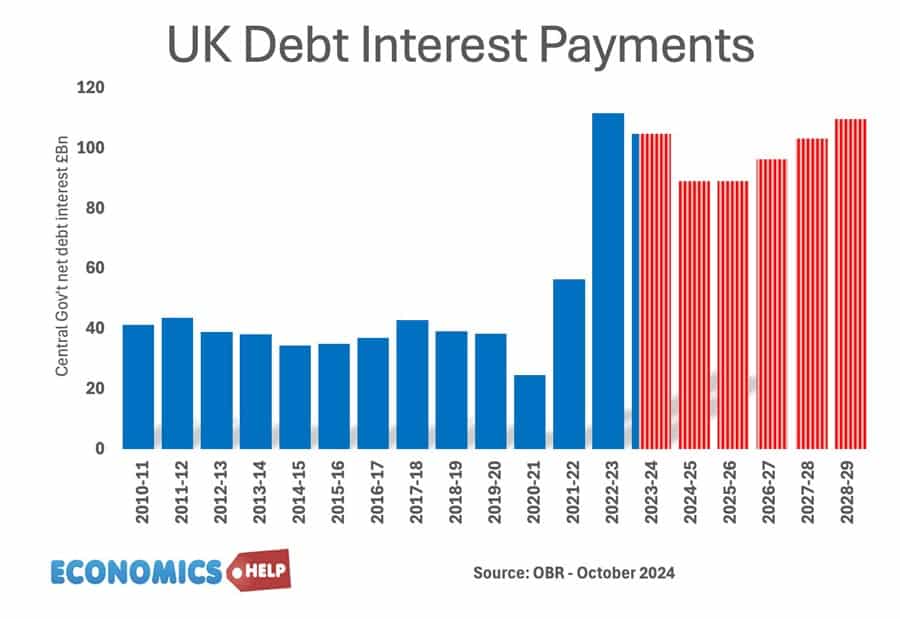

Debt interest payments are the amount the government need to pay to holders of government bonds. It is the cost of servicing public sector debt.

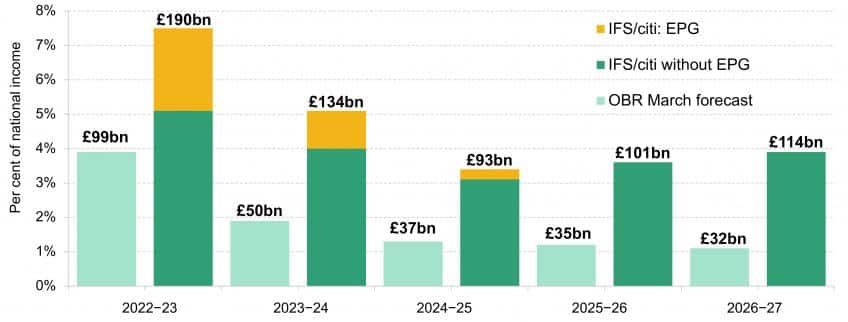

- One forecast by Pantheon Macroeconomics suggested that the UK’s debt interest bill would rise to £123bn for the current financial year alone, £35 billion higher than previously forecast and £54bn more than previous year. (This is Money) .

- Sir Charlie Bean – ex Bank of England chief economist – told Channel 4 (sep 2022) that the rise in interest rates (including long-dated gilts) since Friday will cost the Government an extra £20 bn a year.

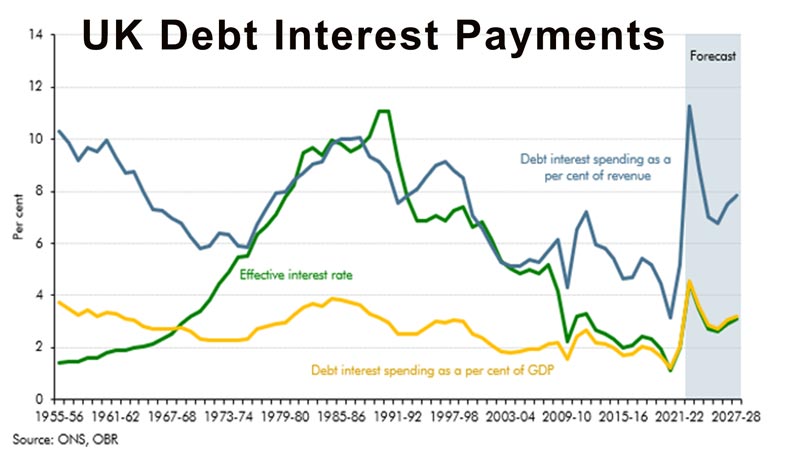

The level of debt interest payments depends on:

