A recent report by the Bank of England made for grim reading. UK Output is forecast to fall and inflation is predicted to rise to a level not seen since the early 1980s. The UK like many economies is facing short-term pressures – rising energy prices, supply shortages and slowing growth. But, the malaise of the UK economy is not just due to these recent short-term pressures. There are several long-term factors, such as poor productivity, low investment, and the impact of Brexit which have caused the UK’s short-term problems to be magnified.

Why is the UK heading for recession?

The wrong type of inflation

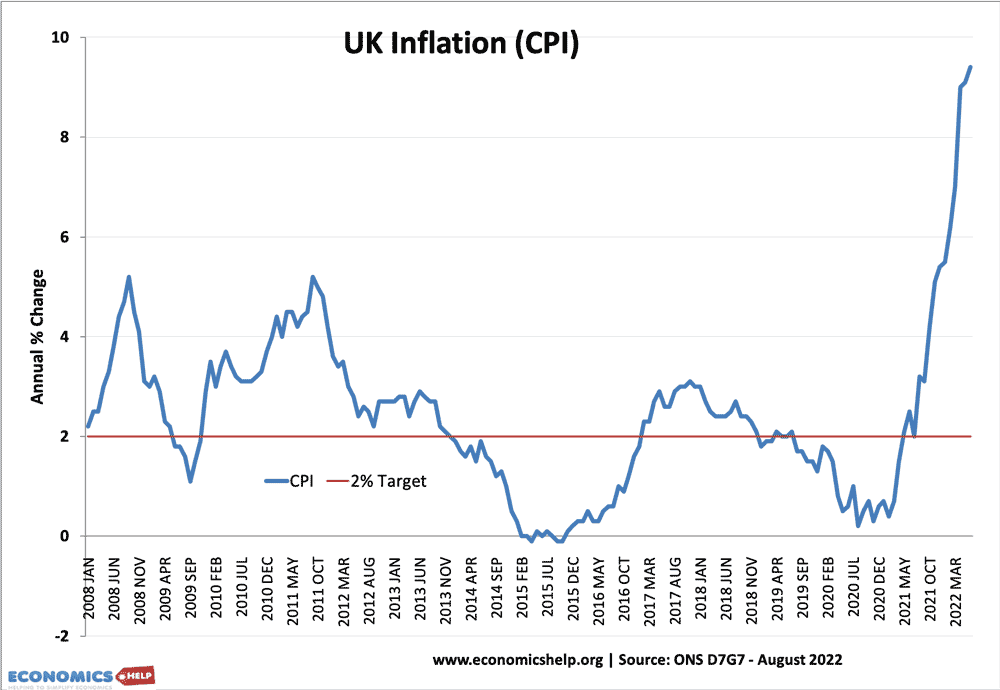

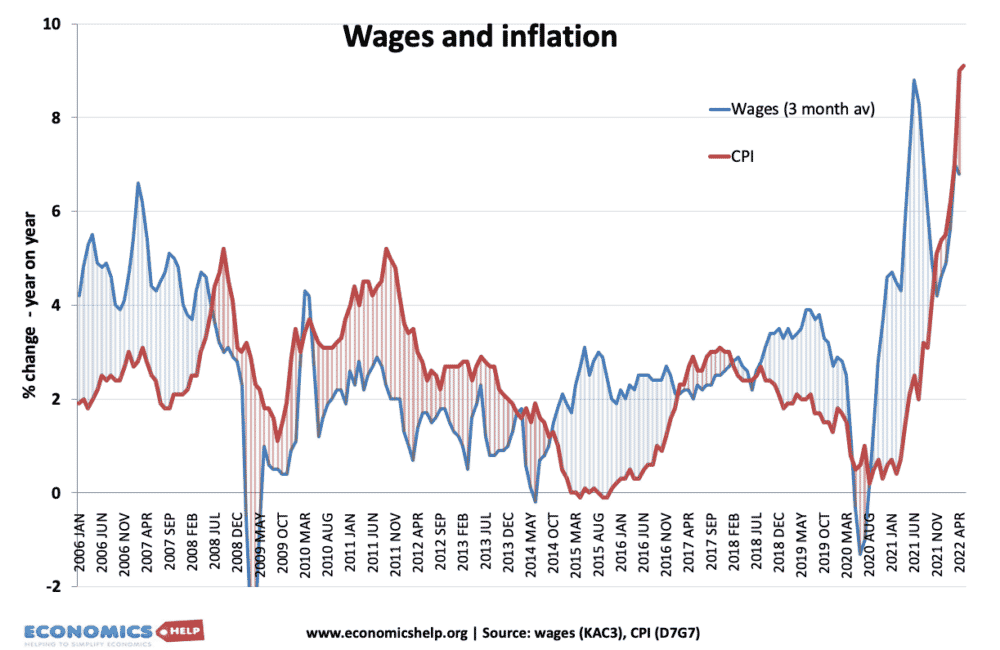

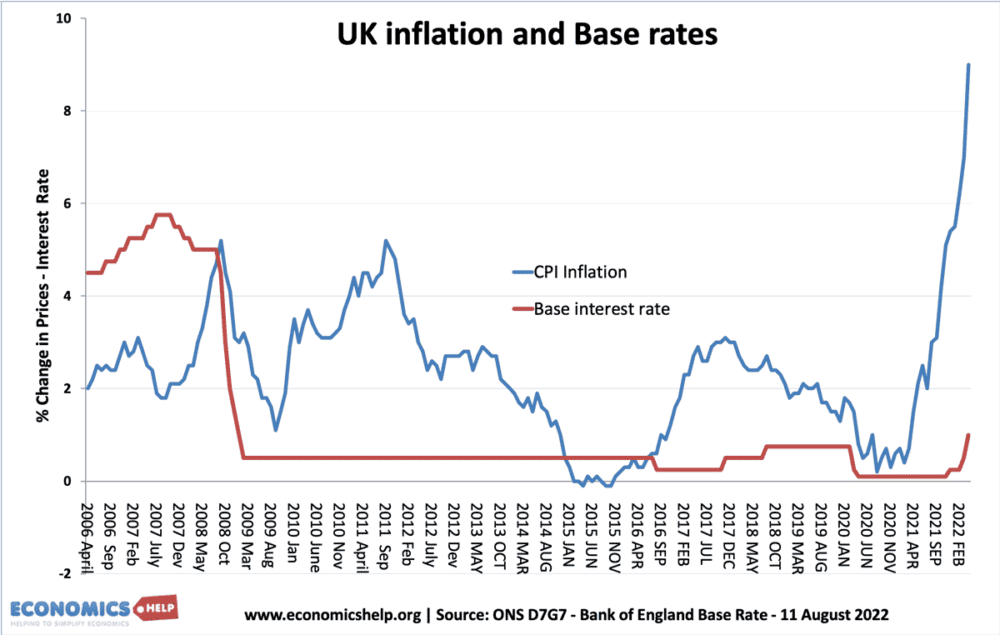

After many years of relatively benign inflation, UK inflation is now heading towards double digits. Inflation imposes several costs on the economy such as uncertainty, lower confidence and discourages investment. But, to compound matters – this inflation is also the wrong kind of inflation. By this we mean it is due to cost-push factors, not strong demand. Therefore, prices are going up, but real wages are not. In fact, workers are struggling to keep wage growth up with inflation, causing the sharpest fall in real income for two decades.

The TUC claim that with inflation forecast to rise to 13% and nominal wage growth struggling to reach 5.5%, the UK could experience the worst real wage falls for 100 years. The 13% inflation is likely to fall back after winter, but it isn’t just an isolated experience, real wage growth has been poor ever since the great financial crash of 2009.

