America is the biggest economy in the world, it is also one of the richest with average GDP per capita of around $80,000. The richest three American billionaires own more wealth than the poorest 70 countries combined.

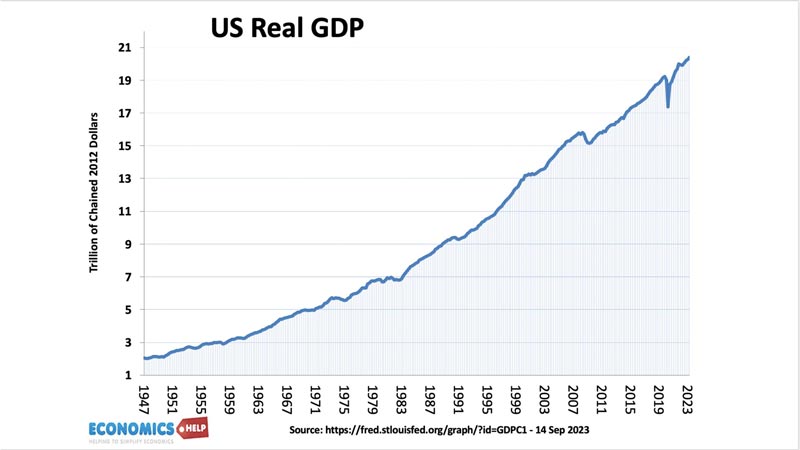

In the post-war period, US GDP increased by 900% leading to unprecedented levels of income.

But, there is a big disconnect between economic statistics and what the average American experiences. An estimated 61% of Americans are living paycheck to paycheck, with 70% reporting financial stress. Post covid, US savings have plummeted and many of the middle class have insufficient savings to meet the unexpected – like uninsured medical bills. Why is there such a disconnect between economic statistics and perceptions of well-being? Is it due to ever-growing inequality, is it due to inflation or is America’s reported poverty something of a myth?

Whilst GDP reflects the total output and total income of an economy, it doesn’t necessarily translate into living standards for the average person.

US Inequality

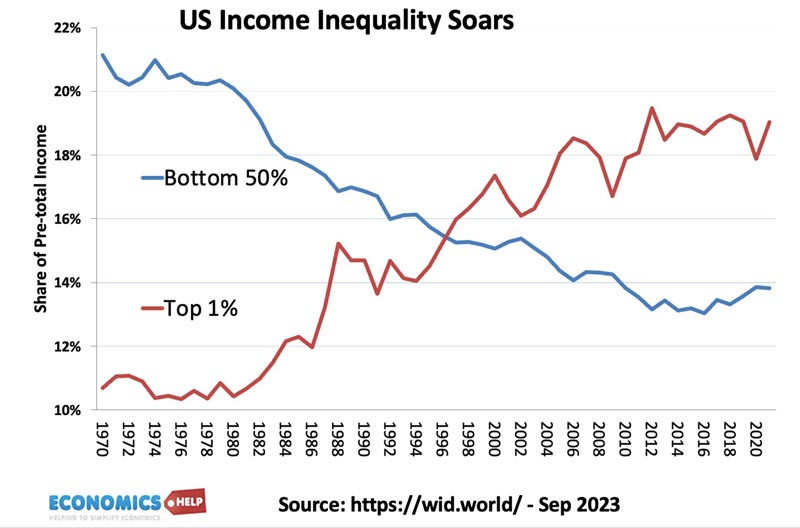

The American economic pie is getting bigger, but the distribution is also becoming more unequal. For example, since the 1960s, there has been a 40% fall in the real, inflation-adjusted value, of the Federal minimum wage, but executive pay for the top 1% has soared over 1500%. Since 1970, the bottom half of America has seen a steady erosion of income share, whilst, at the same time, the top 1% have seen a near doubling of their income share. The top 1% now gain more income than 50% of American households.

