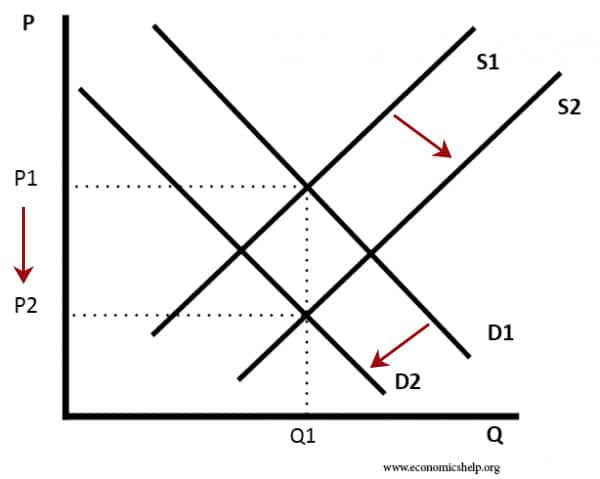

House prices fall where there is a decline in demand and/or excess supply. The main factors that cause a fall in house prices involve:

- Rising interest rates (making mortgage payments more expensive)

- Economic recession / high unemployment (reducing demand and causing home repossessions).

- Fall in bank lending and fall in availability of mortgages (making it difficult to buy).

- Fall in confidence/expectations of future house prices.

- Changing demographics. (less demand, e.g. net migration)

- An excess of supply in the housing market.

- Fall in market rents making it less attractive to buy to let.

