Readers Question: Who exactly is the UK is in Debt to? Please can you simplify and explain?

There are two types of debt:

- Government debt (Public sector debt / National debt) – The money the government has borrowed, primarily from the private sector.

- External debt. Liabilities the UK owe to the rest of the world – this is both private sector and public sector.

Who does the government borrow from?

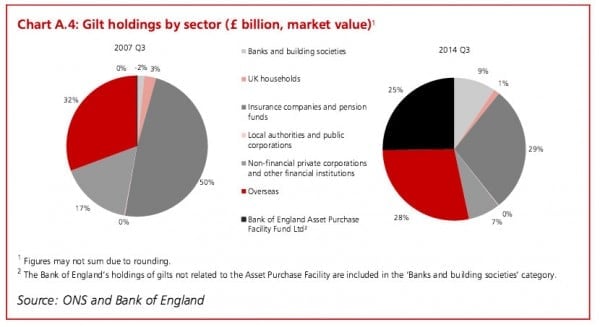

The UK government borrows mainly from

- UK pension funds/insurance companies (29%)

- Private corporations / other financial institutions

- UK building societies. (e.g. building societies buy government gilts to invest their savings to get a decent return.)

- UK Banks

- UK Private investors

- Foreign investors (foreign banks and foreign investment firms (2018 approx 20%)

- Bank of England Asset Purchase facility (Quantitative easing)

