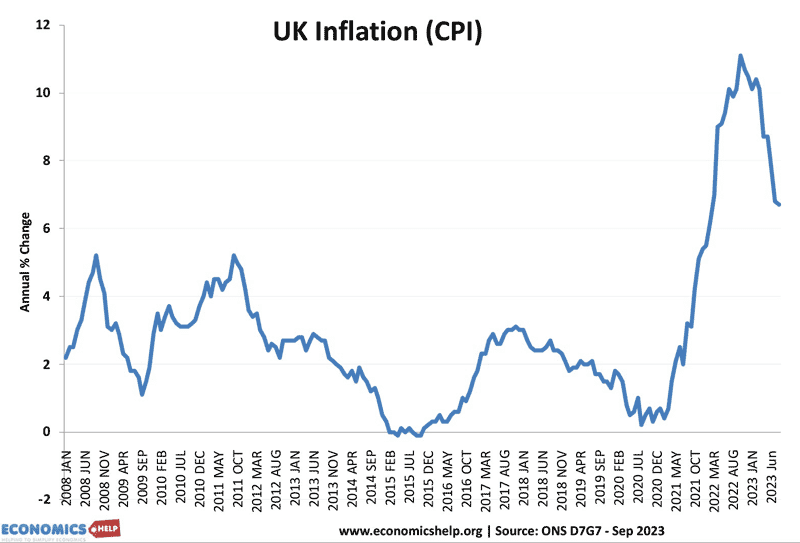

Earlier in the year the UK had record-breaking inflation with both headline and core inflation remaining well above the government’s target and being worse than forecast. As bad news on inflation kept coming the Bank of England increased interest rates 14 times. Finally, in a narrow vote, the Bank paused to halt rate rises.

But, in the coming months these past rate rises will increasingly slow down the economy – the big question is will this record interest rates push a fragile UK economy into recession and who will be hit most by the efforts to reduce inflation?

Last month inflation fell; it was better than economists predicted, but whilst the graph looks good, the reality is that prices are still rising at 6.5% a year. By the way, in the US inflation the rate has fallen sharply, but no one is celebrating, because consumers are still feeling the shock of higher prices.