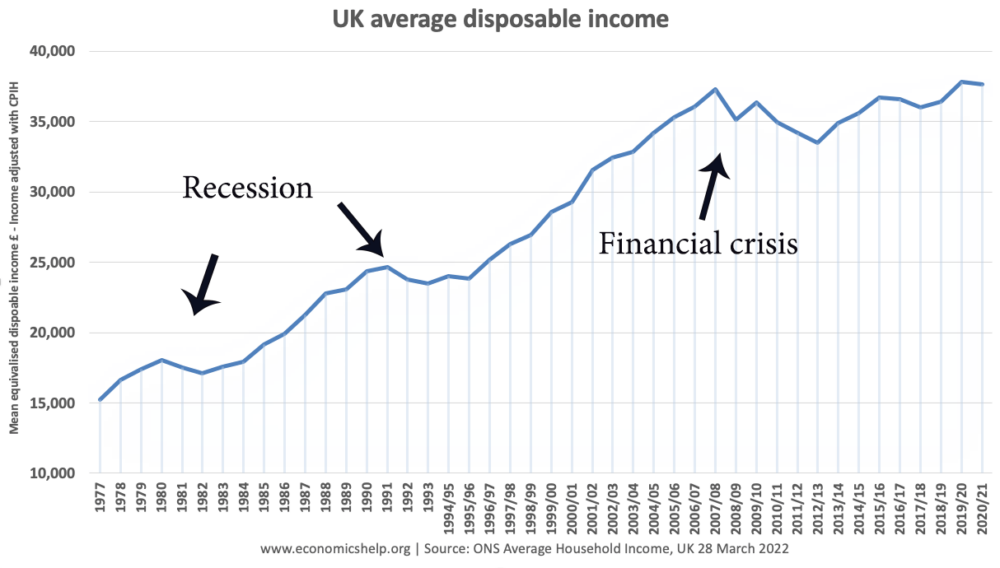

The post-war trend of rising real wages is spluttering. This fall in real wages, will be a big drag on consumer spending which is the biggest component of aggregate demand.

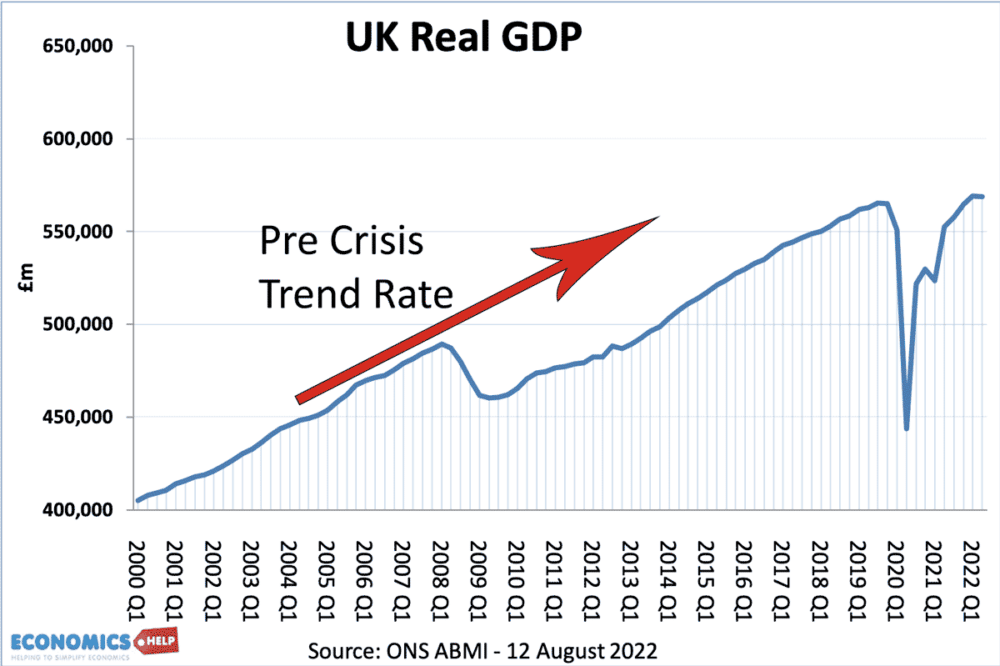

Economic slowdown

In Q2 2022, the UK economy contracted – falling 0.1%. This may partly be due to the Jubilee Bank holiday weekend. But, if we look at other statistics such as new car registrations, it suggests a slowing economy. In July 2021 there were 1,835,000 new care registrations, but only 1,528,000 in July 2022, a decline of 14% (Fortune). The car market is a leading indicator of consumer spending and economic strength and indicates the negative headwinds around the economy.

