus-free, including a 14-day quarantine

SerialPolitics.com