Readers Question: I’m currently reading ‘Crisis Economics’ (by N.Roubini) at the moment and I don’t get some stuff in the book. When it was talking about the current account balance, the book referred to it as a balance between national savings and national investment, but I don’t quite understand this.

The Current account on the Balance of payments measures the balance of trade in goods and services.

A deficit implies we import more goods and services than we export.

To be more precise, the current account equals:

- Trade in goods (visible balance)

- Trade in services (Invisible Balance) e.g. insurance and services

- Investment incomes e.g. dividends, interest and migrants remittances from abroad

- Net transfers – e.g. International aid

The current account is essentially exports – imports (+net international investment balance)

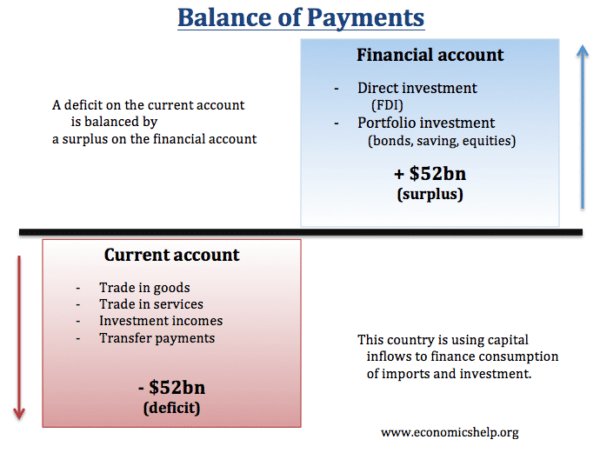

It is also worth noting that if we have a current account deficit, in a floating exchange rate this must be balanced by a surplus on the financial/capital account.

Why do economists say that the current account also equals saving – investment?

Firstly, it is worth remembering that in a closed economy, we assume that saving = investment. (S=I). For a firm to invest, it needs savings to be able to finance the investment. See: Saving and investment

Economists have noted that if domestic saving are lower than domestic investment, we will see a current account deficit. Why?

Before we look at a more mathematical approach, it is helpful to think of a country which experienced a rapid fall in savings, but investment levels stay the same. A fall in savings means people are spending more (higher consumption) therefore, this would tend to suck in imports as we buy goods and services from abroad.

But, also, if domestic savings fall – how will the domestic investment be financed? The investment must be financed by capital inflows from abroad.

A country like Japan has had a glut of saving over investment. This saving has tended to go abroad looking for more profitable investment. Therefore, Japan has had a deficit on capital flows, and a corresponding surplus on the current account.

The US, by contrast, has often had a level of investment greater than savings. This has been financed by capital inflows and a current account deficit.

Savings Investment and Current Account

- GNP (Gross National Product) = Gross Domestic Product (GDP 0r Y) + Net income from abroad (R)

- GNP = Y+R

Net income from abroad can be negative if foreigners own more assets in the UK, – income from these assets will be sent abroad leading to negative net income from abroad.

Equilibrium in National Income – GDP (Y) involves this formula

- GDP (Y) = C+I+G+ (X-M)

(C= consumption, I= Investment, G=government spending) (X-M) = net demand from abroad.)

The Current account (CA) is also conventionally defined as (X-M) (value of exports – value of imports) + Net income from abroad. (R)

- CA = (X-M) + (R)

Therefore,

- CA = GNP – (C+I+G)

The difference between GNP and (C+G) is the level of savings.

As a result, the current account is also equal to the difference between savings and investment

- CA = S-I.

From an accounting perspective, it doesn’t make any difference whether we see the current account as

- Net exports + net investment incomes

- Savings – investment

Suppose domestic saving is insufficient to finance Domestic investment. How will the domestic investment be financed?

It will be financed by investment from abroad. These capital flows are a credit on the capital account and will be matched by a deficit on the current account.

Conversely, if a country has excess savings, these savings will go abroad to finance investment in other countries. This will give a negative balance on the capital account, and enable a current account surplus.

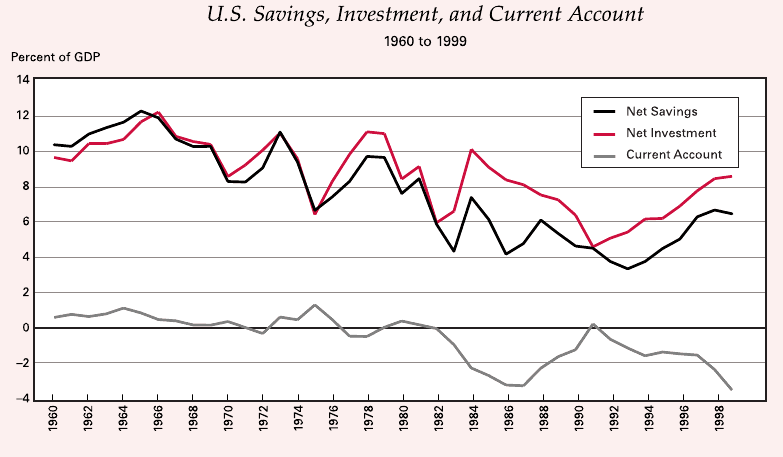

Example of relationship between savings, investment and current account in the US

Related

Suppose domestic saving is insufficient to finance Domestic investment. How will the domestic investment be financed?

It will be financed by investment from abroad. These capital flows are a credit on the capital account and will be matched by a deficit on the current account.

I don’t understand,

“””””These capital flows are a credit on the capital account and will be matched by a deficit on the current account.”””””

Only I will take credit for my investment. why will be matched by deficit on the current account??????

I have the same question. Someone answer please

When there is a current account deficit it means there has been more domestic currency flowing out of an economy to foreigners. Since this currency can’t be used in any country other than the one it came from it naturally will be used in that country by foreigners, either in the form of investments/loans (bonds issued by the country of the currency’s origin), or foreign direct investment. These loans and investments are recorded as a credit on the capital account. Therefore this creates a glut of investment over savings in the economy, reflecting the current account deficit.

this is exellent explanation

what is the impact on savings, investment, and consumption if a country is forced to have a balanced current account (X-M)=0?

a possible scenario is that you might desincentivize investment from abroad because all the goods and services to deploy that capital in the country that is forced to have a 0 trade balance would be more expensive.

Second, people stop importing but that doesn’t mean they save more, but that they are forced to buy more “home made” expensive stuff.

Third, people do save and finance the investment as in a closed economy.

How does this jibe with mark carney’s view of banking as “money creation” on both sides of the balance sheet? Banks create the savings when they create the loan. It renders the whole discussion moot, no? It’s all controlled by banks.

Explained it so well..! 👍🏽

Hi! Thank you for the explanation, the content is great!

However, could you explain more on why GNP=C+G+S? Or can anyone help?

Thanks a lot!

You can look at it this way:

your production (GNP) is equal to your income (GNI); and you use your income for consumption (household (C) and government(G)) and for saving (S); thus

GNP=GNI=C+G+S

You can look at it this way:

your production (GNP) is equal to your income (GNI); and you use your income for consumption (household (C) and government(G)) and for saving (S); thus

GNP=GNI=C+G+S

I was looking through the causes of a current account surplus in a text book and one cause was:

a net inflow of investment income

I was wondering how this causes a surplus

There is also a « Current account surplus» to « Net Saving » casuality.

Net Exported goods generate an increase in domestic production/revenues but not an increase in domestic consumption (i.e. the consumption is from the RoW). The difference between the additional production(Y) and consumption (which is nil), results in an increase of Saving.

Hope this makes sense