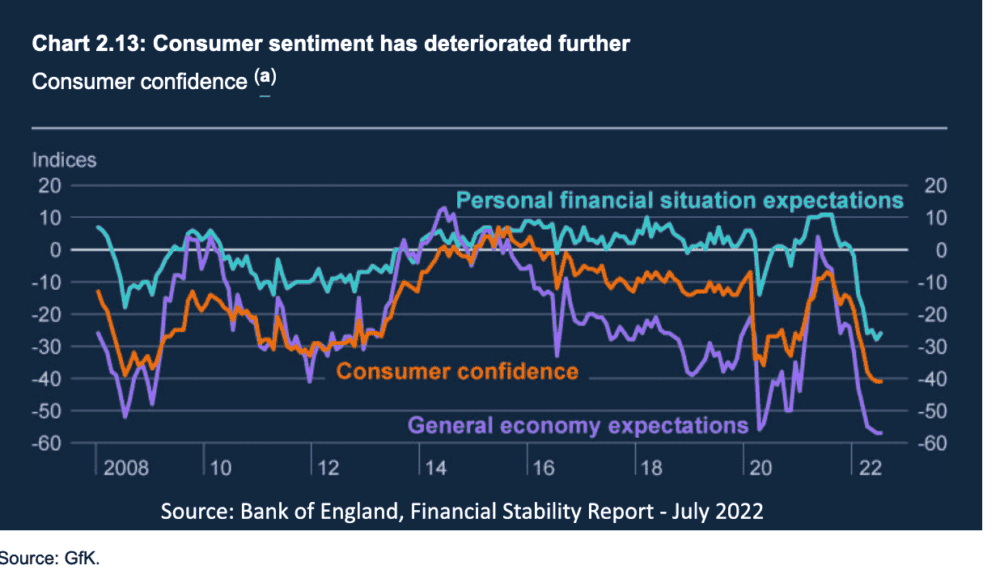

The Bank of England reported falling consumer confidence and personal finance expectations worse than the 2008 crash. Given the slowdown in Europe and concerns over gas supplies and energy prices, the Bank of England made clear they expect a quite deep recession this year.

Interest rate rises

Usually, with a slowdown in economic activity and falling consumer confidence, we might expect a loosening of monetary policy. But, the Bank of England is doing the opposite and raising interest rates to try and tackle the perceived ‘runaway’ inflation. This goes back to the ‘wrong type of inflation’. If inflation was due to high growth, raising interest rates is less painful – you are just deflating the economic bubble. But, when we have stagflation – high inflation and falling output, monetary policy can only tackle one goal at a time.

The Bank of England has clearly stated they are committed to reducing inflation – even if it causes a recession. This is a big change from the post-financial crisis economy, where the Bank have often tolerated cost-push inflation with zero interest rates. Now, they are committed to doing whatever it takes to reducing inflation, even if that leads to recession. The problem, is many households have become accustomed to ultra-low interest rates, and even modest rises in interest rates will increase the cost of borrowing and could lead to a significant fall in house prices.

For borrowers, higher interest rates will worsen the cost of living and it will lead to lower business investment due to higher borrowing costs.

Energy prices

Worryingly for the Bank of England, only a third of current inflation is due to rising energy prices. This suggests inflation is becoming embedded in other areas of the economy such as goods and services. But, the worst news on energy is yet to come with the predicted rise in gas and electricity prices likely to cause a real crisis for many households already struggling to deal with making ends meet. In the worst-case scenario, energy bills could rise to an average of over £5,000 a year, up from £1,000 at the start of 2021. This would cause even worse inflation, and if the Bank of England is determined to bring inflation down, may require further interest rate rises.

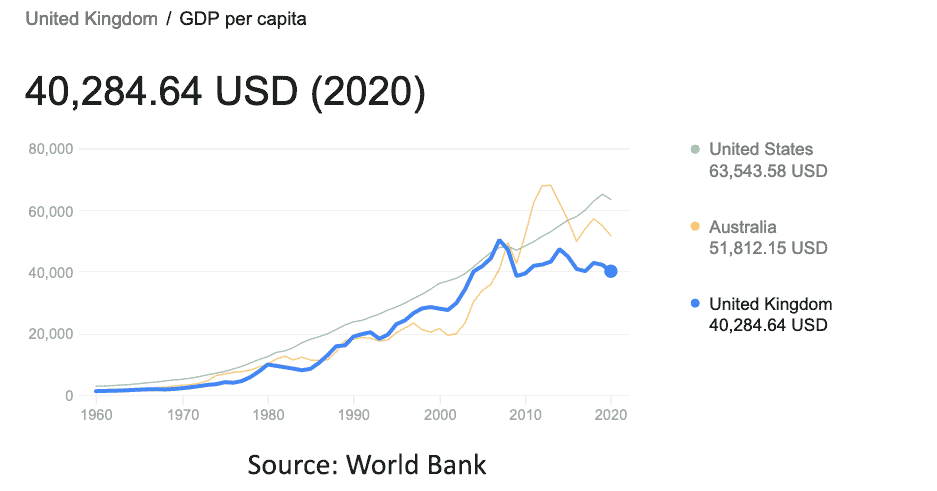

Why UK hit harder than other countries?

