A look at the economic impact of a fall in the exchange rate (termed depreciation or devaluation)

A fall in the exchange rate is known as a depreciation in the exchange rate (or devaluation in a fixed exchange rate system). It means the currency is worth less compared to other countries.

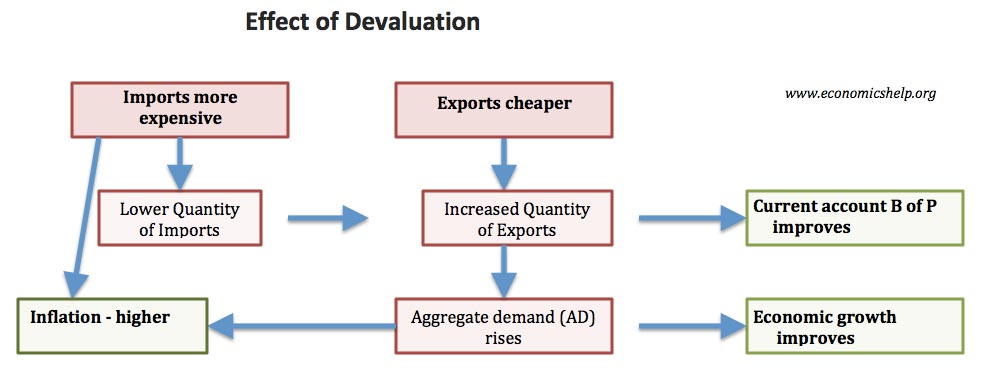

- When there is a depreciation, and the exchange rate goes down

- Exports will be cheaper

- Imports will become more expensive

- For example, a depreciation of the dollar makes US exports more competitive but raises the cost of importing goods into the US.

- Therefore there will be an increase in exports and decrease in the quantity of imports.

- Domestic firms will benefit from increased sales. This may lead to job creation and lower unemployment, especially in export industries.

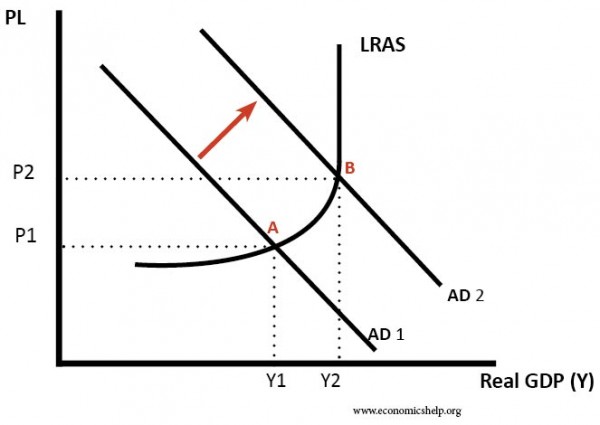

- The increase in (X-M will) help increase Aggregate Demand (AD) and therefore lead to higher economic growth

Macro effect of depreciation in the exchange rate

Impact of depreciation – rise in AD

Impact of depreciation on inflation

Inflation will tend to rise because –

- A depreciation increases the cost of imports so there will be an increase in cost-push inflation.

- A depreciation increases domestic demand, so there could be some demand-pull inflation

- A depreciation makes exports more competitive – without any effort. In the long-term, this may reduce incentives for firms to cut costs, and could lead to declining productivity and rising prices.

The effect of a depreciation in the exchange rate depends on the state of the economy. If the economy is growing quickly and close to full capacity, then a fall in the exchange rate is likely to increase inflationary pressures. In a recession, the fall in the exchange rate may only cause some temporary cost-push inflation.

Impact of fall in exchange rate on current account balance of payments

- A depreciation will tend to improve the current account balance of payments.

- This is because exports increase relative to imports.

- However, this assumes that demand for exports and imports are relatively elastic.

- The Marshall-Lerner condition states that a depreciation improves current account deficit if PED x + PED m >1

- In the short-term, demand for exports may be inelastic so there is no improvement in the current account. However, over a longer period of time, demand becomes more elastic and so there is an improvement in the current account. (see J Curve effect)

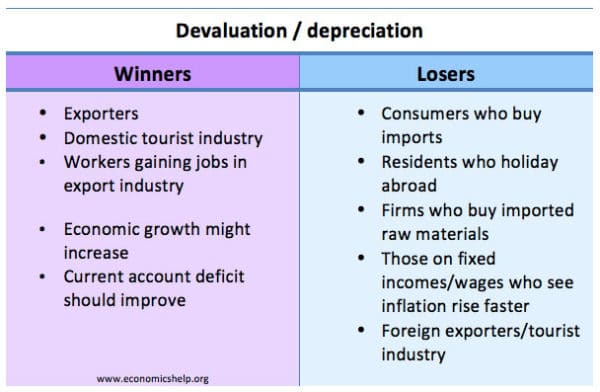

Summary of a fall in the exchange rate

- Tends to increase the rate of economic growth and reduce unemployment.

