Readers Question: Who lends the government money?

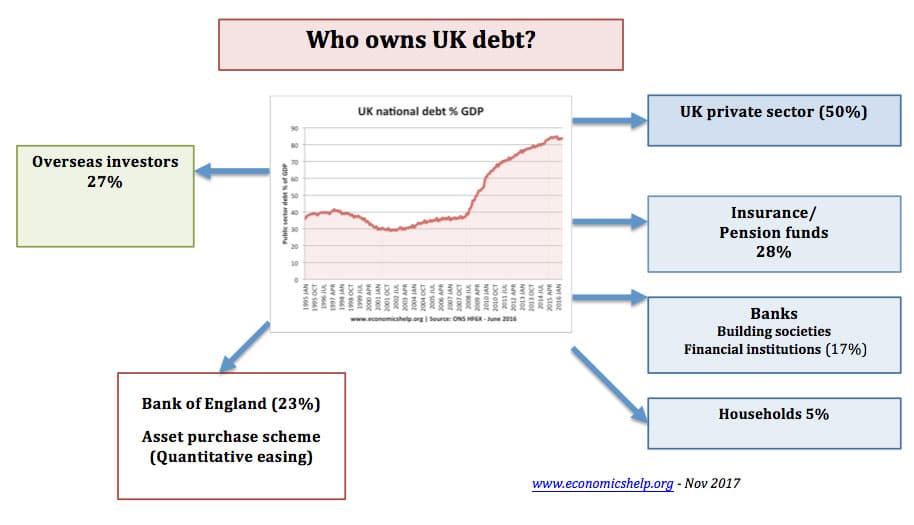

Government debt is primarily sold to banks, pension funds, private investors and overseas investors. These financial institutions and individuals effectively lend the government money in return for gaining a safe investment (bond) with a guaranteed interest payment. Approx 27% is ‘lent’ by overseas investors.

Investors do not see themselves as ‘lending’ money to the government. From their perspective, government bonds provide a relative safe, secure, low-risk investment option. In an investment portfolio, government debt secures the low-risk, low yield aspect.

UK public sector debt in Aug 2017 was £1,773.3 billion equivalent to 88% of GDP. See: UK National Debt.

On this debt, the government have to pay interest payments, In 2016/17 this was £49.1bn – approx 2.5% of GDP billion a year. See: interest payments on UK debt.

To finance this national debt, bonds are sold through the Debt Management Office (DMO) on behalf of the government to the private sector. Most of this government debt is bought by financial institutions such as:

- Pension funds

- Building societies.

- Investment trusts

- Insurance companies

- Private individuals (UK households)

Therefore, the interest payment is paid to those who buy the government bonds and gilts.

Since 2008, The Bank of England has purchased 25% of government gilt holdings as part of quantitative easing. This means a significant proportion of UK debt is being financed by Bank of England.

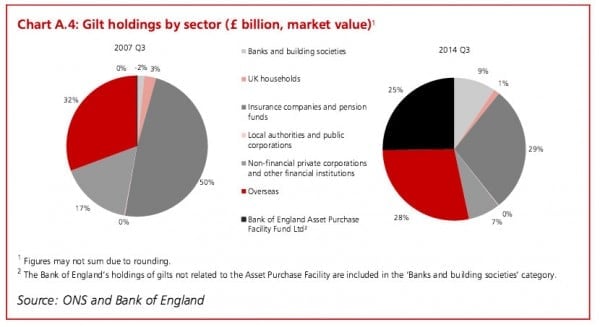

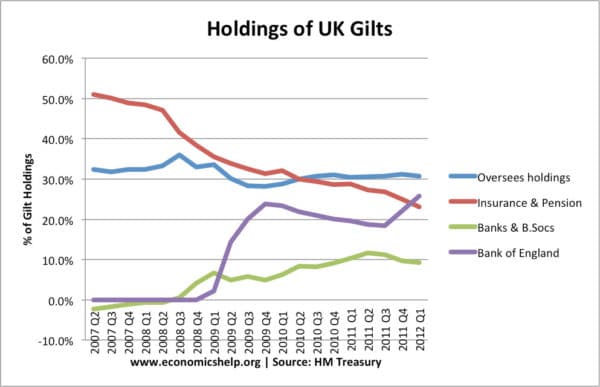

Trends on holdings of UK Gilts

The Bank of England has not taken nearly 30% of gilt holdings.

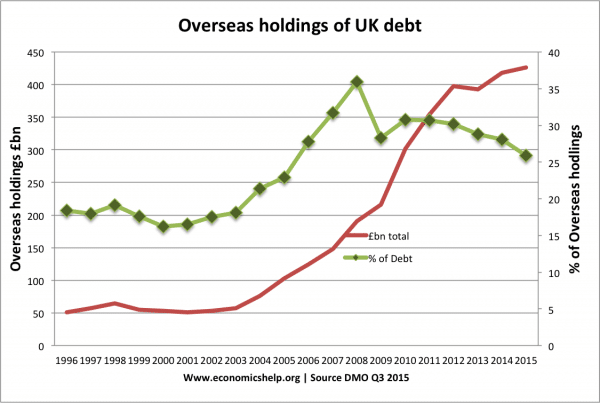

Foreign Holdings of UK Debt

The percent of UK government bonds bought by foreign financial institutions.

