Why has the Pound Sterling been falling?

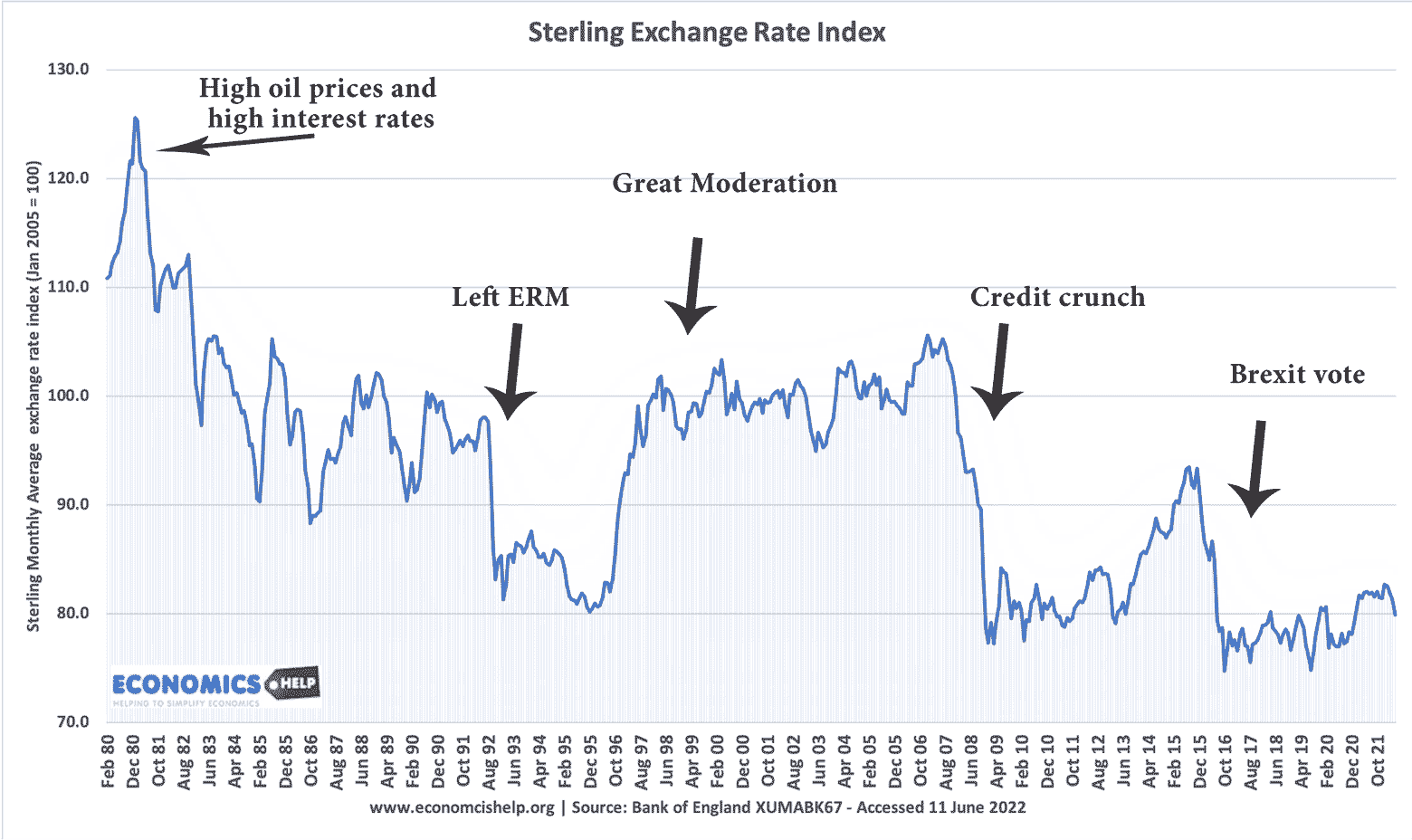

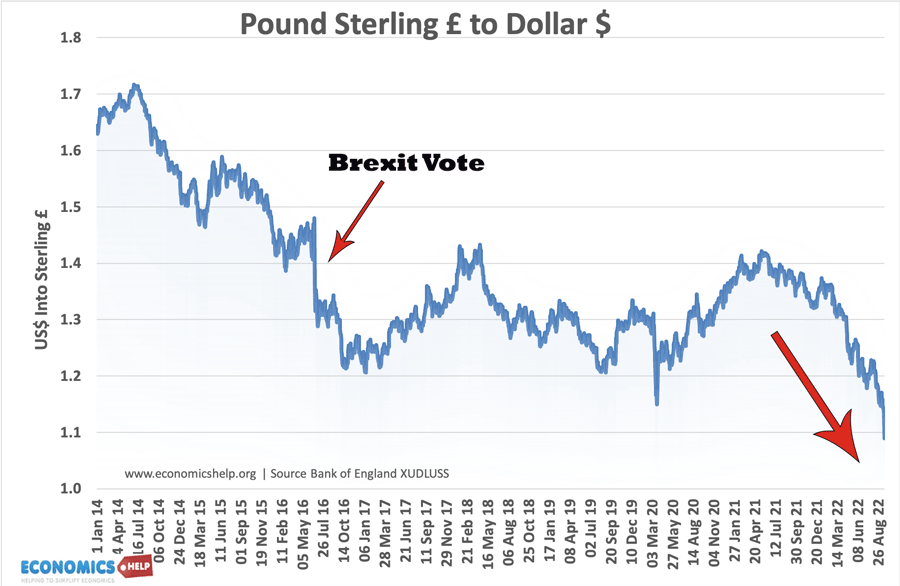

The Pound has been in long term decline since after the Second World War, when £1 = $4.05. In recent decades the pound has continued to decline. In particular since the great financial crash of 2007, which hit the UK hard. In recent years, the combination of Brexit, rising inflation and lack of confidence in the UK economy has pushed sterling lower – especially against the dollar.

Reasons for the fall in the value of Pound post-Brexit June 2016

- Uncertainty. Markets dislike the uncertainty over what will happen to UK politics, UK economy and the UK financial sector. The UK is not seen as a ‘safe haven’. Investors for looking for more certainty will prefer to save in US and Europe.

- Rise in borrowing at a time of high inflation. In the Sept ‘mini budget’ the chancellor announced large fiscal stimulus, focused on tax cuts for companies, high earners and an energy bailout. The cost of the tax give aways is forecast to increase borrowing by over £400bn, causing the IFS to state “UK borrowing is on an unsustainable path” Fall in Pound Sterling due to Brexit, Energy Crisis and Recession

- Less inward capital investment. Loss of Single Market. Since Brexit the UK has left the single market (to be able to restrict the free movement of people), which has discouraged much inward investment (see: levels of inward investment in UK). With less inward investment, there will be less long-term demand for sterling.

