Readers Question: Is it right that private banks can create 97% of all new money by lending it into existence, and what effect does this have on inflation and the value of money already in existence?

Banks can effectively increase the money supply, by lending money. Most money in the modern economy is bank deposits. This is not determined by Central Bank directly but through commercial bank lending. The Central Bank can influence bank lending through monetary policy

I shall give two explanations of how commercial banks create money

- Double accounting model. When banks lend, they create deposits in customer accounts.

- Money Multiplier Model (criticised for not being realistic, in today’s modern economy.)

Bank Loans – Double accounting method

The Bank of England explains (pdf)

“The principal way in which they are created is through commercial banks making loans: whenever a bank makes a loan, it creates a deposit in the borrower’s bank account, thereby creating new money. This description of how money is created differs from the story found in some economics textbooks.”

When a bank lends a loan, it creates money from

- Double entry accounting

- Increase in broader money supply.

If a bank lends £2,000 loan. It

- Creates a loan asset for £2,000 and a deposit for £2,000. This is because it sees the loan as a potential £2,000 asset because it will get the loan paid back over time.

- The bank has a liability of £2,000 for the loan

Money is created because, before the loan, there was no £2,000 deposit. But, now after the loan, the broader money supply will increase.

- Narrow money supply (M0) = notes and cash

- Broad money supply (M1-M4) = electronic money in bank accounts.

Therefore, when the bank lends money, it doesn’t create any narrow money supply. But, the supply of broad money increases to 100% value of the loan. The customer gains £2,000 in their bank account, and the bank sees a corresponding double entry deposit of a loan asset.

Bank reserve requirements

This is the amount of reserves a commercial bank keeps with the Central Bank. This enables the commercial bank to settle deposit withdrawals by customers. In the US banks have to keep 10% of eligible deposits in these reserves. In the UK, banks don’t have reserve requirements, but do need to keep certain liquidity requirements. This is a LCR of 100% or more in normal terms (See: Bank of England)

Capital requirements

This is a requirement that a bank keeps greater assets than liabilities (customer deposits>amount it has lent). It also may require assets to have a certain liquidity. This is to protect the bank going bust. When assets>liabilites, the bank has positive net worth. If liabilities and lending is greater than assets, it will have negative net worth and could go bust. Higher capital requirements, prevent a situation like Northern Rock, Lehman Brothers going bust due to taking risk.

The above reflects the money multiplier model of money creation. It is a textbook explanation of money multiplier model.

- Banks don’t “lend out” deposits. They create new money ex nihilo when they lend. The amount of new money created is equal to the entire value of each loan.

- Banks don’t “lend out” reserves, except to each other. Reserves are created by the central bank and only held by banks.

- Reserve requirements and liquidity requirements ensure that banks have enough money to settle anticipated customer deposit withdrawals.

- Capital requirements protect depositors who don’t withdraw money from losing their money due to their bank going bust.

Money Multiplier Model

(note this is a simplification of real world)

- If you deposit £1,000 in the bank. The bank has £1,000 extra deposits (assets).

- Out of this £1,000, the bank may keep only a reserve of 3% (£30).

- This means they can lend out £970 to other people. The bank lends out money because it is more profitable. For example, they can lend to home-owners wishing to get a mortgage. The bank may charge an interest rate of 6% on this mortgage loan. Also, banks may lend to firms wishing to expand.

- However, if a firm gets a loan from the bank, then workers and the bank may then deposit some of this money back in the bank.

- This means that banks will have additional deposits in the future. Therefore, when this £970 gets deposited they can again lend out 97% of the value.

- Therefore, there is a cumulative creation of money from this system of lending out bank deposits.

- The amount of money created depends on the ratio that banks keep in reserve. If they keep 10% of reserves as cash, then the creation of money will be smaller than if they lent out 99% and only kept 1% in reserve.

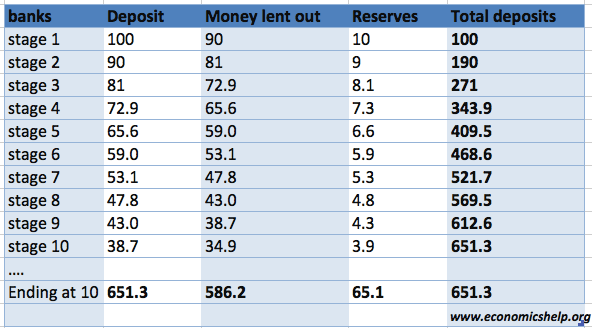

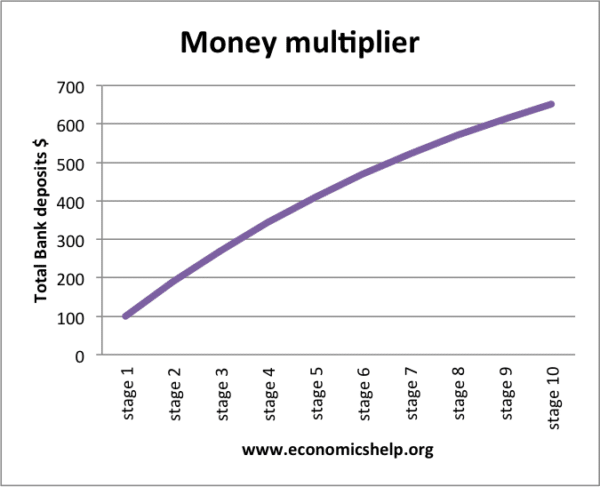

Example of money creation

- Suppose banks keep a reserve ratio of 10%. (0.1)

- Therefore, if someone deposits $100, the bank will keep $10 as reserves and lend out $90.

- However, because $90 has been lent out – other banks will see future deposits of $90.

- Therefore, the process of lending out deposits can start again.

Note: This example stops at stage 10. In theory, the process can continue for a long time until deposits are fractionally very small.

Banks and Falling Money Supply

In some circumstances, commercial banks may be very reluctant to lend money. Therefore, they increase their reserve ratios and reduce the amount of bank lending. This can lead to a fall in the money supply in the economy.

For example, after the credit crunch of 2008, banks significantly reduced the amount of their lending, leading to a fall in the money supply and decline in bank lending.

Central Bank and the Creation of Money

In some circumstances, a Central Bank like the Bank of England or Federal Reserve may decide to electronically create money in a bid to increase the money supply and boost economic activity.

This is often known as quantitative easing. With quantitative easing

- A central bank decides to electronically create money (they just change the amount of money in their account)

- With this money, they buy bonds from commercial banks.

Therefore in theory,

- Commercial banks see an increase in their cash reserves, which should lead to higher bank lending

- Interest rates on bonds should fall. Lower interest rates should help boost economic activity.

More on Quantitative easing.

Effect on Inflation of Money Supply

If there is an increase in the Money supply, it could cause inflation. If the money supply rises much faster than the long-run trend rate of real output, then inflation is likely to occur.

see: Inflation and Money Supply

Related

In practice the money multiplier is less than the inverse of the reserve ratio

What exactly is the money creation?