How The Irish Economy Overtaken Brexit Britain?

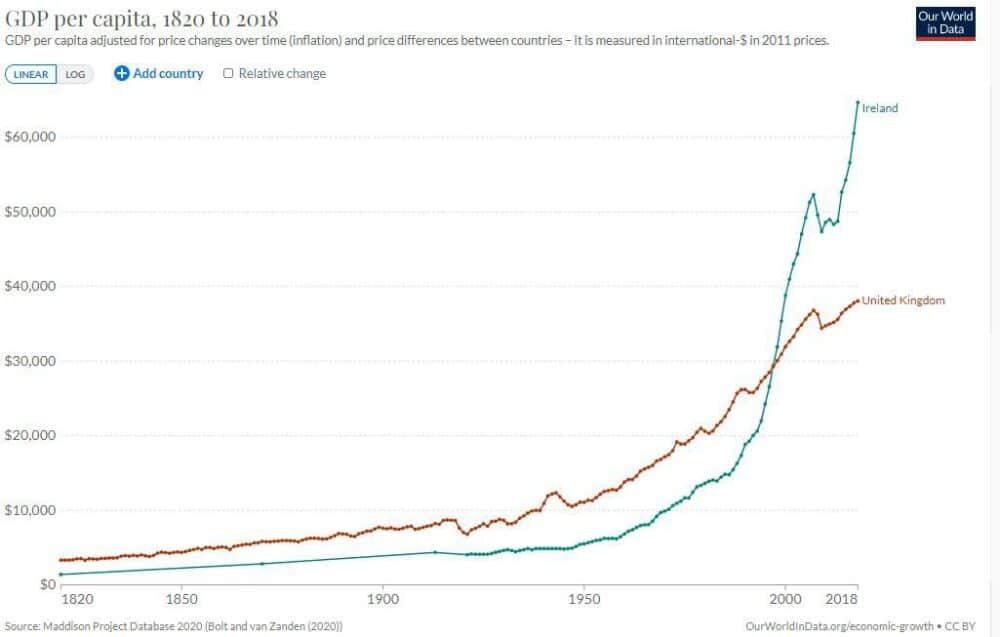

In the post-war period the Republic of Ireland, stood in the shadow of its richer neighbour, with average incomes nearly three times less than the UK.

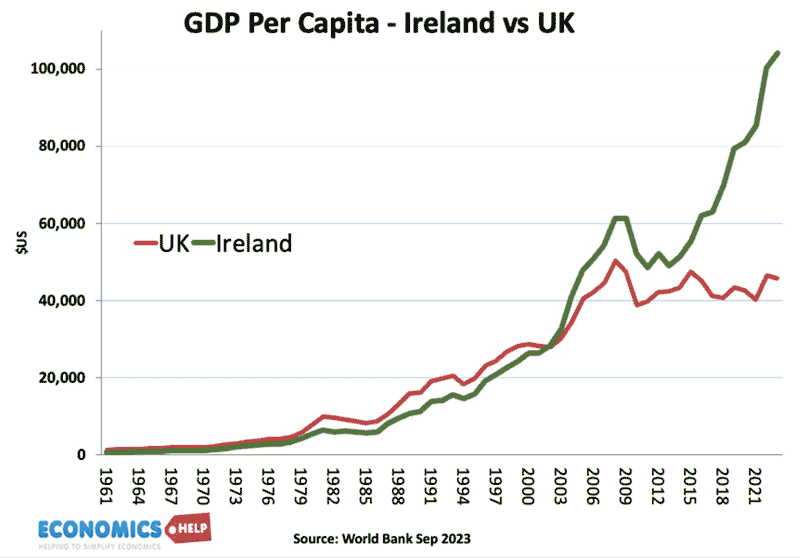

Yet, over the next few decades, the Irish economy was transformed and by the early 2000s, had overtaken UK GDP per capita. Since 2015, the gap has soared with Ireland becoming one of the richest countries in Europe.

Why has the Irish economy done better than UK? Is it due to Brexit, low tax rates –or is it just due to dodgy GDP statistics?

