The UK government faces a perilous situation. In the short-term, there is a combined threat of an energy crisis, high inflation, risk of an imminent recession and a falling value of Sterling. On top of that, there are long-term problems such as climate change, a slowdown in growth and productivity, and rising debt to GDP.

The government’s proposed solutions are quite striking with one of the biggest interventions in the economy in recent years. Their main proposals are

- A price cap on energy (average of £2,500) requires the government paying the excess to energy companies. The cost is estimated at around £130bn.

- Cut in corporation tax

- Cut in income tax. Reversing NI raise

- More deregulation and liberalisation of markets, such as abolishing stamp duty and making it harder for part-time to claim in-work benefits.

- The main objective is “growth, growth” The hope is that by raising economic growth, the tax cuts pay for themselves through higher economic growth.

- It is a bizarre mixture of Keynesian demand management and trickle-down economics. Reminiscent not so much of Mrs Thatcher (who cut income tax, but raised VAT to reduce budget deficit) but Ronald Reagan who in the 1980s cut income tax aggressively (funded by borrowing)

Problems of Energy bailout

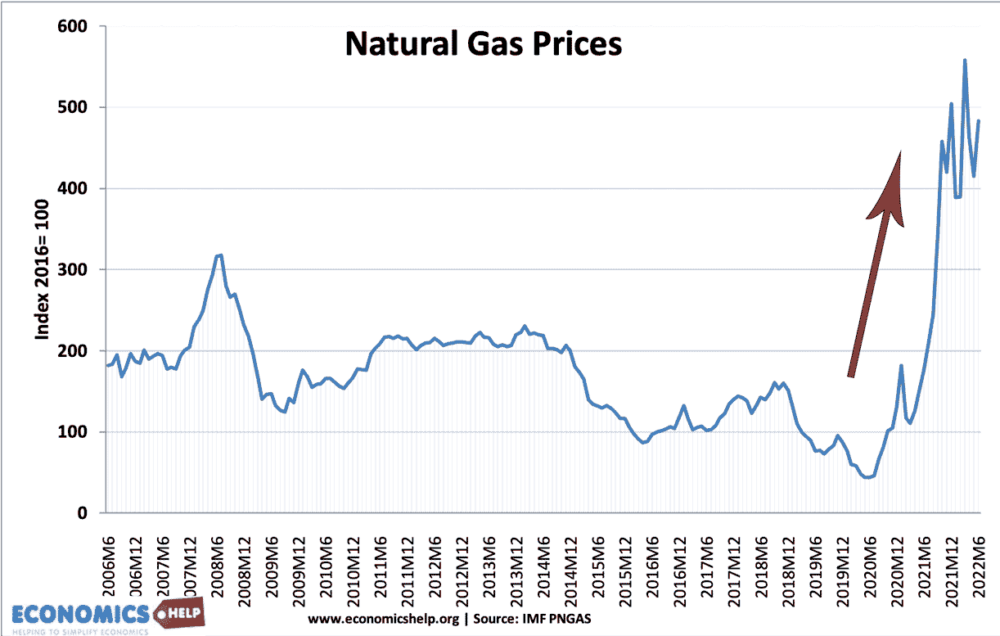

The headline intervention is the energy bailout, which will prevent catastrophic price increases due to rising gas prices this winter. The benefits of this are to avoid a further decline in living standards and prevent costs from becoming even more excessive for business. Also by limiting energy price rises, it will limit the rise inflation to 11% (rather than 13-18%).

It is a necessary intervention, something had to be done, even if imperfect, the main thing is to prevent a meltdown in living costs and forcing businesses to close from excessive energy prices. However, it still does raise some concerns.

- It will be financed by government borrowing. But debt is already rising and set to soar in coming decades, another £130bn (+) on top does raise very real risks about debt, especially with interest rates rising. In the absence of the OBR, the IFS state gov’t proposals would put UK on an unsustainable path.

- With inflation at 10%, there is no question of financing debt through QE like in 2009.

- Ultimately taxpayers will pay for rising energy costs through lower government spending, and higher taxes in the future.

- Should the government pay the whole cost of the energy bailout at a time when energy companies are making record profits? A windfall tax could not meet the whole bailout but spreading the cost would be fairer to the taxpayer.

- There is a strong case for disconnecting the price of electricity from the most expensive input (at the moment gas.) Producers of renewable energy and nuclear are very profitable at moment.

- There is no guarantee energy prices will come down in six months time. We could see very high energy prices into 2024. This could leave the government with the need to spend and borrow even more.

