A minimum price for alcohol means that alcoholic drink cannot be sold below a certain price. It is aimed at preventing the sale of very cheap alcohol by supermarkets. The hope is that a higher price will discourage binge drinking, improve health, and make people pay a price closer to the true social cost of alcohol. Opponents argue it is unfair and a regressive price which will hurt the living standards of those on low income. Furthermore, if you wanted to increase the price of alcohol – a tax is a better way to increase the price because the public will benefit from improved tax revenues.

The UK has a problem with binge drinking. Overconsumption of alcohol can lead to many social problems, such as increased crime, increased accidents. It contributes to a variety of health problems such as premature death, cirrhosis of the liver, heart disease, cancer, alcoholism, and mental problems. All these places costs on the NHS, which have to be borne by the taxpayer. The UK’s alcohol problem is much worse than most European countries, like France. According to the ONS, in 2010/11, there was an 11 percent increase in alcohol-related (hospital) admissions (based on attributable fractions) giving a total of 1,168,300 admissions. This is more than twice as many as in 2002/03 (510,700). (Channel 4 report on alcohol)

Social Costs of Alcohol

Some studies showing costs of alcohol:

Academics say that total deaths from the “wider harms” caused to society by alcohol could reach 250,000 in England and Wales by 2019 if current trends continue. (250,000 deaths from alcohol)

According to a report, “Health First: An evidence-based alcohol strategy for the UK”. “The personal, social and economic cost of alcohol has been estimated to be up to £55bn per year for England and £7.5bn for Scotland,”

Effect of a minimum price of 45p or 50ps

A minimum price of say 45p per unit would mean a can of strong lager could not be sold for less than £1.56 and a bottle of wine below £4.22.

Research carried out by Sheffield University for the government shows a 45p minimum would reduce the consumption of alcohol by 4.3%, leading to 2,000 fewer deaths and 66,000 hospital admissions after 10 years. Researchers also claim the number of crimes would drop by 24,000 a year. (Minimum price targets high-risk drinkers at Univ. of Sheffield)

5p makes a difference

Research by Sheffield University shows that if alcohol is priced at 45p per unit consumption drops by 4.3% – a 75% greater effect than would be seen at 40p. In addition, the biggest effect is amongst young ‘binge’ drinkers who are most price sensitive. Scotland is considering a minimum price of 50p – where the effect would be even greater.

Scotland’s 50p minimum price

In February 2018, Scotland’s devolved government set a minimum price of 50p ($0.70) per unit.

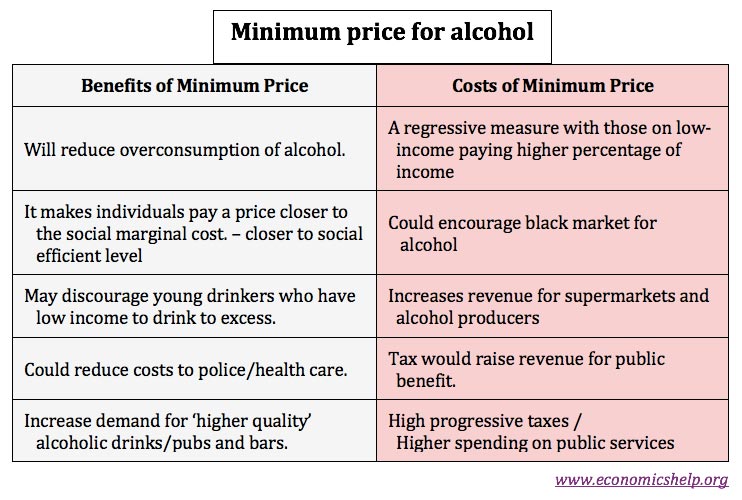

Arguments for a minimum price for alcohol

- It makes people pay the social cost of alcohol.

- The Institute for Fiscal Studies, suggests that approximately 70% of shop-bought alcohol is priced below the 50p a unit. (Economist)

- It is not a panacea, but a higher minimum price can be a factor in dealing with the very high social costs of alcohol abuse.

- It can particularly discourage young drinkers from overconsumption

- It will have a positive effect on the more ‘upmarket’ alcohol brands and pubs. People may go out to a pub and spend there, rather than ‘preloading’ on cheap alcohol from supermarkets.

Arguments against minimum price for alcohol

- Some politicians have argued it would reduce living standards for those on low incomes. The minimum price is highly regressive and will affect those on low incomes the most. There is already a substantial tax on alcohol.

- A higher minimum price could encourage people to switch to illicit ‘home brews’ and replacement alcohol. This is potentially dangerous as it leaves people exposed to alcohol of an unknown quantity and composition.

- It will be an easy way for supermarkets and firms to increase their profits. Demand for alcohol is price inelastic – if all firms are forced to increase their prices, it will be an easy way to increase prices and profits

- The government would be better off just increasing the tax on alcohol so that society pockets the extra cost rather than supermarkets and alcohol producers. Then the tax revenue raised could be used to fund the cost of treating alcohol-related diseases. See: effect of the tax.

Conclusion

The argument about equality and living standards is misplaced. I don’t think that avoiding minimum alcohol pricing is the way to promote greater equality. The most important thing is to set a price for alcohol which is optimal for society. Given the widespread abuse and social costs associated with consumption of cheap alcohol, the price should be raised, and we should see a significant reduction in some alcohol-related problems. It is by no means a panacea, there are many other things that need to be done to address problems related to alcohol, but high prices do have some effect in reducing demand – especially amongst some young people.

Suppose alcohol was already at 50p per unit, and this was considered to be a good socially efficient price, would it make sense to cut the price of alcohol to improve the living standards of those on low incomes? No. If we wanted to improve living standards it would make more sense to redistribute income through benefits, taxes – rather than making it cheaper to buy a demerit good.

