The real effective exchange rate measures the value of a currency against a basket of other currencies; it takes into account changes in relative prices and shows what can actually be bought.

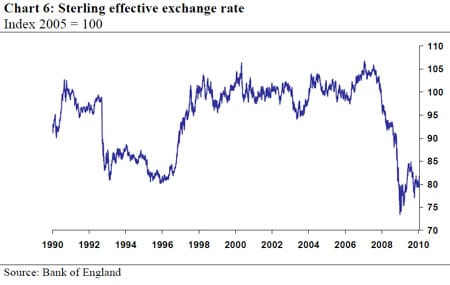

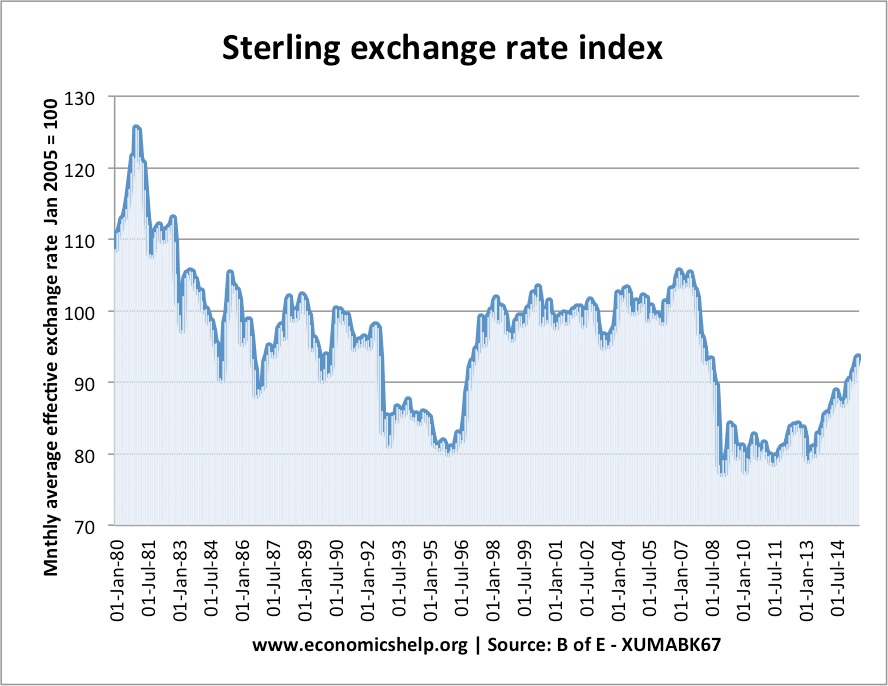

Sterling effective exchange rate index.

Nominal exchange rate

The nominal exchange rate measures the current value of a currency against another. For example, in Sept 2014

£1 – $1.61 or $1 = £0.62

Effective exchange rate

The effective exchange rate measures a currency against a basket of other currencies. This is usually trade-weighted. When looking at the effective Sterling exchange rate, we will compare the value of Sterling against our main trading partners – The Euro, the Dollar, the Yen e.t.c and give a weighting depending on how much we trade with that country, e.g. Eurozone 60%. A weighting will be given to different trading countries depending on how significant they are.

The effective exchange rate is good for looking at the overall performance of a currency. For example, the Pound may appreciate against the Dollar – but this may be due to just temporary weakness in the Dollar. However, if the overall effective exchange rate increases, it suggests the Pound is becoming stronger.

