Readers Question I have read that the UK debt is £920bn to rise to £1.1-£1.2 trillion by next year – if the government cuts are effective. However why is it that the CIA quote UK external Debt as $8.9 trillion… that would be around £5.56trillion…. is this including public sector debt, private sector, government debt and all liabilities? It quotes the US debt as $14.3trillion which is consistent with what I’ve read.

- UK debt (public sector debt) is government borrowing.

- UK external debt is the debt the whole country owes to the rest of the world. This primarily composes bank and corporate liabilities. Though we do have assets in exchange for these liabilities.

- As it happens it appears the US external debt is very similar to the US public sector debt

Therefore, they are really quite separate statistics

The official UK public sector debt is currently around £920bn (forecast to rise to over £1trillion next year). UK debt

This statistics is a measure of how much the government has borrowed from the private sector and other purchasers of UK bonds and gilts.

Note, most of this UK national debt is held by domestic UK investors (e.g. British pension funds). About 20-30% of the UK debt is financed by selling bonds oversees.

External Debt

External debt is a different statistics. It measures the net debt of the UK to overseas investors. This includes both government debt to oversees, but also private sector debt. E.g. British banks have liabilities oversees.

The latest figure for UK external debt in Q1 2011 is £6,114bn over 400% of GDP. See bottom of ONS stats. I have seen a CIA statistic which puts UK external debt at £8,000bn. This measure may include a bigger definition of external liabilities.

By far the biggest component of UK external debt is the Banking sector. Government debt abroad only accounts for £31bn of the £6,114bn. You can see all breakdown of UK external debt here (XL file)

UK External Assets

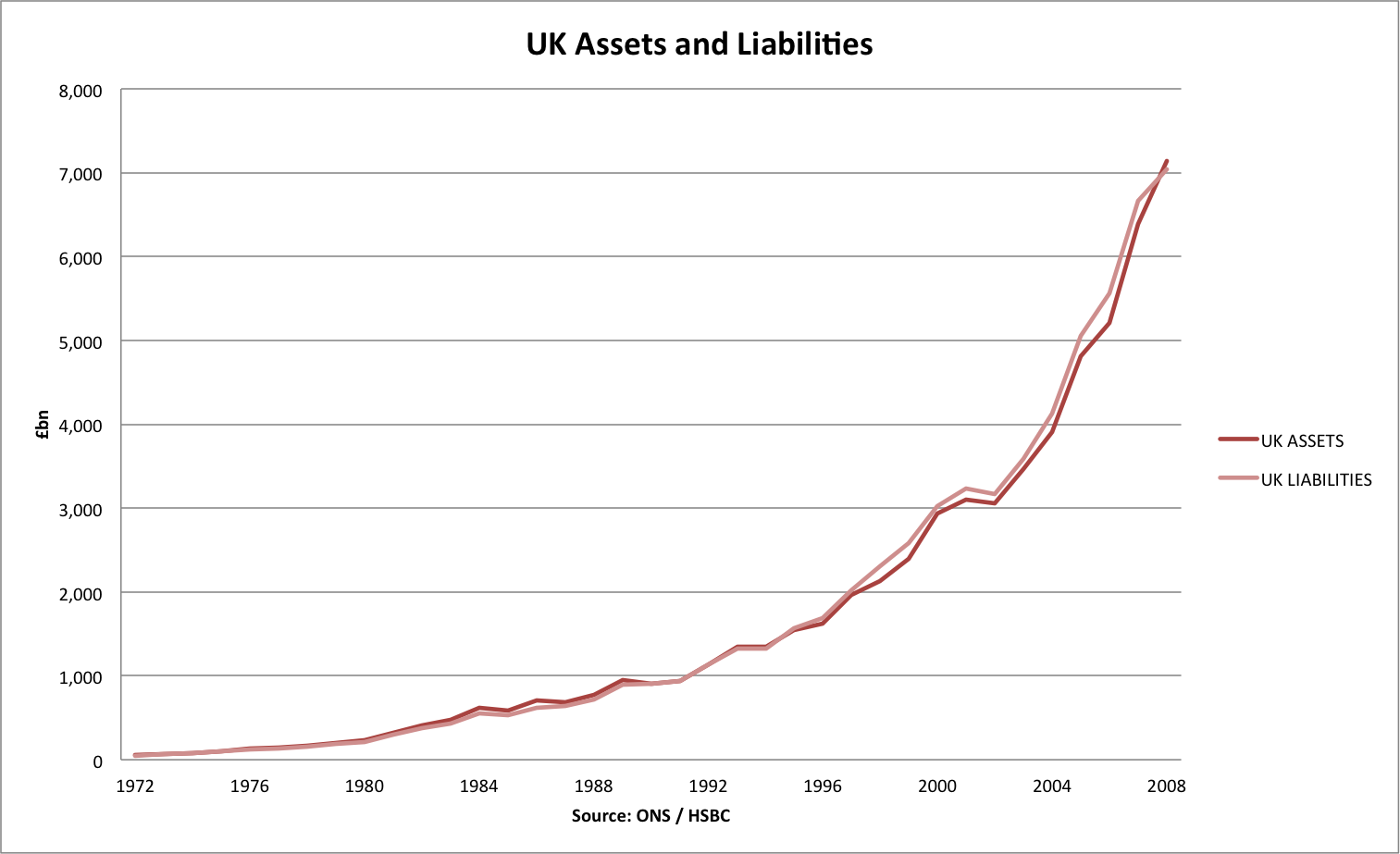

External debt seems a very big figure. But, as well as these external liabilities, we do have assets. The problem would come if there was a sharp deterioration in the value of the assets we got in exchange for the liabilities.

In 2008, the UK had net external assets of £7,135.1 billion and total liabilities at £7,042.1 . (source: HSBC). Therefore our assets exceeded our liabilities by a very small amount.

The level of assets and liabilities is very large given the size of the UK economy. This reflects the fact the UK economy is very open with an active financial sector and free movement of capital.

- UK external debt is 400% of GDP

- Ireland has external debt of over 1100% of GDP.

- The highest is Luxembourg whose external debt is 3,443% of GDP.

This reflects the fact that Luxembourg is a highly attractive place for banking. It doesn’t reflect the fact Luxembourg is on the verge of collapse. Ireland on the other hand reflects the losses of their own banks.

Related

Dear sir,

Have you read the book “this time is different – eight centuries of financial folly”, by Kenneth Rogoff. In this book one of the greatest historical factors precipitating sovereign defaults is excessive external debt. Whilst the government external debt is below average external debt generally is out of hand. There is no doubt the external assets will depreciate below their book value when Greece and other countries crash. I cannot see how we will not default also when the pack of cards starts to fall. I just wish I’d bought CDS’s against most European countries defaulting in 2012 – 2015 back in 2008.

Regards

Andrew