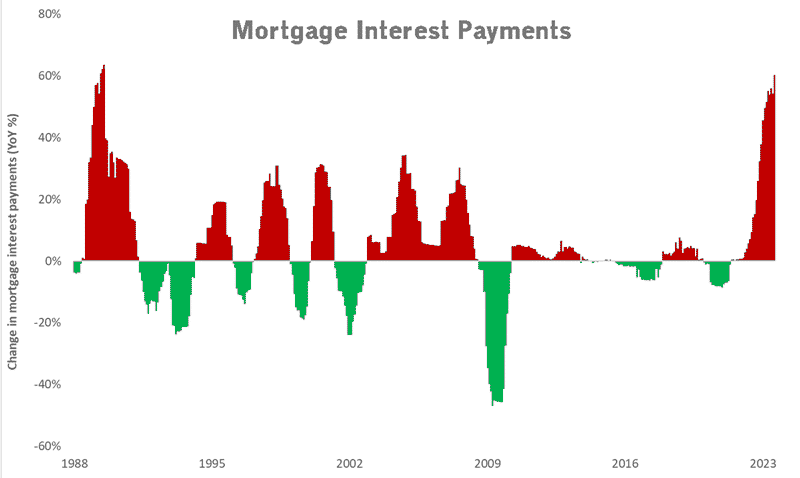

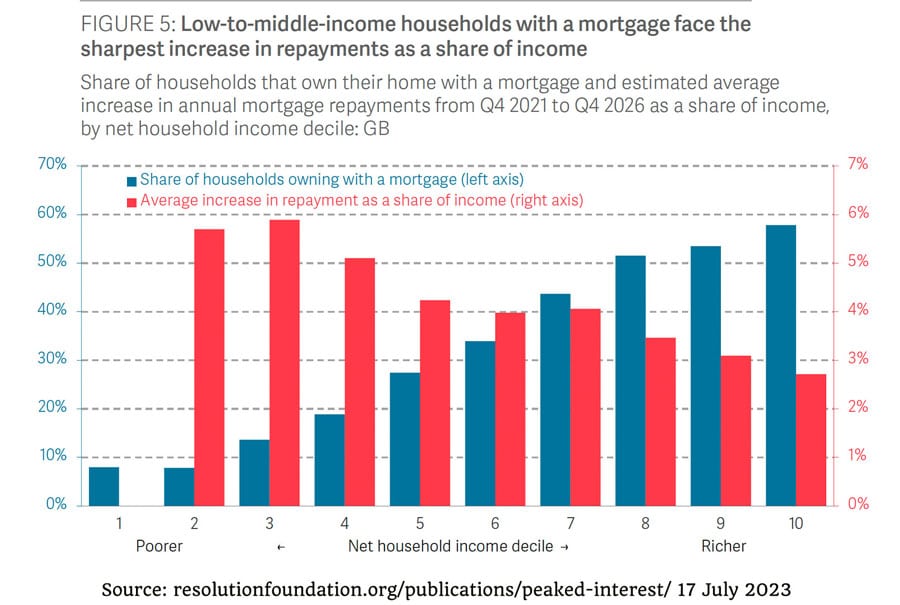

Hidden in last month’s inflation data was a 60% rise in mortgage interest payments – the biggest jump in mortgage interest costs since 1989. For homeowners, mortgage payments as a share of income have risen sharply, squeezing household incomes at a time of real cost of living pressures. Although fewer households have mortgages than in the 1990s, there is little respite for those renting who have also seen a record-breaking 12% rise in rents this year. Rents have been rising faster than earnings, worsening affordability for those stuck in a broken rented sector. Also, it is worth bearing in mind, that the effect of interest rates is more pronounced than in the past, when interest rates were 15% in 1990, average house prices were £55,000. The surge in house prices and typical mortgage means that even a 0.5% rise in interest rates can cause householders to pay an extra £60 a month on a £200,000 mortgage

The problem is that the impact of past interest rates have still not been felt. Many homeowners have been insulated by having 2 year fixed mortgages. Over the next 12 months, millions of householders will face an acute shock to their living expenses as they remortgage to higher rates. Even if the Bank of England had cut interest rates this month, millions would still be facing higher mortgage payments in 2024. With homeowners facing up to an extra £500 a month, real disposable incomes will be squeezed for millions of households. Even if UK technically avoids a recession, it won’t feel like that for the highly indebted. Not only do homeowners facing higher mortgage payments, but falling house prices will reduce wealth and confidence.

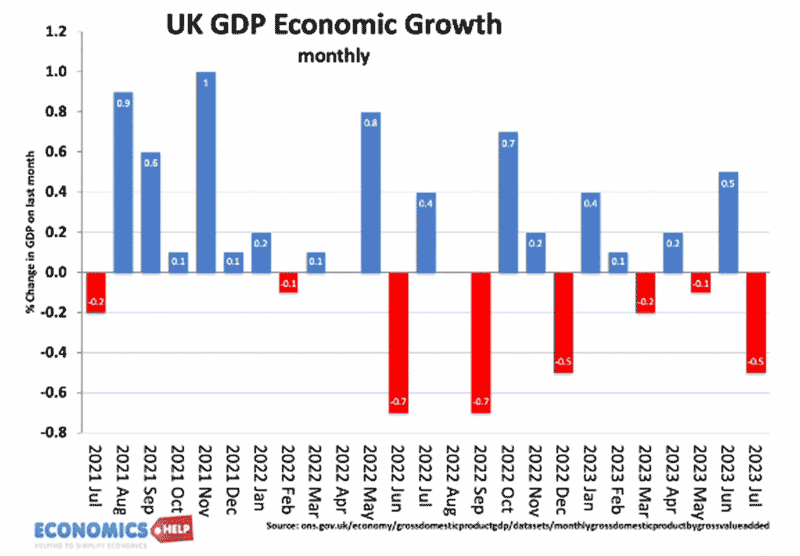

Last year, the Bank were actually predicting a prolonged recession, but the UK economy was unexpectedly resilient, avoiding a technical recession. Given the squeeze on living standards, how did the UK avoid recession as some predicted last year? Firstly, if we look at GDP growth this year, we see a real stop-start pattern. It shows, that firstly, you have to be wary of extrapolating from one month’s data, but secondly, the underlying picture is still very weak.

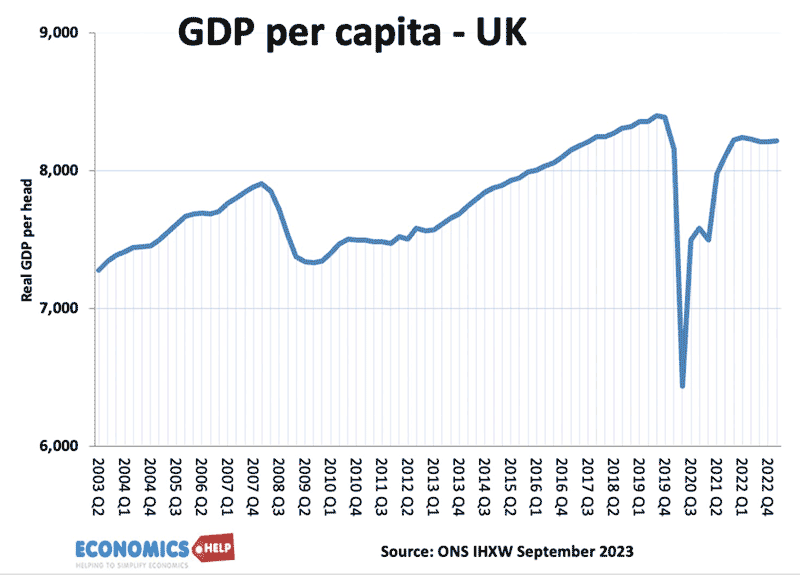

This is real GDP per capita. By the way it includes the recent upward revisions to GDP, which don’t look particularly noticeable. – this is the big picture of the UK economy economic growth very weak and the past trend rate has broken down.

