Readers Question: Who lends the government money?

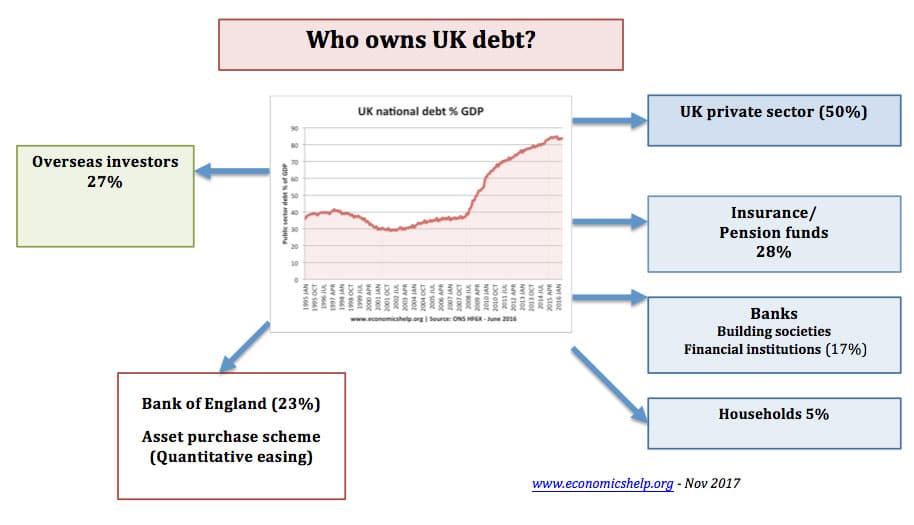

Government debt is primarily sold to banks, pension funds, private investors and overseas investors. These financial institutions and individuals effectively lend the government money in return for gaining a safe investment (bond) with a guaranteed interest payment. Approx 27% is ‘lent’ by overseas investors.

Investors do not see themselves as ‘lending’ money to the government. From their perspective, government bonds provide a relative safe, secure, low-risk investment option. In an investment portfolio, government debt secures the low-risk, low yield aspect.

UK public sector debt in Aug 2017 was £1,773.3 billion equivalent to 88% of GDP. See: UK National Debt.

On this debt, the government have to pay interest payments, In 2016/17 this was £49.1bn – approx 2.5% of GDP billion a year. See: interest payments on UK debt.

To finance this national debt, bonds are sold through the Debt Management Office (DMO) on behalf of the government to the private sector. Most of this government debt is bought by financial institutions such as:

- Pension funds

- Building societies.

- Investment trusts

- Insurance companies

- Private individuals (UK households)

Therefore, the interest payment is paid to those who buy the government bonds and gilts.

Since 2008, The Bank of England has purchased 25% of government gilt holdings as part of quantitative easing. This means a significant proportion of UK debt is being financed by Bank of England.

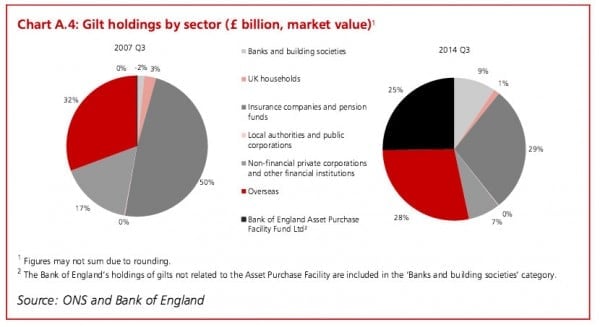

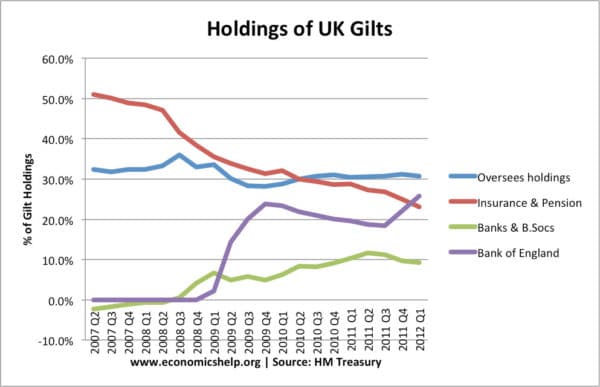

Trends on holdings of UK Gilts

The Bank of England has not taken nearly 30% of gilt holdings.

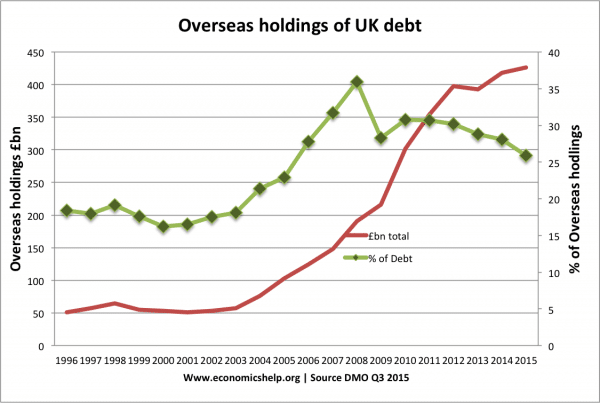

Foreign Holdings of UK Debt

The percent of UK government bonds bought by foreign financial institutions.

UK Debt held by oversees investors

Quantitative Easing and Government Debt

Since 2009, the Bank of England has used electronically created money to purchase government bonds. The initial wave of quantitative easing involved £200bn. Therefore, a significant part of the governments debt is held by the Bank of England. (21% at start of 2011)

Note: The purpose of quantitative easing is supposed to be – keep interest rates low, encourage bank lending. It isn’t meant as a way of financing government debt. After economic recovery, the Bank of England will sell these government bonds back onto the market. Thus debt will be held by the private sector again.

