Benefit fraud and tax avoidance are currently emotive topics. What is the extent of benefit fraud and tax fraud in the UK?

Benefit Fraud

- For 2011/12 (preliminary), it is estimated that 2.0 per cent of total benefit expenditure was overpaid due to fraud and error.

- In 2010/11 – benefit fraud was estimated at £3.4bn – 2.2% of total benefit expenditure (£154bn)

- (Dept for Work and Pensions)

- It is also estimated that 0.9%, or £1.3bn, of total benefit expenditure was underpaid due to error.

More specifically

- 4.4%, or £350m, of Income Support expenditure has been overpaid;

- 6.5%, or £290m, of Jobseeker’s Allowance expenditure has been overpaid;

- 6.0%, or £500m, of Pension Credit expenditure has been overpaid;

- 2.4%, or £130m, of Incapacity Benefit expenditure has been overpaid;

- 4.7%, or £1030m, of Housing Benefit expenditure has been overpaid.

- (Dept for Work and Pensions)

Public Perception of Benefits

The public have an increasingly negative opinion to benefit claimants. A study suggested that 1 in 5 people believe a majority of claims are false, while 14% believe a majority of claims are fraudulent. Benefits stigma

Benefits Unclaimed

“In 2010 an estimated £16 billion in benefits and tax credits were unclaimed. (charities claim £16bn a year unclaimed at Telegraph)

For example, the Dept for work and pension estimate:

Pension Credit: The number of pensioners that were estimated to be entitled but not claiming Pension Credit was between 1.21 million and 1.58 million. The total amount of Pension Credit unclaimed was between £1.94 billion and £2.80 billion. (DWP)

Job Seekers Allowance In 2009-10 there were 910 thousand recipients claiming £3.01 billion of Jobseeker’s Allowance (Income-Based). The number of people that were entitled to but not claiming Jobseeker’s Allowance (Income-Based) was between 440 thousand and 610 thousand. The total amount of Jobseeker’s Allowance (Income-Based) unclaimed was between £1.28 billion and £1.95 billion. (DWP) | see also increasing gap between Claimant count and ILO measure of unemployment

Underclaiming of benefits people are entitled to is a bigger issue than benefit fraud.

Disincentives of Benefits

More difficult to evaluate is the extent to which benefits create disincentives to work or gain better employment. This is not benefit fraud. But, many argue the structure of the benefit system creates strong financial disincentives to get a better paid job or to work at all.

I searched for some research on the impact of benefits on incentives to work, but struggled to find anything conclusive. If you know any good links on the extent to which UK benefits are creating disincentives (for or against) I’d be interested.

The government claim that their welfare reforms will help overcome these disincentives and make the welfare system simpler. Others argue, that it will leave vulnerable with lower income. Welfare reform at DWP

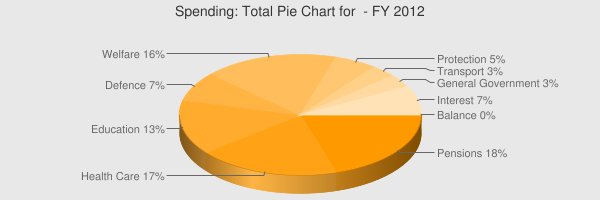

Total Cost of Welfare in UK

In 2011/12

- Social Welfare (income support, unemployment benefits) £111.7bn

- Pensions (old age and sickness) £129.3bnWhat does government spend money on?

Tax Avoidance and Tax Fraud

By comparison to benefit fraud, lost revenues from tax avoidance and tax evasion seems much greater. Using some measures of tax evasion and tax avoidance.

- £70 billion of tax evasion,

- £25 billion tax avoidance

- £25 billion of unpaid tax

Others claim lost tax receipts are up to £150bn a year PCS.org.uk

My local barber, has a staff vacancy with a potential to earn £500/wk. The only takers he can get are ones willing to work 2/3 days/wk because they say that they will lose benefits

Incredible. Trained barbers who would prefer to be paid benefits ? I cant see many people from my Trade saying the same.

£26,000 a year. Thats around the average family income.

So John Kelly – you have just had all of these simple facts spelt out to you. Tax evasion and fraud amounts to billions and billions of pounds And yet your ‘insightful’ comment consists of some unsubstanciated pub bar talk about some one you claim to know that, in you feel – in your tiny, tiny little world – is a point with some telling view of reality.

Pathetic.

Dear Mr Kelly,

After seeing your ad above I would like to put my self forward for the position.

Please could you tell me where this barber is based and send me the contact details.

Would he be willing to take on an apprentice, I am a uni grad and a hard worker.

Regards,

Tom

John Kelly you’ve just made that up. £500 p.w. is around £24k. Nobody is better off on benefits and you, I and anyone else reading this knows this as well.

Tax avoidence is a big problem but just the nature of big business and individualist neo-liberal ideology. But also not working because you can earn enough to just get by on benefits and if you get a job youd still earn just enough to get by is a problem more socially than economically id say, but this is a big problem.

The problem to me is that a very large part of work that needs doing for the good of our country and communities socially, health wise and enviromentally simply isnt profitable in the market place. This is why theres so many of these problems even though weve got tonnes of money and technology, why theres so many NGOs, volunteer organisations and why are state sector has to be large and larger than it is now.

People like the tories and the IDIOTS who support them putting an emphasis on how bad benefits are is THE MAIN CAUSE OF THIS. If there was an emphasis on helping out our communities rather than on your economic output then we wouldnt have so many social, enviromental and health problems.

Someone who works full time but is a slob for the rest of there lives and doesnt care about there community, there enviroment or the general intrests of other people is to me much worse than someone who works part time or doesnt work but actually cares about there community and enviroment.