Readers Question: Undertake an evaluation of the causes of economic instability and the role, if any, that the government can play in reducing economic instability by constraining their discretion in policy making.

Economic instability involves a shock to the usual workings of the economy. Instability tends to reduce confidence and lead to lower investment, lower spending, lower growth and higher unemployment.

Economic instability can be caused by

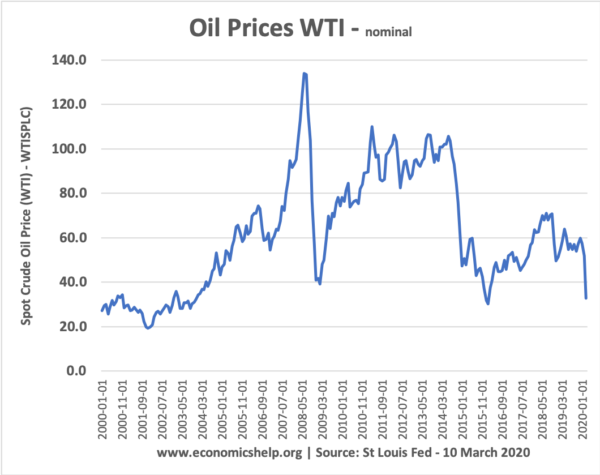

- Changing commodity prices (especially oil, e.g. 1974 oil price shock)

- Changing interest rates (rise in interest rates around 2005-07)

- Change in confidence levels (e.g. worries after 9/11)

- Stock market crashes (e.g. 1929 Stock market crash)

- Black swan events (e.g. major natural disaster, coronavirus outbreak 2020)

Causes of Economic Instability

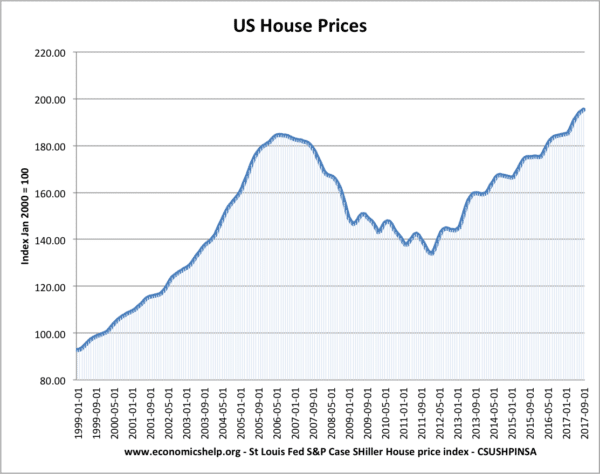

1. Changes in house prices/assets

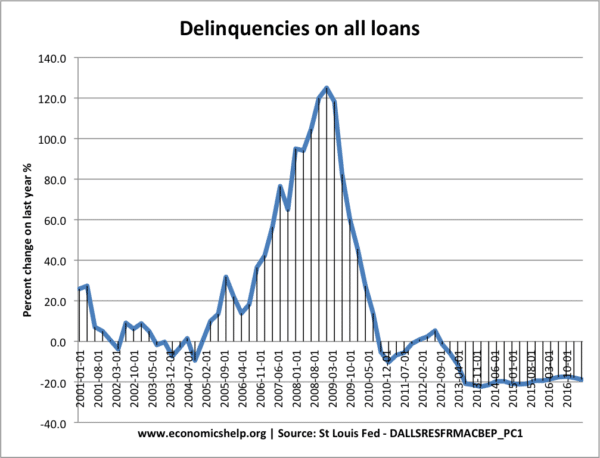

A fall in house prices can caused a negative wealth effect – householders see a decline in their net worth, leading to lower confidence and less spending. It can also cause financial losses for banks. For example 2006-10, the US saw its housing bubble burst with a 50% fall in house prices. This caused a rise in delinquencies, negative equity (people lost wealth) and a rise in defaults. As a result, banks started to lose money on failed mortgage payments. In 2007, this caused a fall in bank lending, the credit crisis and the 2008 recession.

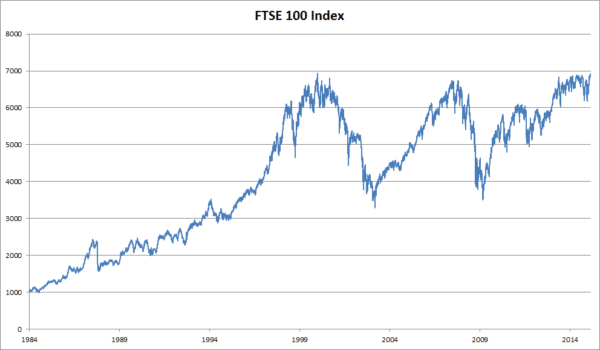

2. Fluctuations in Stock Markets

A big fall in stock markets can trigger falls in consumer confidence, a loss of consumer wealth and lead to a recession. The Wall Street crash of 1929 was a significant cause of the great depression. In 2008, the stock market crash again coincided with the 2008 recession.