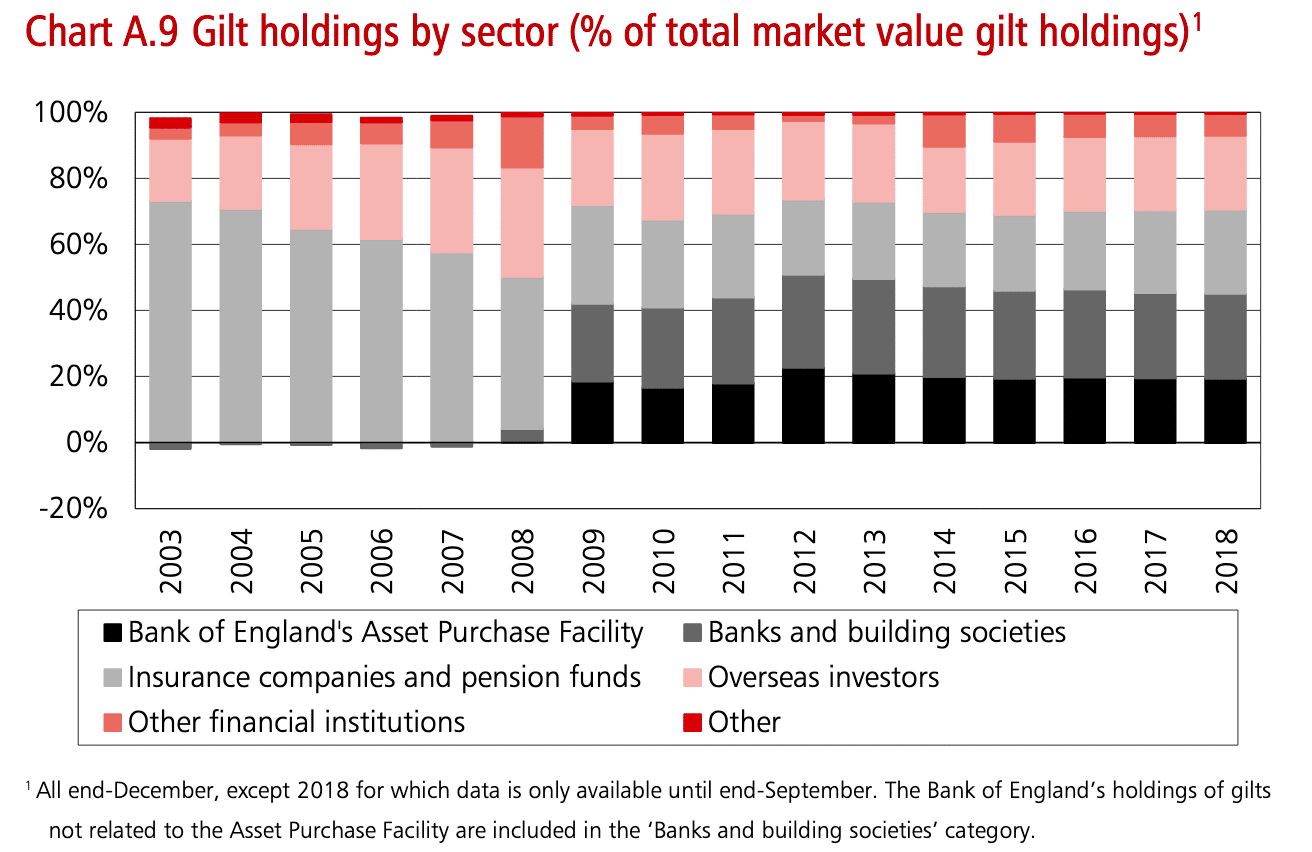

Change in debt composition 2003-2018

This shows overseas investors hold approx 20% of UK gilts.

Example

- A pension fund will be interested in purchasing UK government gilts to gain a secure return on long-term investment.

- A charity/firm with excess savings may purchase government gilts to get a good interest rate while it decides how to use the money. Retained profit from UK companies has increased in recent years, and corporations have become a bigger buyer of UK gilts.

- A private individual may purchase gilts as part of a balanced portfolio of investment.

We owe money to ourselves

One feature of UK government borrowing is that 75% of the debt we are borrowing from UK citizens and UK institutions. It is like a transfer of pension funds to the government.

Foreign holdings of UK Debt

How much does the government owe to foreign nationals?

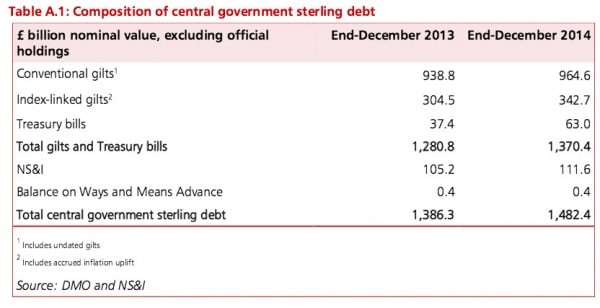

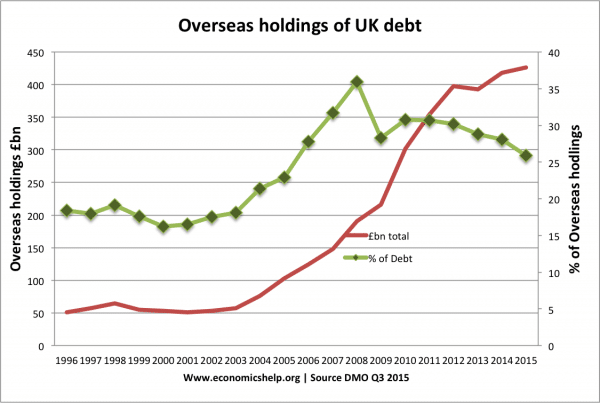

UK Debt held by overseas investors (source: DMO)

Foreign holdings of UK debt can be seen at DMO – Gilt Market Data – Oversees holdings

In Q3 2015, 25.9% of UK debt was held by foreign investors. This is lower than the mid-2008 peak of 35% but also higher than previous decades.

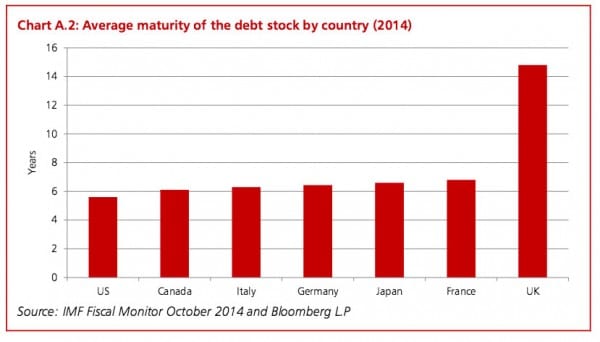

The UK has a high percentage of long-term maturity gilts. This means that the government is not liable to repay the gilt for a longer period. This means it doesn’t have to reimburse gilt owners and resell gilts as frequently.

