Readers Question: I would like your help in answering a query of mine………Is foreign exchange rate an indicator of economic growth?

No.

The foreign exchange rate is determined independently to the economic growth rate. The exchange rate can have an influence on economic growth. And the economic growth rate can influence the exchange rate. But, with many other variables at work, there is no direct link.

Strong Exchange Rate

A strong exchange rate is often considered to be a sign of economic strength. It can become a symbol of national pride. Often politicians are worried if they see a ‘weakening’ in the exchange rate. They will point to a strong exchange rate as a symbol of economic success.

In the long-term, a strong (appreciating) exchange rate tends to occur in countries with low inflation, improving competitiveness and a strong economic performance. For example, Japan and Germany saw a sustained rise in their exchange rates in the post-war period because they had a good economic performance.

In the short-term, a strong exchange rate could be due to a variety of other factors. For example, the Swiss Franc appreciated in 2012 because it was seen as a relative safe haven compared to the Eurozone currencies. Short-term movements in the exchange rate can be misleading to the overall economic situation because it might be driven by speculation rather than long-term economic improvement.

In the Eurozone, an overvalued exchange rate caused lower economic growth in countries in the south – Greece, Portugal and Greece all experienced a decline in competitiveness in the 2000s, and then growth suffered because exports were uncompetitive.

Fixed Exchange Rate and Economic Growth

In a few days time, it is the 20th anniversary of ‘Black Wednesday‘ – The day when Britain was forced out of the Exchange Rate Mechanism (ERM) and forced to devalue.

For months, the government had been trying to keep the Pound in the ERM. They spent billions of pounds buying Sterling on the foreign exchange. They increased interest rates (even in the middle of a recession) to try and protect the value of the currency.

However, keeping this strong exchange rate caused the recession to be deeper. A strong exchange rate can depress economic growth because:

- Exports more expensive, therefore less demand for exports

- Imports cheaper, therefore more demand for imported goods (and therefore less demand for domestically produced goods)

- Overall, this reduces Aggregate Demand (AD)

- Furthermore, to keep the pound high, the government kept interest rates high. But, high-interest rates reduced the rate of economic growth.

Today, countries in the Euro, have a permanently fixed exchange rate, leaving them becoming increasingly uncompetitive. This rigidity in foreign exchange is a significant factor in causing lower economic growth in southern Europe.

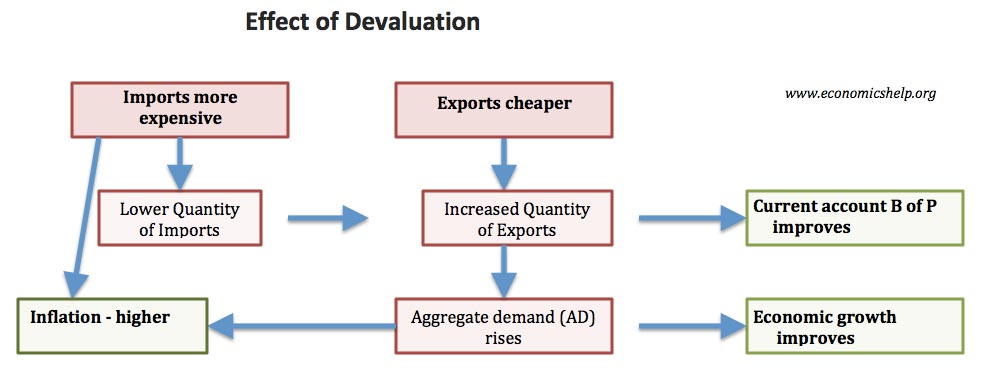

Devaluation and Economic Growth

Often a devaluation (fall in the value of the exchange rate) can cause a boost to economic growth. A lower exchange rate makes exports cheaper and increases demand for UK goods. This can provide additional demand which increases economic growth.

A devaluation may cause inflation:

- Imports more expensive

- Higher domestic demand

But, if demand for exports and imports is relatively elastic and there is some spare capacity in the economy, then there should be an increase in economic growth.

In a way, the UK’s experience in the ERM and black Wednesday was our lucky escape from being in the Euro. If we had survived the ERM and joined the Euro, things would be different.

