In recent months, the Pound Sterling has fallen against the dollar to levels not seen since 1985. This reflects long-term concerns about the UK economy, Brexit, the winter energy crisis and concerns about an imminent recession.

The pound has fallen 16% this year, and the last month was the worst since 2016. The Pound is not just falling against the dollar, but, to a lesser extent against the Euro and other currencies. The Bank of England data show the effective exchange rate index has fallen 6.5% in 2022.

The fall in the Pound will add to inflationary pressures as the domestic price of dollar imports, such as oil increases in price. In theory, a falling pound will help UK exporters to be more competitive, but given the current state of the UK export industry, demand is likely to prove relatively inelastic and only give limited gains in exports.

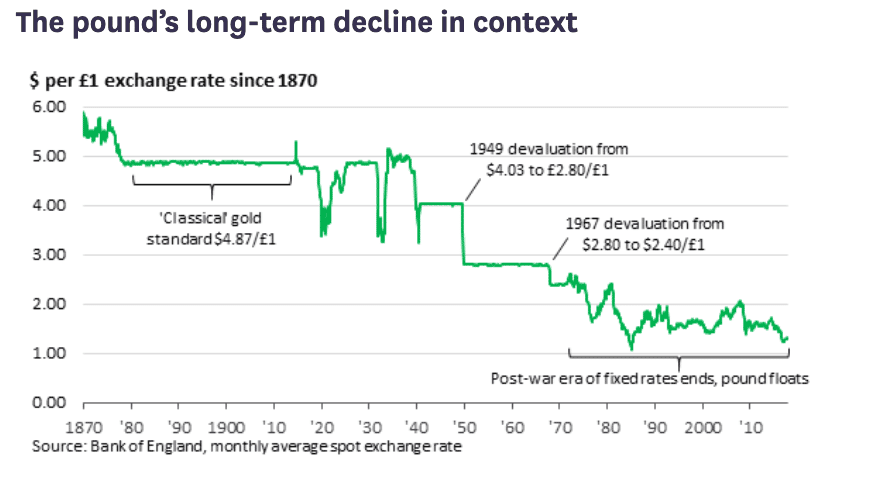

A prolonged decline in Sterling

Since the Second World War, there has been a prolonged decline in the value of the Pound. This decline reflects the UK’s diminishing importance in economic terms on a global scale. Symbolically in the week of the passing of Queen Elizabeth II, the Indian economy overtook the UK in terms of GDP.

What is causing the current fall in the value of the Pound Sterling?

- Brexit

- Winter energy crisis

- Risk of UK recession

- Poor productivity and economic growth compared to US

- Record current account deficit

- Concerns over government borrowing.

Winter energy crisis and inflation

It is not just the Pound Sterling falling against the dollar, the Euro is also under pressure, with markets concerned about the impact of Russia’s energy war and cutting off gas supplies to Europe. Cutting off gas has pushed up prices and risks the prospect of gas rationing over winter. Gas prices are also embedded in other goods, such as electricity, transport and food prices. Therefore, the continued gas shortages and price rises are pushing up European inflation which is causing a headache to Central Banks dealing with higher inflation and lower growth at the same time.