- Trade friction. Not only has the UK left the single market but also the EU customs union. This has meant UK exporters have faced increased costs of trade, leading to less demand for UK exports and Sterling.

- A predicted decline in portfolio investment. The City of London has been the dominant European trading centre, attracting many capital flows. Outside the EU and the single market, trading in the City of London is less attractive, causing the Pound to fall in value.

- Higher UK inflation than competitors. The UK is experiencing higher inflation than many of our competitors, making UK goods less attractive.

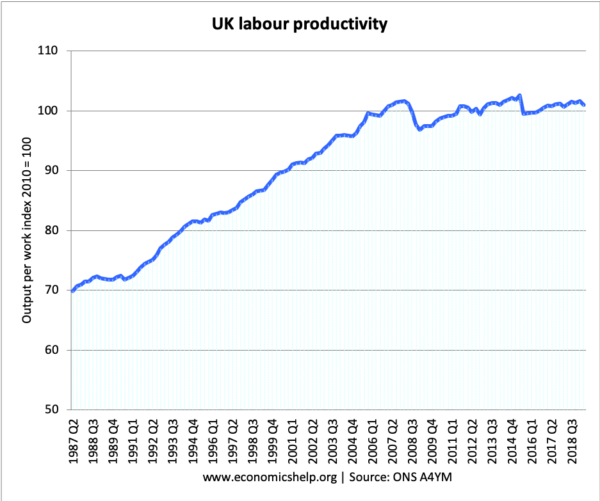

One reason for this higher inflation, is the UK’s poor productivity performance in recent years. Stagnating productivity has led to lower economic growth and more inflationary pressures.

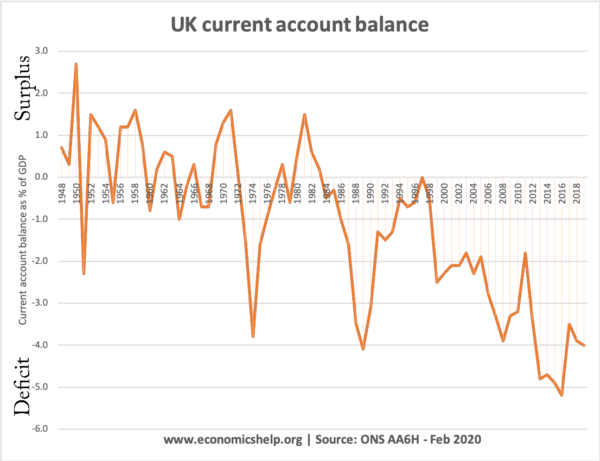

- Current account deficit. Since 2016, the UK has a high current account deficit as a % of GDP – up to 7% of GDP (see current account. This current account deficit has been financed by capital flows, but if these dry up, the Pound will have to fall to correct the imbalance in trade.

- Rising energy imports. A difficulty the UK faces is that the rising price of gas and oil have pushed up the cost of imports. Demand is inelastic meaning higher prices cause rise in import spending.

Video on sterling crisis

Sterling Crisis - How far will the Pound Sterling fall?

