The UK is heading for an energy crisis this winter, with average bills set to rise from £1,100 per year to at least £3,600. And with the possibility of prices rising to over £5,000 in January 2023. The lowest income families may see energy costs rise from 7% to 24% of income. (Link) For better-off households the increase will be from 2% to 7%. (BTW: Fuel poverty is defined as spending more than 10% of income on energy.) Prices are rising in the UK faster than elsewhere, with the French government limiting electricity price increases to 4%. (Sky News) Yet many UK consumers are still underestimating how much energy prices will rise this winter. The big question is what to do about it?

Possible options include

- Do nothing – Libertarian approach to markets.

- Price caps on energy. With the state pays for the difference and forces energy suppliers to make lower profits.

- Tax cuts. Cut VAT on energy. Income tax cuts to increase disposable income

- Direct benefits to households and firms

- Nationalisation of energy suppliers/producers. (Difficult)

- Reform of energy markets, changing price structures.

- Long-term measures to reduce demand, and increase the supply of alternative measures.

How to finance extra support

- Windfall tax on energy firms/banks

- Wealth tax on property/savings

- Higher income tax/VAT

- Government Borrowing/Bank of England Funding.

- Spread costs on consumers over several years.

Firstly to do nothing is reminiscent of the response to the Irish potato famine of the ninenteenth century. When the philosophy of laissez faire economics was so widely adhered to, the UK government wouldn’t intervene in markets, despite widespread famine.