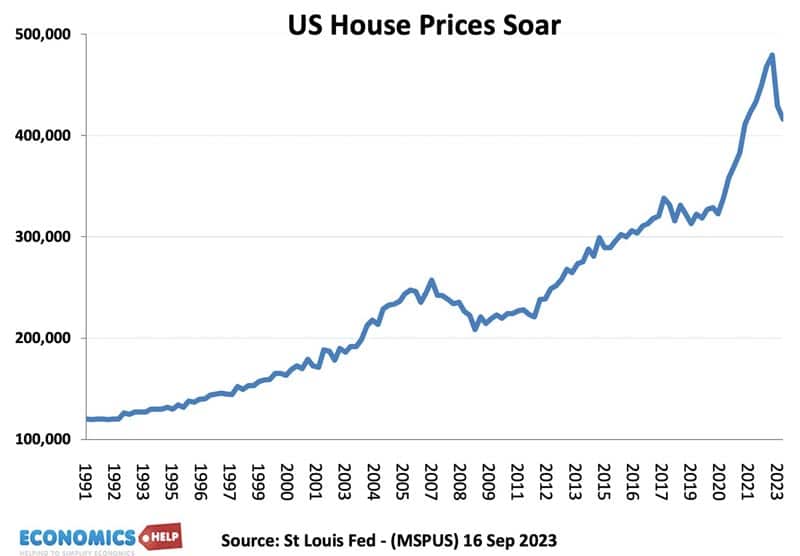

It is taking America back to levels of inequality not seen since the Gilded Age. However, it’s not just about income, but the cost of living that increasingly affects the middle classes. Over the last 50 years, average real household income in the U.S. saw just a 16% increase. But, in comparison, housing costs have increased by 190% with a similar rise in tuition costs.

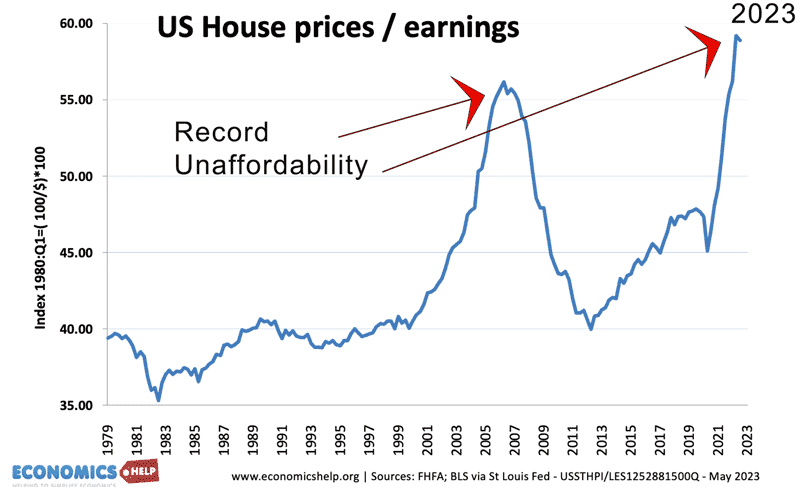

US house prices have soared in recent years, causing the ratio of house prices to incomes to reach record levels.

House prices are so unaffordable there has been a surge in demand for renting, pushing up rent costs. Even if incomes rise, people feel worse off because such a large chunk of their income goes into basic living expenses. And this rise in house prices has created a nation of winners and losers. Property owners have benefitted from rising wealth, whilst the younger generation is squeezed out. In 2020, the bottom 50% decile of America has 0.2% of the nation’s wealth, compared to 35% for the top 1%

Healthcare

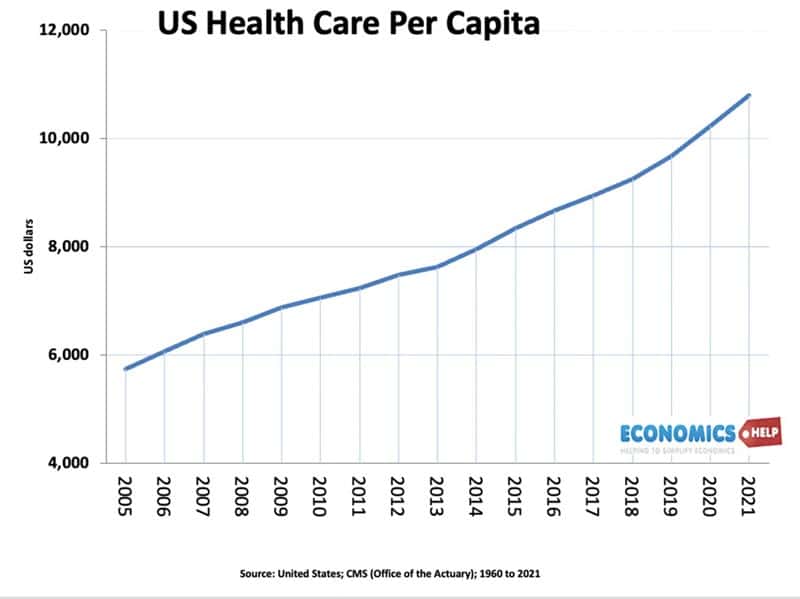

Whilst America has relatively lower taxes than other countries, healthcare costs are the highest in the developed world. Average healthcare costs have doubled in the past 15 years to over $12,000 per year. The American system is the most expensive in the world, and ironically for the richest country, it is also by far the leading country for bankruptcies due to health care.