UK Debt held by oversees investors

Quantitative Easing and Government Debt

Since 2009, the Bank of England has used electronically created money to purchase government bonds. The initial wave of quantitative easing involved £200bn. Therefore, a significant part of the governments debt is held by the Bank of England. (21% at start of 2011)

Note: The purpose of quantitative easing is supposed to be – keep interest rates low, encourage bank lending. It isn’t meant as a way of financing government debt. After economic recovery, the Bank of England will sell these government bonds back onto the market. Thus debt will be held by the private sector again.

Related

Nobody lends the goverment money, they just take it and write it on our tab. Cash reserves and credit are used (read: money is robbed out of pensions & long term deposits, also known as your savings, that you ultimately pay back after they spend it)) and they bang it on to our tax bills, to complete a “world class rodgering”. Thank you Labor, although I do like a bit of slap & tickle first!

about why there is not enough money to pay debt, money is lent from central bank at intrest, which means there can never be enough money in circulation to pay it back, say if i borrowed 1000 pounds and had to pay back 1200 if i give all money back i still owe two hundred pounds that i dont have so the banks are creating a constant spiral of debt that is why every country is sinking deeper and deeper and it will never stop

THAT IS THE POINT!!!

that is why greece had one bailout and now needs another and there debt is getting bigger, because they borrowed money at intrest so they stabilised for a while but mass intrest payments on the loan mean now they need another and whatever happens this time in two years they will need another, only by loaning intrest free then using austerity cuts can you reduce it

what a tangled web we weave…governments have no money,therefore the taxpayers should

run the countries and govern the countries and cut out the banks and interest and put an

end to all the problems of boom and bust economies that will be the ruin of us all.

I think the only way to make that possible is decentralization through the use of blockchain technology, a technology that can take us out of the repeated cycle of centralization, corruption, war and famine. Spread the worrd

Not the ruin of all of us, just those of us at the bottom (the majority) who will be taxed by incompetant government to finance the lifestyle of the elitist parasite who live off the machinations of the capitalist system manipulators.

Geez you Yanks are stupid! The more money you create, the less it is worth. The USA is owned by China Japan, the UK and a handful of rich Arab countries. This is who really controls the USA. It wasnt this way until Bush JR came into power and destroyed the economy and took away all financial control from the USA and put it into the hands of these countries which can afford to bankroll the USA.

This is a capitalism fact you all need to get. Central bank is a PRIVATE COMPANY which print money. The government does not have the permit to print money. They need to ask the Central bank to print out money for them. This does not happen in communism country. Enough said.

Can anyone explain the precipitate drop in household holdings of gilts?

In the UK’s experience, at least, it appears to be related to policy of Quantitative easing.

There’s some graphs here on holdings of UK gits.

https://www.economicshelp.org/blog/1407/economics/who-owns-government-debt/

The Bank of England has gone from 0% of gilt holdings to nearly 30%.

Banks are holding more gilts (due to not wanting to lend). But, pension fund and investment trusts’ share has fallen from 50% to 25%.

Bear in mind, the government is borrowing more. So private investors are still holding bonds, but their share is falling.

Until a few years ago, the surplus in the ring fenced National Insurance Fund was invested in Gilts. Since then the surplus has been managed by the Debt Management Office (part of the Commissioners for the Reduction in the National Debt – CRND) and directly invested with the government with lower holding and transfer costs in Call Notice Deposits. The surplus has been as high as over £50 billion in 2007/08 but has fallen to around £40 billion in 2012. I am not sure how that had been classified when it was held in Gilts but it isn’t invested in Gilts any more.

my guess is, the reason interest is charged at-all, is because no one actually expects to get the money they lent back again, so interest payments make up the difference.

Secondly, the UK does not want to get a reputation as a weak economy, because that would increase the interest rate it has to pay to borrow money.

It is the same as an individual trying to take out a loan from a bank: if the bank is absolutely confident that the individual has enough money coming in to pay back the loan then it will charge a much lower interest rate than it will for somebody it is a bit less sure about.

as the bbc says.

basically interest is charged because to a greater or lesser extent the lender isn’t expecting to get the money back.

One important point that that throws a spanner in the works. The bank of England is buying ever increasing government debt in the form of guilts. And yet the The Bank of England is wholly owned by the British government! This is shunting part of the national debt sideways. Nothing is being reduced or payed off, it has been moved to a different ledger within the same system.

Question…feel free to scrutinise.

In theory whats to stop a powerful country such as the US lending a heap of money and then saying to the lender..”actually, i dont think im going to pay you back. And theres nothing you can do about it…i control the military. And now we are going to print our own money to avoid paying interest”

I know it sounds stupid but why not? whats stopping them!

The buyers of bonds would lose confidence in the us gov, they would then demand higher interest on the bonds they purchase,

Lucien Crofts.

Apt spelling of Gilts. Was it deliberate?