Cost of inaction

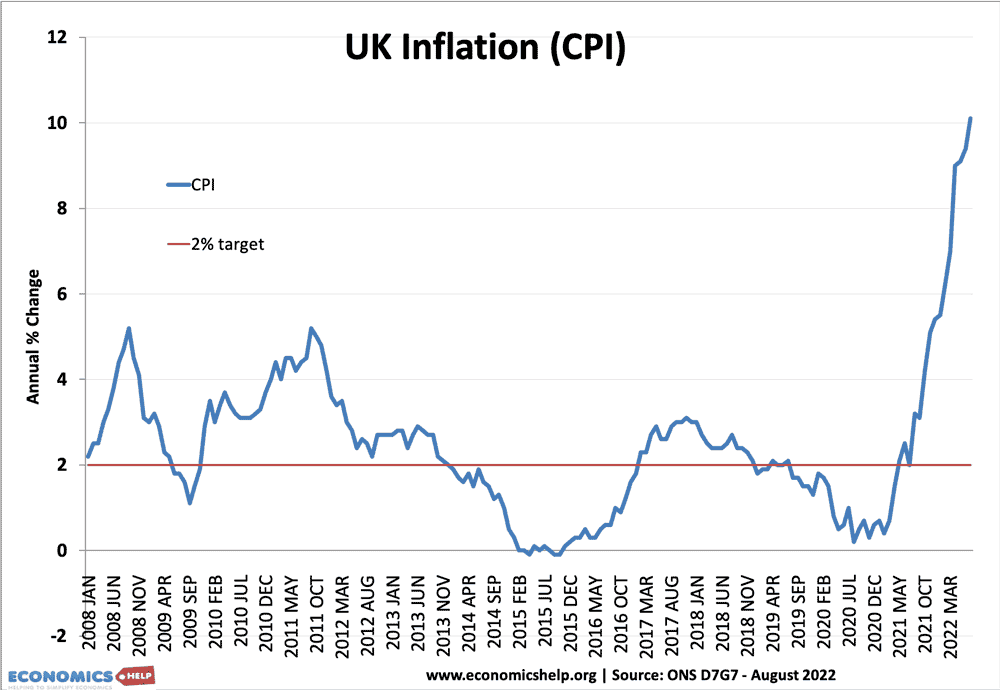

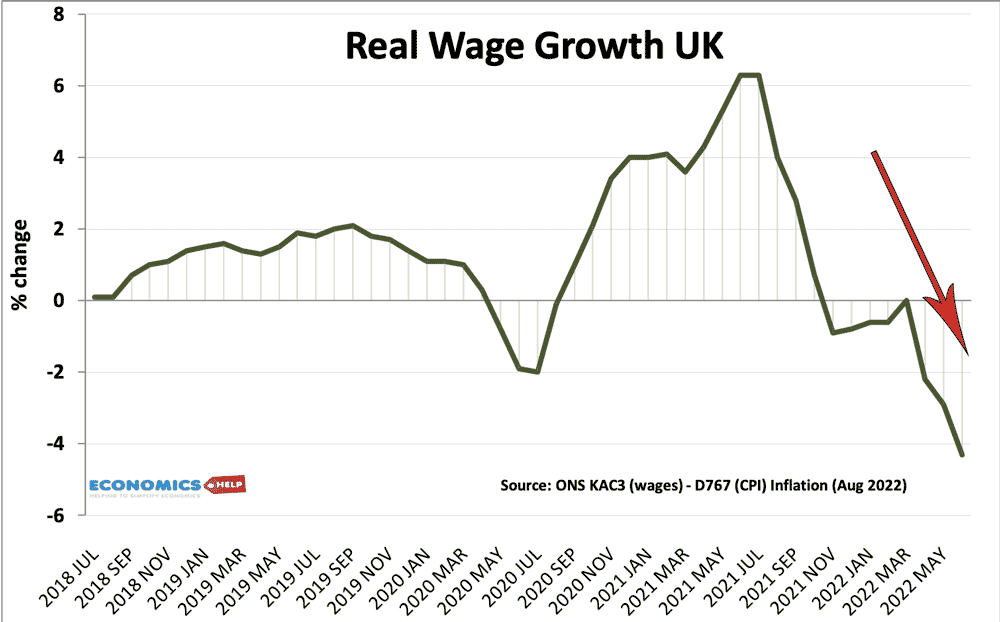

The costs of inaction would be very significant. Firstly, there is the impact on poverty, with many low-income (and middle-income) families not being able to afford these prices. But, it is not just households who would be affected, it is also charities, schools, public buildings and businesses who would face difficulties heating their buildings and turning on the electricity. The government’s current offering of an extra £400 is only a small fraction of the future rising costs. The problem is that other prices are also rising, with inflation now increasing to over 10% (and making the Bank of England’s forecast of 13% look optimistic). Furthermore wages are not keeping up. Real wages have dropped 3% and could fall by more, leaving many struggling to pay bills – even before the winter price rises.

If prices do rise, and there is insufficient support, we are likely to see real poverty, but also knock of effects for the rest of the economy.

- There will be a big drop in demand for hospitality and the entertainment industry as households cut back on spending.

- Landlords would see a rise in rent defaults as tenants could not afford all their bills. With rising interest rates, mortgage owners could be pushed into financial distress and increase in mortgage defaults.

- Business would be hit in two ways. Firstly from the fall in demand due to cash-strapped households, but also facing their own increase in costs. For any small to medium business electricity prices are increasing at an unprecedented rate. The FT reports the case of an energy broker reporting

“a hospitality business he works with was offered a new electricity contract priced at £605,000 a year, a seven-fold increase on its previous one.” (FT)

Rising electricity prices would be bad enough but many firms have been struggling to attract sufficient labour and have been increasing wages to attract labour. Pubs have reported they may try to open shorter hours to save costs. Other firms are not sure whether they can make it through the winter. If firms do start to go out of business, it will have a negative multiplier effect on the rest of the economy, leading to rising unemployment, lost business and rising debt levels.

How should the government respond?

The current government proposals of offering £400 for every household (and up to £1,200 for the most vulnerable people, is insufficient given price rises could be going up £2-3,000 a year. £66 a month will not cover the extra living costs.

Part of this energy crisis is a temporary phenomenon. Although we may have high energy prices for a few years, the real crunch time is this winter, with energy prices predicted to peak. Therefore, it should be treated as a temporary emergency and action taken to avoid the extremes of prices. This could take the form of either direct income support or price caps (or combination). The important thing is to shield households and businesses from the extremes of price fluctuations, which will be unmanageable. This short-term crisis can be financed by government borrowing or temporary taxes such as windfall taxes on energy producers/banks (who have become profitable from rising interest rates).

In the medium/long term, the government can’t insulate consumers and households from higher prices. Higher prices have to play role in reducing demand and encouraging efficiencies. Reducing demand for energy is part of the long-term solution from both an environmental perspective and economic one.

Insulation

A good investment from both an equity, energy and environmental point of view is for the government to subsidise or provide directly improved insulation for many homes which are lacking. This should have been done before, but the energy crisis is a good motivator to make it happen. In the long run, it will save money because over several years energy bills will be reduced as households need less energy to keep their house warm. This is the kind of public good investment which would be acceptable to finance from long-run government borrowing.

Reform of energy market

At the moment, many low-income households face higher tariffs because those with poor credit histories are put on pre-paid meters which have higher rates than standard deals. However, this penalises the poorest incomes with higher prices. The discrepency should be stopped.

Another poor feature of UK bills is the high level of standing charges. As of April 2022, the standing charge for electricity almost doubled to 45p. This means even if you don’t use any electricity, you will pay £146 a year just to be connected.