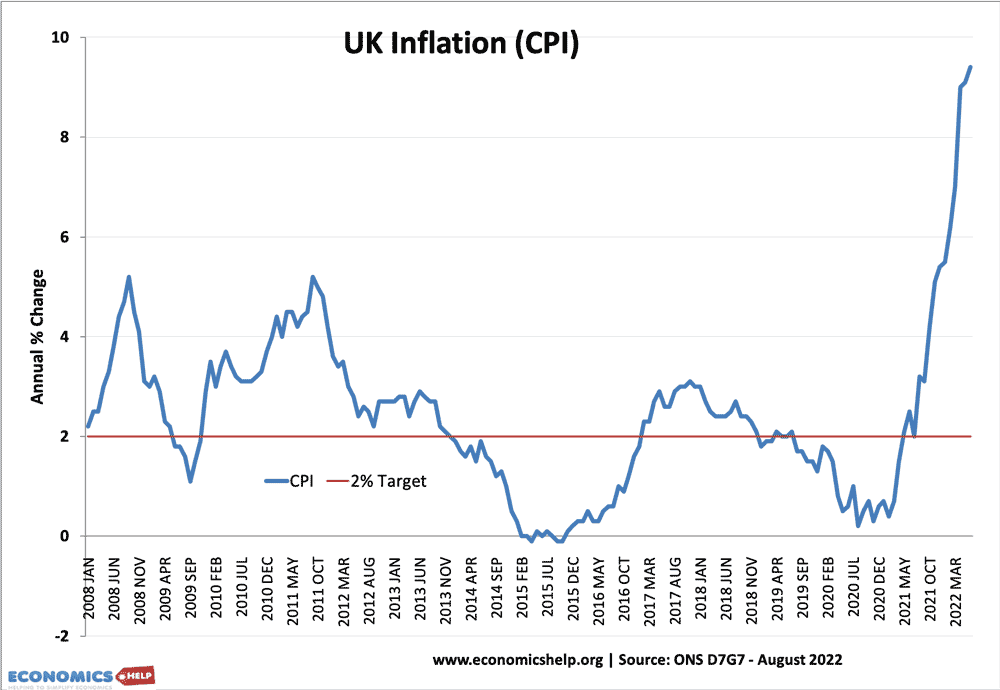

The high inflation in the UK is making UK goods less competitive, leading to less demand for Sterling.

The UK only gets 4% of its natural gas from Europe but has been more affected by price rises than other European economies. This is partly due to limited gas storage facilities in the UK and the fact the market is privatised with electric prices set by the highest-priced source of electric generation. The prospect of substantial price rises has forced the government to propose a very extensive and expensive intervention in the energy market.

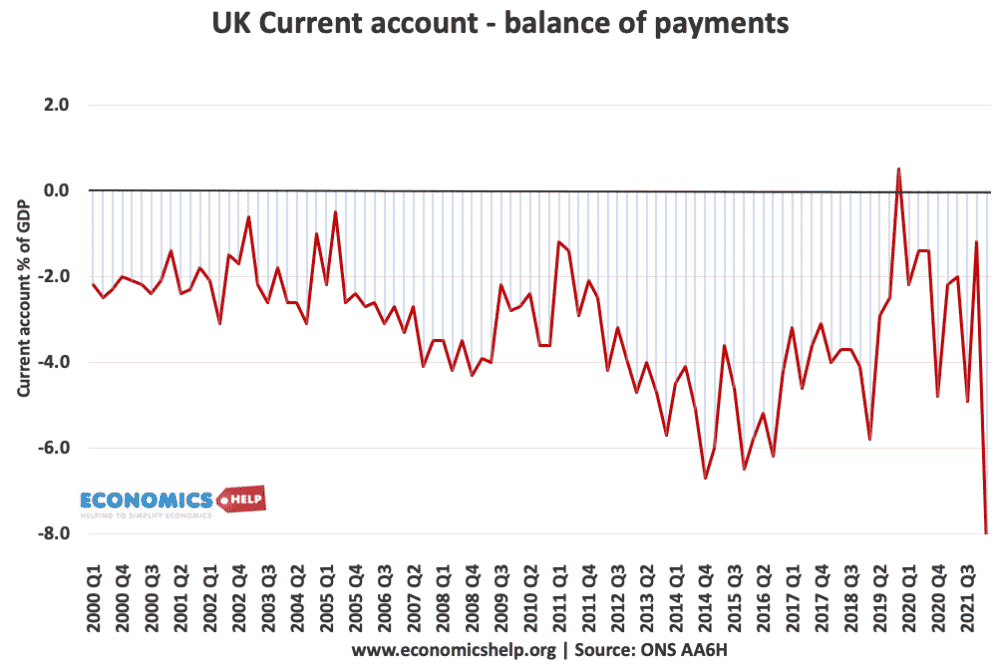

Trade deficit

The UK’s trade deficit has been reaching record levels. Despite some rebound in exports during the summer, the trade deficit is expected to soar in the coming months due to the cost of importing energy. The FT reports that experts believe the trade deficit will grow to a record 7.5% later this year. July figures show imports of fuel reached more than £11 billion – accounting for more than 21% of all imports. However, the price gas futures suggest the value of gas imports will rise from £1.8 bn in July to £8 billion by the end of the year, putting further strain on the UK trade balance.

A current account deficit of this magnitude will put further downward pressure on the Pound Sterling as Sterling is sold to buy foreign imports, and the UK is not attracting the same capital/financial flows to finance the trade deficit.

