Hysteresis is a concept which states that history affects the value of a current issue. In economics, hysteresis states that historical rates of unemployment are likely to influence the current and future rates of unemployment.

If there is a recession and rise in cyclical unemployment, this temporary unemployment can affect the underlying structural rate and increase the natural rate of unemployment. This phenomenon can make unemployment a lagging factor.

Why does past unemployment affect future unemployment?

- If people are made redundant in a recession, then they may become demotivated and lose on the job training, which makes them less employable. After a period of unemployment, it is harder for them to find work. Also, firms may be more reluctant to take on workers who have been unemployed for a certain period.

- Also, in a recession, firms may lose jobs in manufacturing but may lack the skills to move into new jobs created in the service sector.

- Therefore, the worker who was temporarily unemployed due to cyclical factors may find over time, he becomes structurally unemployed. From the temporary rise in unemployment, we get a higher natural rate of unemployment (NAIRU)

- According to Blanchard and Summers (1996), proponents of hysteresis, recessions can have a permanent impact if they change the characteristics or attitude of those who lost their jobs as a result of recessions

- Another reason for possible hysteresis is in sticky wages. If a worker loses his job, he becomes an outsider and is unable to influence wages. The remaining workers manage to prevent cuts in nominal wages, and so real wages don’t fall to retain equilibrium wage rates.

Evidence of Hysteresis in unemployment

1. European unemployment problem. (1986) Hysteresis and the European Unemployment Problem, Olivier J. Blanchard, Lawrence H. Summers. This study examines the persistent European unemployment since the 1980s, examining the role of hysteresis in raising the average unemployment rate.

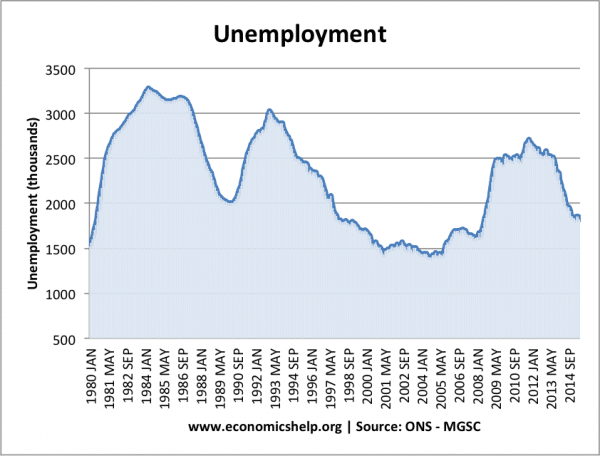

2. UK unemployment. After the 1981 UK recession, unemployment rose to 3 million.

However, as the economy recovered, unemployment didn’t fall but continued to slowly rise to a peak in 1986. This suggests there was a hysteresis effect. The turmoil of the 1981 recession created structural unemployment, and once unemployment was 3 million, it was hard to reduce it.

Different evidence of hysteresis

- Post-2008 recession, the evidence in the UK is different. Despite a deeper recession, unemployment fell much quicker than many expected. It appeared that unemployment was no longer a lagging factor. High rates of unemployment in 2009, were not a barrier to falling unemployment – a fall in unemployment which occurred despite relatively weak growth.

- The difference, post-2009, is that many believe the UK labour market is more flexible. There have been more new part-time/temporary / self-employment jobs created. Falling unemployment has also been helped by low wage growth, which has encouraged firms to keep workers.

- Periods of high unemployment can be better explained through other causes of unemployment, such as structural, frictional and real wage factors. See: Causes of unemployment.

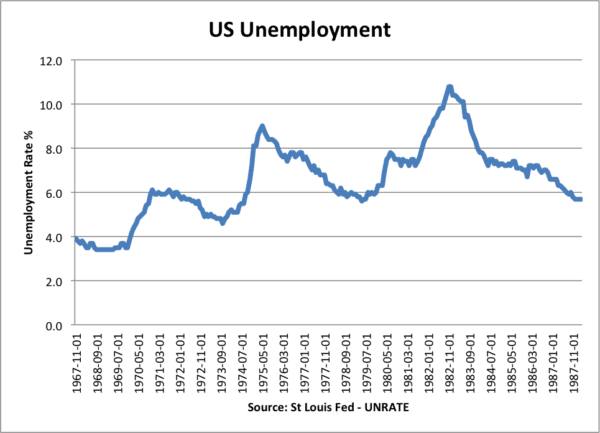

US unemployment 1960s to 1980s

Unemployment rate keeps rising.

Other types of hysteresis effects

You could argue there is a kind of hysteresis effect with regard to inflation. In particular, high inflation influences inflation expectations and so high inflation tends to cause high inflation in the future. Similarly, low inflation tends to cause low inflation.

Related