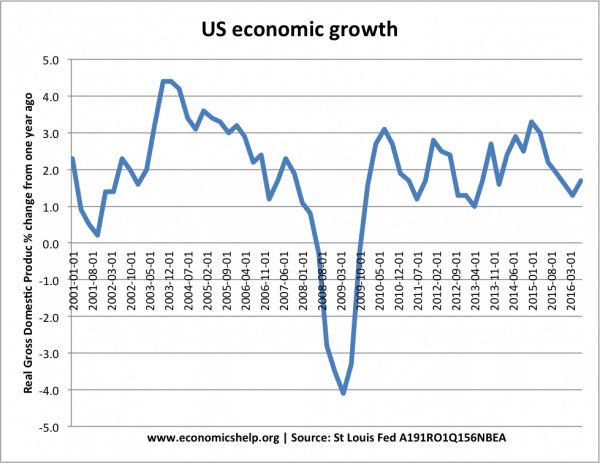

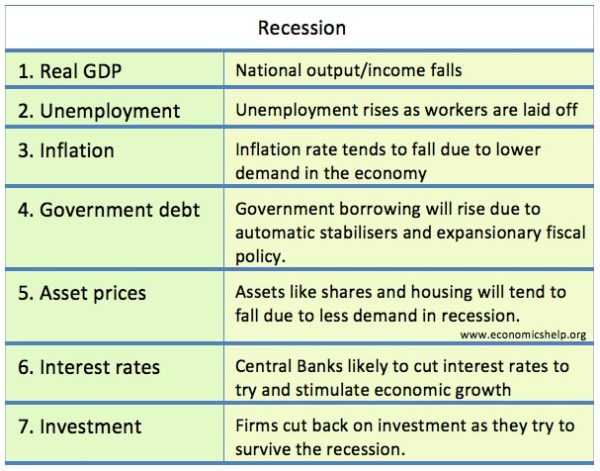

A recession is a period of negative economic growth. In a recession, we see falling real GDP, falling average incomes and rising unemployment.

Other things we are likely to see in a recession

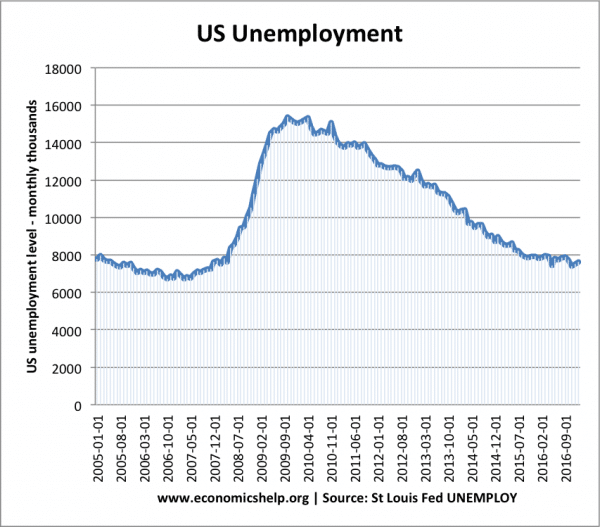

1. Unemployment

The rise in unemployment 2008-09 mirrors the fall in real GDP.

In a recession, firms will be producing less and therefore will need fewer workers. Also, in a recession, some firms will go out of business, causing workers to lose their jobs. For example, after the credit crunch of 2008/09, many working in the finance industry lost their jobs in banking. Then when demand for cars fell, car firms started to lay off workers too.