Inflation

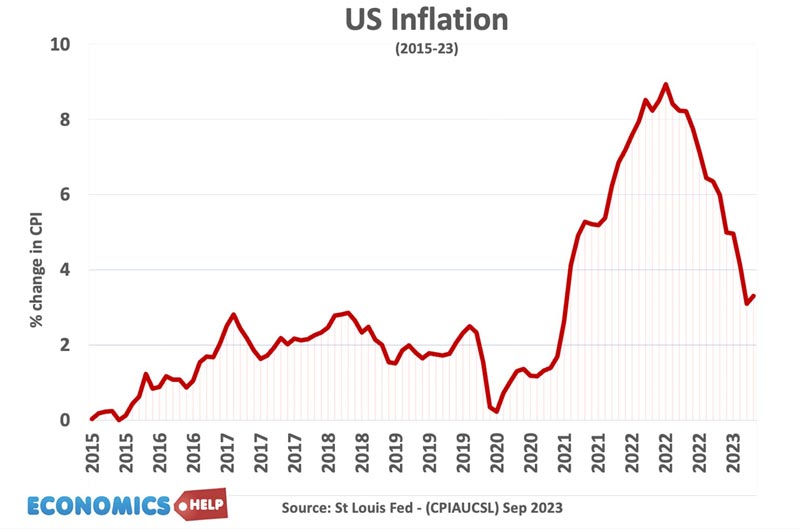

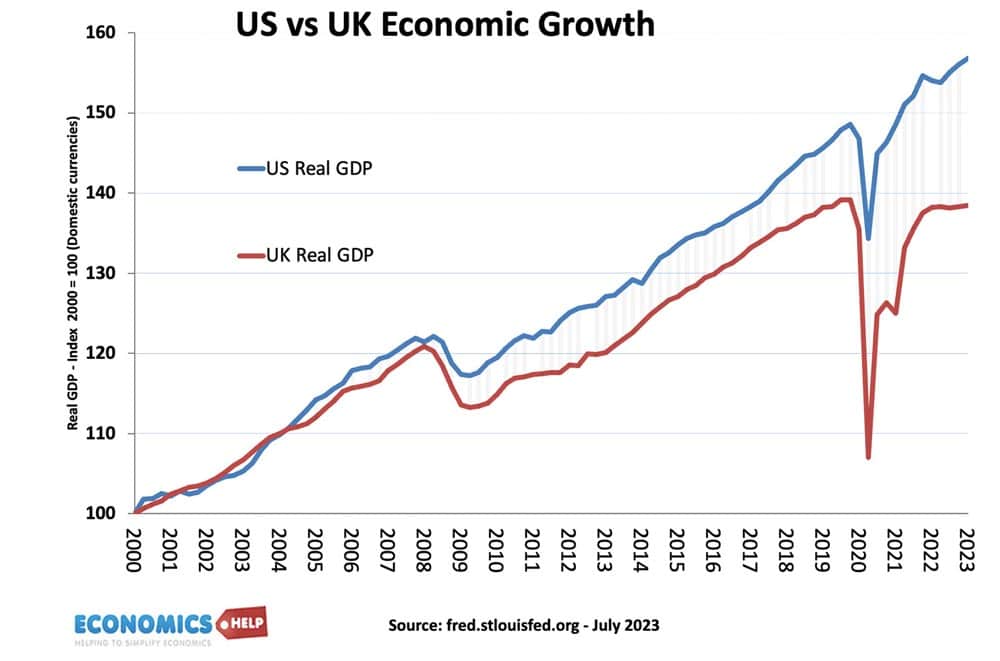

In recent years, cost of living pressures have been exacerbated by a surge in inflation. The recent inflation – caused by economic stimulus, Covid constraints and rising oil prices – particularly affected the struggling middle classes, with inflation rising faster than wages and particularly hitting visible items like food. And even though inflation in the US has fallen during 2023, perceptions of inflation have yet to catch up. Another interesting fact is that despite all the cost of living pressures in America, the US economy is still significantly outperforming the EU and UK economies.

