Foreign or external debt represents the amount a country (both public and private sector) owe to other countries.

Foreign debt can involve:

- Outstanding loans to foreign private banks (both principal and outstanding interest)

- Due payments to international organisations like the IMF

- Outstanding payments for a current account deficit, with country owing money for imports

Debt includes both

- Short-term liabilities – loans which need to be paid in near future (within one year)

- Long-term liabilities – long-term loans which are scheduled to be repaid over a longer term.

When is external debt a problem?

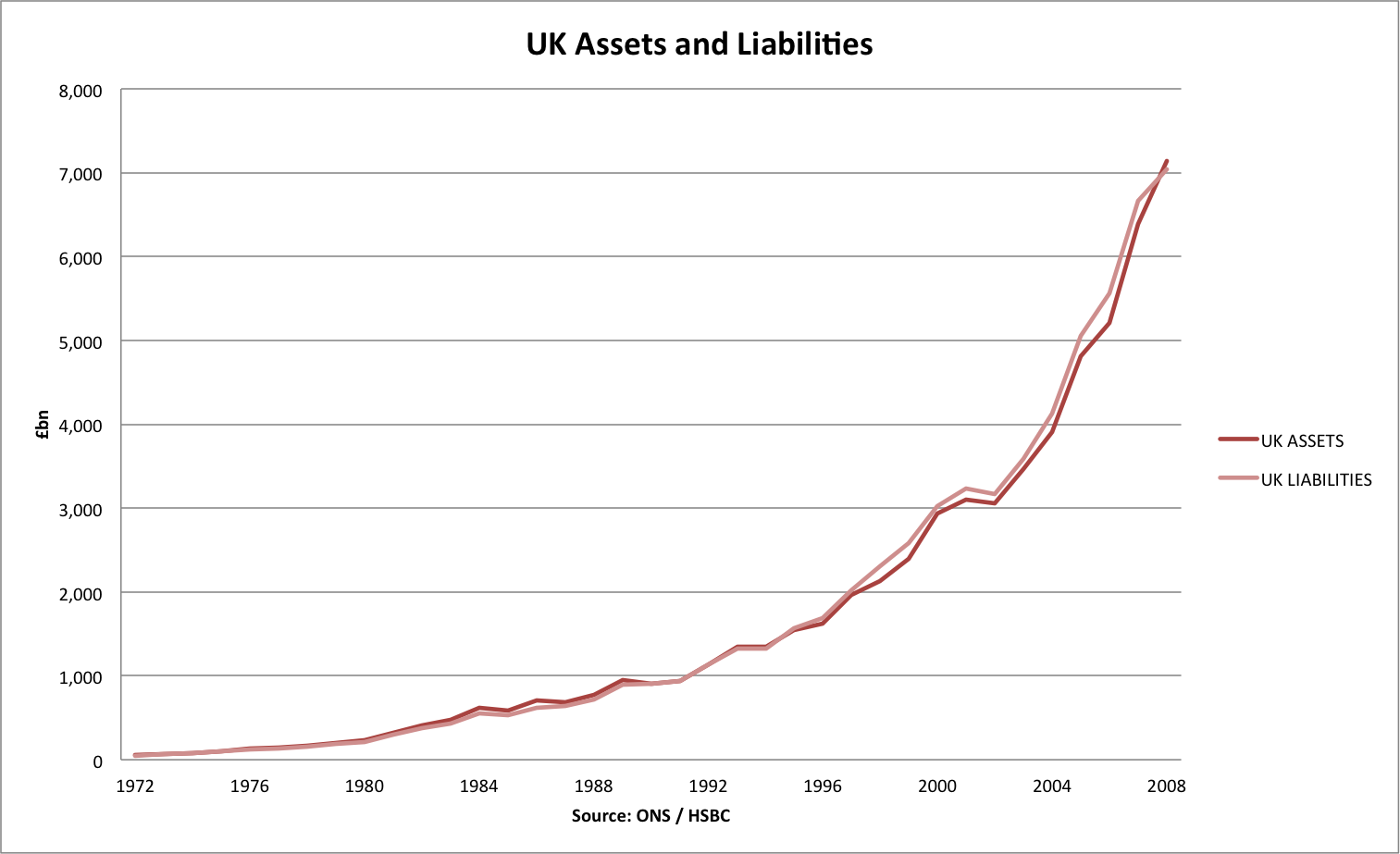

The easiest guide is to look at the level of external debt to GDP. However, countries with large financial sectors, such as the UK and Hong Kong have both higher levels of liabilities, but also a higher level of assets because of its role as a financial centre.

There are no precise rules for when external debt becomes a problem. But, a key factor is whether a country can satisfactorily meet debt interest payments from export earnings.

The IMF has suggested external debt should be kept below

- A country’s level of debt in Net Present Value to either 150 percent of exports or 250 percent of government

Foreign debt interest

Countries with foreign debt have to meet the interest payments on the debt. This can only be met with:

- Foreign currency earnings from exports

- Gold reserves / foreign currency reserves

- Further borrowing

How foreign debt can become a problem

- Excessive confidence in borrowing to promote economic growth and development. Equally, there could be over-confidence in lenders to lend money in short-term without evaluation of possible problems.

- Investment that is misplaced and fails to achieve a decent rate of return to help pay the debt interest payments. For example, developing countries may struggle to make use of funds for industrialisation if they lack the necessary skills and infrastructure.

- Unexpected devaluation in the exchange rate, which increases the real value of debt interest payments denominated in dollars.

- A decline in commodity prices which leads to a decline in the terms of trade for developing economies and relative fall in export earnings.

- Demand-side shock which reduces GDP. For example, conflict or global recession which hits demand and GDP.

- Servicing external debt (paying debt interest payments) ceteris paribus, reduces GDP because the monetary payments flow out of the country. These debt payments reduce the amount available to invest in improving public services, which can help economic development.

- Growing levels of debt can discourage foreign and private investment because of concerns that the debt is becoming unsustainable.

- If a country is struggling to meet interest payments, they may be tempted to borrow to meet debt interest payments, but then the problem can spiral and magnify.

- Countries in regional areas may suffer from a regional downgrade in credit assessment. For example, many Sub-Saharan African countries experienced rising external debt ratios, and this made investors reluctant to lend at cheap rates.

Debt cancellation / debt forgiveness

Because of the problem associated with rising external debt, there has been pressure for developed countries to cancel outstanding debt by developing economies.

The argument is that debt cancellation can make a significant contribution to improving economic development because it frees up resources to invest in the recipient country – rather than send abroad in debt interest payments.

Related

Thank you it helped alot and in my assignment.

Funding purchase of imports. When do foreigners lose faith in our currency and insist that they (the foreigners) want to be paid in something other than a devalued currency?