- The bailout will go disproportionately to high-income earners because they use more energy. As Paul Johnson of the Institute for Fiscal Studies said on R4 “the majority of the money will go to better off people who use more energy so this is very poorly targeted.”

Alternative solutions could have been more direct income support rather than capping prices. This would create more incentive to reduce demand (and prevent gas shortages) and target support to those who need it more.

I understand there is a logic that the energy price cap is at least simple and easy to understand and avoids some people slipping through net, but a side-effect of the chosen solution is that it will go disproportionately to high-income earners, which is a problem given tax cuts (and ending cap on bankers bonuses) will disproportionately benefit high earners too. Also, price caps discourage efforts to reduce demand, install solar panels e.t.c.

Tax cuts

The good news about tax cuts is that it will to some extent stave off a dramatic fall in aggregate demand and imminent recession (which recently the Bank of England predicted to be the worst in living memory). The bailout and tax cuts are a very large fiscal expansion, which will provide some boost to demand at a time of falling spending and weak growth.

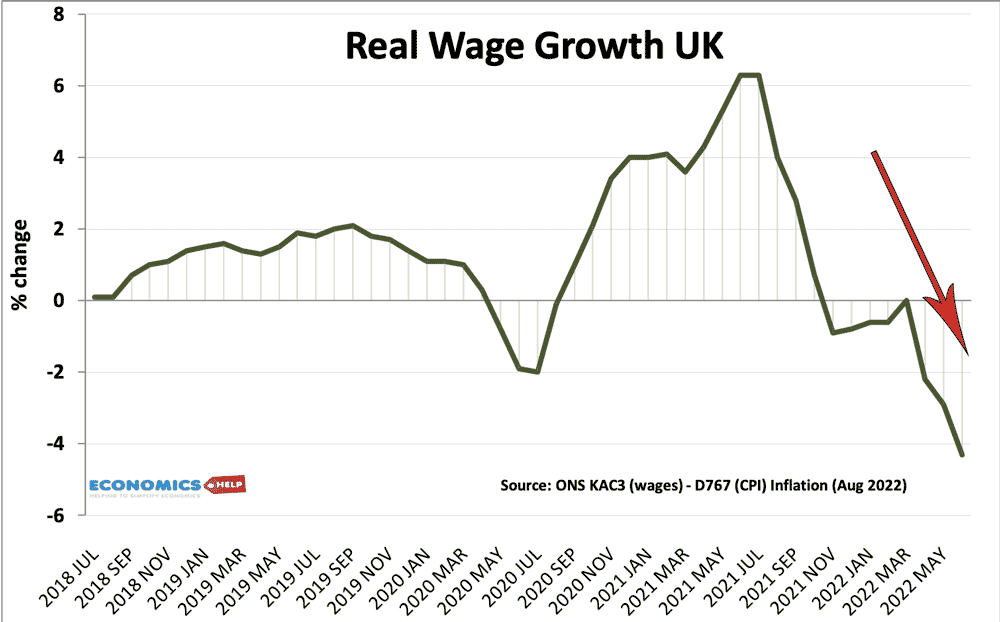

- The bad news is that they may not be enough. That might sound strange given the scope of extra borrowing. But, many households, will not actually see this energy bailout as a boost. Prices are still going to rise in October, at a time when the cost of living is already a real issue with real wages falling. Many people haven’t come to terms with the price rises from last April.

- The latest tax cuts will have the largest impact on high earners and big companies. High earners will spend more as a result, but if fiscal expansion had been better targeted to those really struggling with the cost of living, it would have had a bigger impact on avoiding poverty and also boosting short-term growth because those on low incomes have a higher propensity to spend.