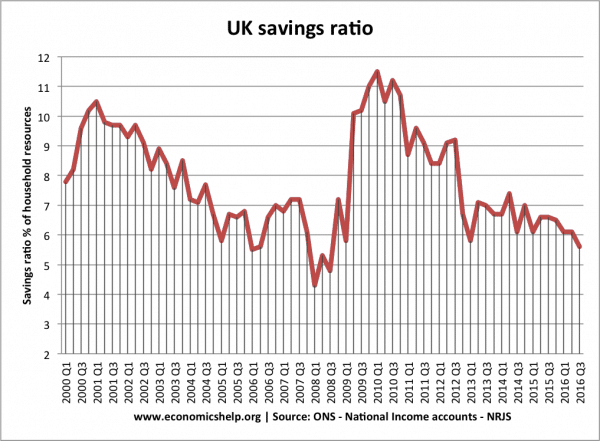

2. Increase in saving ratio

- In a recession, people tend to save money because there is a fall in confidence. If people expect to be made unemployed (or fear unemployment), then you don’t want to spend and borrow, saving becomes more attractive.

- Keynes noted that in the great depression, there was a paradox of thrift – because people saved more and reduced consumption, this makes the recession worse because it causes a further fall in consumption. Individually they are doing the right thing, but because many people are saving more – they are further reducing consumer spending and making the recession worse.

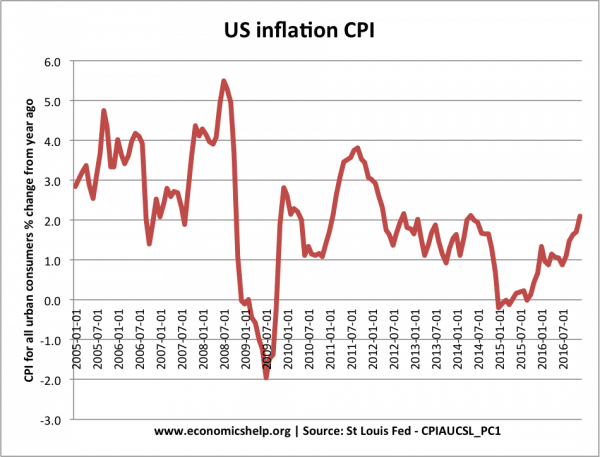

3. Lower inflation rate

US inflation was high in 2008 due to rising oil prices. But, the recession of 2009 caused a sharp drop in the inflation rate – for a period, there was falling prices (deflation)

With a fall in aggregate demand and lower economic growth, this puts downward pressure on prices. In a recession, you are more likely to see shops selling at a discount to sell unsold goods. Therefore, we tend to get a lower inflation rate. In the Great Depression of the 1930s – we saw deflation – when prices fell.

See also: Pricing strategies in recession

4. Fall in interest rates

- In recessions, interest rates tend to fall. This is because inflation is lower and Central Banks wish to try and stimulate the economy. Lower interest rates, in theory, should help the economy from recession. Lower interest rates reduce the cost of borrowing and should encourage investment and consumer spending.

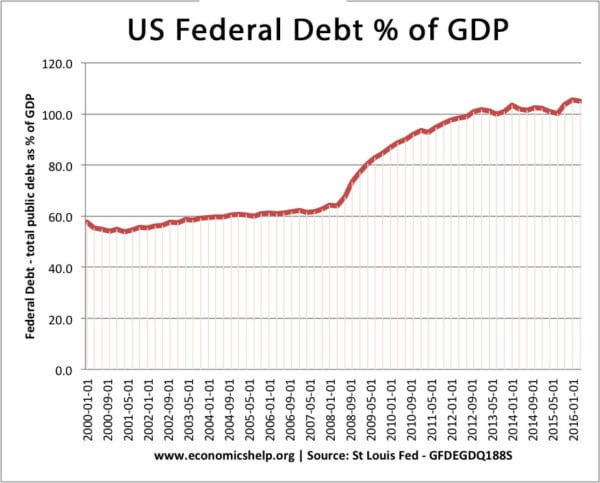

5. Government borrowing increases

US debt as a % of GDP rose after the start of the recession in 2008.

In a recession, we will see higher government borrowing. This is for two reasons:

- Automatic stabilisers. With rising unemployment, the government will need to spend more on unemployment benefits. However, because fewer people are working, they will receive less income tax. Also, firms profitability falls, so corporation tax receipts fall.

