Readers Question: Why is house price inflation considered good while other forms of inflation are considered bad? Or are all forms of inflation bad for the economy?

House price inflation has a mixed impact on the economy depending upon the extent and timing of the rise in house prices.

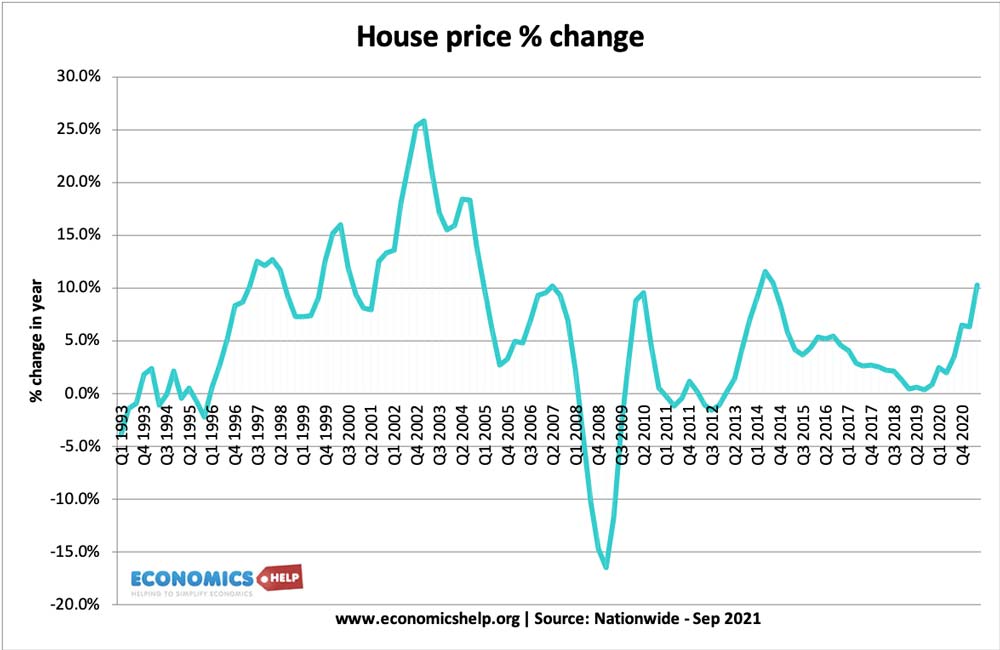

This graph shows house price inflation in the UK since 1981. It shows the volatility of house price inflation in the UK.

Benefits of Moderate House Price Inflation

- A rise in house prices increases the wealth of householders. This can lead to increased consumer spending. Householders can take equity withdrawal from the increased value of their house.

- House price inflation doesn’t reduce the value of savings like ordinary inflation. For homeowners, wealth actually increases.

- House price inflation doesn’t indicate the economy is at full capacity and overheating, it just reflects demand is greater than supply in this particular market.

Problems of House Price Inflation

Rising house prices are good for homeowners, but it can reduce living standards for those who don’t have a house. In the UK house price inflation has made homes unaffordable for many first time buyers – see: House price to income ratios. Rising house prices have also had an impact on increasing rents. House prices inflation, in the UK, has increased inter generational inequality; those buying houses in the 1970s and 80s have done very well, but young people facing a very difficult housing market.

House Price Inflation and Boom and Busts

The most serious problem of house price inflation is that in booms, the rise in house prices often prove to be unsustainable. In the 1980s, rising house prices contributed to an economic boom – rising consumer spending and rapid economic growth. However, this economic growth and rise in house prices both proved unsustainable. When interest rates were increased to reduce inflation, it caused a collapse in house prices. This fall in house prices left many with negative equity. The subsequent fall in house prices was a factor in contributing to the recession of 1991. Volatility in house price inflation has a big impact on economic instability. Similarly falling house prices post 2008 (as a consequence of the overheating in house prices) has been a big drag on the US and European economies.

House Price Inflation distorts economic behaviour. If we look at Spain and US, rapid house price inflation in the early 2000s encouraged a boom in bank lending and home building. Encouraged by rising house prices, banks lent to a wider variety of people. This credit bubble later proved unsustainable contributing to the credit crisis. This excess lending wasn’t just a result of house price inflation. It was partly a regulatory failure and failure by banks. But, rapid house price inflation often encourages a credit bubble and bust – which can be very damaging to the wider economy.

Conclusion

When people say house price inflation is good and normal inflation isn’t, they are thinking from the perspective of their wealth. Inflation reduces the value of cash savings, but rising house prices increase the wealth of homeowners. However, this is only a narrow perspective on the implications of house price inflation.

Firstly, house price inflation in the UK has left many people struggling to find affordable housing.

But, the most serious concern is the role house price inflation can play in encouraging unsustainable asset boom and busts. The house price inflation of the early 2000s was much more serious than policy makers admitted at the time. Rising house prices contributed to a credit bubble that later popped with devastating impact.

A big mistake of policy makers in the 2000s was only to target headline inflation and ignore an asset bubble (house price inflation). In future, rapid house price inflation of the 1980s and 2000s should raise warning bells and encourage policy makers to reduce house price inflation.

It seems a shame that many new people cannot get onto the housing ladder. The less people in the market the less it gets competitive. Let’s also remember there is a social impact also.

It’s more than a shame. This system promotes narcissists while simultaneously destroying the lives of better people. The social impact is untold

The truth is not allowed to be posted here!