Demand management policies are efforts to influence the level of aggregate demand (AD) in an economy. The two main types of demand management policies are:

To some extent, the exchange rate could be used to influence aggregate demand, but in practice, it is rarely used as a tool to influence aggregate demand.

Another indirect factor that is important is confidence. For example, if there is political turmoil and people are pessimistic about the economy, then any demand management policy may be less likely to be effective. If the government/Central Bank can improve confidence, this can help encourage investment and encourage consumers to spend.

Fiscal Policy

Fiscal policy involves changing government spending and taxation. In a recession, the government could pursue expansionary fiscal policy (“looser fiscal policy”) and try to increase AD. For example, cutting income tax will give consumers more income and should lead to an increase in consumer spending. This should lead to an increase in AD and higher economic growth.

- In a recession, there are also automatic stabilisers (paying of unemployment benefits and lower VAT from less spending)

- In a period of high economic growth, fiscal policy may need to be ‘tighter’ – this involves higher tax and lower spending.

However, it is worth bearing in mind fiscal policy has many limitations such as:

- Political costs. To reduce inflation the government could increase income tax, but this would be politically difficult.

- Crowding out ( higher government spending may lead to lower private sector spending)

- Time lags (takes time for a decision to increase government spending to increase AD)

- Impacts on government spending and taxes may distort economic behaviour, e.g. higher corporation tax to reduce AD, may discourage foreign investment.

- See: Problems of fiscal policy for more

Monetary Policy

Monetary policy involves cutting or raising interest rates.

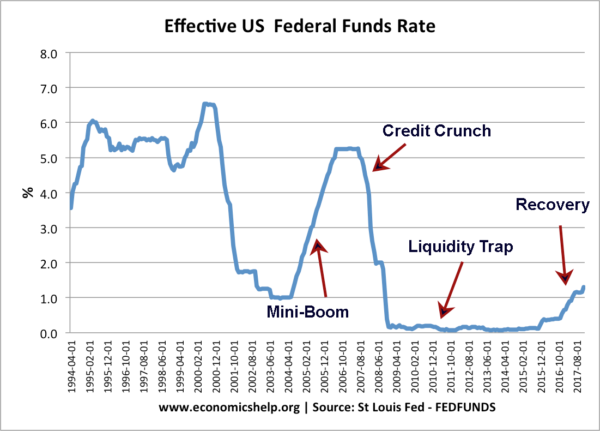

This shows the change in US interest rates. During the mini boom of 2002-2006, interest rates were reduced to partly slow down the economy. However, when the credit crunch led to a recession, interest rates were cut sharply until the economy started to recover in 2015/16.

In a recession, lower interest rates should make it cheaper to borrow leading to a boost in consumer spending and investment. Lower interest rates will also reduce the value of the exchange rate, making exports more competitive and boosting export demand.

Quantitative Easing

In some cases, cutting interest rates may fail to boost spending. For example, in a liquidity trap banks may be unwilling to lend to consumers, therefore even though it is cheap to borrow – in practise firms and consumers can’t get access to finance. Therefore, in this case, lower interest rates are ineffective.

To boost demand in this case the Central Bank may pursue quantitative easing. This involves electronically creating money and using the funds to buy government bonds. This reduces long-term interest rates and boosts the money supply.

Related

Which of he following policies is generally considered to be the most effective demand management policy? a. fiscal policy, b foreign policy, c. monetary policy, d trade policy.

i think fiscal policy is the one becuase if government cut its spending there will be cutting on interest rate