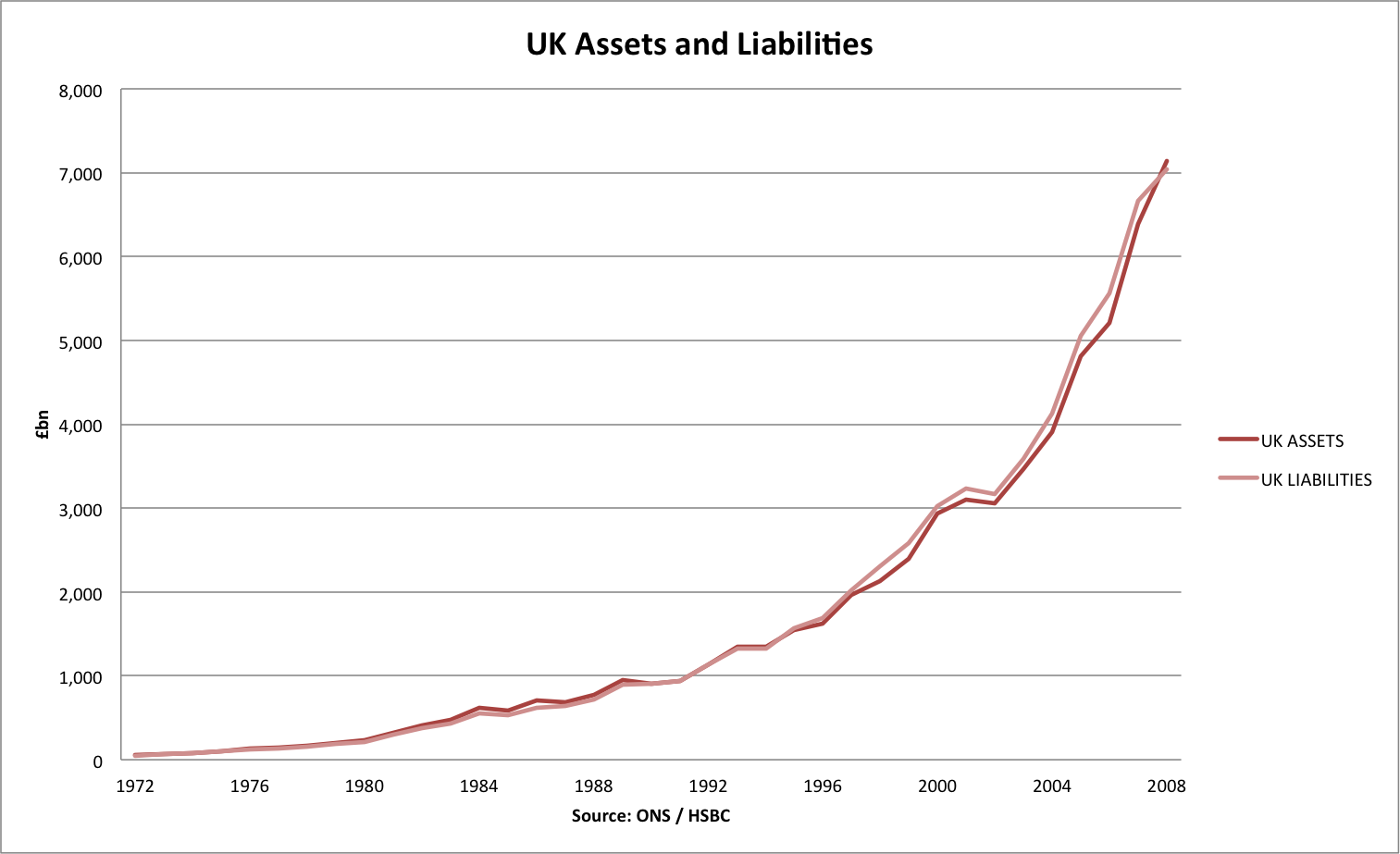

2. UK External Debt

Firstly, this is very different to government (national) debt. It is the total amount that people in a country owe to the rest of the world. It includes both government debt and private sector debt.

In the UK, external debt is currently over 430% of GDP (£6,200bn)

The vast majority of this is liabilities by the banking and finance sector. UK banks external liabilities amount to over £4,000bn.

However, it should be noted that this size of external liabilities is matched by UK external assets of £6,000bn.

See: UK External debts and assets

3. Private Sector Debt

As well as government debt, we have private sector debt (households, business, finance sector). Total UK debt.