Supply and demand diagram

Interest rates

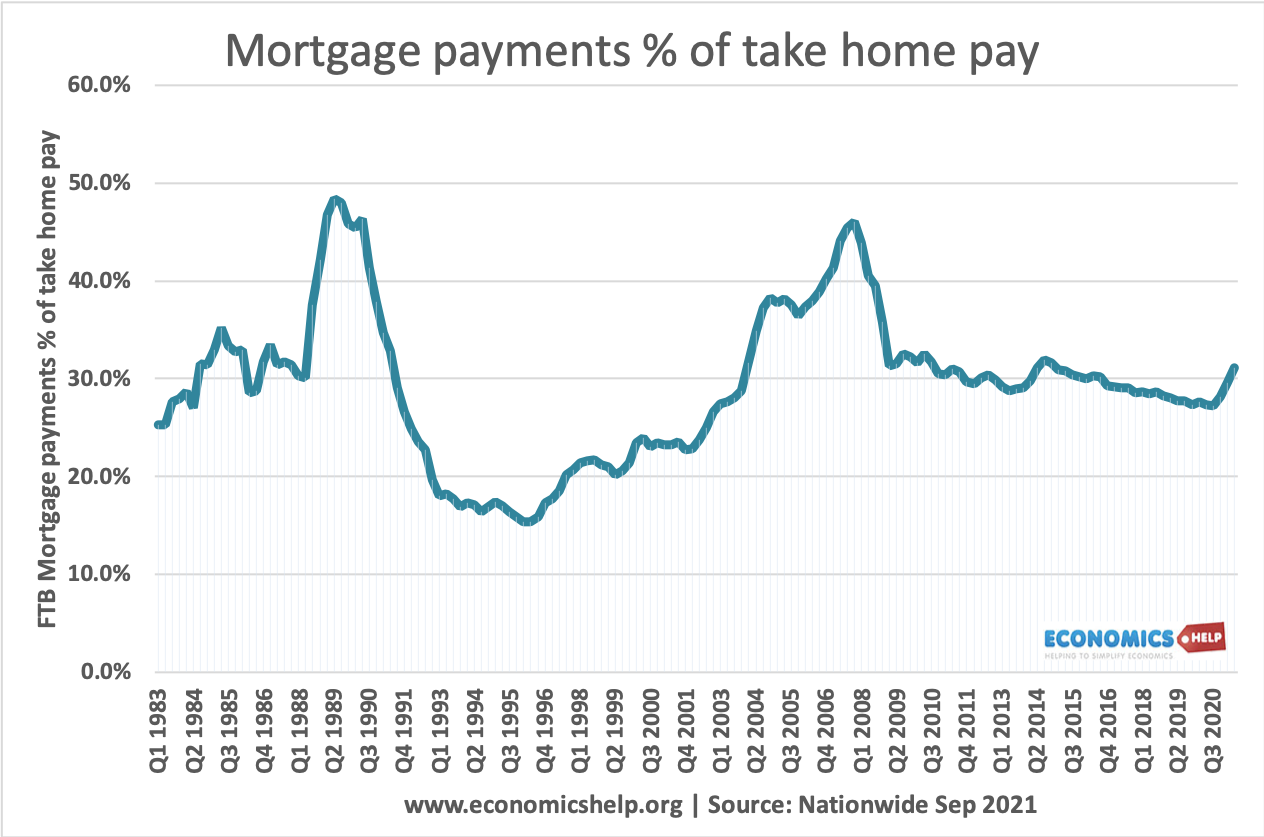

Interest rates are very significant to the housing market. An increase in interest rates will increase the cost of variable mortgage interest payments. Those on a fixed mortgage may be insulated from higher mortgage payments in the short-term, but over time – even fixed-rate mortgages – will become more expensive.

In the late 1980s, interest rates were increased to 15%. This caused a significant rise in mortgage payments. With mortgage payments taking over 50% of disposable income it led to mortgage delinquencies and so people sold houses and demand fell. In 2006, interest rates rose to a more modest level, but people had taken out more risky mortgages.

Interest rates are also very important for buy to let investors. Low-interest rates mean that mortgage payments will be cheaper than rentable income. So a rise in interest rates will provide an incentive to sell.

To highlight the importance of interest rates on house prices, In a recent paper by the Bank of England, Miles and Monro calculate that:

“Over time, a 1 per cent rise in real interest rates from their present level would push real house prices down by nearly 20 per cent.”

Bank of England Staff Working Paper No. 837, Dec. 2020,

Recession

In a recession, unemployment rises, incomes fall and consumers lack the confidence to make a big investment in the housing market. There is a strong correlation between a period of recession and falling housing prices.

Preceding the recession, house prices had risen much faster than inflation and wages. It meant in the preceding years, house price to incomes ratios had increased. The recession caused a ‘correction’ in these house price to incomes ratios. For example, in the boom years, buy to let landlords may buy houses to try and make capital gains. But, in a recession, sell because house prices are falling. UK House price affordability

Fall in bank lending

The 2009 recession had an additional element – banks were short of liquidity and so cut back on bank lending. It became harder to get a mortgage and even though homeowners wished to take out a mortgage and low-interest rates, banks were unwilling to lend and tightened their lending criteria significantly

Tax rises

A small change in stamp duty or other forms of tax on homes would increase the cost of buying a house and making it less attractive to buy. There are proposals to increase taxes on second homes – making the buy to let property less attractive.

Excess supply of housing

If there was a boom in home building, then any fall in demand would be liable to cause a significant fall in house prices.

