Why has the Pound Sterling been falling?

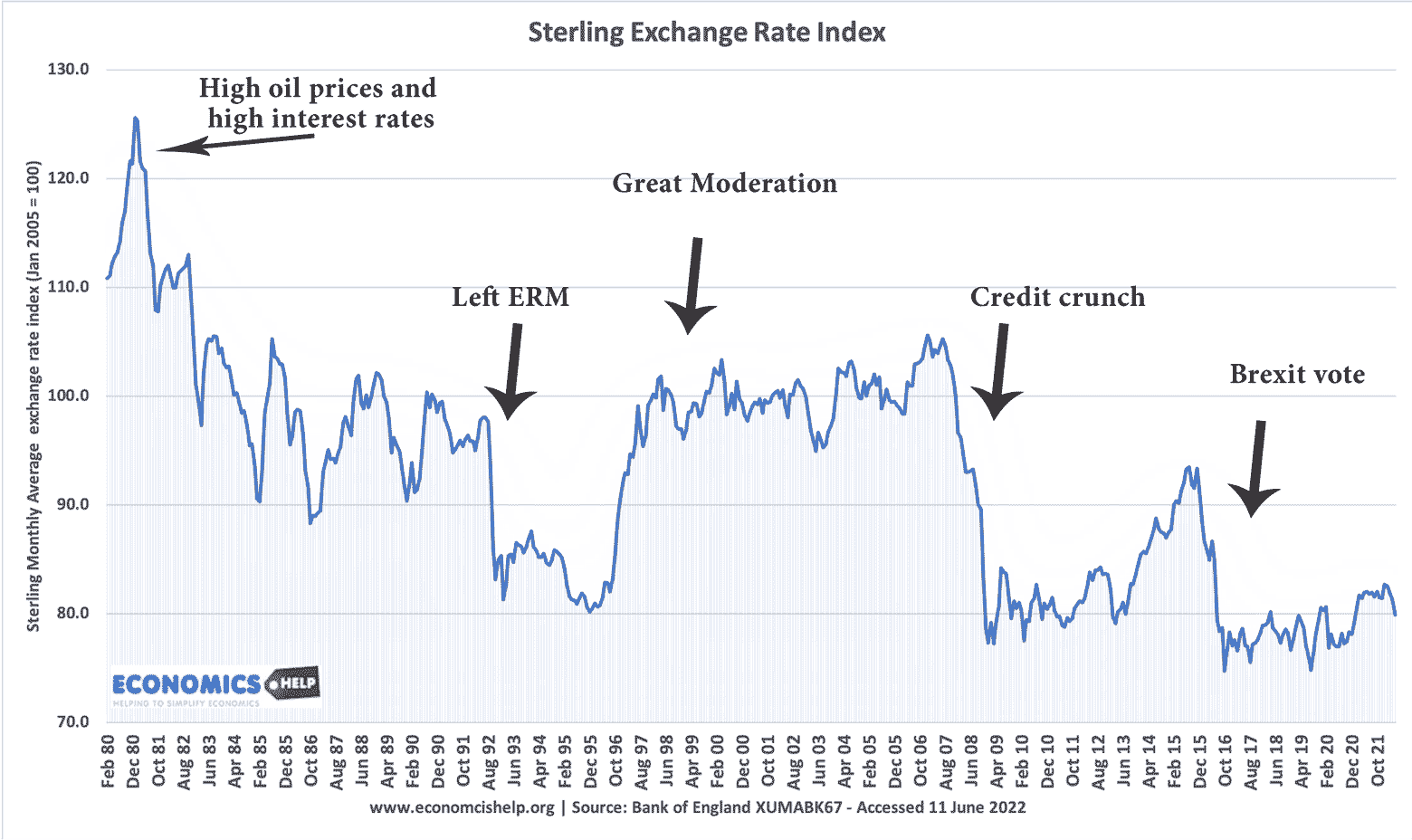

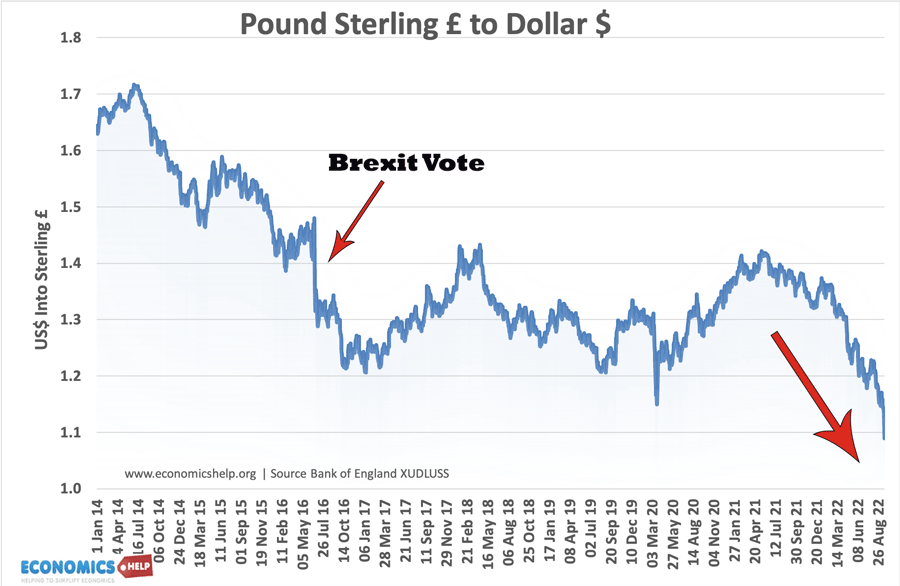

The Pound has been in long term decline since after the Second World War, when £1 = $4.05. In recent decades the pound has continued to decline. In particular since the great financial crash of 2007, which hit the UK hard. In recent years, the combination of Brexit, rising inflation and lack of confidence in the UK economy has pushed sterling lower – especially against the dollar.

Reasons for the fall in the value of Pound post-Brexit June 2016

- Uncertainty. Markets dislike the uncertainty over what will happen to UK politics, UK economy and the UK financial sector. The UK is not seen as a ‘safe haven’. Investors for looking for more certainty will prefer to save in US and Europe.

- Rise in borrowing at a time of high inflation. In the Sept ‘mini budget’ the chancellor announced large fiscal stimulus, focused on tax cuts for companies, high earners and an energy bailout. The cost of the tax give aways is forecast to increase borrowing by over £400bn, causing the IFS to state “UK borrowing is on an unsustainable path” Fall in Pound Sterling due to Brexit, Energy Crisis and Recession

- Less inward capital investment. Loss of Single Market. Since Brexit the UK has left the single market (to be able to restrict the free movement of people), which has discouraged much inward investment (see: levels of inward investment in UK). With less inward investment, there will be less long-term demand for sterling.

- Trade friction. Not only has the UK left the single market but also the EU customs union. This has meant UK exporters have faced increased costs of trade, leading to less demand for UK exports and Sterling.

- A predicted decline in portfolio investment. The City of London has been the dominant European trading centre, attracting many capital flows. Outside the EU and the single market, trading in the City of London is less attractive, causing the Pound to fall in value.

- Higher UK inflation than competitors. The UK is experiencing higher inflation than many of our competitors, making UK goods less attractive.