It is true, that these cost of living issues are affecting many countries around the world, especially Europe with its dependency on Russian energy sources. But, by quite a few metrics, the UK is being hit harder than other economies. US inflation is somewhat lower, but the US economy has been growing much stronger. The UK has one of the highest inflation rates in the OECD, but also a slowing economy. This raises issues that go back to 2008. The last 15 years have seen a dropoff in UK economic performance and economic growth has fallen behind the post-war trend.

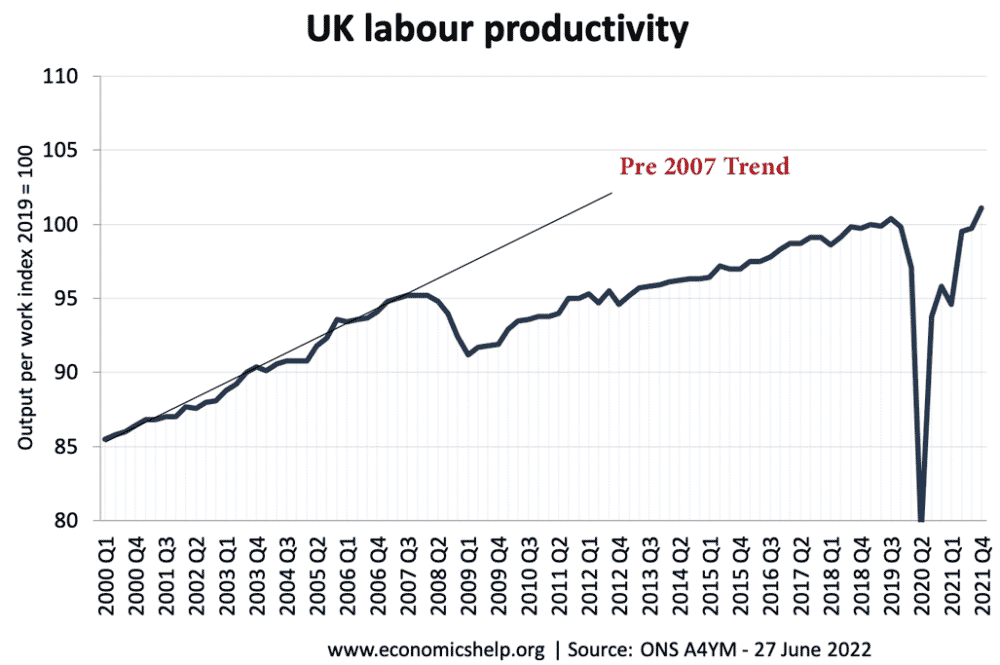

A key factor in this change in economic performance is labour productivity. Labour productivity grew by around 2.5% in the post-war period, but this trend has been broken in the past 15 years.

The fall in productivity has been attributed to several factors, but in particular, we have seen weak levels of investment from both the private sector and the public sector. There are shortfalls in housing, transport and the development of new technologies in manufacturing. This fall in productivity growth represents lost output and lost income for the economy. It has important implications for government finances. As mentioned in UK Debt to soar – demographic pressures are causing higher demand for government spending on welfare payments, pensions and health care, but the tax revenues are not rising like in the post-war period. This leads to the underperformance of public services despite high tax levels.

Brexit

One issue that has had a major impact on the UK economy since 2016 is Brexit. Leaving the Single Market and Customs Union has increased the cost of trade with Europe, our main trading partner.