- Most household debt/business debt will be owed to UK banks and building societies

Related

Video on UK Debt

Really interesting Tejvan. There’s nothing about external debt in any of my books! Extra questions that come to mind:

1. What are these assets and liabilities? Asset backed securities? bank issued bonds & shares?

2. I guess it should be obvious, but why are the assets and liabilities so close? Is the banks running a tight balance sheet?

Yes, I think they are things like asset backed securities / long term loans, bond shares. Because they tend to be asset backed, that is why they tend to be so close. However, I’m not an expert on external liabilities and assets.

Is this the complete picture?

It is regularly reported that so-and-so pension fund has a black hole and may require a government bailout? There is a need to know precisely who are the creditors and were they involved in the 2008 collapse. Billions of pounds of investment have been lost as a result of qe and low interest rates. How is that woven into the picture?

Good question. That’s exactly what I was just discussing. The real picture would explain why the country appears rich but pensioners are expected to live on a pittance.

Thank you Tejvan, I’m not sure who thought up government bonds but they seem like a pretty selfish money grabbing way of making interest? Jx

What would happen if the Bank of England purchased all the external debt with issued currency and then recreate the agreements with all the people/institutions that owed the money at 0% interest?

Not satisfied with what has been put down. There is more to it than that, The money we owe is very much more than has come via stated , During a war money would not have been invested as much as we are led to believe ,

This is all just smoke and mirrors to conceal the fact that the Bank of England is a privately owned enterprise. If the government (UK people) owned the Bank of England than we could ‘print’ our own debt free money. The government and B of E could print as much as they liked but this would obviously lose its value as other countries would be unwilling to accept it. Never the less this still would mean the government has no need to borrow money from anyone. I actually find it laughable when th article says the borrow money from pension funds. So you and I earn money to sav for a pension. This money is conjured out of thin air by the Bank of England, government and others and is then borrowed by the government at interest. The interest being paid by ‘borrowin’ more money. Sound like a Ponzi scheme.

The government owns the Bank of England see Bank of England Act 1946

You are right in what you say. It’s just that the UK government is ideologically opposed to utilising the power of the fiat currency and is intent on basing its whole manifest on gold standard restrictionist principles that are irrelevant since the early 70’s.

But the BoE is wholly owned by the state, and it’s independence is only partial.

One mans debt is another mans profit margin . What I would like to know is ,can a UK individual invest money abroad that is then loaned back to our govenment ? Secondly ,are MPs allowed to own govenment bonds because that would be conflict of interest ? It all seems a big scam to me because there is no profit in a small govenment debt if you are in the business of loaning to the govenment .

The government does own Bank of England, however BOE has to borrow money from a bank like Barclays, who then have to pay its millions to its directors for the privilege

Actually the BoE doesn’t ‘borrow money’ at all it offers external parties the opportunity to bank with it by placing their funds in the BoE in return for a promissory note to repay the money with interest just like any normal bank.

As BoE controls the money presses there is never a chance of the bank going bust and the savers losing their money – so it is a safe place to invest.

The monies received can then be spent by HMT but this ‘debt’ is not the same debt as you and I have because the BoE has a money printing press and can clear any ‘debt’ in seconds – we cant.

Yes paul, but the fact that the bank is printing more money means that it is reducing the value of the pound in your pocket (that is what all the recent money printing will do with a vengeance). In addition the Bank of England forces the domestic banks to store their money into the Bank of England’s vaults in order to reduce the amount of money for loans ( liquidity). Then the commercial banks are blamed for debtors and small companies not being able to borrow by reporters and newspapers. What I have never understood is why the commercial banks were hammered and blamed for the 2008 crisis when the real motivators of the catastrophe were the politicians and the Bank of England. They got hardly any criticism.

You mentioned the BoE borrow from banks like Barclays.

I would argue the opposite true. As the sole currency issuer, the UK gov and BoE create money these days with just strokes on a keyboard and crediting and debiting accounts digitally.

No physical money changes hands.

In fact the QE was BoE money being lent to the banks, which was then stored at the BoE, which the BoE pay the bank’s interest on the money it gave them in the first place.

Alphabet soup, obfuscations,

pseudo scientific meanderings, opinionated statements. Can anyone define national debt in a simple sentence, saying to whom the debt is owed?

Did you ever get an answer?

who is the dept owed to simply?

Notice no answer to the simple question: “who is the debt owed to”?