When reading economic articles in the past few years, you may frequently come across the reference to the ‘zero lower bound’ or ZLB.

What is the Zero Lower Bound rate?

In short – when interest rates can’t fall any further below 0%

Examples of ZLB

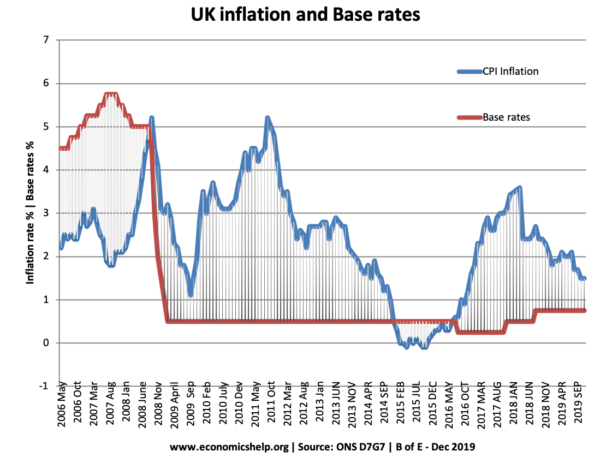

- UK interest rates were cut to 0.5% in March 2009 and have stayed there until 2013

- In Dec 2008, the US, the Federal Reserve cut interest rates to between 0% and 0.25%. Interest rates stayed at 0% as unemployment rose from 7.3% to 10% at the end of 2009. Between Dec 2008 and 2013, the US has been at this zero lower bound of monetary policy.

- In April 2020, interest rates cut to zero in US, Europe and UK in response to Corona recession.

ZLB explained

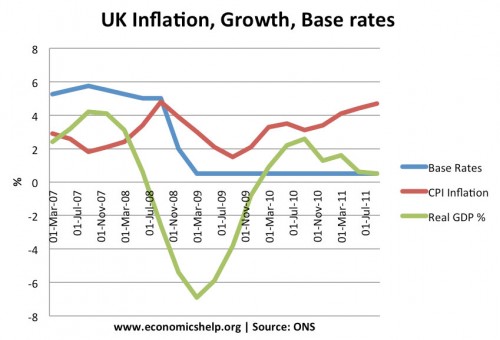

- The main tool of conventional monetary policy is interest rates, set by the Central Bank. If inflation is low and economic growth negative, the Central Bank will cut interest rates to stimulate demand and higher economic growth. (see effect of lower interest rates)

- However, there may come a point when interest rates have fallen to zero and therefore, they can’t fall any further.

- This is the zero lower bound rate – interest rates have fallen as far as they can.

- Note: it is considered not practical to have negative nominal interest rates. No one would lend money at a negative interest rate – you would be better off just holding cash.

- This means the Central Bank can no longer use interest rates to stimulate the economy. People often term this a liquidity trap.

Increasing the Money supply at the ZLB rate

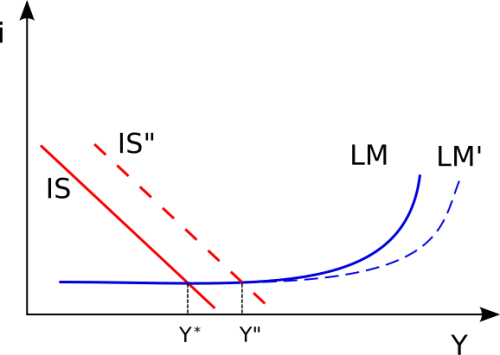

In a liquidity trap, increasing the money supply is likely to be ineffective in stimulating economic activity.

Usually, an increase in the money supply leads to lower interest rates and encourages more spending. However, in a liquidity trap, people are generally indifferent to an increase in the money base. Interest rates don’t fall and the extra money tends to be saved rather than spent.

Economies such as the UK and US had a substantial increase in the monetary base during 2009-11 (through quantitative easing) but this expansion of the monetary base had limited impact in increasing economic growth. see: link between money supply and inflation

Policies to overcome the Zero Lower Bound rate

1. Higher inflation. The problem with zero nominal interest rates is that real interest rates may be too high. If nominal rates are 0% and there is inflation of 1%, real interest rates are -1%. If the government commits to and achieves a higher inflation rate, then real interest rates fall and this creates an incentive to borrow and spend.

If the government achieved an inflation rate of 3%, then real interest rates would fall to -3%. Holding onto cash with inflation of 3% and 0% interest rate means your savings are falling in value. Therefore, there is greater incentive to spend.

Also committing to higher inflation is likely to increase expectations of higher growth, and this will encourage spending.

The danger of committing to higher inflation is that inflationary expectations may become embedded and the higher inflation could create uncertainty which discourages investment. However, deflation tends to be a big factor in limiting economic growth

2. Fiscal Policy

At the zero lower bound rate, fiscal policy provides a direct injection of spending into the economy. This injection of demand raises economic growth and makes use of surplus savings. Expansionary fiscal policy may have a positive multiplier effect. Also, at the ZLB, bond yields are likely to be very low and the government will be able to borrow at low cost.

If monetary policy is ineffective then fiscal policy is essential for making sure there is a stimulus to demand. The drawbacks to using fiscal policy is the rise in government borrowing. Countries in Euro, may in particular struggle to borrow sufficient funds because of concerns in the bond market.

3. Negative real interest rates

Although rarely used, some argue it is theoretically possible to have negative interest rates i.e. pay someone to look after your money. See: negative interest rates

ZLB and Taylor Rule

In a liquidity trap, deflation and deep recession, there is likely to be substantial spare capacity, the Taylor rule may suggest high negative real interest rates to counteract the recession. In this case, the ZLB is more serious because real interest rates are likely to be too high because of deflation and the spare capacity – ZLB blogging (Krugman)

Related

- Liquidity trap

- ZLB at Greg Mankiw