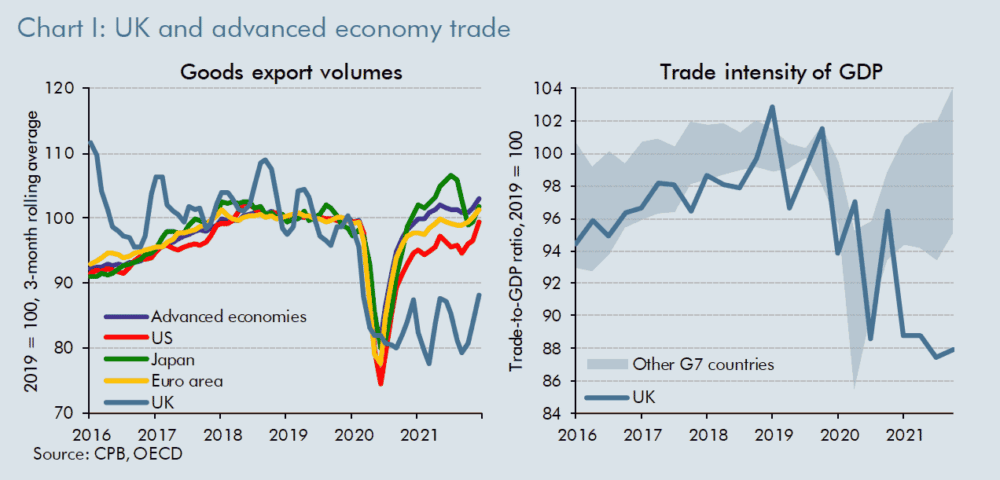

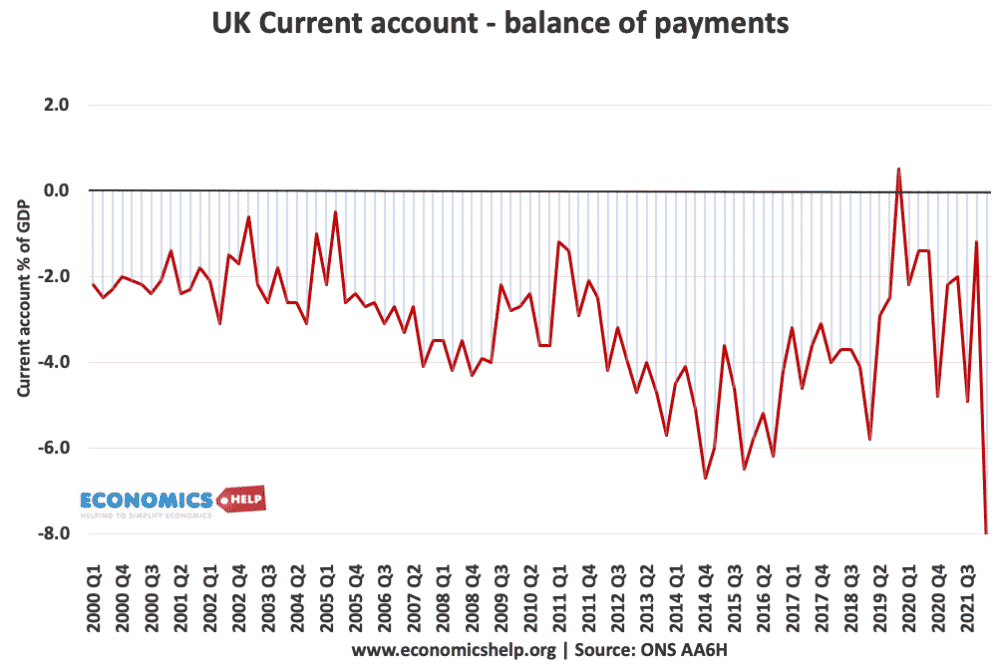

The OBR show how UK’s export and import volumes have been hit harder than other countries, and Brexit costs on trade are a major factor. The UK’s poor trade performance has also contributed to a widening of the current account deficit, despite low growth.