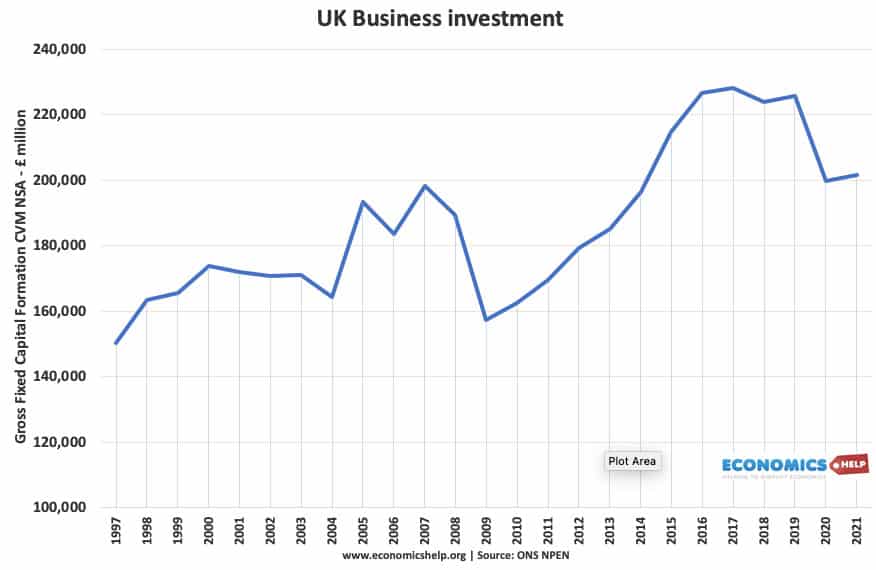

- I’m not convinced corporation tax cuts will boost investment. There is no evidence that lower rates of corporation tax guarantee higher investment, especially in the current climate of long-term weakness in investment.

- It is most likely that firms will continue to be cautious about large-scale investment, given higher interest rates, weak growth, global uncertainty and rising prices. (see effect of tax cuts)

- A much better use of government borrowing would have been to fund investment directly. There is no shortage of possible investment projects, such as improving infrastructure, education, and health care. A really good use of public money would be to invest in insulating homes and factories so that we are in a better position to deal with high energy prices in the long-term.

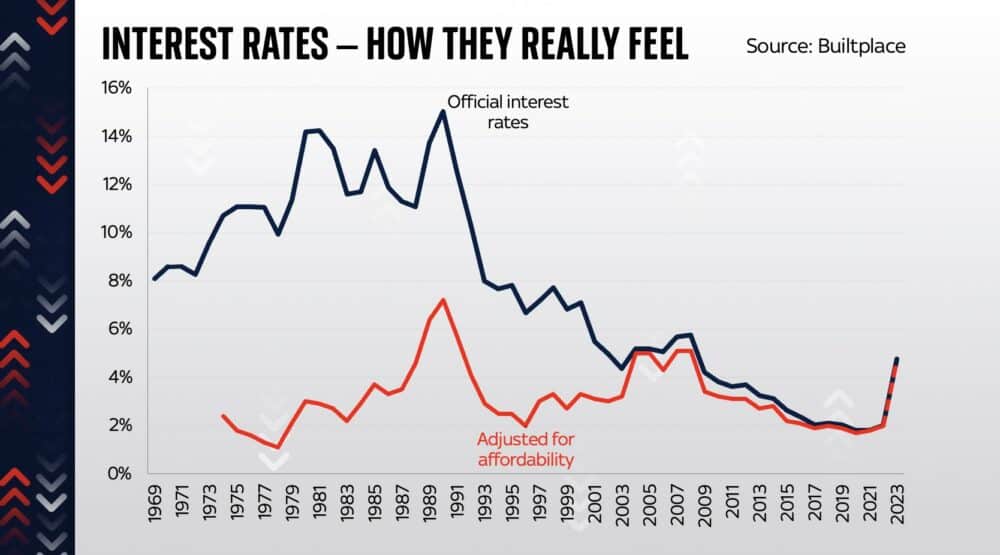

- Interest rate rises will also weigh down the economy because with high mortgage balances, small increases in interest rates will have a big effect in reducing affordability.

Tax cuts pay for themselves

A real area of concern is that the Conservative government appear unwilling to allow the OBR to publish forecasts for debt, and they talk of ‘tax cuts funding themselves and everything will be OK when tax cuts boost the rate of economic growth. This is what might politely be called ‘fantasy economics.’

It is true right-wing leaning economists like Greg Mankiw may claim a 1/3 of tax cuts end up paying for themselves with higher growth. But, a left-wing leaning economist like Paul Krugman is more unforgiving arguing the idea tax cuts pay for themselves is the ultimate ‘zombie’ idea that no matter how many times it is disproved it doesn’t go away. (partly because it is so politically appealing) (More papers on this subject here)

The problem is that with rising interest rates, the cost of servicing UK debt is going to rise significantly. One forecast suggests UK debt interest payments could surge to £118 bn for the current financial year alone, £35 billion higher than previously forecast (on the back of higher rates and higher interest rates).