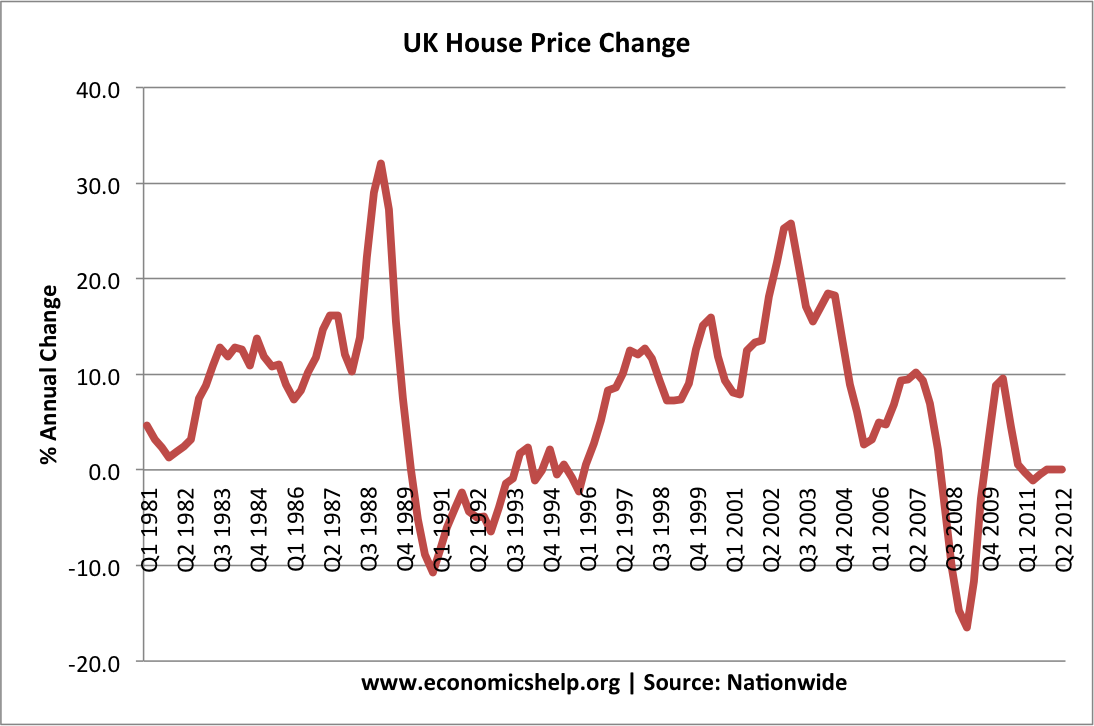

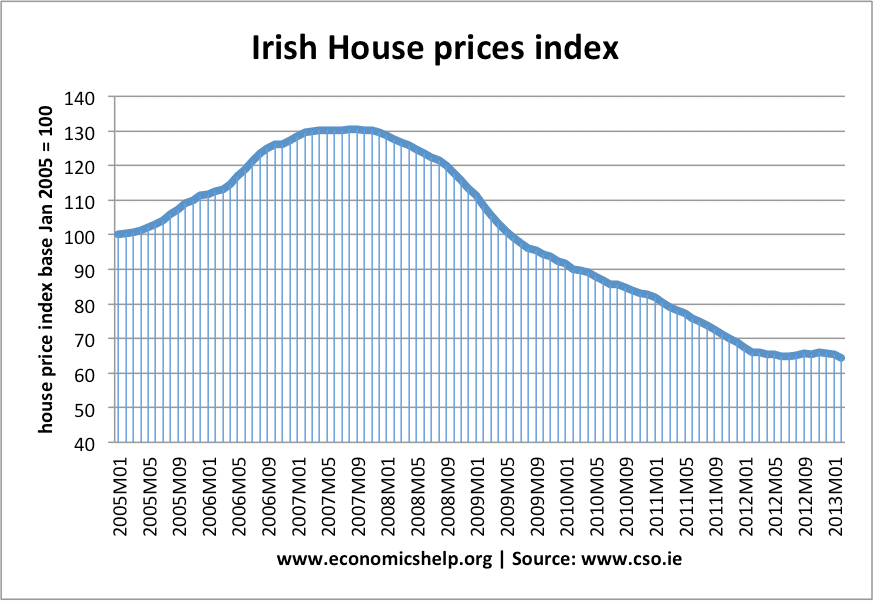

It is worth contrasting the experience of the UK and Ireland after the financial crash of 2008. Post-2008, the fall in UK house prices (20%) was quite mild compared to other countries.

For example, Ireland saw a real collapse in house prices (-50%). The Irish house price collapse follows a similar pattern to the UK – banking crisis causing a shortage of finance. Recession causing unemployment and falling demand. However, in addition, Ireland had a real boom in house building in the preceding years. Therefore, with falling demand, Ireland, Spain and the US have had a bigger excess of supply. Therefore, house prices fell more in these countries, than in the UK.

UK house prices have been insulated by this shortage of supply – which has kept prices higher than if supply was more elastic. If we look at the graph of UK house price affordability. There has only been a very small improvement in the affordability of houses. The ratio of house price to incomes is still greater than early 1990s, suggesting certain factors have prevented a bigger than expected fall in UK house prices.

House price falls between Q4 2007 and Jan 2013 – Economist house price indicator

- Britain – 11%

- United States – 20%

- Spain – 24%

- Ireland – 49%

- Germany + 8.8%

- Canada + 20%

- Global house prices at Economist.com

Changing demographics

A fall in the number of households would affect demand. This may occur due to fall in population or rise in the average size of a household.

Yield on renting

For a property investor, they will look closely at the yield on renting a property compared to other forms of investment. If interest rates on other assets rise relative to property yields it will become more attractive to buy other assets and less housing.

Related

- Pros and cons of house price inflation

- Why are UK house prices so high?

- Impact of falling house prices

thanks. helped a lot

hey there. please can u help me with this question. “Assess the likely impact of falling house prices on house building firms”