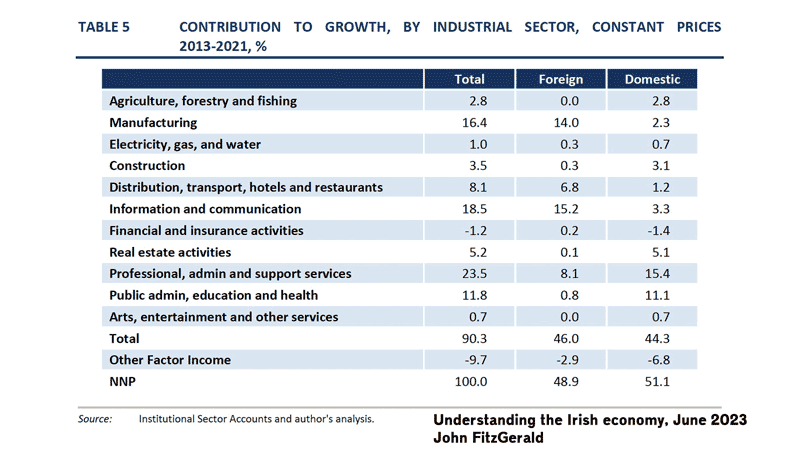

In 1973, both the UK and Ireland joined the EEC. But, it was perhaps Ireland who benefitted the most with regional aid boosting investment and infrastructure and helping the transformation from a small rural economy to modern global economy. But, it was from the mid 1990s, that the Irish economy really boomed. Helped by low corporation tax rates and a young dynamic workforce. Ireland attracted foreign investment from multinationals such as Microsoft, Google, and Facebook. Between 2013 and 2021 foreign companies contributed to 48% of Ireland’s economic growth.

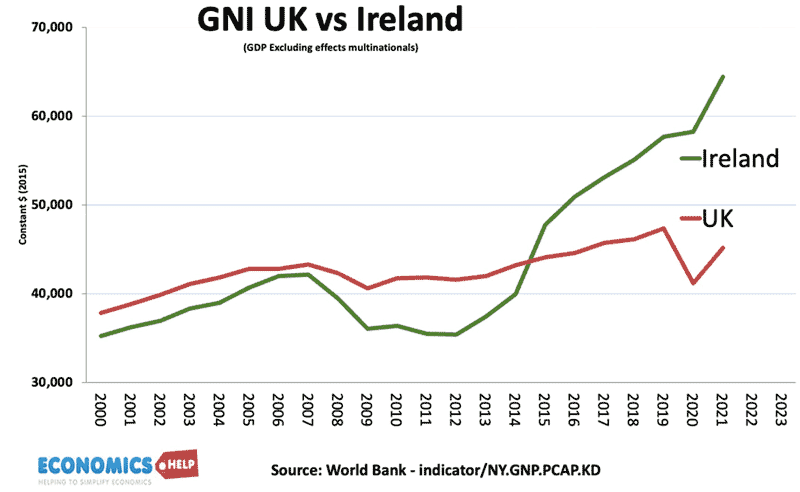

But, this foreign direct investment has also distorted Irish GDP statistics. When Microsoft and Google make profit in Ireland, it has limited benefit for Irish citizens with the profit repatriated back to the US shareholders. Excluding output produced by foreign multinationals, gross national income is 24% less.

However, even if we compare the UK and Ireland with an alternative measure – Gross National Income, Ireland has still done much better. In recent years, Ireland attracted major pharmaceutical companies and during Covid they saw record growth in earnings with exports topping €45 billion annually and directly employing 50,000 people. Also, Ireland’s strong tech sector benefitted from the boom in remote working that we saw during Covid.