But despite boasting strong economic growth and a near-miraculous fall in inflation and record levels of employment, Americans also have near-record levels of pessimism about the economy. Assessments about personal finances are fairly stable, but interestingly, perceptions of the rest of the economy are at record-low levels. In other words, people increasingly think they are doing OK, but the rest of the economy is going down.

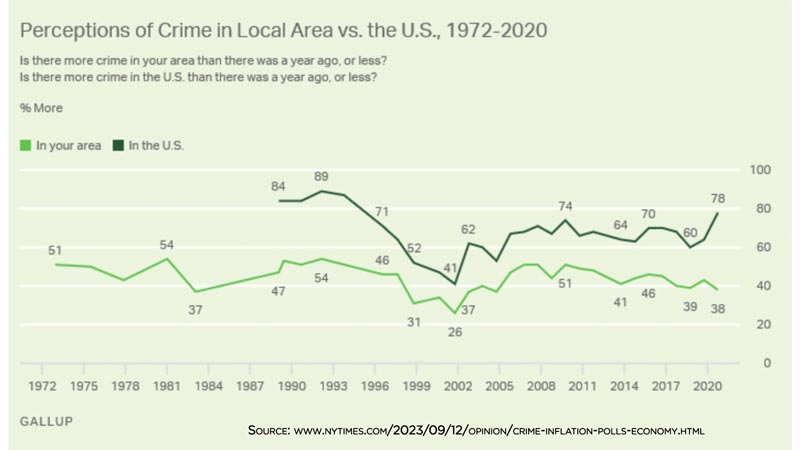

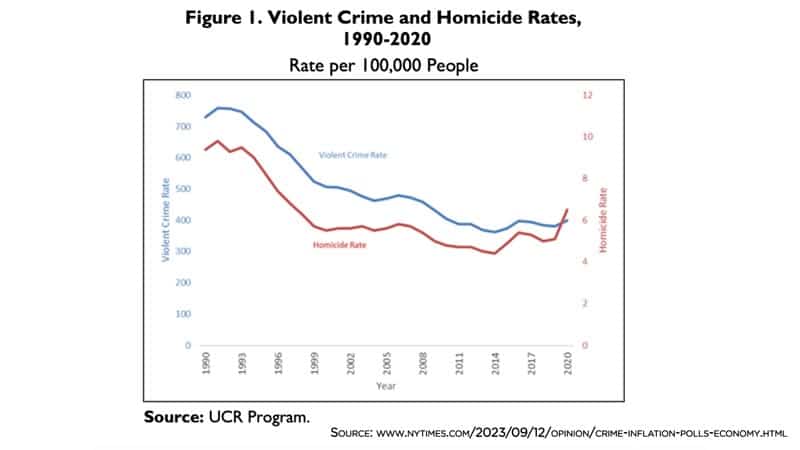

Paul Krugman makes the observation it is similar to perceptions of violent crime. Between 1990 and 2023, violent crime in the US has fallen roughly 50%, but fear of crime remains high. Despite falling crime levels, people who feel there is more crime in the US have nearly doubled since 2002.

In the past year, 74% of Americans stated that inflation had gone in the wrong direction, but, inflation data tells us the opposite. What explains this?

Just last month I was in New York, where I was able to eat out at a variety of diners. Firstly I was shocked at the size of portions in America, but I was also even more shocked at how expensive it was. It seemed to be 50% higher than my previous visit. Inflation was a topic of conversation like never before. As a nerdy economist, I happen to know that the “multivariate core trend,” rate of inflation fell to 2.8% in July 2023, but even that knowledge doesn’t compensate for the fact that food is really expensive. I used to be able to buy breakfast with a $10 bill, now you need a $20 bill. It’s scant consolation if the rate of inflation is coming down.

Economists measure inflation from the past 12 months, but there is no guarantee that consumers will do the same. The inflation shock of 2021/22 still reverberates because so many households are squeezed by the cost of living. For 15 years, inflation was very low, so it was a real shock when prices rose so fast – especially food, which is psychologically important and also has a bigger impact on low income consumers.

Nevertheless, perceptions of inflation are worse now, than under-stay Ronald Reagan in the 1980s, when inflation was higher, but often people talk of the 1980s as “Morning in America” and a goldilocks economy. Media perceptions can be influential in creating perceptions of economic well-being. Maybe one difference with the early 1980s is the absence of YouTube videos with clickbait titles talking about the coming economic crisis. And of course, being America, perceptions of the economy do divide on partisan lines, with Republican voters currently more pessimistic than Democrats.