For those struggling to meet cost of living, talk of avoid a technical recession will be little comfort, for many households dealing with stagnant real wages, inflation, higher taxes and now rising interest rates, it may feel like a recession. Arrears on mortgages are rising at a fast pace, though still well below the 1990s. This is why the outlook is bleak for 2024 and the effect of past rate rises could be more damaging than many predict.

What about the outlook for inflation?

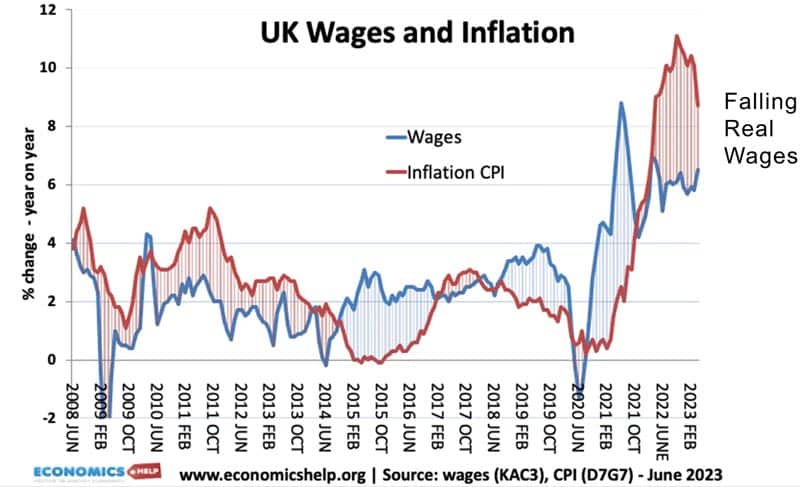

In the early part of the year, inflation often exceeded forecasts, economists underestimated the impact of inflation shocks. Finally after months of falling real wages, nominal wages have grown to 8% – And this will be cited as evidence needed for higher interest rates as firms will try to pass on wage costs to consumers. The economist, Nouriel Roubini has been very bearish on the European economy, stating that will be very hard to get inflation down to 2% because of rising commodity prices. He points to the fact oil prices have recently rebounded and although it has faded from headline news, the ongoing Ukraine war, will continue to put upward pressure on commodity prices. This will act as a drag on reducing inflation. And the relief of falling gas prices this year, may prove only temporary.

Roubini argues that Central Bankers should raise interest rates even more to get inflation back on target of 2%. However, this strategy risks pushing the economy into an even deeper recession. And it is always worth asking, should 2% inflation be the holy grail of economic policy? Firstly, the outlook for inflation is more promising than the first half of the year. Since mid summer, inflation has started to undershoot expectations.