- Secondly, the government may also try to use expansionary fiscal policy. This involves cutting tax rates and increasing government spending. The idea is to make use of surplus private sector savings and get unemployed resources back into use. For example, Obama’s stimulus package of 2009. See Obama economics.

6. Stock market falls

- Stock Markets may fall because firms make less profit. There is also the danger firms may go out of business.

- If stock markets anticipated the recession, it might already be built into share prices. Share prices do not necessarily fall in a recession.

- But, if the recession is unexpected then profit forecasts will be downgraded, and share prices generally fall.

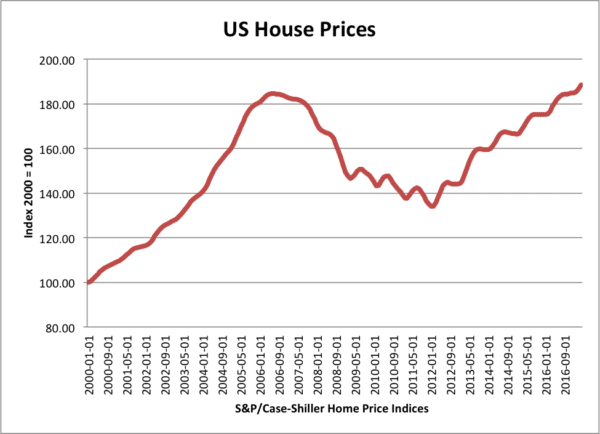

7. Fall in house prices

In this case, US house prices fell before the recession. House price falls were a cause of the recession. They didn’t recover until the end of 2012.

In a recession, with rising unemployment, many may not be able to afford their mortgages, and so we can see home repossessions. This will lead to an increase in the supply of housing and less demand. In the 2008 recession, US house prices fell sharply because of the previous housing boom. In fact, the bursting of the housing/mortgage bubble in 2005/06 was a factor behind that recession.

8. Investment. Investment will fall as firms cut back on risk-taking and uncertainty. It may also be harder to borrow if banks are short of liquidity (e.g. credit crunch of 2008). Investment is usually more volatile than economic growth due to factors such as the accelerator theory.

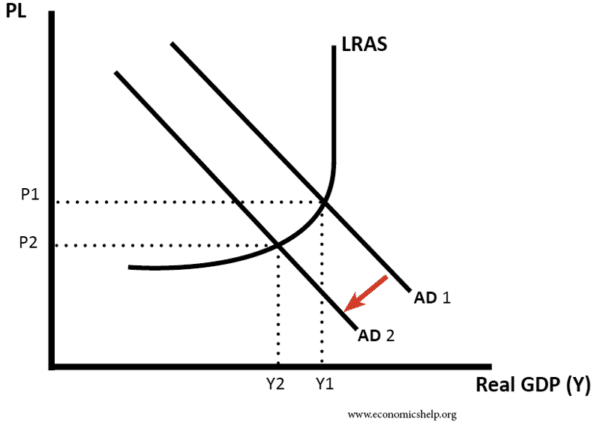

AD/AS Model

Simple AD/AS framework showing the effect of a fall in AD leading to lower real GDP and lower price level.

Other possible effects

9. Hysteresis effect. This states that the temporary rise in unemployment could translate into permanently higher structural unemployment. For example, manufacturing workers who lost a job in the 1981 recession took time to find new jobs in the service sector. See hysteresis effect.

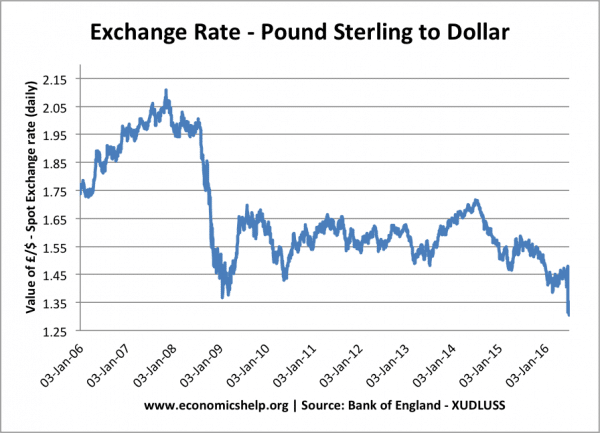

10. Depreciation in the exchange rate. A recession which affects one country more than others could lead to depreciation. This is because there is less demand for the currency if interest rates fall (worse return)

In 2008/09, the UK saw a sharp depreciation in the value of the Pound because the credit crunch particularly affected the UK economy which was reliant on the finance sector.