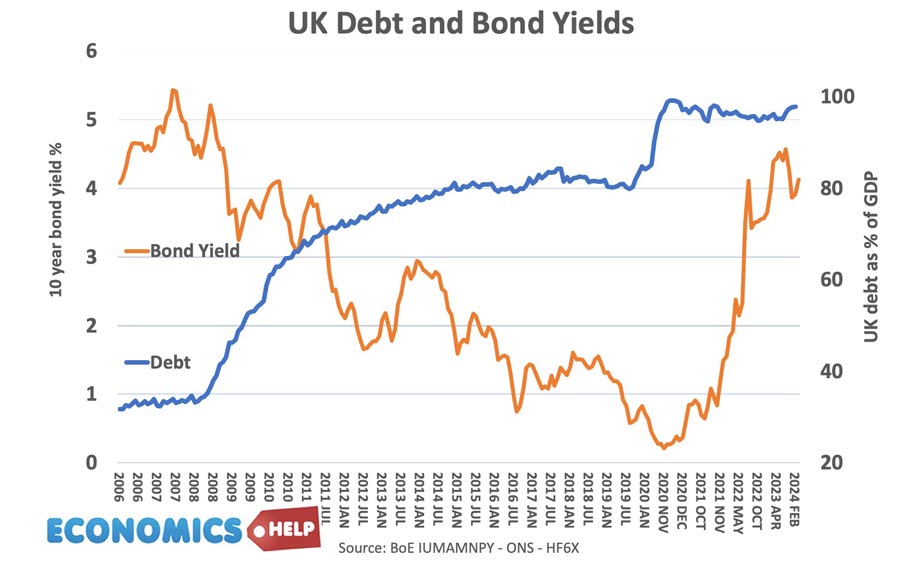

- Outstanding levels of government debt. In June 2023, UK public sector net debt was £2,567.7 billion or around 100% of GDP).

- Interest rates on debt.

