Readers Question: In Risks and benefits of Quantitative easing one point the programme mentioned was:

The scale of quantitative easing could make it impossible to sell bonds back to market and this will damage the UK’s ability to borrow in the future. If the UK’s ability to borrow is constrained, this will lead to higher interest rates and reduce economic growth.

Readers Question: Why won’t we be able to sell bonds because of the size of QE? it surely is not that big as % of total?

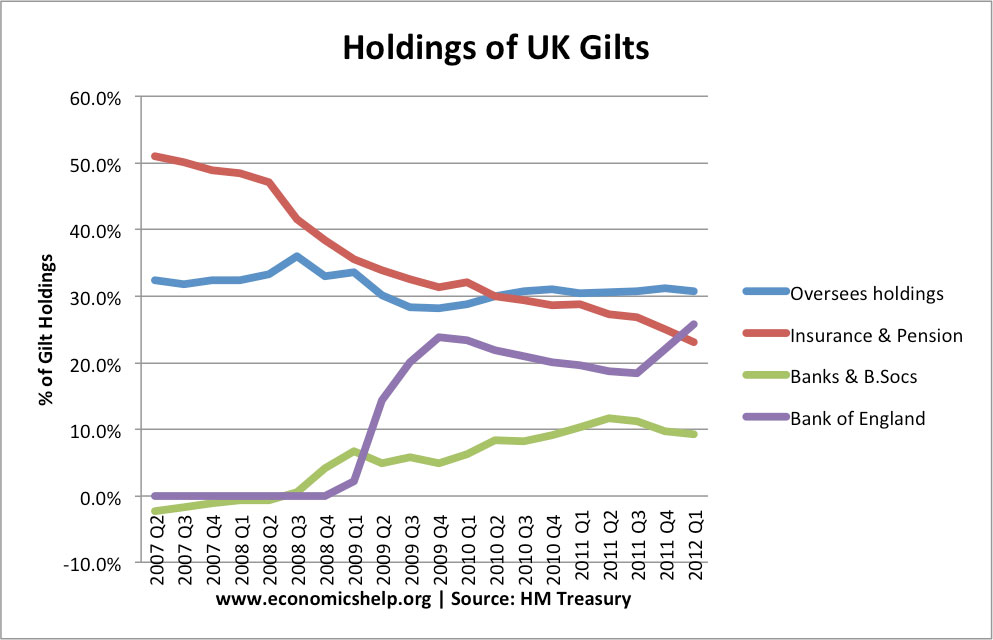

Firstly, Bank of England gilt holdings are getting close to 30% of the total public sector debt, £375bn so it is a significant total.

Bank of England gilt holdings as % of total

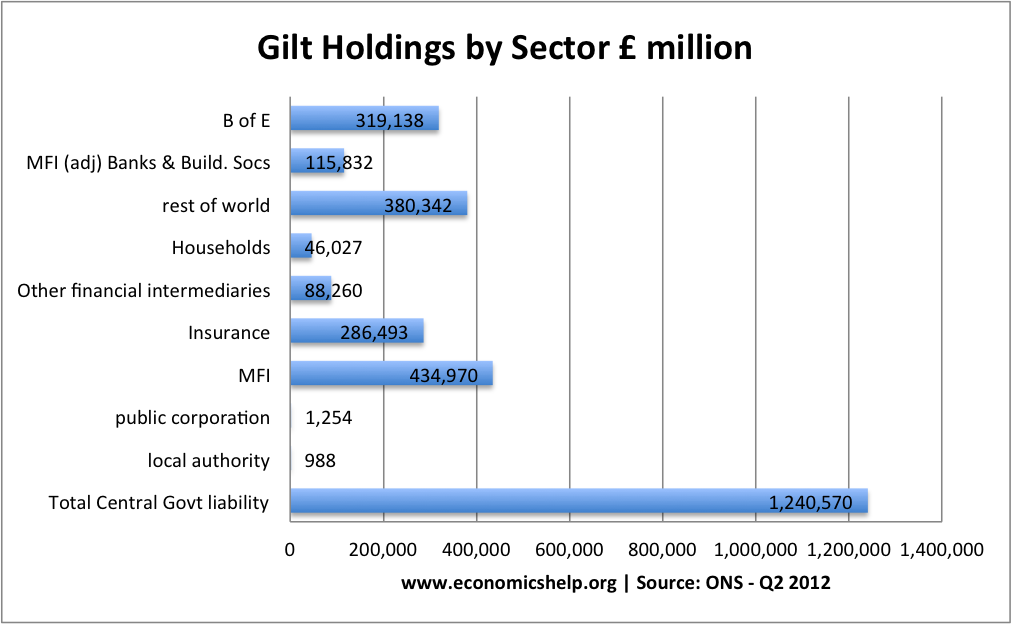

Gilt holdings by Sector £m

This data is from 2012, but it gives an indication of the scale of bond buying by the Bank of England. Since then the gilt holdings have risen. – In October 2013, the quantity of gilt holdings have risen to £374,991 mn or £374 billion. (HM Treasury)

Will the Bank of England be able to sell these gilts on the open market when the economy recovers and the Bank of England wants to reverse quantitative easing?

Firstly, I’m not entirely sure how it will go. There is no precedent for a Central Bank in the UK adopting such a policy of quantitative easing. I can only suggest there will be a few factors at play

- The Bank of England can take its time, and decide when it wants to sell. It won’t have to sell £374 billion in a short time frame. I suppose it is possible the Bank of England will never fully sell off its gilt holdings or it will allow inflation to slowly reduce the real value of the gilt holdings.

- If the Bank want to reverse quantitative easing because of economic recovery, markers are more likely to be optimistic about long term prospects for debt to GDP. Strong economic recovery will help improve the government fiscal position and so this factor will help the bond market and make it easier to sell bonds.

- But, Economic recovery generally weakens the bond market. With economic recovery people move out of ‘safe’ low risk government bonds and look for investments with a better return. With recovery, investors will take more risks in the private sector. Therefore, with economic recovery you tend to see rising bond yields, and falling bond prices. It might be difficult to sell into this market.

- Confidence and expectations of investors will be important. The reaction to the Fed’s decision to talk about possible tapering of bond buying did cause a market reaction and bond prices fell. A decision to reverse quantitative easing will cause many investors to sell in anticipation of falling bond prices. Currently, people have been buying bonds to benefit from rising prices during the period of Q.E. It depends how expectations and confidence is managed. But, if the fundamental fiscal situation is satisfactory, it will make it easier.

- On the one hand people fear UK public sector debt is too high (at 100% of GDP by 2016). But, on the other hand, we have had higher levels of debt in the past without great concern

- Bond Bubble? Some fear Q.E. has caused a bond bubble and low interest rates suggest bond prices are inflated. But, low interest rates on bond yields are to be expected in a deep recession and liquidity trap. Low bond yields are not purely due to the policy of Q.E. as some suggest.

Conclusion

I guess I don’t really know the answer to this question.

More on what happens when Q.E. ends