Pound Sterling fell in 2008/09 recession

However, in the 1981 recession, the Pound was strong. In fact the strength of Pound was a factor in causing recession.

11. Creative destruction and new firms. Some economists are more positive about recessions suggesting that a recession can force inefficient firms out of business and enable more innovative and efficient firms to come to the fore.

- However, good firms can go out of business in a recession due to temporary factors rather than long-term lack of competitiveness.

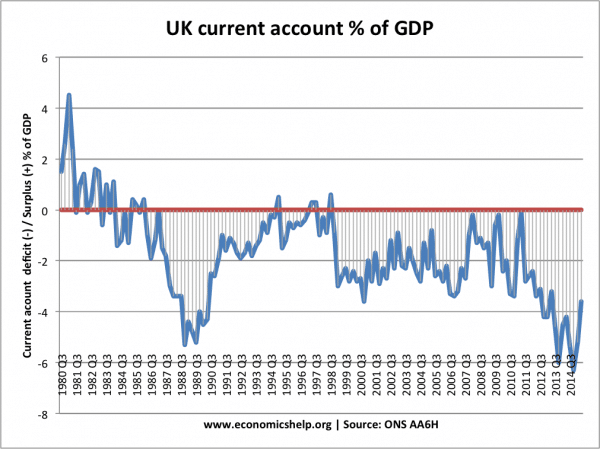

12. Current account on balance of payments. If a country experiences a sharp fall in domestic consumption – it could see an improvement in the current account deficit. This is because import spending will fall.

In the 1981 and 1991 recession, the UK saw an improvement in the current account. But, the improvement in current account in 2009 was relatively short-lived.

Evaluation

- It depends on the causes of the recession. For example in mid-1970s recession was caused by high oil prices. Therefore, inflation was higher than usual in a recession.

- In the 1981 recession, the high value of the Pound hit the manufacturing (export) sector hard. In the 1991/92 recession, homeowners bore a higher burden because the recession was caused by very high-interest rates, which made mortgages expensive. In the 2008 recession, it was the finance and banking sector which experienced the biggest falls.

- It depends on whether the recession is global or specific to a country. In 1981 and 1991, the UK recession was deeper than elsewhere in the world

- It depends on the response of governments/Central Bank. For example, in 1931, UK tried to balance the budget – causing further falls in aggregate demand.

Related

But what happens to the balance of payments in a recession?

Current account likely to improve – if it leads to fall in import spending

when there is a recession people are more likely to save than spending as rate of interests are rising..

recession also causes unemployment as firms face less demand for their goods and thus needing less workers to produce goods..demand for most goods and services fall..

there is also a fall in GDP(gross domestic product)

the standard of living also falls!!

This is pretty confusing. Saving is a function of income and both should decrease during a recession. The data usually show that saving at least stops increasing during a recession until the Fed increases the money supply. I think the confusion here is the fundamental difference between trying to “save money” when consuming and saving in an economic sense. During a recession, incomes decline, and because consumption and saving both come from income they should also both decline. People try to “save money” by consuming less but this is because they have less income or otherwise reduced wealth due to a stock market crash. They also have less money to save and this should be made clear. Total saving may increase in the mid-point of a recession but this is only due to the Fed’s actions. It’s also pretty stupid for someone to save their money during a recession only to be left with plenty of saving when things get better and their income increases. It’s much wiser for people to conduct precautionary saving during good times so they can use it during bad times.