- Tends to benefit exporters, but makes imports more expensive.

- Benefits the domestic tourist industry. It is more expensive to travel abroad and foreigners will find the UK more attractive.

- Consumers likely to see higher prices – at least for imported goods.

- Tends to cause inflation. This is because:

- imports more expensive

- higher domestic demand

- firms have less incentive to cut costs

- Tends to improve the current account deficit

Winners and losers from a fall in the exchange rate

Evaluation

The impact of a fall in the exchange rate depends on a few factors:

- State of the economy. If the economy is in a recession, a depreciation may help boost growth with little effect on inflation. But, if inflation is already high, a fall in the exchange rate will make inflation worse.

- Other components of AD. If the exchange rate falls, this increases export demand. However, if there is a fall in consumer confidence, there may be no overall increase in AD.

- Time lag and elasticity of demand. In the short term, demand for exports tends to be inelastic (therefore only a small increase in demand). Over time, demand becomes more elastic. Therefore there is a bigger increase in demand for exports.

- Depends on the cause of the fall in the exchange rate. For example, countries experiencing a balance of payments crisis (e.g. Russia 2007/17) will see an outflow of capital as investors become nervous over the speed of the currency devaluation.

Examples of fall in the exchange rate

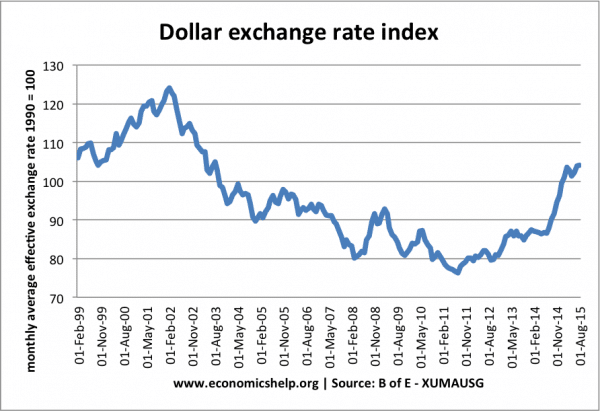

US Dollar depreciation 2001-2008

The steady fall in the Dollar 2001-08 was generally a period of positive economic growth. Inflation remained low during this period because – apart from import prices rising – inflationary pressures were generally low.

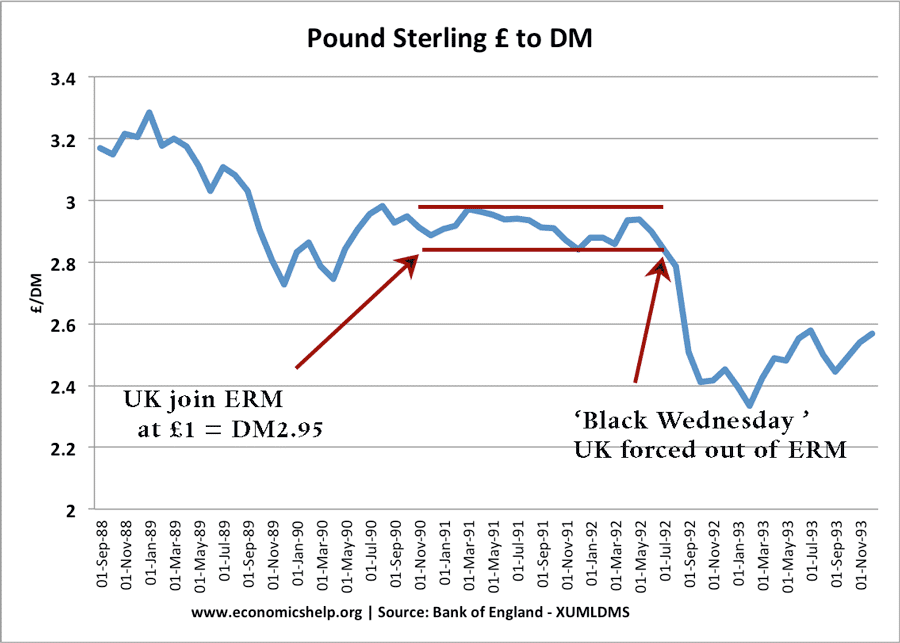

UK devaluation in 1992

In 1990-92, the UK was in a fixed exchange rate mechanism. This led to higher interest rates and a recession. In 1992, there was a sharp fall in the value of Sterling when the UK left the Exchange Rate Mechanism (ERM) The devaluation (and lower interest rates) helped the UK recover from a deep recession, and it led to a period of economic growth. 1992 Exchange Rate Mechanism