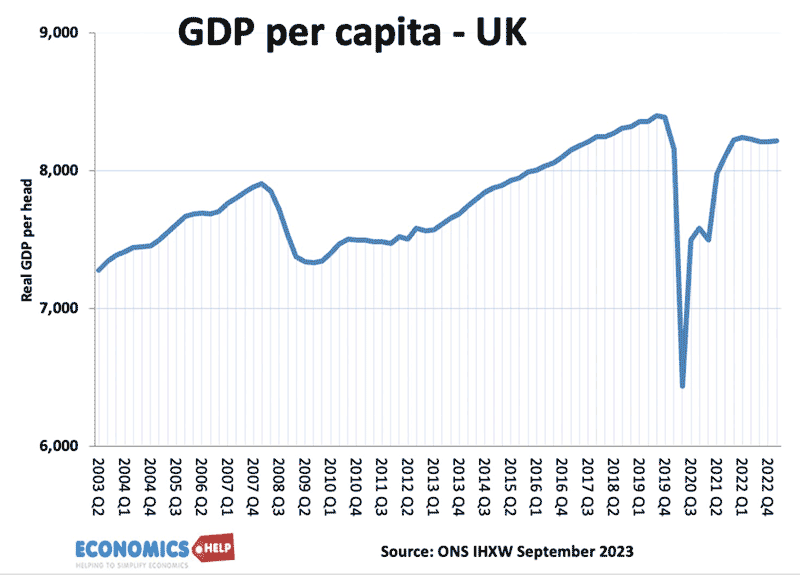

By contrast, the UK economy has struggled And it is not co-incidence that since the Brexit vote in 2016, there has been a sharp divergence between the UK and Ireland. The uncertainties and costs of Brexit, have led to falling UK investment, higher costs for trade and an estimated 4-5% loss of GDP. Since Brexit, Ireland has increasingly benefited from investment from multinationals seeking an alternative English speaking entry point into the EU.

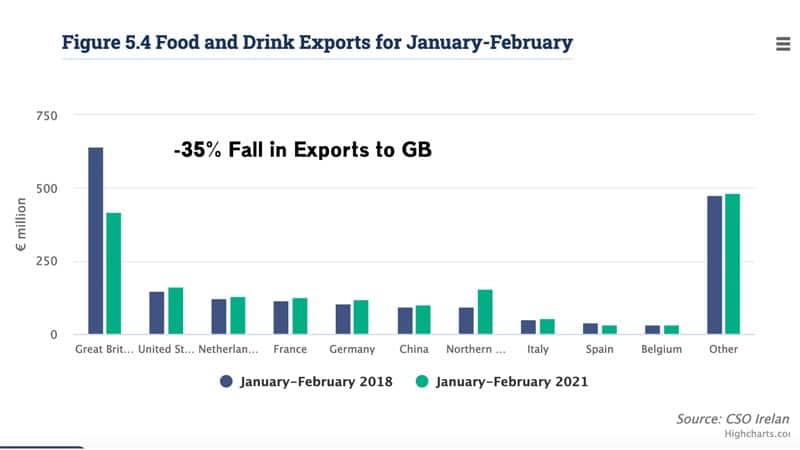

However, whilst Dublin is attracting finance and multinational investment, Brexit has been harder on agriculture and the fishing sector.

Observers of Ireland point to a dual economy: a high-tech capital intensive sector, powered by foreign investment and a “traditional” jobs-intensive food business. Brexit has reduced fishing quotas, pushing the Irish fishing industry close to despair, and Brexit has also disrupted agricultural trade with the UK. This has caused a two-speed economy. A shining tech economy, but less prosperous rural sector.

