A look at the different economic factors that determine the price of gold

Essentially the price of gold is determined by:

- Supply of gold

- Demand for use in goods such as jewellery.

- Speculative demand to hedge against inflation and economic uncertainty.

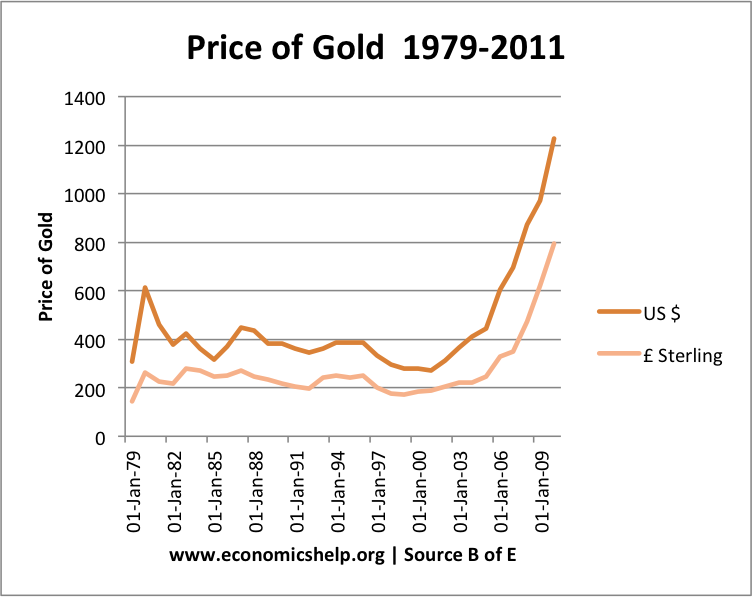

In early August 2011, gold touched $1,716.19. Adjusted for inflation, the record gold price reached $2,500 in 1980 (just over $600 in nominal terms) However, after this 1980 peak, the price of gold fell sharply.

In 1979-80, there were fears over rising inflation in the west and also political uncertainty (Soviet Union invasion of Afghanistan), But these fears failed to materialise in the 1980s and inflation was brought under control. This led to a sharp fall in the price of gold.

Inflation adjusted price of gold

The price of gold is determined by several factors. It is an important commodity in certain products such as jewellery. However, it also is seen as an important way to invest wealth – especially in times of economic uncertainty.

The world consumption of new gold produced is about 50% in jewellery, 40% in investments, and 10% in industry (excellent as conductor and resists corrosion)

Main factors affecting the price of gold

Demand for consumer goods

Markets like India have a strong demand for using gold in jewellery. Economic growth in India increases disposable income and therefore demand for gold. As gold is a luxury good (income elasticity of demand > 1) then a rise in income in India could lead to a bigger % demand for gold.

Investment

Gold is seen as a desirable element in an investment portfolio. Gold will hold its value even during inflation. At various times, investment trusts and individuals will have a greater demand for saving their wealth in the form of gold. This can lead to higher demand for gold to store wealth. This investment demand is the primary factor behind the increase in the price of gold between 2006 and 2011.

Inflation prospects

With inflation of 0%, money retains its value. However, if inflation increases to 20%, then money (notes and coins) will reduce in value. If inflation is very high, then money can soon lose all its value. Therefore in periods of high inflation, people will seek to switch out of cash and into physical assets which retain their value. The most important inflation-proof investment is seen as gold.

Note, it also depends on the real interest rate. If inflation is 6%, but interest rates are 8%, you can still protect the value of your savings in a bank. However, if you get a situation of high and volatile inflation, you are more likely to have negative real interest rates. A key issue is whether market fears inflation could get out of control.

Any prospect of hyper inflation (e.g. Germany, Zimbabwe) would cause people to store as much wealth in physical assets such as gold.

Value of the dollar

In the post-war period, the Dollar has been viewed as the dominant global currency. The dollar plays a key role in storing wealth and as a medium of exchange. Many countries keep exchange rate reserves in dollars. US dollar securities (e.g. US government bonds) are one of the most popular forms of global investment. In the past, people have been willing to buy US dollar assets because they have confidence that the US dollar will hold its value (e.g. avoid large devaluation). Therefore, if people suspect the dollar may be vulnerable, they may sell US dollar assets and look for something more secure like other currencies or gold.

Gold reserves

Central banks usually keep some of their reserves in gold. Gold doesn’t give any interest so Central banks may prefer bonds which give some interest. But, if they decide to hold more reserves in gold, demand and price will rise. Recently, China and Russia have indicated they will seek to hold more reserves in gold. Part of this may be due to China becoming more concerned about the value of its dollar assets.

Lack of safe havens

If the dollar is predicted to fall because of inflation or debt fears, investors may seek for other currencies (popular targets have included Swiss Franc and Japanese yen). However, in times of economic stagnation, countries like Japan and Switzerland are likely to try and prevent their currencies appreciate too much (makes their exports less competitive). At the moment, there are no obvious currencies to invest in. The Eurozone has great problems, the UK is weak. No-one really wants a strong currency at the moment. Therefore, as an alternative to investing in a currency, investors may buy gold.

US government borrowing

The level of US government borrowing can have an impact on the price of gold. If markets feel the US debt is projected to get out of control, there is a greater chance that the dollar will devalue and dollar assets will fall. This means people may sell dollar assets (e.g. US treasury bills) and buy gold instead.

Monetary policy / quantitative easing

Quantitative easing involves increasing the money supply. This raises the prospect of higher inflation in the future. As it happens, quantitative easing hasn’t caused inflation, the increase in bank reserves have largely been saved. But, if large economies like the US and EU engage in quantitative easing (which to some extent is untried), investors are more likely to favour gold as it gives greater security in times of unorthodox monetary policy.

Gold vs stock market

Gold is often seen as an alternative to the stock market. Buying shares can give a higher return because investors receive dividends and possible growth in share capital. However, in times of economic turmoil or recession, the value of shares tends to fall. Therefore investors may sell shares and buy gold instead. Thus fears over a recession tend to increase the value of gold as people move from more risky stock market to gold.

Speculation

Like any commodity, investors can be caught up in the mood and expectations of the moment. Rising gold prices can become self-fulfilling as investors pile into gold to take advantage of rising prices. The price of gold can be highly volatile. Some argue we are in a gold bubble when the economy returns to normal people may feel gold is highly overvalued and we could see a fall in the price of gold like the early 1980s.

Supply

A change in supply could alter the price of gold. For example, if there was a sharp increase in production, the price is likely to fall. However, the supply of gold is relatively stable. The fluctuations in price tend to occur due to changes in demand.

(Useless fact of the day, Gold can be added to food, and even has its own E-number. EU) It is completely inert to body chemicals and leaves the body unchanged.)

Readers Questions on Gold

1. During 1982-2003 the price of gold given in USD/oz hovered around 400. How come it didn’t increase slowly along with the inflation rate of the same period?

It could be many reasons. The most probable was that in 1980 when gold reached a peak, investors may have felt it was fundamentally overvalued. Therefore the 1980s and early 2000s were a period of readjustment. Also this period 1982-2003 was generally a period of economic and political stability with high positive growth. During this time, investors may have preferred assets like shares and bonds which tend to give a better return. Inflation is only one factor of many that influence gold.

Related

This is very interesting that Precious Metals will hold value in a recession.

Will the gold mining stocks also hold value or go up like the gold bullion is discussed

as a investment that will hold value, or go up in value.

So will gold mining stocks do well in recession or do poorly in recession??