Examples of Exchange rate movements on economic growth

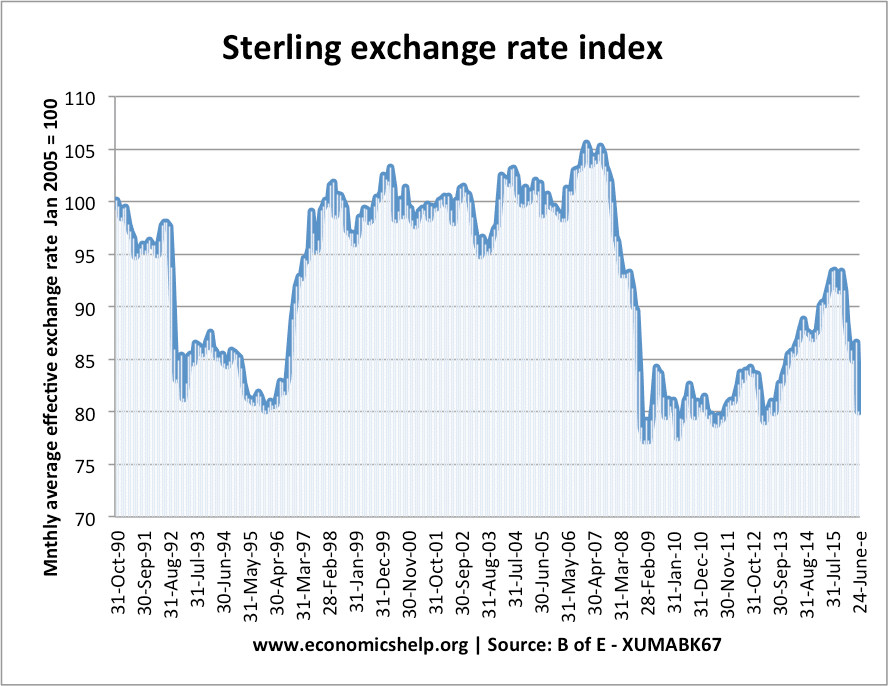

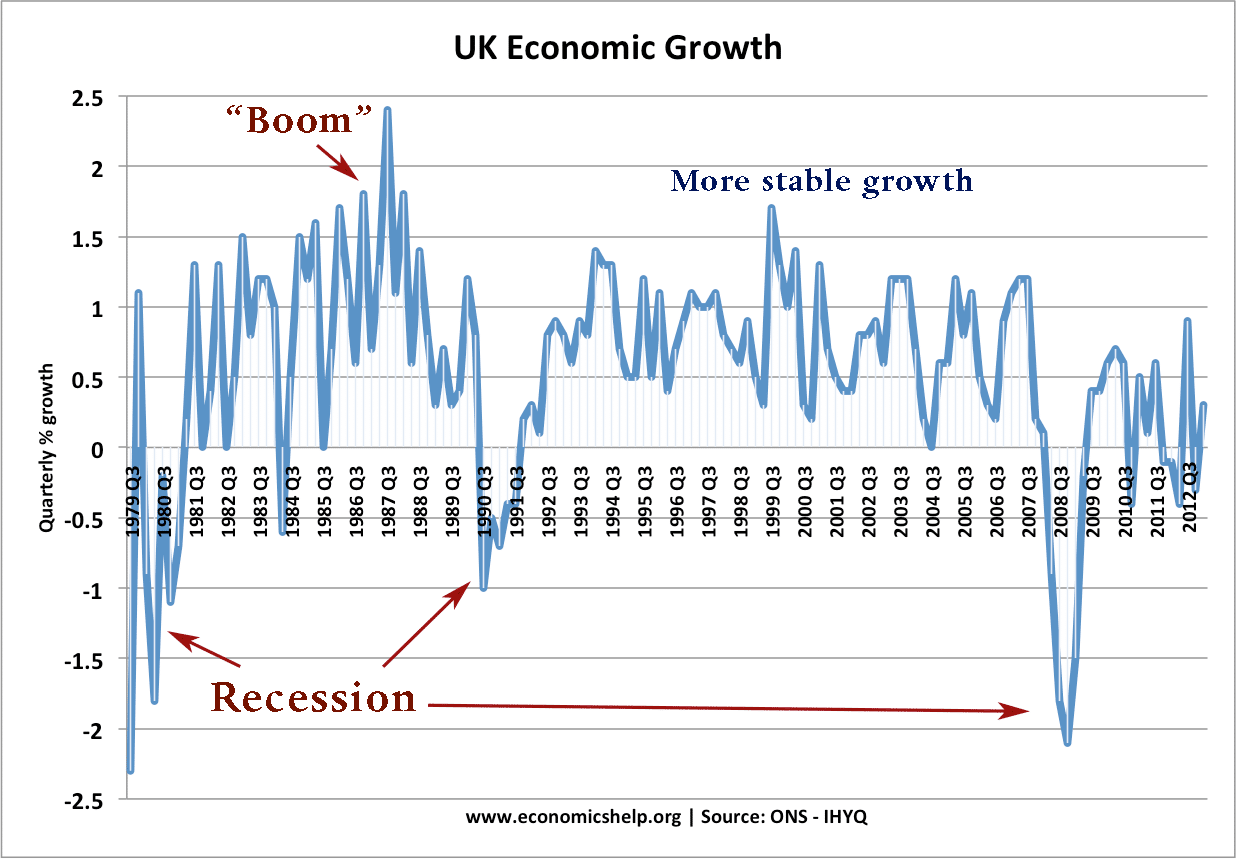

In 1992, the UK experienced a large devaluation as it left the ERM. This also allowed interest rates to fall from record highs of 15%.

This caused a strong economic recovery. The low-inflationary economic growth of the 1990s, also contributed to appreciation in Sterling as it regained former value.

However, the 2008 devaluation didn’t really help economic growth. There was a sharp fall in GDP in 2009. The negative impact of the credit crunch was so strong, it offset the expansionary effect of cheaper exports. Also, because the world economy was in recession, cheaper UK exports didn’t cause much increase in demand.

Related