However, if you are going to increase the minimum price of alcohol, there is a much stronger case for alcohol tax – rather than a minimum price. A tax gives the government much needed tax revenues. A minimum price is an easy way for supermarkets and drink producers to increase revenue.

Economics of minimum price

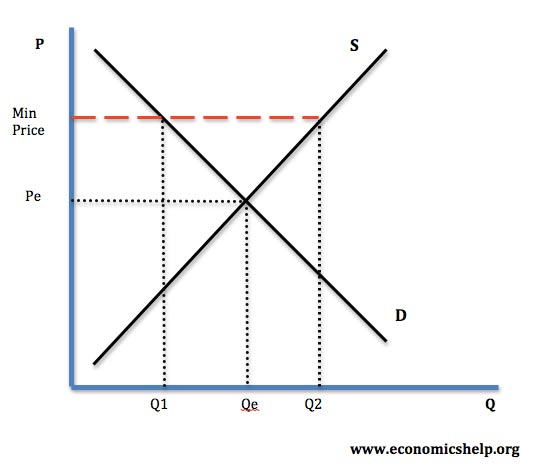

Just a brief note on the economics of minimum prices. A simple supply and demand model suggests a minimum price above the equilibrium could cause a surplus (supply greater than demand). This did occur with the minimum prices of the Common Agricultural Policy (CAP).

Minimum Prices

However, with alcohol pricing, this wouldn’t occur. Supply and demand are both very inelastic, supermarkets would just put up the prices

Minimum price at Home office

Externalities of alcohol

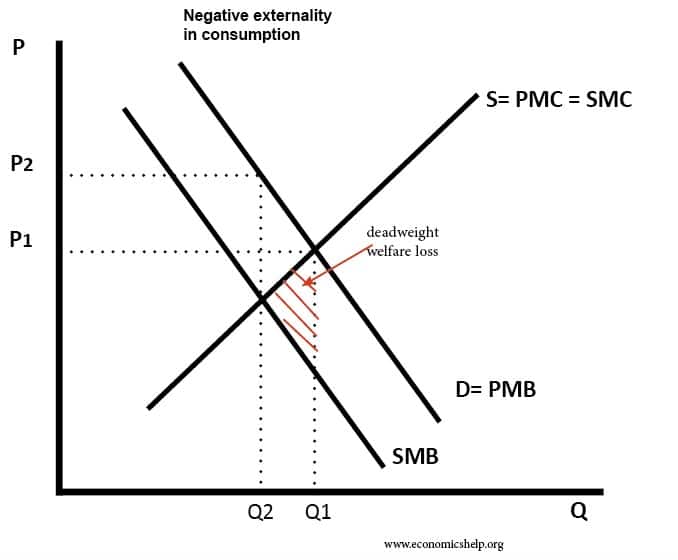

Externalities in alcohol can lead to market failure and social inefficiency. This provides a case for government intervention. To show the negative externalities of alcohol, we could either show:

- Negative externalities of consumption.

- Negative externalities of production.

Diagram for negative externality in consumption

- PMB = private marginal benefit

- SMB = social marginal benefit

- PMC = private marginal cost.

- SMC = social marginal cost.

If you consume alcohol, there are costs to the rest of society – drunkenness, lost productivity, cost of policing, costs of health care. You might think there is a personal benefit of drinking, but with these costs the social benefit is less than your private benefit. You have a good night out, but your firm loses out from your lower productivity on a Monday morning.

In a free market, the outcome would be Q1, but this is greater than the socially efficient level – there is overconsumption. At Q1 – SMC>SMB

If the government set a minimum price of P2, it would reduce demand to Q2 where SMB = SMC and the outcome is socially efficient.

Production negative externality

Another way of thinking of the external costs of alcohol is that as alcohol is produced, there is a cost to the rest of society not met by the individual drinker – therefore the social marginal cost of drinking is greater than private marginal cost. Arthur Pigou used alcohol to illustrate his concept of externalities in The Economics of Welfare (1920)

A Pigovian tax is a tax which makes individuals pay the full social marginal cost.

Production negative externality

Free market equilibrium of Q1, P1. But social efficiency occurs at Q2,P2

A minimum price of P2 would have the same effect of reducing output to the socially efficient level of Q2.

Related

Minimum pricing may stop or reduce the chances of, consuming cheap alcohol with synthetic compounds and other chemicals that may pose risk (probably containing cleaning fluid) . However lower taxes in some parts of Europe (without minimum unit pricing) increase the chance of premium brands being bought with natural compounds included not as dangerous . Scotland has introduced 50p per unit which is crazy and it doesn’t understand how their neighbours perform tackling substance misuse in a less regressive way. Uk has the third highest taxes on booze in Europe. Preloading ain’t too much of a problem it’s how it’s done. If everyone cut down on consumption they may have more energy throughout the day. Just like debating gun rights for some parts of the USA.

Nobody has thought this completely through, especially the Scottish Government who are now opening themselves to a lawsuit for giving an unfair commercial advantage. If a big American corporation sued the Scottish Government in the US courts, the punitive damages could be astronomical since the government had no legal defense as they themselves introduced the legislation

all this will do is punish the poor the tax on alcohol in this country is allready to high it will hit the moderate drinker how enjoys a quiet dring in house it should be left to the individual to decide to much interference from nanny state again

Where does the extra,cash raised go?

Straight into the retailer’s pocket

Where does the extra cash raised go diagio Budweiser tennents lager etc . Tell me where that cash is going.the cash should go to help people not multinational companies.

It is a good question. This is why I prefer tax rather than minimum price.

what disadvantages will producers/suppliers face?

This article was EXTREMELY useful to me! Thank you very much!!

thank you for a insight which has been needed for an essay for uni.