Brexit pressures on the Pound Sterling

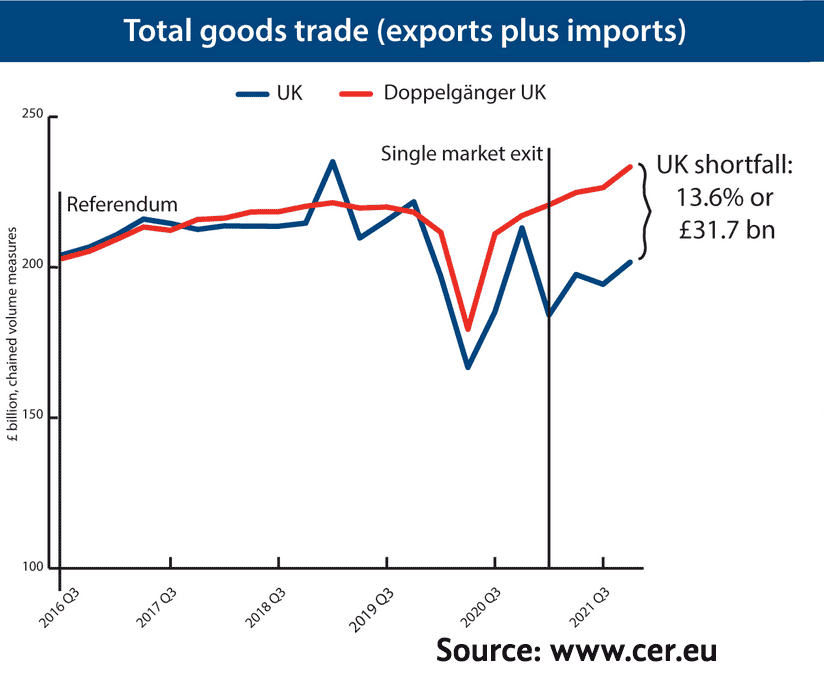

After the Brexit vote, the Pound fell 16% in anticipation of lower growth and lower investment. As the nature of Brexit became more apparent, markets have become more concerned about how Brexit is affecting trade and investment. For firms, there is a greater incentive to relocate into a single market and this is reducing business investment. Then there are the obstacles to trade and new tariff barriers which have reduced trade with Europe.

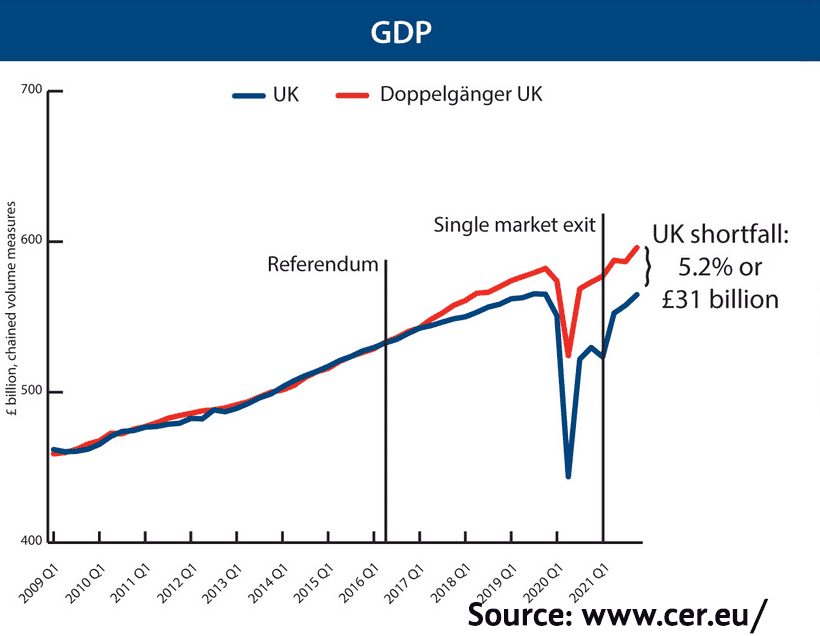

Source: CER

Whilst the loss of GDP and business investment is difficult to disentangle from the effects of Covid. CER, claim that compared to a UK in the EU, GDP would have 13% more trade and 5% more GDP.

Whether this exaggerates the costs of Brexit may be disputed, but the markets have a habit of being unsentimental and the fact the UK is showing one of the poorest performances against the dollar is sign markets don’t like what they see.

Imminent recession

The high inflation, combined with economic uncertainty has led to falling retail sales (Retail sales in the UK fell 1.6 per cent between July and August) and is a strong sign of an imminent recession. The concern is that the worst is yet to come for consumers. This economic slowdown is also putting downward pressure on the Pound Sterling as it means interest rates can’t be increased as much as other countries with higher growth.