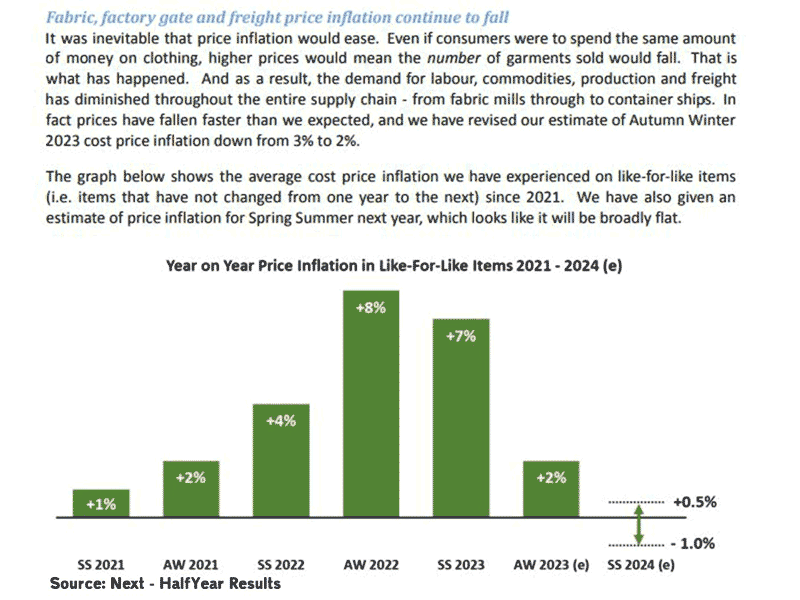

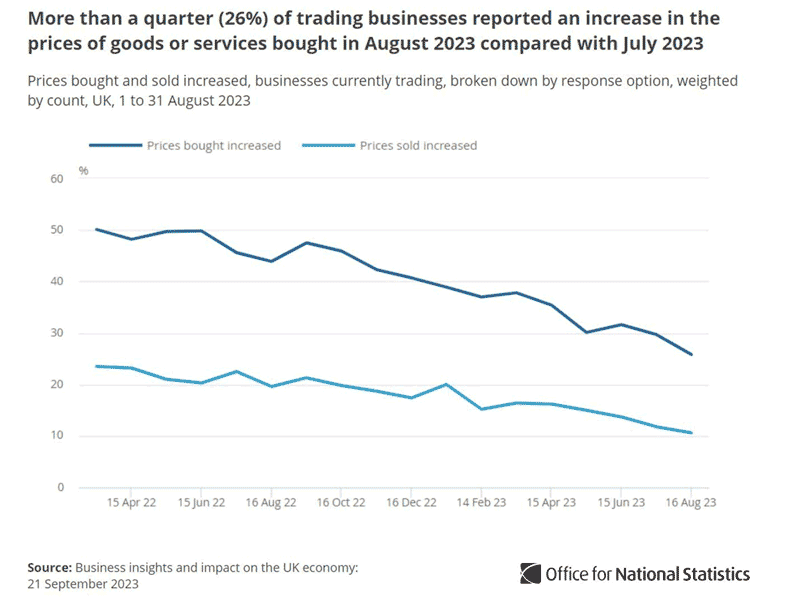

The retail group Next produced an interesting report, where they expect the inflation they face to fall sharply in 2024, they predict prices could even fall. They note that higher prices have caused consumers to cut back spending, the fall in demand is causing lower pressure on supply chains and goods. It is also worth mentioning that since the food price inflation earlier in the year, global food prices are sharply lower and this will feed into future prices. The ONS report similar optimism on inflation, with a steady decline in firms expecting price rises.

If inflation does fall as looks likely, it may lead to positive real wage growth which will help the economy. Thought it will take a long time to catch up with the the lost wage growth.

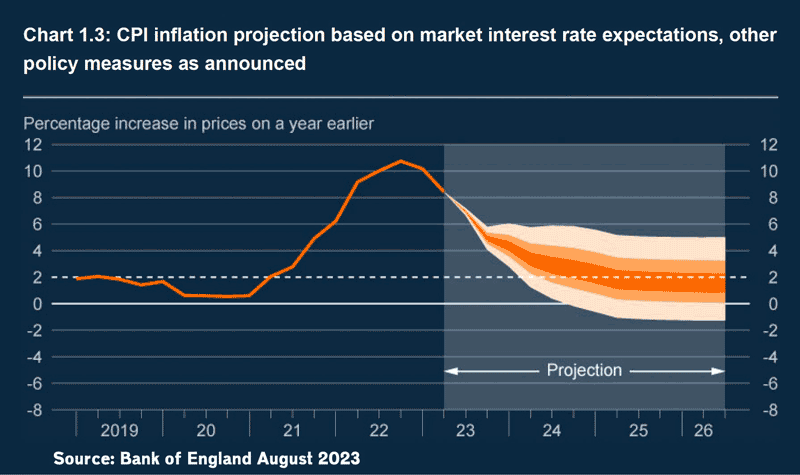

The Banks own inflation forecasts suggest that inflation could fall below target by 2025. But, interest rates take 18-24 months to have an effect. So the current interest rate changes will be affecting the economy in early 2025. Are rising interest rates the right response to disinflation and a likely recession? You may be sceptical of an inflation forecast for 12 months hence. But, if we take a look at the real economy, confidence is very low, towns are being hollowed out by the decline of retail shops like Wilco. Unemployment rose for the first time in August. Higher interest rates do not just affect householders but also firms who are struggling with rising borrowing costs.

Given the weakness of economic growth, it is important to wait to see the effect of past interest rate rises on the economy. There is a danger than in 2024, the momentum from past rate rises cause a sharper fall in growth than expected. Then the concern will not be meeting an arbitrary inflation target but unemployment and home repossessions. Roubini mentions if we don’t get a inflation down to 2% we will see a wage price spiral making inflation become embedded and hard to reduce. But, I don’t agree there is a wage price spiral, the evidence is that workers are belatedly trying to catch up with past inflation. It is not wages causing inflation. But, wages slowly trying to catch up with inflation.

It is too early to declare victory on inflation, but there will be several disinflationary forces working in 2024. Unless oil prices jump back up to $150 inflation should fall. But, the impact of 14 rate rises is also still to be felt, and this the big question, how will business, homeowners and banking sector react to such as unexpected and large rise in rates after years of very low rates.