General government gross debt is a definition of government borrowing used by the EU.

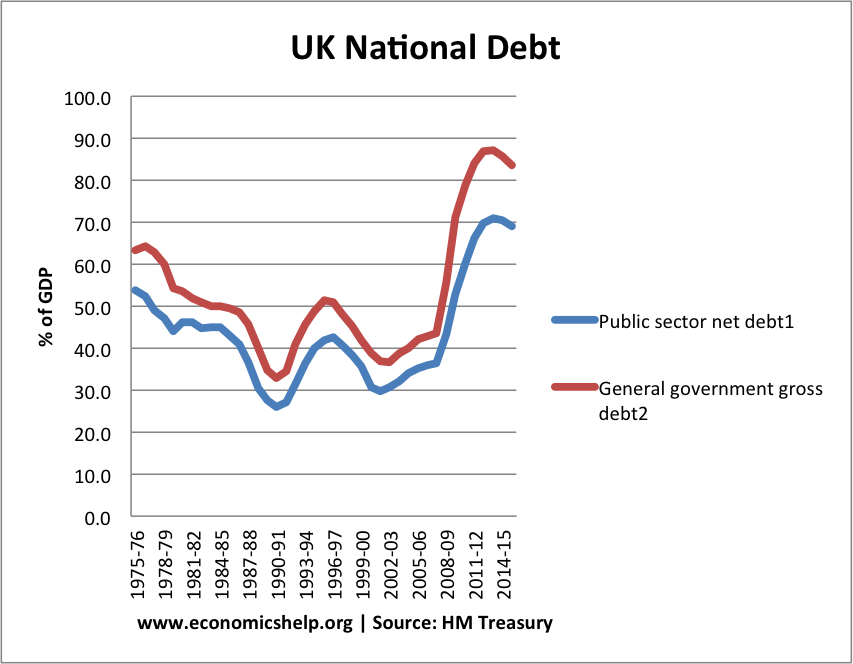

Generally, UK government debt is published as ‘public sector net borrowing’ – There are two measures of this public sector net borrowing – one which includes financial sector intervention, and another which excludes. see: UK National Debt

source: Stats on UK public finances at HM Treasury

1) Public sector net debt excluding financial sector intervention

2) Based on Maastrict criteria see below.

General Gross government debt gives a higher figure than just using public sector net debt.

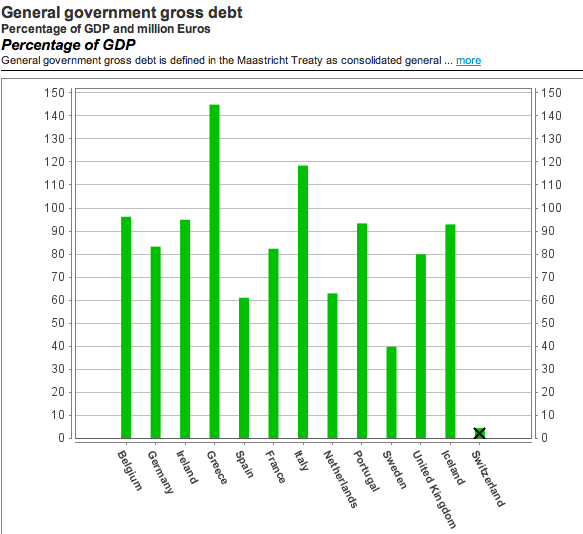

EU Gross Government debt

stats from: 2010 source: EU

stats from: 2010 source: EU

Definition of General Government Gross Debt

General government gross debt is similar to public sector debt, but includes more in the definition of debt. General government gross debt includes government liabilities, all the different sub-sectors of local and central government and social security funds.

- General Government gross debt definition at OECD

- Gross government debt at EU Stat

Definition of Gross Government debt at EU

General government gross debt is defined in the Maastricht Treaty as consolidated general government gross debt at nominal value, outstanding at the end of the year in the following categories of government liabilities (as defined in ESA95): currency and deposits (AF.2), securities other than shares excluding financial derivatives (AF.3, excluding AF.34), and loans (AF.4). The general government sector comprises the sub-sectors of central government, state government, local government and social security funds. The series are presented as a percentage of GDP and in millions of euro. GDP used as a denominator is the gross domestic product at current market prices. Data expressed in national currency are converted into euro using end-year exchange rates provided by the European Central Bank.

Related

1 thought on “General Government Gross Debt in UK and EU 2011”

Comments are closed.