Readers Question: Can someone please tell me what percent of the UK debt is held by the Bank of England?

The Bank of England have purchased £325 bn of asset purchases, which are financed by issuing created reserves. Of these £325bn of assets, the vast majority are government gilts (bonds).

The government’s net public sector debt is currently £1022.5 billion. Therefore, roughly 25-30% of public sector debt is held by the Bank of England as asset purchases. Q.E. at Bank of England

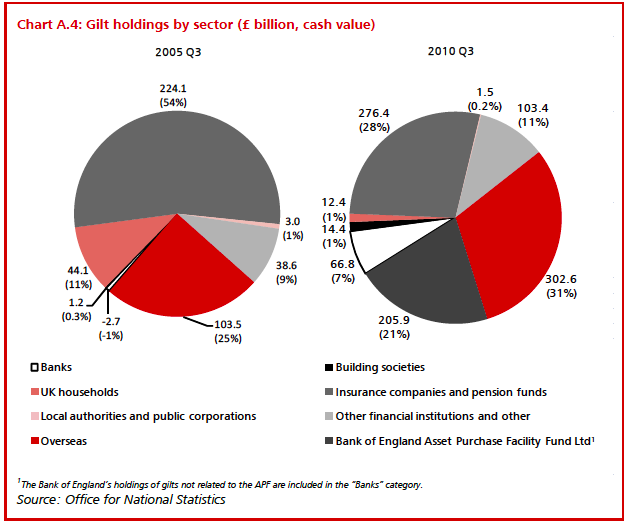

This shows that 21% of gilts were held by Bank of England in 2010 (Who lends government money)

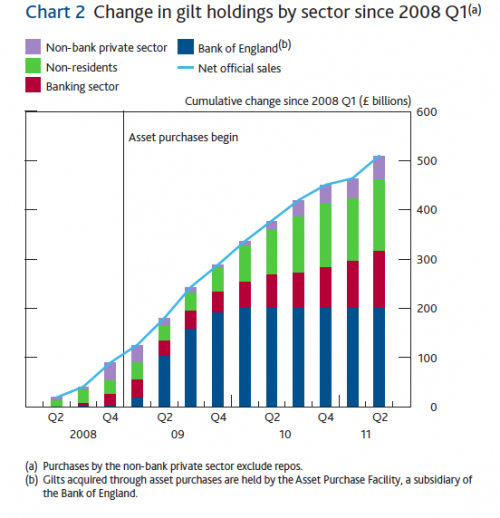

This graph from the Bank of England shows that by Q2 2011, the Bank of England held £200bn of government gilts a substantial part of the increase in gilts. There has also been a rise in external debt.

Source: Q.E. Bank of England

Source: Q.E. Bank of England

Also is it true that

1) If debt is held by the Bank of England then we (the people) hold our own debt?

- You could argue that if a domestic pension fund buys government debt, then in a way we hold our own debt. The private sector is lending to the government.

- In the case of the Bank of England, the debt is being held by a subsidiary of the government.

- About 30% of UK debt is held by foreign investors. This is the only part of government debt that is held by people outside the UK. See: Who lends the government money?

2) Interest paid to the Bank of England is really coming back to us?

I don’t know what happens to the interest paid to the Bank of England.

3) Quantitative easing is really a way for the Bank of England (us) to buy up debt.

I do believe the main motivation for quantitative easing is to try and increase nominal demand. Q.E. was started in 2009, when GDP fell by 6%. Without Q.E. bond yields would be higher (though they are close to historical lows). But, I do think we would still be able to sell the necessary government bonds. In a liquidity trap with rise in saving ratios, there is a high demand for government bonds.

Related

1) If debt is held by the Bank of England then we (the people) hold our own debt?

A: If the gilts are held by the Bank of England, and the Bank of England was nationalised in 1946, then yes the gilts themselves are a debt owed by one part of the government to another part of the government, and the gilts themselves are not a debt burden to taxpayers. In principle, the government could just write off the gilts.

But there’s a huge catch. Remember that there is another debt involved in QE: the BoE created new reserves to buy these gilts from someone in the private sector, those reserves are a debt from the BoE to whoever now has them, and those reserves still exist. All that happened in QE was that the private sector exchanged a debt from the government proper for a debt from the BoE, another part of the government.

If the government were to instruct the BoE to write off the gilts, the BoE would make a giant loss, meaning that its liabilities (the reserves) would have to be paid by the government and therefore by taxpayers. The only way to avoid this loss to the BoE is if the gilt debt is paid by the government and therefore, once again, by taxpayers. The only possible way around it is for the BoE to default on its debts, which is even more serious than a government debt crisis, because it affects everyone who uses the currency, not just holders of government debt.

In summary, the creation, trading and writing off of debts (such as in QE) has absolutely no effect on the combined net worth (assets minus liabilities) of the people participating in the transactions, or on the net worth of anyone not participating. There is no free lunch.

2. Interest paid to the BoE is a transfer of net worth from the government proper’s balance sheet to the BoE’s. Any profits made by the BoE are remitted back to the government proper, so it is all just transfers internal to the government as a whole.

3. Yes, QE is buying up debt, but buying with a new debt, so it is just exchanging one form of government debt for another.