Readers Question: I am also interested in Marxist economics and they seem to say the 2007-2008 crisis was a result of over-financialisation of the economy, and that investors/owners could not squeeze surplus out of other sectors in the economy as they once could.

Financialisation of an economy refers to the situation where the finance sector takes a bigger share of GDP and employment. The consequence of financialisation include the possibility that:

- Financial markets have greater influence over firms and the real economy.

- The economy is more dependent on the strength of the finance sector.

- Widening inequality as the finance sector is often able to capture relatively higher salaries and profits.

- Growth in financial instruments has increased the risk of unsustainable debt and lending levels.

- The nature of the finance sector means that if it fails it is has a much wider knock-on effect to other industries. If coal mines close, it doesn’t really adversely affect other industries. But, if banks get into difficulties, it has severe adverse effects for every other industry.

Epstein (2001) defines financialisation as:

“the increasing importance of financial markets, financial motives, financial institutions, and financial elites in the operation of the economy and its governing institutions, both at the national and international level” (Financialisation and its consequences)

Growth of Financial sectors in developed countries

Between 1970 and 2008, most industrialised countries saw a growth in the importance of the finance industry. The total share of finance in value added (GDP) to the economy more than doubled in 11 OECD countries. In terms of employment, economies have seen a growth in the share of financial sector employment.

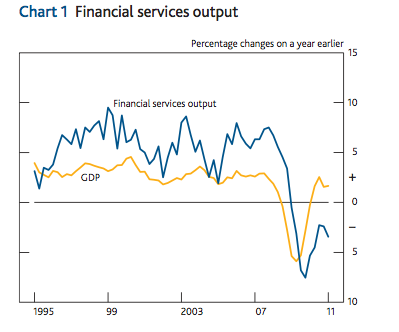

source: Bank of England

UK Finance sector

Source: Bank of England

UK financial sector growth – strong between 1995 and 2008, but experienced a deeper dip in the 2008 recession.

How important is the Finance sector to the UK economy?

The Office of National Statistics (ONS) ‘Blue Book’ reports that the financial sector accounted for 31.9 per cent of Gross Value Added (GVA) to the British economy. (fact check)

However, the finance sector includes a wide array of sub-sectors like IT and accountancy. If we just look at financial intermediation (banking), it is closer to 8% of gross value added.

However, another way of looking at the importance of the banking sector is the size of bank assets and liabilities. Until the 1970s, Bank assets accounted for roughly 50 per cent of UK GDP. But, after financial deregulation, bank assets, rose to 300 per cent of GDP by 2000, and to 550 per cent by 2007. This shows increased importance of bank assets and lending. (Is the Finance sector too big? ECB)

Was over-financialisation to blame?

- The growth of particular financial intermediaries and financial activities did create a significant problem. The growth of unsustainable bank liabilities in the early 2000s left the economy vulnerable to a financial implosion and the debt deflation we are still experiencing. The search for high risk, high yield lending meant many banks became over-exposed to bad debts. When the first mortgage defaults started in 2005/06, this had an increasing effect on the whole financial sector. The resulting credit crunch was definitely one of the key contributing factors in the subsequent great recession.

- The problem of the financial sector was those bank losses and the bank’s attitude to lending had a very significant cost to non-financial firms. Banking may only account for 8% of value added to the economy, but even now firms across Europe are experiencing high bank rates and difficulty in accessing credit. This credit crunch in the financial sector has harmed business activity. It has highlighted how the wider economy is heavily dependent on the banking sector. (see: bank rates vs base rates)

- Other problems of over-financialisation. This paper suggests there is empirical evidence to suggest that growing financialisation has increased inequality and had adverse effects in terms of output and employment.

- Concern over short-term profit motives. One effect of increased financialisation is that shareholders and hedge funds have increased influence over firms. This has encouraged firms to place greater emphasis on short term profit goals, to pay higher salaries and place less emphasis on long-term sustainable business growth.

- Inequality. The growth of financialisation has co-coincided with a declining share of wages and corporate profit-taking an increased share. (corporate profit share of GDP)

Evaluation

- You could argue the growth of the finance sector is a sign of an increasingly developed economy. With greater mechanisation and improved technology, it is inevitable that the service sector increases in importance and the primary/manufacturing sector decline.

- It is not necessarily a bad thing if the finance sector increases as a share of GDP. It could be partly a reflection of higher living standards, which means more people can invest in shares. There is no intrinsic reason why it better to have 20% of the workforce working in a mine than in a bank.

- The biggest problem of greater financialisation is the fact that banks keen to see rapid growth, undertook increased risk-taking and increased lending which wasn’t based on sound fundamentals. The finance sector was rewarding high risk, there was a problem of moral hazard, with financial firms able to take the profits, but relying on the state to bailout when they lost money.

- Another problem of this aspect of the finance sector is that it appeared to slip under the radar of monetary authorities. Central Banks have experience of dealing with inflation and setting interest rates. But, the growth of risky lending was much harder to spot, evaluate and deal with.

- There is a real concern that financialisation has increased inequality. In theory, you could have greater financialisation without increased income inequality. There is no reason why a strong finance sector can’t benefit everyone, but at the moment it does seem to be creating greater inequality.

- The problem with the finance sector is that there is no guarantee, that the mistakes of the past 10 years won’t be repeated in the future. Regulation to prevent unsustainable financial bubbles requires a high degree of political will and competence from regulators.

- Rather than blaming ‘over-financialisation’ I would tend to stress the role of the unregulated and irresponsible lending practises of certain banks and financial institutions.

- A strong, well functioning banking sector can play an important role in promoting economic prosperity. Firms need banks and financial markets to finance investment. However, it depends on how the banking sector is created. Do banks take a short term view or long term view? Is the bank lending sustainable? Are banks taking too much risk by borrowing on money markets to make temporarily more profitable loans?

- The finance sector is not the only factor behind the European recession. There are other issues related to failures of fiscal policy, failures of the single currency. Also, even countries like Germany which have a different financial model (and banking sector has not increased in terms of value added, were also negatively affected by recession).

…that investors/owners could not squeeze surplus out of other sectors in the economy as they once could.

I’m not sure about this. I wouldn’t say that banks were unable to squeeze surplus out of other sectors. The fundamental problem is that banks were over-exposed. They had too much debt and liabilities they couldn’t finance in the short term. The problem was that businesses who relied on credit suddenly found bank lending closed to them. This caused firms to suffer unnecessary cash flow problems and this led to lower growth.

Related