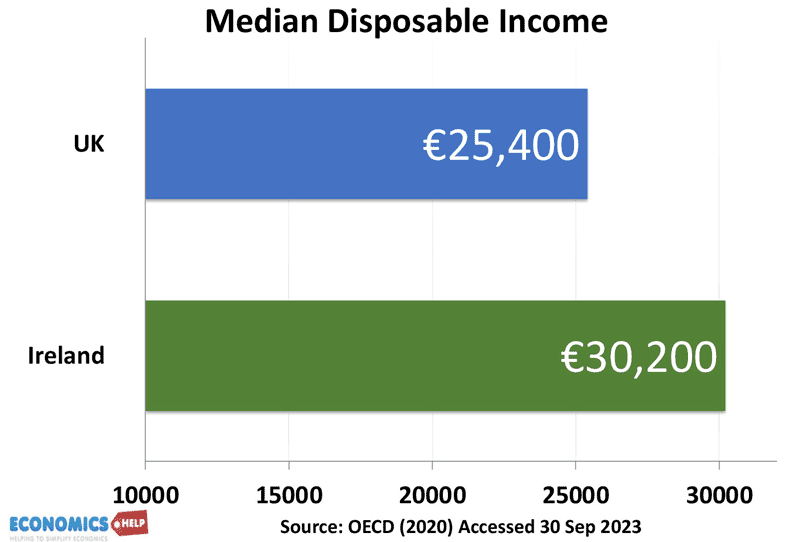

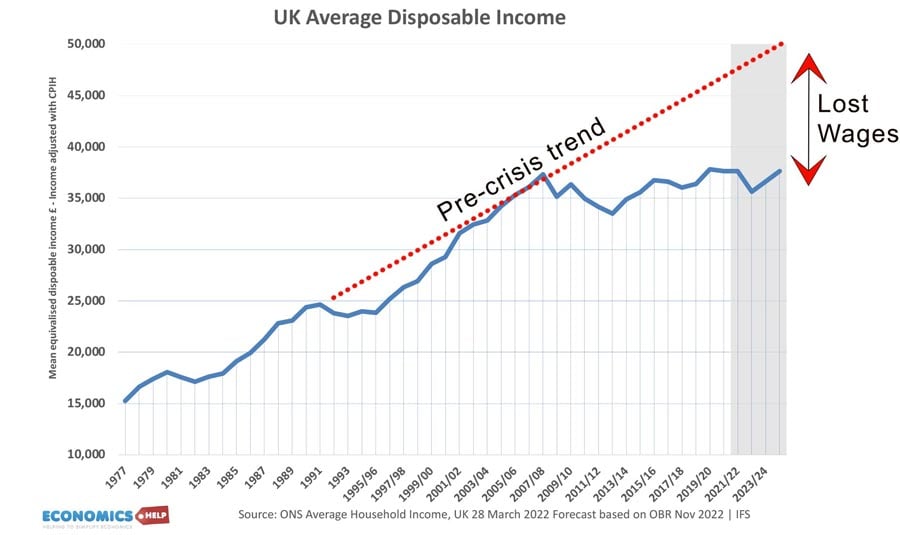

If we ignore GDP and GNI statistics, a better guide to actual living standards is to look at median disposable income – the average income. Here the gap is narrower, with Ireland only recently overtaking the UK. But, the trend is different. The UK has been stuck with stagnant wage growth for several years, Ireland’s trend rate looks more optimistic.

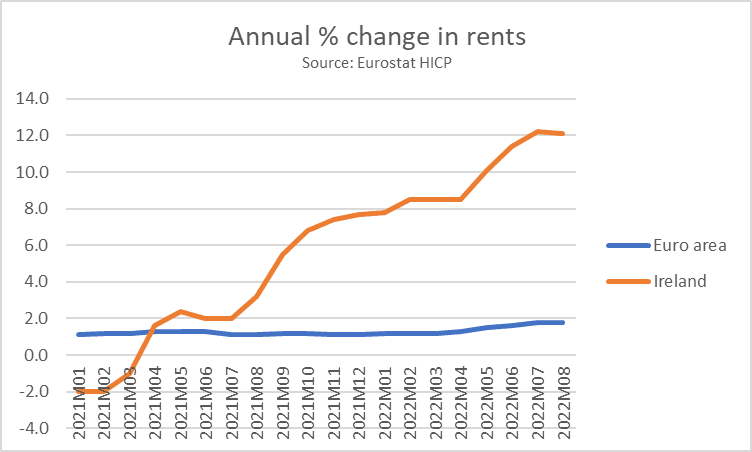

However, it is not just income levels, we need to look at prices, and here Ireland is the most expensive country in the EU, with prices 46% above the EU average, and this is particularly acute in essential sectors like food and housing.