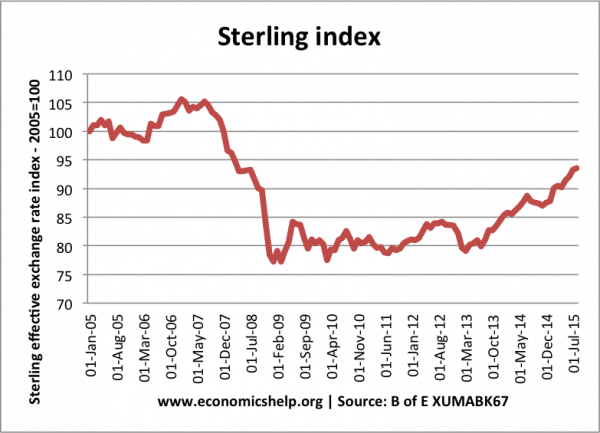

UK Depreciation 2007-09

Sterling fell by approx 30% between 2007 and 2009 – this was due to the UK economy being hit hard by global credit crunch and damage to the financial sector. Often a fall in exchange rate boosts domestic demand. But, the UK economy still went into recession because of the credit crunch, fall in bank lending and global recession.

Despite the recession, the UK experience a spike in inflation (5%)

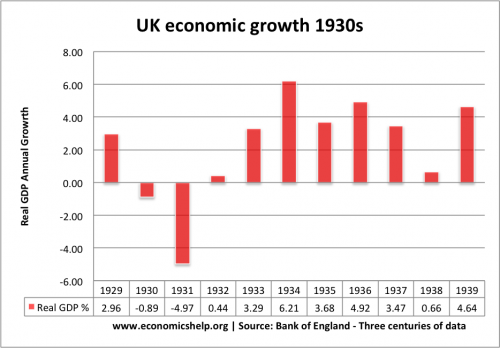

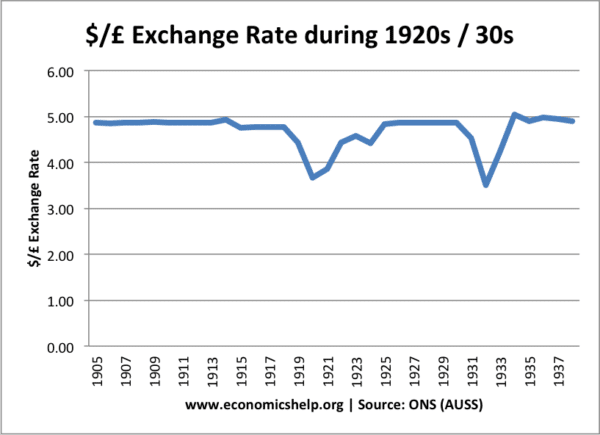

UK Leaving gold standard in 1931

In 1931, the UK economy was in a serious recession – with unemployment rising towards 20%. In 1931, the UK left the Gold Standard, causing the Pound to fall in value. This fall in the exchange rate enabled the economy to recover quicker than many other countries stuck in the great depression.

Video on effect of depreciation in value of Pound

See also:

That is really interesting that the values of different types of money are falling. It would be nice if our exchange rate was better so we could get good value. That is something that I would love to have if I travelled the world.

There are further consequences of a depreciation of sterling against the dollar and the euro. In real terms we are handing over part of our national output and income to the countries with which we trade.

Through sterling depreciation, the UK’s exports, measured in dollars/euros, have become cheaper relative to the prices of UK imports in dollars euros. It follows that we have to export a greater VOLUME of exports to earn sufficient dollars/euros to buy the same volume of imports as before. To put it another way, we have handed large chunks of our national output and income to our international trading partners.

There are further consequences. The UK runs an unsustainable balance of payments deficit on current account; we are not paying our way in the world. But because of recent changes in the relative prices of exports and imports (measured in dollars/euros) by 15%, we will have to increase the VOLUME of our exports by more than 15% in order to begin the process of reducing our balance of payments deficit.

Questions: Analyse how a fall in a country foreign exchange rate could increase employment

Discuss whether or not it is an advantage to keep a firm small