General reasons for a decline in the value of Pound Sterling could include:

- If Recession is forecast in UK. A recession means interest rates will stay low and more possible monetary easing. Lower interest rates make the UK a less attractive place to invest hot money flows (get a better return elsewhere)

- House price fall. A significant fall in house prices increase the likelihood of persistently low interest rates. See: Are we set for a housing market crash?

- Balance of Payments. A current account deficit (value of exports less than imports) leads to an outflow of foreign currency, putting downward pressure on sterling. This is important since drying up of capital flows due to lower interest rates and global credit crunch

- Strength of the Euro / dollar. If the Euro or Dollar becomes very strong, e.g. because of good economic news, the Pound will fall relative to these currencies.

- Quantitative Easing. The Bank of England’s policy to create money electronically, increases the monetary base. This increases the risk of future inflation in UK and so tends to reduce the value of the Pound.

- Long term purchasing power parity. If UK goods become relatively more expensive compared to other goods, then there will be a gradual decline in demand for UK exports, putting downward pressure on the Pound.

Euro or Euros – What is the plural of Euros?

A falling pound impacts on our exporters, the price of importers and future rate of economic growth. But, the most interesting thing about this post seems to be whether the plural of Euro is Euro or Euros.

I’m going for euros. Because I Just like using it. But, it is also what the EU recommend for non-legal documents.

See more:

its neither euroaux,euroes,euro’s its just plain and simple. The pound is goosed so jump while you can …..last one out put the lights out.

I’ve just used this website to explain to my 13 yr old daughter about the current recession and she wants to babysit and give me the money. my son,10 wants a paper round and give me the money. my 7yr old will probbably go up a chimney!! I’ve tried over 8 years to support family. lost £35,000 on house £7000 on shares now paying 28% on cr cards which mge wld normally pay but not now. after 18 years paying my way, now have two sick parents aswell don’t know what to do. have to ride this storm like everyone else. God help us all!! And I was always for keeping our pounds sterling. hope the queen appreciates that! and, by the way, if it wasn’t for people that had nothing, no-one would have anything.

what is the ruppe value of Pound ,Euro,Dollar

Thaks

Rahul

I looked into this site to read a meaningful debate on the strength of our pound; little did I know we would be correcting each other’s English. Let’s concentrate on the matter at hand. So, any intellectual out there can tell me when we are looking to come out on the other end of this horrid recession?

analysts predict by the end of 2011, but i reckon its going to last for longer than that, simply because historically recession did not take one, two years to recover from, the world recently recovered from major crisis, relating to the dot com bust and all the other little financial bubbles that brust and left individuals like you and me on the downside. and today we have seen another financial crisis, the credit crunch as its know was bought about by sub prime lending and greedy directors, this required governments to borrow money leaving them with fiscal deficit, and in my opinion until this deficit is repaid, britain will not come out of recession.

What are exactly the advantages and disadvantages of a falling currency?

Would it have been a good idea to have joined the euro currency say 7 years ago? Why or why not?

Pound will get back up to 1.8 to 1.9 within the next 6 months or so.

We have been fed so much anti-European propaganda by those who, either don’t know, or have a vested interest in keeping us out of the Eurozone. There is a global crisis but against other currencies, the value of Sterling has plummeted in comparison with that of the Euro. The values of our homes, our holdings and our stock have all fallen. The cost of importing raw materials for the manufacturing industries has escalated because we have to use “weak” sterling. Most of our manufacturing base disappeared years ago, so we don’t make much to export, anyway. A short while ago we were told that the UK was the fourth richest economy in the world. This was mainly due to the trust in the City and our service industries. Were these more lies and propaganda?

We should immediately launch a bloodless, military attack on Brussels and Strasbourg and let the EU armed forces win. We would then be forced into the Eurozone and the governance of this country would be in the hands of more competent and experienced politicians!

The British people would then be able to have the benefit of the same standard of living, education and training and health care as that enjoyed by the citizens of mainland Western Europe.

There’s many a true word spoken in jest!

You can clearly see by some of the predictions stated above that no one really has a clue. So let me tell you how it really is. With Bush & Blairs plains since in power…..you must know by now what they were being the most crooked politicians ever in power across the pond consecutively, the result is showing now of their work. They are richer, everyone else is worse of. With neo-con emmigration policies, matters will only get worse. You’re all in it for the long run people. No ones going to get rich quick except those that fooled you!

I reckon our Government got it wrong in beleiving that staying put with sterling was a good idea on the basis that we were becoming the centre of the Universe in the financial world. Well that theory has been well & truly scuppered, so I think it’s time to eat humble pie & join up with the rest of Europe. Our little country with little or no manufacturing capability & an ever smaller voice in the world of politics should just wake up & smell the coffee. Euros surely? Dollars,cents, Pounds & pennies.

every country with a strong currency, purposely and with political reason……..the country let and attract overseas investers…… with a long period of time the government lets depreciate the national currence thus getting the huge benefit….. when investers demand their monies. ita well known policy so nothing abnormal in pound decline

Going to australia in july what will the pound be like then

Frank buy your Aussie dollars now!!! The UK Pound is a basket case. We will default on our debts, re-value and de-value, then lose a third of our wealth.