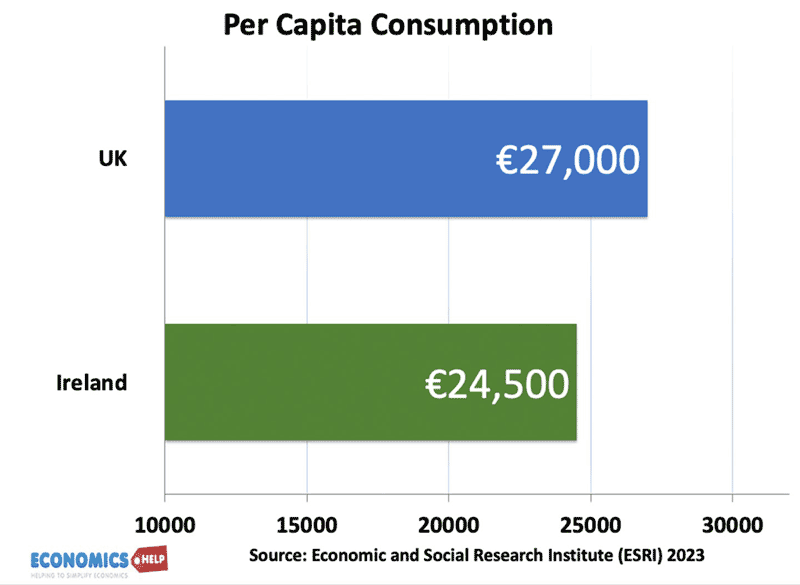

If we compare actual consumption, recent analysis suggests the UK has still higher levels than Ireland. UK consumption is €27,000 whilst Ireland is €24,500. This reflects the fact that Ireland has a much higher saving rate. UK households have been squeezed by a cost of living crisis and prolonged stagnation in real wages, Irish households are more willing and able to save for the future. Ireland’s saving rate was 14% in 2023, compared to 8.7% in UK.

But, whilst the UK has currently higher levels of consumption, how long will this last? In 2024, the UK is forecast a recession, Ireland growth of 4.3%. High savings also provide something of a buffer for the Irish economy, a legacy perhaps of the spectacular bust from the financial crisis of 2008.

Housing Crisis

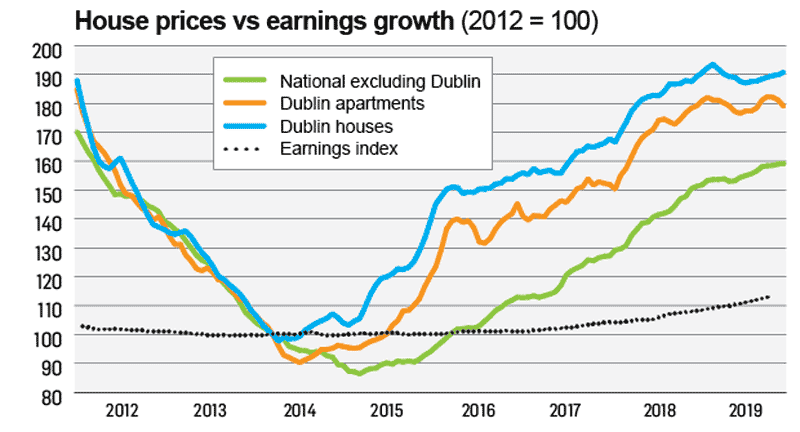

One area where there is a surprising degree of affinity between the two economies is in relation to housing. Both economies have experienced strong population growth, partly caused by migration, but both countries have failed to build sufficient housing. The result is a surge in the cost of housing, especially falling on the young.

It is one reason, why many young Irish people may be sceptical of impressive GDP statistics. Ireland’s record-breaking rise in GDP has usually not filtered down to the younger generation who struggle to get affordable housing. 68% of young Irish adults are still living with their parents, the highest rate in the EU. There has been a worrying rise in homelessness as many are locked out of a tight housing market. It has created, a bit like the UK, a two speed economy, between property owners who have benefitted from rising house prices and the younger generation who pay high rents.