Another issue is that 50% of gas used in British homes is produced domestically, but OFGEM let suppliers use international market prices. This is why even an increase in gas supply from fracking would have very little impact in reducing prices for British customers because firms could still charge the international price. UK Gas firms are making more profits because their costs haven’t increased. Also, OFGEM allows firms to charge a price equal to the most expensive method of producing electricity because its remit is to make sure firms are profitable. A change in the OFGEM pricing model would enable more competition between the different types of energy. However, it is important to bear in mind, that even if we forced energy suppliers to make zero profit over the next six months, that would not solve the problem. The real profit is made from producing gas.

Progressive tax charges

I like the idea in Richard Murphy’s report on surviving 2003 to make electricity and gas charges progressive. This means the first units of electricity are charged at a low rate, and as you use more there is a higher tariff. The logic of this is that it would make energy bills more progressive. Low-income households use less electricity because they have smaller homes, fewer appliances and are more sensitive to prices. High income households use more electricity because they have bigger homes and are less sensitive to prices. This would mean richer households would be paying more for the use of electricity that isn’t essential. The advantage of this is it would make it relatively cheaper to have essential electricity use (e.g. minimum temperature) but the use of inessential electricity would be charged at a higher rate.

Nationalisation of energy suppliers?

There have been calls to nationalise energy suppliers to ensure low prices and avoid excess profits. It is worth distinguishing between energy suppliers and energy producers. The real profit in the industry is coming from the big producers and refiners of energy, not from domestic retail. For example, in the first six months of 2022, the big five energy producers BP, Shell, ExxonMobil, Chevron and Total Energy made over $100bn. (Guardian link) (They would point out they made a loss in 2020 when oil prices were negative). Energy supply by contrast is not as profitable. The highest earner, SSE, made £600m in profit before taxes in 2021 according to annual accounts published by the energy regulator Ofgem. (Open Democracy) But other energy suppliers have made a loss in recent years, forcing 30 firms out of business. Companies like Octopus Energy reported a loss of £85m in 2021. Even profits of £600m dwarf the potential rise in prices.

Another problem with taxing the big winners from high oil prices is that they are often foreign firms, such as the Norwegian state-owned sovereign wealth fund. Multinationals are also adept at hiding profit in countries with lower tax rates. E.g. BP can make profit in offshore refineries which avoids UK tax rates.

By the way, state-owned Norwegian energy firms have created a $1.2 trillion wealth fund by saving surplus oil revenues. This is the advantage of national ownership of major commodities. In the UK, BP was privatised in the 1980s, meaning the benefits of oil extraction go to shareholders rather than the wider economy. It is one thing to criticise privatisation but to turn back the clock and nationalise BP would be incredibly difficult now.

Tax cuts

The prospective PM Lizz Truss has made much of her promise to cut income taxes. But, it doesn’t target help those who most need it. A cut in VAT and energy tariffs on bills also is only a small fraction of the overall prospective price increases.

Best solution

The government shouldn’t try to stop all price rises. Support should be split into two parts, price caps to avoid a surge in prices this winter which would be devastating for businesses and consumers. This price surge should be absorbed and paid off over the coming years. Secondly, there should be direct income support targeted at those who most need it.

Long-term

In the long-term, there are several reforms that can improve the energy market and make us less reliant on fossil fuel energy.

In the long-term, the most important thing is to continue to invest in renewable energy and reduce our dependency on fossil fuels and their volatile prices. (There are also major environmental reasons for this) Also, simple things like improving insulation, and subsidies for more fuel-efficient machines and appliances can help reduce demand.

Further reading

- Surviving 2003 Richard Murphy

You perhaps need to buy some time to make the reforms needed and avoid severe poverty. The forecast curve for whole power suggests prices will mean revert by the end of the decade to more historical levels. Instead of quarterly price adjustment pain, instead take an 8 year view, use relatively cheap Bank of England borrowing to fix prices to around say 25% higher than 2021 levels. It will still hurt consumers but keep inflation more muted. It is a semi private public solution. There will be lots of details to work out but principle is fine

I have installed solar panels on my roof three years ago, at 67 year old I thought £4200 was better on the roof than in the bank doing nothing.

What I think and probably would not be popular is there should be a law change to get these panels on as many roofs as possible, hence reducing the energy required in the uk by approximately a third.

This obviously would not be immediately done but would create massive employment.

Handouts would not be possible forever we need to

act.

The funding for panels is something which would require working out but the uk has a lot of clever people capable of creating schemes for installation.