As output falls, you would expect a rise in unemployment. If output is lower, firms will need less workers.

Okun’s law is a look at the relationship between falling output and rising unemployment. As a rough rule of thumb, in Okun’s original statement of his law, he found a 3% increase in output corresponded to a 1% decline in the rate of unemployment; a .5% increase in labor force participation; a .5% increase in hours worked per employee; and a 1 % increase in output per hours worked.

Therefore, as output falls we would expect a rise in unemployment as firms lay off workers. However, the relationship between output and unemployment can vary significantly.

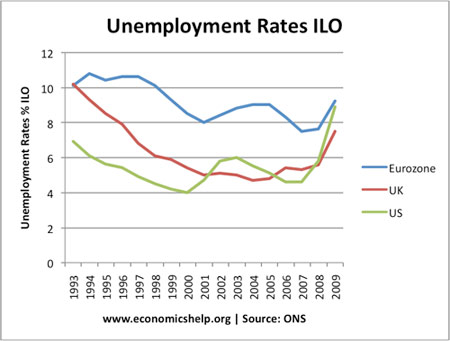

For example, falling output in the Eurozone has led to a much smaller rise in unemployment than in the US.

Reasons why Unemployment in Eurozone has risen more slowly than US

- Greater protection for Eurozone workers. More difficult to fire workers

- Government subsidies for workers working shorter hours. This encourages people to work part time, rather than full time.

- Firms keener to retain skilled workers rather than the costs of laying off workers then rehiring them.

The UK has seen a rise in numbers working part time or shorter hours. Therefore, the decline in full time employment has been greater than the rise in official unemployment.

What this means is that the forecast rise in unemployment may be less than predicted, but, when the economy recovers, it will take much longer for unemployment to fall.