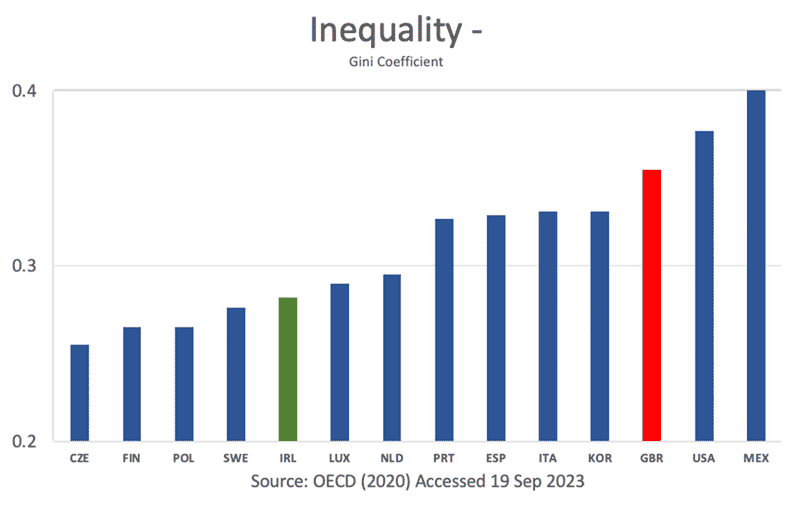

However, the UK still has significantly higher levels of income inequality than Ireland – 25% worse inequality. And another interesting stat – In 2020, Ireland’s life expectancy from birth was 82 years – 2 years more than the UK.

One benefit of the surge in Irish economic growth, is a record growth in tax revenue. Last year, the Irish government recorded a budget surplus of 10 billion Euros and this is forecast to grow to €16bn next year. The UK by contrast has experienced rising budget deficits and soaring debt interest payments, Even years of austerity, failed to reduce the UK debt to GDP ratio, which continues to rise. In Ireland, there is a big debate about what to do with this tax windfall. Young people wanting more affordable homes, whilst older generation wants it to be saved to pay for future pensions. The different priorities a split in economic fortunes, but it is a nice dilemma to have and a far cry from the 2010 financial crisis and EU/IMF bailout. In the current climate, the UK could only dream of a budget surplus, with tax revenues continuing to disappoint, despite a record tax burden on households.

What about Future Prospects?

The biggest threat to the Irish economy is an over-reliance on foreign multinational investment for GDP growth and tax revenues. A large sector of the economy relies on a very low corporation tax in Ireland. However, the OECD is leading an effort to promote a global minimum corporate tax rate of 15% in an effort to prevent wasteful tax competition between countries. In 2016, Ireland’s GDP jumped 26% purely due to Apple restructuring its company to take advantage of Irish tax rates. A phenomenon Paul Krugman coined as “leprechaun economics,” But, what can come in can also go out. America has toyed with changing tax laws to prevent this loss of tax revenue abroad. On a more positive side, since Brexit, Ireland has also spied new opportunities as a more pragmatic alternative to the hard Brexit adopted by the UK. The UK by contrast is still reeling from the triple shocks of austerity, low productivity and Brexit. Ireland has many problems and the GDP statistics are misleading, but it does have a lot more momentum than the UK economy that is looking in vain for a new spark to overturn the recent poor performance.

There was a time when thousands of Irish emigrated to England in search of higher wages, but not it is Ireland which is attracting net migration. Although there is a reason to be sceptical of GDP statistics, Ireland has a lot of potential, if only it could solve its housing crisis. If you enjoyed this video, you might enjoy this one, which goes into more detail on the decline of the UK economy.

Further reading

External Links

- Comparing UK and Irish economy – Slugger O’Toole

Oh wow! I know Ireland is very good at economy growth but I didn’t think they are better than the UK’s economy growth. After reading your article I think Ireland’s economy growing faster cause they are not involved in global nasty politics. They are focused on to make businesses environment and easy rules for global giants and tech company.

Excellent analysis.

A very one sided report. Obviously writted by a pro EU journalist

It’s amazing how the above comment can deduce that this is a one sided report. Probably a staunch brexiteer. Responsible by vote for the difference in both economic set of results in the UK & Ireland. How any country thought that stepping outside of the world’s largest trading block, was going to bring prosperity, is ludicrous. It’s now netting the results that were predicted by all but the Delusional Brexit campaign.

Cameron wanted to blow away the UKIP Farage Take Back Control anti European ethic by a referendum which by a small % decided for Brexit- Sterling Currency devalued by 20% immediately -Duties charged on Exports,Increased costs on imports -Loss of Thatcher derogation on CAP -loss of transport thru Dover -4 new Ferry routes Ireland direct to Europe-

Brexit-mistaken belief Europe needed UK more than UK needed EU.

The EU concept after 2 World Wars was to Unify Europe -Brexit was meant to divide costing Britain power influence & wealth