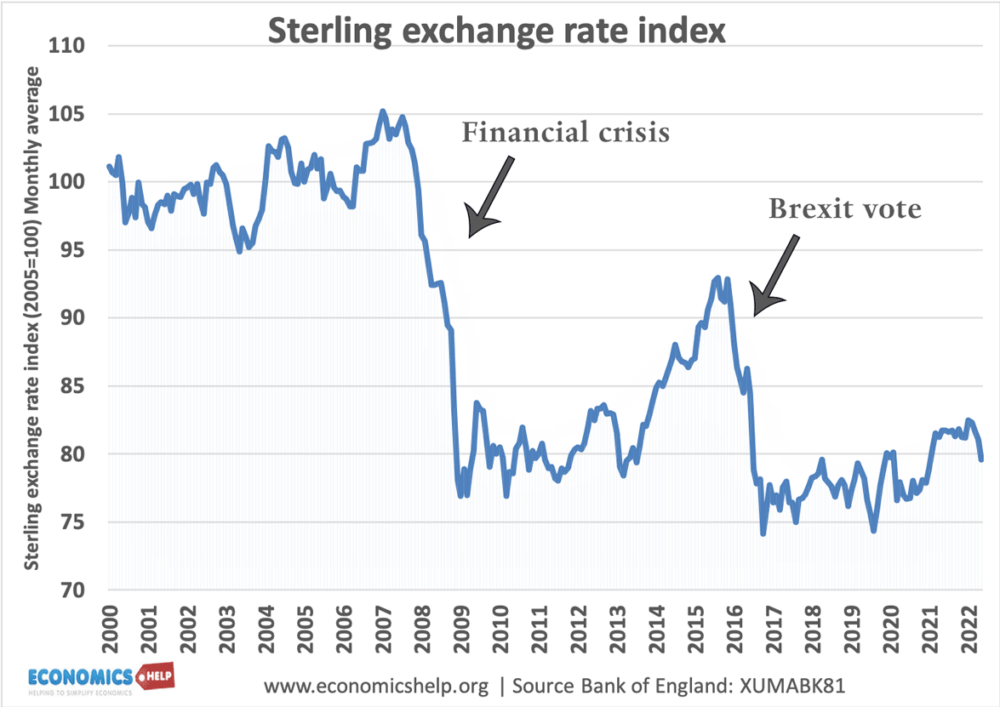

Another impact of Brexit has been the depreciation in the value of the Pound

The Pound has been weak since 2016 reflecting the UK’s worsening economic outlook. This weakness of Sterling has raised the price of imports and is a reason petrol prices in the US have fallen faster than the UK. Commodity imports become more expensive as the Pound falls in value.

Labour market shortages

One area of good news in the UK economy, is the fall in unemployment, with the UK economy close to full employment. However, the good news on unemployment is masked by the rise in firms struggling to recruit workers. This is due to a few factors, lack of qualified workers, a fall in the participation rate and lack of access to European workers post-Brexit.

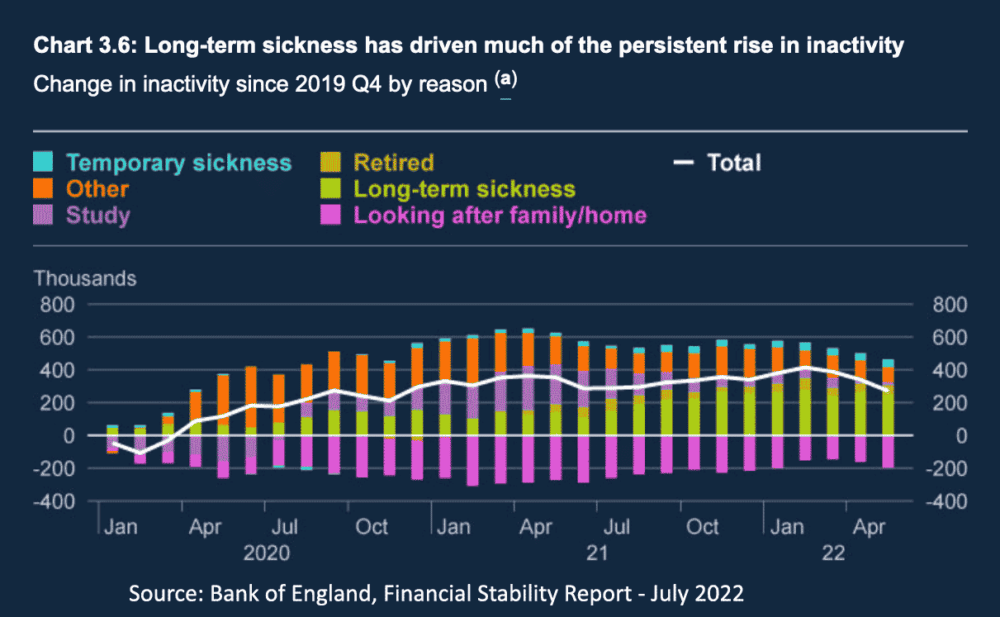

The fall in the participation rate is a cause for concern with a rise in long-term sickness a major factor behind the recent decline in labour supply.

Further reading

Andrew Bailey, Governor of The Bank Of England, has just today stated that the main reason for the coming Recession the Ukrainian war. Its total nonsense of course, and no other European, or Western nation will suffer half as much as we will in the coming year. It has been caused by massive Tory fiscal incompetence, Brexit (same thing), years of awful productivity and almost zero investment. The UK has been hollowed out by thieves, tax dodgers (same thing) grifters, spivs and political chancers. Its all OK though, because a talentless idealogue, who has totally inverted all of her original beliefs in the pursuit of power, is now in charge. Somehow. Some weird, weird how.