Related

I do not understand. You say the govt borrows from pension funds but I read in the press that such funds are in jeapordy because of the credit crunch, so how can they lend money?. They NEED money

I have been told that the B of E buy bonds from the government with cash they create out of thin air in ‘open market operations’. I have also been told that the B of E is a privately owned corporation. Is this all nonsense?

does the bank of england loan money to the government……if so why do they have to pay interest…if not why not…….in todays fractional reserve system they have a licence to invent money …..the goverment deposits……the bank of england lends them at a 9-1 ratio …….if the government owns the bank of england they would be paying interest to themselves……..why cant we print the money we need instead of taxing people…….we could buy the public services Build roads and bridges etc and this would not inflate the system as banks are flooding the market with new money anyway………..everytime a bank creates a loan they are pushing up inflation arnt they, which means that our government is pushing up inflation when they borrow….but if you borrow without interest you cannot push up inflation. When people talk about money they talk about it like religion…….they say if you introduce more paper money to the system then they will be increased inflation…But i have not heard a satisfactory answer..as to why…just that you just have to trust that thats the way it is…why…..there isnt enough physical money in the system anyway …..who would know if you printed what you needed and then withdrew it at a later date ……..when the bank of england prints money do they put an add in the paper ? do they give it away to people in the street ……as such everyone will have loads of money…..and therefore it will not be in demand which will push up inflation ? if the government has a bank account at the bank of england ….Why cant they increase there balance by however much they like …….its electronic money….ie just some numbers on a bank balance anyway…until you withdraw some……and they control the physical money anyway……can someone just put me out of my misery…………..i just dont get it …..people talk about money like it has a life of its own and not created by people, like i know it is……..it is a product…..it doesnt come from god……if the goverment really wanted to they could create some instead of collecting taxes…………but then greedy banks wouldnt make as much money out of us because we pay roughly 40 percent of our money in tax which makes us skint enough to need loans to buy stuff

How is it that our businesses are failing, and we are cash-strapped and borrowing furiously (from whom?), while Israel, an economy dependent on foreign aid, is awash with cash?

Israeli President Simon Peres said this to an Israeli economic forum in Tel-Aviv on 10 October 2007, according to the Hebrew Israeli daily Mááriv:

‘These days, it is possible to build an empire without colonies and armed struggle. Just look at the empire Bill Gates built himself without the aid of soldiers or police, and note its power. Faced with such power, governments are unable to exercise their own power. They have banks and treasuries, but there is no money in them. Governments are therefore incapable of functioning productively. This, however, does not seal off businesses. Israeli businessmen are investing all over the world. Israel is experiencing unprecedented business successes. We have won our economic independence. We are buying up Manhattan, Poland and Hungary.’

Did the world’s money end up in Israel?

When the government buys its own bonds, is that like it’s lending money to itself?

In a way, I’m really asking you to grade my homework…

“To finance the National debt, bonds are sold through the Debt Management Office (DMO) on behalf of the government to the private sector.”

government can not buy its own debt its sells it debt in the form of bonds

So going back to the beginning of the question who lends the government money ?

because to get into debt in the first place place must mean the Government borrowed money. so if the BOE is Government run then they should be printing money so no need to get into debt

, but if there are not then they must be lending to the government at interest

why don’t the government -Bank of England instead of giving stupid banks money as if the banks are the sole of the country and instead lift the mood of the country by giving back to the people especially those who are in great financial problems so that they might continue to spending. The government needs to stop being greedy and see the bigger picture. Proposal, people who have savings of 20,000 do not need help of such but help the people out. japan did it. why not us.

No one around me or in the media seems to know who the goverment is loaning the money from that they are giving to the banks. From the research I have done it seems to go around the houses and comes back to the goverment. So if it is that goverment is borrowing money from itself why is it charging itself (taxpayers) interest. Can anyone explain this to me?

They just printing money which is NOT backed by Gold standard like it used to be! JUst like the Feds in the US, they print money and act like they borrowed from somewhere! Sometimes I begin asking question like “who did they borrow the money from?” and nobody can give you a significant answer to that

i would like to know more on the issue of who exactly benefits from the uk national debt that my great grandchildren are going to be paying.

We have given these people the authority to create money out of thin air and through that device they control everything. And if you want to win the battle to stop that you have to deny them the ability to create money.

Why in the world does the government borrow money from the bank, when they have the ability to create it themselves without borrowing and asking interest for it? And nobody can answer that question!

Broken Note – Let ‘Em Hang 😉

National Debt

The Government borrows money from the private sector. The borrowed money is the national debt.

Is there are list of the people/organisations/institutions who have loaned the government money?

How much of the money that the Government owes has been borrowed from UK banks – that have been rescued by the government?

Now that would be ironic, borrowing money with interest from the very people who created the problem in the first place, seem like heads I win, tales you lose.

watch money masters on u tube.it explains all this in great detail.3 1/2 hours long.

gordon states that the Govt. borrows money from the private sector. For that, read a private bank or banks. Formerly, the BoE was private of course. These private financiers are the likes of the Rockefellers (who also have a HUGE vested interest in the New York & Federal Reserve banks) and our old friends the Rothschilds.

You all know the tale of how the Rothschilds financed both sides fighting in the Napoleonic War, right? I hope so, as I don’t want to go over it again. Basically these private bankers plan the economy for the government departments, & allow the boom-bust actions we’ve seen all too often. The ‘ministers’ are just the mouthpiece, which of course makes it look like the Govt. is at the rudder steering us through the murky financial waters that are actually controlled by the 6 mega-banks who in turn control the markets.