However, it is not always the case falling share prices cause instability. The stock market crash of 1987 did not cause an economic downturn. In fact, in the UK it was followed by an unprecedented economic boom. This was partly due to the way the government responded by cutting income tax and cutting interest rates. The falls 2000-2004 also did not cause a recession.

However, if the stock market falls are due to a real shock to the economy (e.g. Coronavirus in March 2020) then the falls in share prices are likely to exacerbate the uncertainty.

3. Global Credit Markets

The subprime mortgage problems in the US caused many firms to go insolvent. This cause a big fall in confidence in lending money. This shortage of credit led to a shortage of credit. This caused the problems of northern rock and reduced consumer confidence. See: credit crisis

4. Changes in Interest Rates

Interest rates are used as a tool in controlling inflation. However, they can also have an impact on consumer spending. Sometimes interest rates may have little impact; however, if they coincide with other factors they can cause a much bigger than expected fall in consumer spending. For example, in the UK, many homeowners have a variable mortgage. Therefore a small change in interest rates can have a big effect on disposable income. If an increase in interest rates was combined with another factor such as the slowing down of house price growth it may cause a big fall in spending.

- Note, interest rates can have a delayed effect. E.g. the effect of interest rate increases last year may continue to affect consumer spending for up to 18 months

5. Global Factors

In an era of globalisation, there is an increasing interdependence of the world economies. For example, if China’s boom was to end, there would be a marked slowdown in global growth. It used to be the case the world was very dependent on the US economy. if the US economy suffered a recession, it would often drag the rest of the world into recession. This was because the US was the world’s biggest consumer of imports. However, it is argued that the world is less dependent on the US economy because of the development of new economies like China and India. Nevertheless, global factors are of great importance. When the coronavirus interrupted manufacturing in China in early 2020, this had a knock-on effect for nearly all multinational companies who relied on Chinese manufacturing of parts.

6. Government Debt Crisis

If markets fear government debt is unsustainable or likely to face liquidity shortages, bonds will be sold. This will tend to push up interest rates on bond yields. This increases government debt interest payments and puts pressure on the government to cut spending and reduce the budget deficit. This can cause a negative spiral of lower growth and lower tax receipts. (sovereign debt crisis)

7. Black swan events

Black swan events are unexpected events, which can destabilise the economy. In theory, they have a very low probability, but throughout history, they occur at an unexpected moment. For example, the outbreak of an infectious virus can cause a fall in travel and economic activity. A major terrorist attack or natural disaster can also cause a fall in economic growth.

The 2020 coronavirus is a good example of how a black swan event can cause major instability. The virus led to a sharp fall in travel and quarantines imposed across the world. This disrupts usual economic activity. The virus also causes great uncertainty because the effects are unknown. It led to a major fall in shares, investment and the price of oil.

8. Erratic leadership

If political leaders are erratic, it can cause instability. For example, President Trump initiated a trade war with China, which caused a decline in global trade.

Supply-side Causes of Economic Instability

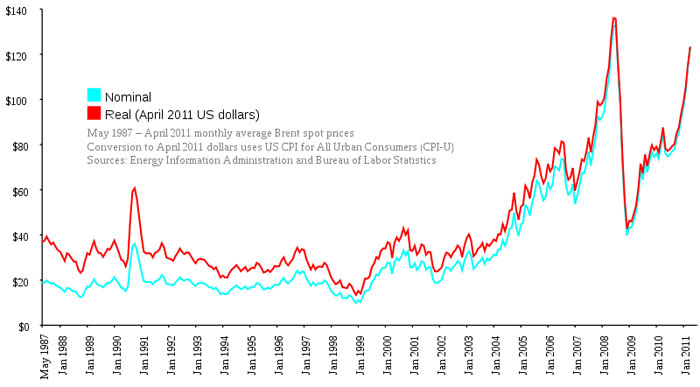

1. Price of Oil

An increase in the price of oil can cause economic instability, especially if it is a sudden increase like in the 1970s. higher oil prices increase the costs of firms and cause the AS curve to shift to the left. This causes both inflation and lower growth.

However, it is worth noting that although the oil price is now nearing nearly $100 a barrel, it is not having a huge effect. The impact on economies like the UK is less than it was in the 1970s, partly because the increase in price has been more gradual. Costs of transport are still not a major problem. It would require a much bigger increase to have a really damaging impact.

Note a very rapid fall in oil prices also may cause problems – because it indicates a lack of confidence in the economy.

Related

I’ m economic student in MA and resaerch acout economic instability.

Thank you for sending paper and comment to me.

wen de we say a country is at a middle in come , what is de effect and why?

I’m economist student also I was involved economic issues in the last two decades particularly in my country where life and people lack of economic policy and work without reason their business, only for profit oriented by import materials and buy in local market, and the civilsociety remain punish endure for this market. inflation is common in this era of globalization since it my country and people blindly trade everything they ought to have profitmaking

the second thing I guest for life is why, and how I can advocate economic issues that relate rest state where everything remian balance price, inflation, deflation, recession, greation of wealth, etc in economic term and also sustianable enviromental freind based policy with equal distribution of income

What are the effects of economic instability

How to solve the instability in growth?