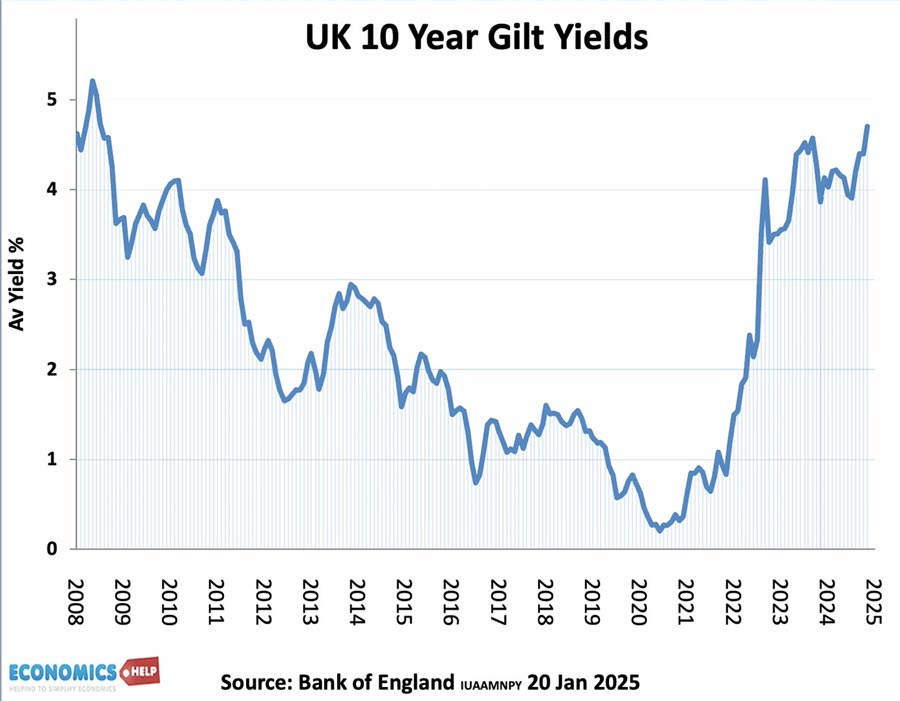

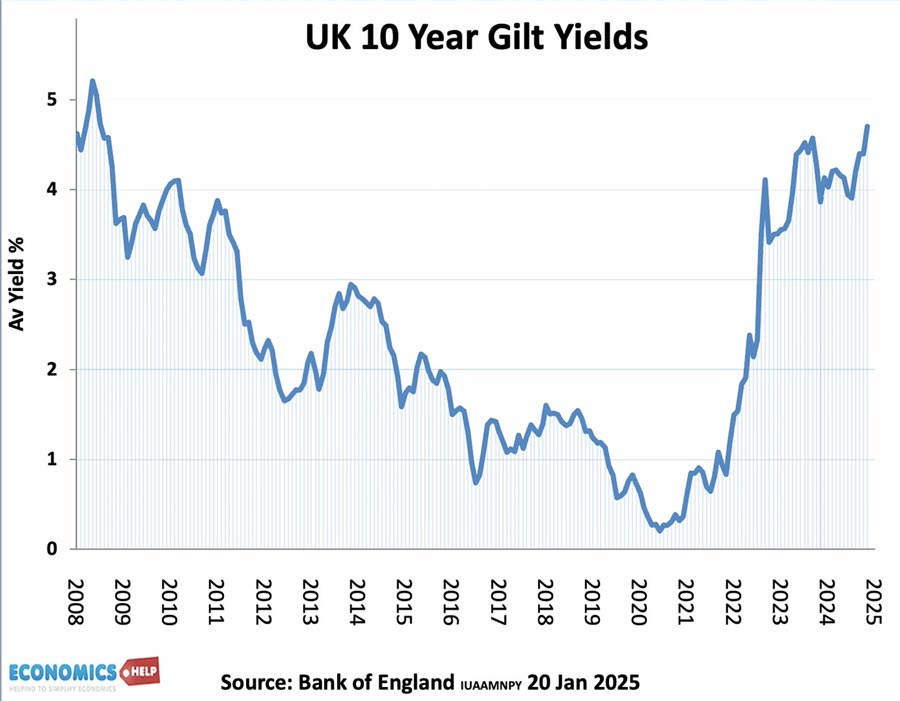

- Bond yields can rise or fall depending on the economic situation. In 2021, bond yields fell to 0.8%, but after mini-budget of Sept 2022, bond yields shot up to 4.5% which will cause a very large increase in debt yields.

- Inflation – A higher inflation rate will lead to an increased cost of index-linked gilts (bonds where interest payments are directly linked to the inflation rate.) Higher inflation will also put upward pressure on interest rates.

Sources for debt interest payments

- OBR Economic and Fiscal outlook 2024-

- UK Debt-interest-payments.pdf

- Public sector spending Gov.

What determines the amount of debt interest payments?

- Level of net debt/borrowing

- Inflation. Higher inflation rates increase the cost of index linked bonds

- Interest rates on bonds

- The interest rate is determined by the demand for government bonds.

- If demand for buying government debt falls, the price of bonds rises, pushing up bond yields, increasing the cost of borrowing.

- Some European countries like Ireland and Italy have seen rapid increases in bond yields, making it very expensive to service the debt. This is because markets worry about their ability to repay debt.

- Between 2008-17 – the UK has seen a rise in debt levels, but interest rates have actually fallen.

Bond yields in UK (2007-2024)

Bond yields in the UK fell between 2007 and 2022 because:

- Low inflation expectations

- Low economic growth and a lack of demand for private sector investment.

- Low expectations about economic growth have made ‘safe’ UK government bonds more attractive than riskier private sector investment

- Policy of quantitative easing and purchase of government bonds by Central Bank

- UK seen as a relative ‘safe haven’ compared to countries in the Eurozone (Being in the EUrozone makes you more vulnerable to liquidity crisis because you can’t print your own currency like the UK can)

- See also: reasons for falling bond yields

You can see a table of bond maturity levels on this post – Global Debt Crisis

UK debt crisis of 2022

Why did bond yields surge in September 2022?

Inflation was running at 10% and the economy at risk of recession. The government announced a huge fiscal expansion (involving tax cuts for high earners and an energy price guarantee) which saw the budget deficit soar.

The IFS believed the budget meant the UK debt was on an unsustainable path. Also the fiscal expansion alone was likely to raise inflation. Markets saw UK debt as more risky and investors sold on expectations of higher inflation, higher interest rates. See: Truss Economics – Will tax cuts save the UK economy?

Impact of higher bond yields.

In April 2022, UK public sector net debt was £2,347.7 billion or around 95.7% of GDP)

- With bond yields of 3.75% the annual interest payment would be £88bn.

In 2023, if we have a £200bn increase in debt to £2,547v bn and average bond yields rise

- With bond yields of 6%, the annual interest payment would be £152bn.

It is more complicated than this because debt is issued every month and so different bonds have different yields. Also, the UK sell index-linked gilts, which means the yield is tied to inflation, so as inflation increases, the interest payment also rises.

Related

- Should We worry about National Debt?

- The biggest lie in UK politics? – Is the debt issue exaggerated?

Note: There is some inconsistency in data depending on the source. This is because forecasts of future debt interest payments may not be accurate.

Why would anybody buy 10yr bonds yielding 0.8% interest when the ftse100 was yielding 4%.