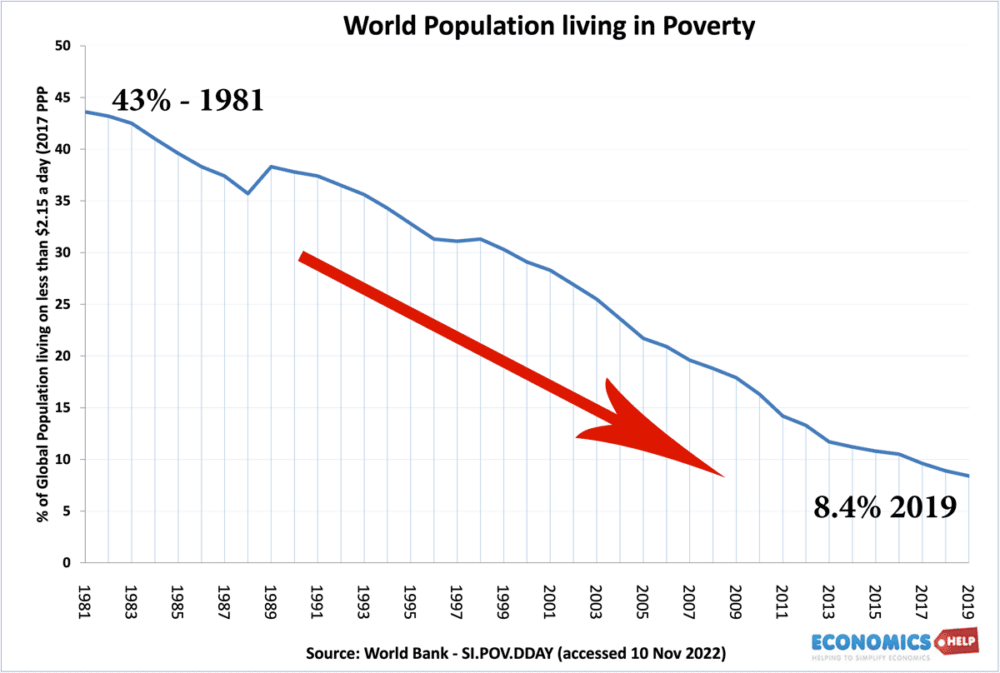

Global Poverty

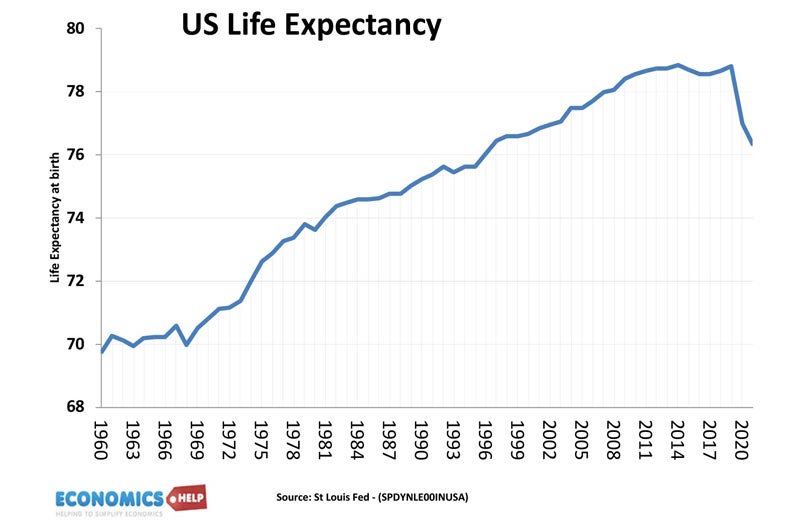

Although it is important not to place too much importance on GDP, it is not without some value. Living standards are better than 100 years ago, and a large degree of this is due to higher GDP. One of the great success stories of recent years is the decline in levels of global absolute poverty. Economic growth is an important factor behind this Higher GDP does have quite a few correlations with better education, better health care, life expectancy and personal happiness. However, this correlation is breaking down in America. One of the most shocking things is that despite ever-higher GDP, life expectancy in America is falling, and in rural and poor areas the decline is even sharper.

The US is one of the first advanced nations to experience a drop in life expectancy and healthy life expectancy. It shows that a higher GDP is no guarantee to lead to better life quality, and this is the challenge for rich countries like America, how do societies increase living standards, well-being and healthy life expectancy? And not just focus on the treadmill of higher growth, which benefits the privileged. This video is about America, but it could easily be for other western developed economies.

Related