I am doing business as a qualification and one of my questions is, analyse the effects of a fall interest rates for coco-cola and Gucci, i dont understand how this would effect both businesses because they are both so large.

A substantial reduction in the rate of interest essentially means that as the cost of borrowing financial capital decreases that further incentives private enterprise firms such as Coca-cola & Gucci to further borrow more financial capital necessary to invest in producing more goods & providing more services by means of obtaining more labour & more capital goods necessary to productively & dynamically economically efficiently produce more goods & provide more services not only leading to more borrowing for firms such as Gucci & Coca-cola to invest leading to more demand-side economic growth due to the fact that private investment is one of the components of aggregate demand or AD.

Good work, it was very helpful in my presentation.

how does recession affect the distribution of income?

Likely to worsen distribution of income. Rise in unemployment increases size of population in lowest income bracket (benefits)

Hi. I am new here. If the government borrows money to increase its (government) spending does it help promote recovery from recession?

That is the whole notion of fiscal policy that government spending is intended to increase aggregate demand or AD as government spending is one of the components of aggregate demand or AD! Although bear in mind that not all government spending increases private investment (or crowds-in private investment) research studies find that government spending in the labour markets causes misallocation of private enterprises’ production factors ie labour as labour is one of the four factors of production leading to a negative redistributionist effect on private investment, hence leading to less private investment less demand side economic growth due to the crowding out effect of government spending on private investment as private investment is also one of the components of aggregate demand or AD. One of the main criticisms of Keynesian economics is that government spending does not necessarily increase private investment as when government deficit spending increases during a deflationary recession or demand-side deficit recession (by the way John Maynard Keynes himself advocated for the increase in budget deficit spending during a deflationary recession to “boost aggregate demand”) but when the government increases its deficit spending that means that the demand for loans in the loanable funds market increases as government spending is one of the components of aggregate demand or AD so therefore interest rates have to increase hence budget deficits financially crowd out private investment as the budget deficit increases interest rates due to the simultaneous & substantial increase in the level of demand of borrowing financial capital within the loanable funds market, leading to less consumer spending & private investment less demand-side economic growth as consumer spending & private investment are two of the components of aggregate demand or AD. Also it’s worth noting that research studies show that government spending on infrastructure, R&D transfer of payments, etc actually “crowd-in” or increase private investment as it makes private investment much more attractive for investors & private enterprise alike due to the substantial reduction in risks to privately invest in infrastructure projects & R&D projects as government spending essentially not only takes on the bulk of the risk but this then crowds-in or increases private investment hence increases demand-side economic growth number one as government spending & private investment are two of the components of aggregate demand or AD & as government spending in R&D, infrastructure, etc increases, private investment simultaneously & substantially increases leading to an overall increase in the level of aggregate demand or AD as government spending increases or crowds-in private investment! So in conclusion, if fiscal policy is concentrated on R&D, infrastructure, etc then it increases or crowds-in private investment hence increasing overall aggregate demand or AD, whereas is fiscal policy is concentrated on creating more public sector jobs or increasing budget deficit (as Keynes advocated for) this means that the misallocation of private enterprise’s production factors (as labour is one of the four factors of production) causes economic resource crowding out or reduction in private investment in hiring workers & the increase in the budget deficit leading to higher interest rates due to the simultaneous & substantial increase in the level of demand for loans in the loanable funds market as government spending is also one of the components of aggregate demand or AD, making consumer borrowing & private enterprise borrowing much more costly as a result of high interest rates that is caused by increase in the level of demand for loans in the loanable funds market, hence financially crowding out (or reducing private investment) due to the interest rates being raised.

Thank you for the article. I really love economics as a science and I admire the United States for their level of economic development. My dream is to go there and I’m just preparing visa documents.

I hope that I will succeed and I will see this magnificent country

think about this, if u dont have an income loss of job in a recession can u spend money ?, can u save money? U can call it a recession , or a depression, does it matter? the result is the same !