National debt is financed by selling government bonds to the private sector. Banks, pension funds and individuals all buy bonds in return for an interest on the bond. In some circumstances, debt can be financed by the Central Bank printing money and buying bonds itself.

Responding to a comment on UK National Debt,

“The interest is paid I presume, to the bank of England that lends the money to our government.”

it is worth explaining in brief about how the national debt is financed.

The UK Debt management office (DMO) is responsible for selling the government’s debt, through the sale of gilts, Treasury bills and bonds. It used to be the Bank of England who was responsible for selling the government debt to the private sector. But, in 1998, the government transferred the operation to the UK debt management office, a branch of the HM Treasury.

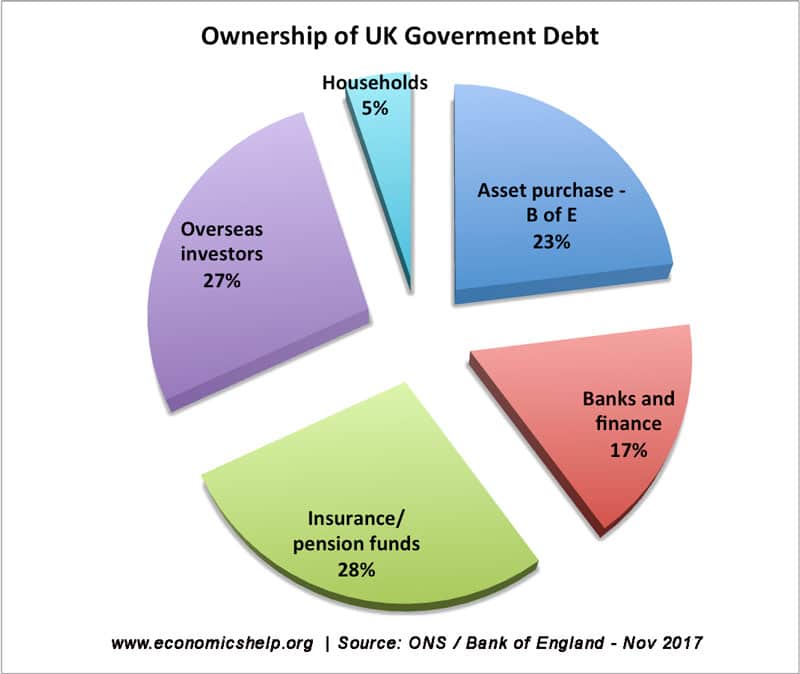

The national debt is mostly financed through the sale of government bonds, bills and gilts. These Government bonds tend to be bought by financial institutions such as investment trusts and pension funds. They are bought because they provide a secure investment with reasonable rates of interest.

If the government had to borrow a lot then the interest rate on bonds may be forced upwards to attract enough people to buy the bonds.

The bonds and gilts may be anything from 3 months to 30 years. In the First World War, the Government borrowed by selling open ended stocks; some are still outstanding (though relatively insignificant)

The Government have to pay interest to those who buy the bonds and bills. The cost of interest payments on the National debt is about £30 billion a year.

More detail on how the UK finances its debt

- Who does UK owe debt to?– including a look at foreign ownership of UK debt

‘The Bank of England has a responsibility to sell the government debt to the private sector’

Q. Is that the private sector in the UK alone, or do financial institututions in other countries also buy UK government bonds?

Actually, the debt is sold by The Debt Management Office not the Bank of England. It was split out by Gordon Brown in 1998. Technically it is ‘owed’ by an entity called The National Loan Fund. Google their accounts. Its fascinating.

Thanks Anthony!

Greece has a current account deficit of almost 14% (!) of gdp and greece is a member of the EU. How can it resolve the problem if it cannot devalue the currency ( the quick way out, which was used in the past when the greek drachma was around) and when productivity is so low and consumer spending is holding up due to EU money/subsidies and “black” money?

I am a normal working man aged 40 working 5 days a week and wondering if this national debt is likeley to lead to higher interest rates ?

Interest is paid to the Bank of England on the £200bn or so of gilts which they hold under QE. Perhaps the austerity hit British Public should not be too worried about paying this particular portion of the debt.

do you have some infos about deficit spending in UK? and fiscal policy in uk?

Nice fantasy. But in the real world, government “finances” it’s debt by crediting bank accounts. All money is debt so we may as well call government issued money debt.

Purpose of bond sales is not to finance anything, but to drain reserves out of the banking system to allow central bank to hit it’s overnight interest rate target.