The government have announced a huge bailout and promises of tax cuts, with a mantra to go for ‘growth, growth, growth’ They are clearly signalling they want to prioritise economic growth, but at the moment markets are not convinced a large expansionary fiscal policy will solve the economic problems of the UK.

Firstly, even though it is genuinely large, households will still, very much feel a cost of living crisis and be reluctant to spend. Even tax cuts, may not prove the magic bullet to boost confidence and spending.

Government borrowing

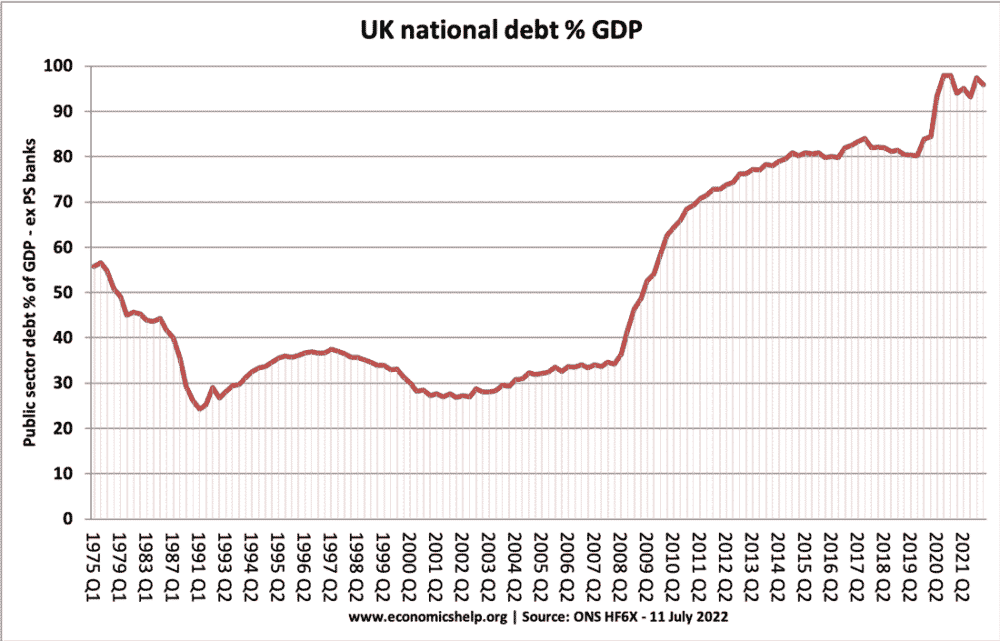

Since the financial crisis of 2007, markets have been relaxed about UK government borrowing, partly because the debt interest payments have been so low. But, now with interest rates rising and another big surge in debt from the energy bailout, markets are becoming more cautious about UK borrowing. The UK has also been hit by index-linking bonds, which means as inflation rises, so does the cost of debt servicing. One forecast by Pantheon Macroeconomics suggested that the UK’s debt interest bill would rise to £118 bn for the current financial year alone, £35 billion higher than previously forecast. (This is Money)

Whilst debt as % of GDP has been higher in the past (240% in the late 1940s), this was reduced by the post-war economic growth. In the UK, we are stumbling into low growth, with productivity growth almost stagnant since 2007. Therefore, with the prospects of low growth and rising interest rates, debt starts to look less manageable.

Prospects for UK sterling

UK inflation is still forecast to rise, despite the government’s energy intervention. Inflation of 13% would place the UK with the highest levels of inflation in the OECD, making UK goods less competitive. This will only worsen the trade deficit, but the UK is struggling to attract investment with Brexit-related uncertainties.

UK economist Paul Dales of Capital Economics Chief U.K. Economist Paul Dales expects sterling to “plumb new depths” and could fall to 1.05 by mid-2023 as political and economic uncertainty continue to damage UK assets.

A big factor will be the decisions of the Bank of England. Credit Suisse argues that the BoE need to hike interest rates 100 points to stave off the current decline and raise rates to at least 5%. If rates are only raised by 50 points, less than the US rises, it will disappoint markets. But, a sharp rise in interest rates will only increase the risk of recession.

Movements in the exchange rate can also reflect long-term political events. Concerns over Scottish independence and the passing of Queen Elizabeth II can all influence investors’ outlook on the UK.

Further reading