Real exchange rate

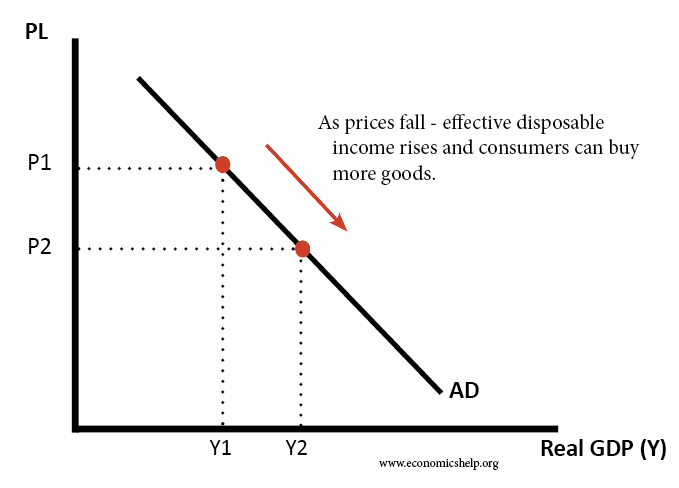

The real exchange rate measures the value of currencies, taking into account changes in the price level. The real exchange rate shows what you can actually buy. It is the value consumers will actually pay for a good.

RER = E.R *(price level in country A/Price level in country B)

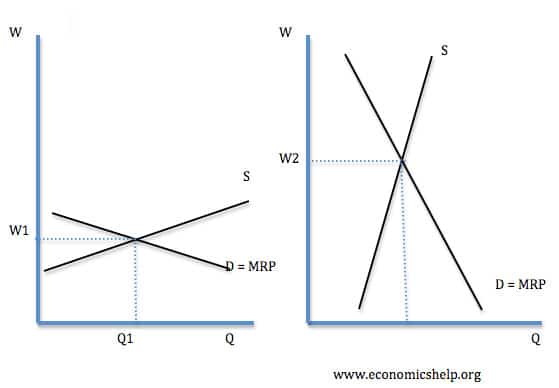

Increase in real exchange rate

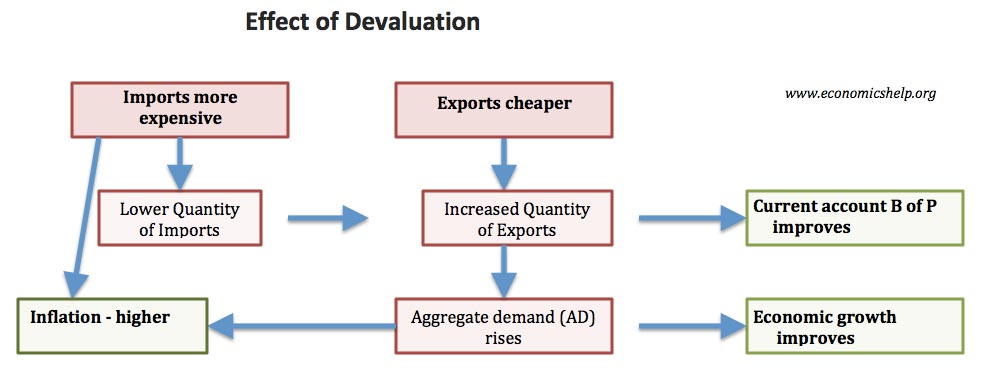

- If a countries real exchange rate is rising, it means its goods are becoming more expensive relative to its competitors.

- An increase in the real exchange rate means people in a country can get more foreign goods for an equivalent amount of domestic goods.

- Therefore an increase in the real exchange rate will tend to increase net imports. Foreigners will buy our less expensive exports. It now becomes more attractive to buy imports. This can cause a widening of the current account deficit and lower domestic AD. It will also help reduce inflation.

- Similarly, a fall in the real exchange rate should increase net exports as domestic goods are more competitive.

(Readers Question: Does an increase in Real Effective Exchange Rate increase or decreases international competitiveness for the country? An increase in the real effective exchange rate will decrease international competitiveness. It means the country has relatively more expensive exports, leading to a fall in net Ex)

Inflation and the exchange rate

If the UK experienced inflation of 10% and the US had inflation of 0%.

We would expect the nominal value of the Pound to fall 10%. In this case, the real exchange rate would stay the same.

Due to inflation, British goods are 10% more expensive, but the depreciation then reduces the prices of British exports to America – so the effective price Americans pay is the same. The number of goods you can buy stays the same.