The amount of debt interest a government needs to pay depends on two factors:

- The amount of outstanding debt.

- The interest rate on government bonds.

Higher bond yields will increase the cost of future borrowing.

Note: There are quite a few different ways of measuring government debt / financial liabilities, therefore you may come across slightly different statistics for debt interest payments as a % of GDP. I have indicated source of data where possible.

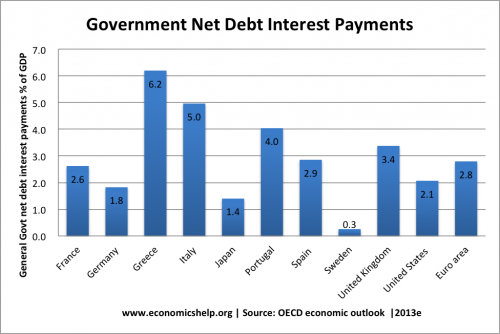

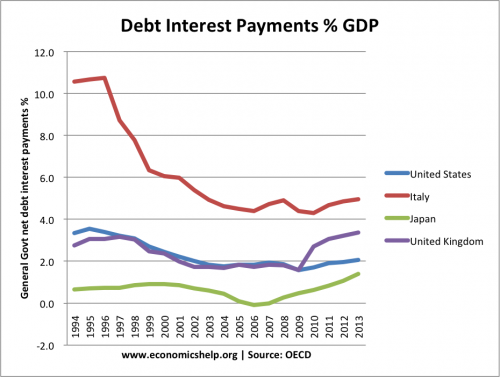

Debt interest payments as a % of GDP / Tax revenue give a reasonable guide to how manageable the government’s debt situation is. For example, Japan has a national debt of over 220% of GDP, yet net debt interest payments are forecast to be only 1.4% of GDP in 2013. Italy by contrast is facing a higher interest burden, with over 5% of GDP going on net debt interest payments.

It is worth noting that in the case of UK and US, net interest payments are not exceptionally high as a % of GDP.

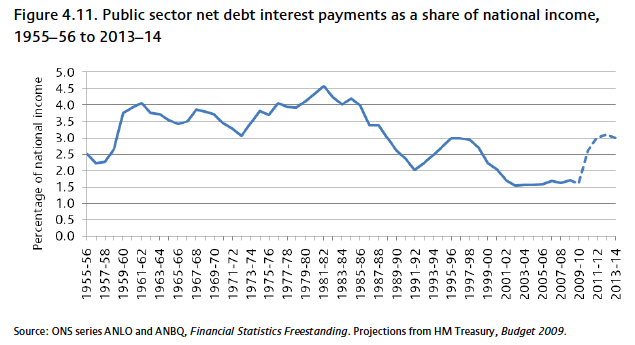

UK Net Interest Payments as a % of GDP

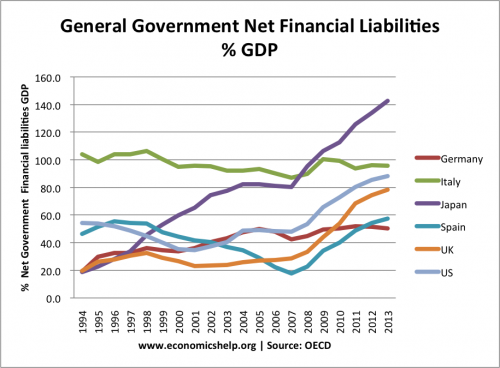

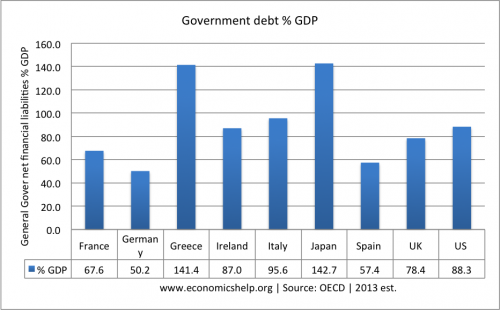

Government net financial liabilities. Japan’s have increased significantly, though the interest rate burden has stayed low because of very low interest rates.

General Government net financial liabilities % of GDP.

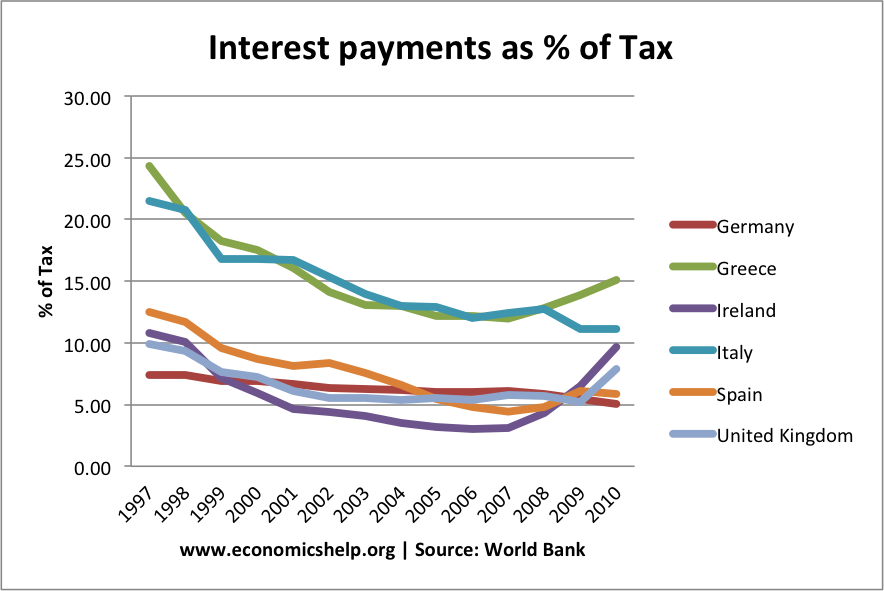

Interest Payments as a % of Tax Revenues.

source: World Bank Interest payments % tax

Interest payments as a % of tax revenue also give an idea to the affordability of debt.

An interesting fact is to see how debt interest payments as a % of tax revenues fell considerably for Greece and Italy in the period 1997 to 2007. This was due to the benefit of joining the Euro and getting lower interest rates as a result of being in the Euro. (It’s hardly surprising countries were so keen to join, when you see how much interest payments fell). However, from 2008, it has been quite a different story as the benefit of low interest rates evaporated. It was a shame the data stopped in 2010, it would be interesting to see how debt interest payments as a % of tax have increased in the peripheral Eurozone economies. See: EU Bond yields

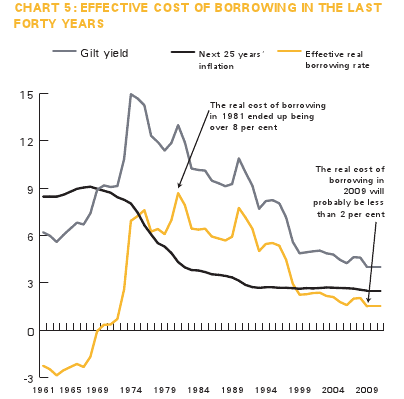

Real Debt Interest Payments

When examining the effective cost of borrowing, it is important to take into account inflation. If inflation is 10% and gilt yields 10%, then the effective cost of borrowing (real interest rate) is zero. If inflation was 12% and gilt yields 10%, the real cost would be 12-10.

Currently, UK bond yields are close to 2%, slightly lower than CPI inflation of 2.6%

Effective Cost of Borrowing

Source: Centre Forum

2 thoughts on “Debt Interest Payments as a % of GDP and Tax”

Comments are closed.