The Net international investment Position (IIP) measures the balance of gross assets – gross liabilities.

- An asset means the UK has a claim on the rest of the world.

- A liability means the rest of the world has a claim on the UK.

There are 4 sections of net international investment.

- direct investment (DI)

- portfolio investment (PI)

- other investment (OI)

- reserve assets

For example, if a Japanese firms invests in the UK. This is an example of direct inward investment into the UK. This acts as a UK liability because it is owned by a foreign company.

If a UK invests oversees, this increases UK gross assets.

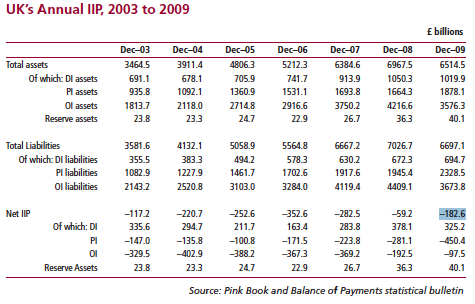

For example in Dec 2009

- Total UK Liabilities were – £6697.1bn

- Total UK Assets were – £6514.5bn

This gives a net IIP of – £182.6bn (or 2.7% of net assets) or 13% of GDP

Source: Office of National statistics, The UK’s international Investment position pdf

Factors Which Influence the Net IIP

Current Account deficit. If a country runs a current account deficit. The value of imports of goods and services are greater than exports. To finance this current account deficit, the country requires inflows of capital to finance the deficit. This could be direct inward investment or portfolio investment. This inward investment increases UK gross liabilities leading to a deficit in IIP

Exchange Rate. The IIP is measured in the countries domestic currency. A depreciation in the Pound Sterling means that UK price of assets would increase. E.g. an asset worth $10,000 could be worth £5,000 if exchange rate is £1 to $2, but if the value fell to £1=$1 the dollar asset would be worth now £10,000

The improvement in the net IIP in 2008 was due to the devaluation in the value of the Pound Sterling, which made the IIP measured in Pound Sterling look better.

The value of UK assets and liabilities dwarfs the size of UK GDP. This reflects the fact the City of London is an important centre of international finance.

Importance of Net International Investment

- Countries with a large deficit on net IIP are more at risk of failing to meet repayments on liabilities. It is a reflection the country has an unbalanced economy – relying on inflows of capital to finance a current account deficit.

- Currently, countries with worst net international investment position are Greece (-83% of GDP) , Spain Portugal, Ireland. These countries are struggling with uncompetitiveness within the Euro.