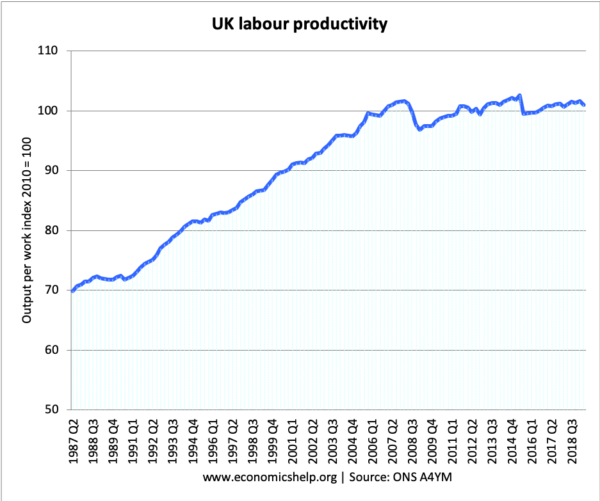

One reason for this higher inflation, is the UK’s poor productivity performance in recent years. Stagnating productivity has led to lower economic growth and more inflationary pressures.

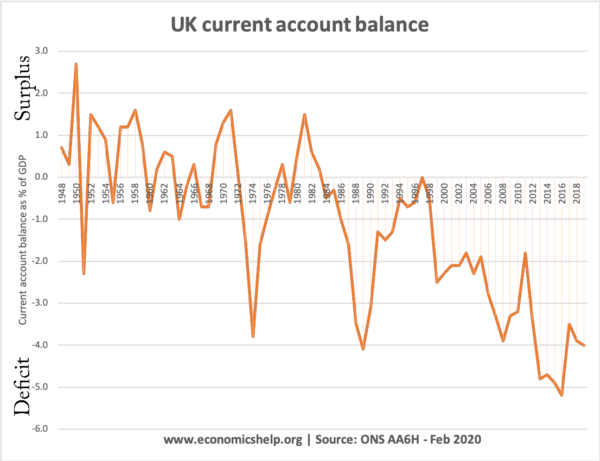

- Current account deficit. Since 2016, the UK has a high current account deficit as a % of GDP – up to 7% of GDP (see current account. This current account deficit has been financed by capital flows, but if these dry up, the Pound will have to fall to correct the imbalance in trade.

- Rising energy imports. A difficulty the UK faces is that the rising price of gas and oil have pushed up the cost of imports. Demand is inelastic meaning higher prices cause rise in import spending.

Video on sterling crisis

Sterling Crisis - How far will the Pound Sterling fall?

General reasons for a decline in the value of Pound Sterling could include:

- If Recession is forecast in UK. A recession means interest rates will stay low and more possible monetary easing. Lower interest rates make the UK a less attractive place to invest hot money flows (get a better return elsewhere)

- House price fall. A significant fall in house prices increase the likelihood of persistently low interest rates. See: Are we set for a housing market crash?

- Balance of Payments. A current account deficit (value of exports less than imports) leads to an outflow of foreign currency, putting downward pressure on sterling. This is important since drying up of capital flows due to lower interest rates and global credit crunch

- Strength of the Euro / dollar. If the Euro or Dollar becomes very strong, e.g. because of good economic news, the Pound will fall relative to these currencies.

- Quantitative Easing. The Bank of England’s policy to create money electronically, increases the monetary base. This increases the risk of future inflation in UK and so tends to reduce the value of the Pound.

- Long term purchasing power parity. If UK goods become relatively more expensive compared to other goods, then there will be a gradual decline in demand for UK exports, putting downward pressure on the Pound.

Euro or Euros – What is the plural of Euros?

A falling pound impacts on our exporters, the price of importers and future rate of economic growth. But, the most interesting thing about this post seems to be whether the plural of Euro is Euro or Euros.

I’m going for euros. Because I Just like using it. But, it is also what the EU recommend for non-legal documents.

See more:

Even poor pensioners are suffering .

Please find a way to get the system up and running

.THANKS Paramjit singh

Can someone explain to me why the pound is falling. If prospects for higher rates to control inflation then why does this not instead make the pound more attractive

Ask those who voted for Brexit🤔

Perhaps somebody should tell Mica that the UK has worse recessions whilst a member of the EU.