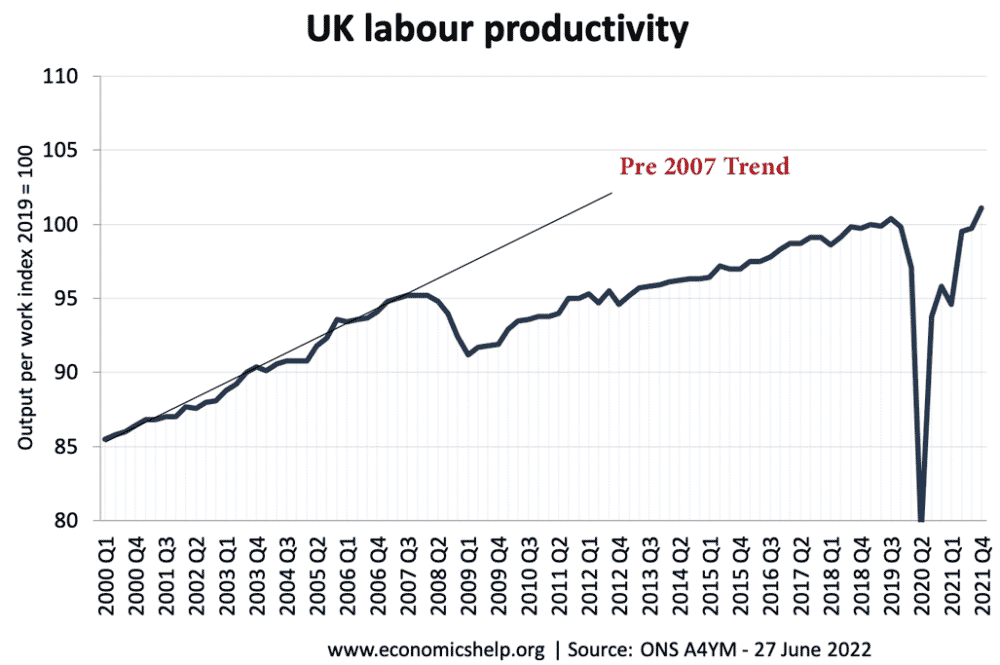

A real problem the UK economy faces is a slowdown in productivity growth since 2007, partly due to an unwillingness to invest by firms but also demographics, technological factors and weak demand. Tax cuts alone will not change this dynamic, especially given all the continued global uncertainty, higher costs, weak demand and issues relating to Brexit.

Stamp Duty cut

Stamp duty is a distortionary tax which discourages people from moving. In theory, there are advantages of abolishing stamp duty to encourage greater flexibility in the housing markets (e.g. make it easier for people to downsize or upsize). But, given the increasing wealth inequality in the UK, a cut in stamp duty needs to be part of a bigger package to address the huge wealth inequality (and intergenerational equality) which would be worsened by cutting stamp duty. Also stamp duty raises in the region of £17bn.

Conclusion

The government are right to take big action for this unprecedented challenge, some of which is out of its control. They do face a challenging economic climate with an unwelcome combination of inflation, recession, and rising energy prices. However, although this package does stave off the worst impact, there is a sense of a missed opportunity.

The faith in trickle-down economics and tax cuts to revitalise the UK economy and create some kind of ‘economic miracle’ is misplaced. It reminds me of the late 1980s, when chancellor Nigel Lawson talked about an ‘economic miracle’ from the 1980s supply-side policies, allowing UK growth to increase to 4%+ – but this was just hubris and we ended up with a boom and bust (recession 1990/91).

Also, the energy crisis may not go away for quite a long time, the UK desperately needs to develop more renewable energy, insulate homes and businesses and wean itself off fossil fuels (for both economic and environmental reasons). If the government is going to borrow an extra £140bn + then there should be more targeted use of public money for these goals of renewable energy and better insulation.

Also, the distributional effects of the bailout are skewed towards the highest earners, both tax cuts and energy bailout will benefit higher earners significantly more. The government would get two significant benefits from more targetted help to low-income earners

- The poor have a higher marginal propensity to consume so expansionary fiscal policy and avoiding recession would be bigger.

- It would tackle the real cost of living crisis and poverty many households will face over this winter.

Effectively, the US is exporting inflation. Could it be that a deal has been struck between the US and UK.

This seems crazy but think of the benefits to both countries. The US won’t need to raise interest rates to such an extent that will cripple it’s economy, simultaneously “offloading” some of the manufactured dollars, in circulation. The public sector, have seen projected pay increases (most notably the NHS), including a rise in pension contributions. Could this be portending a devaluation of the pound?