The Cardboard bike needs no oil.

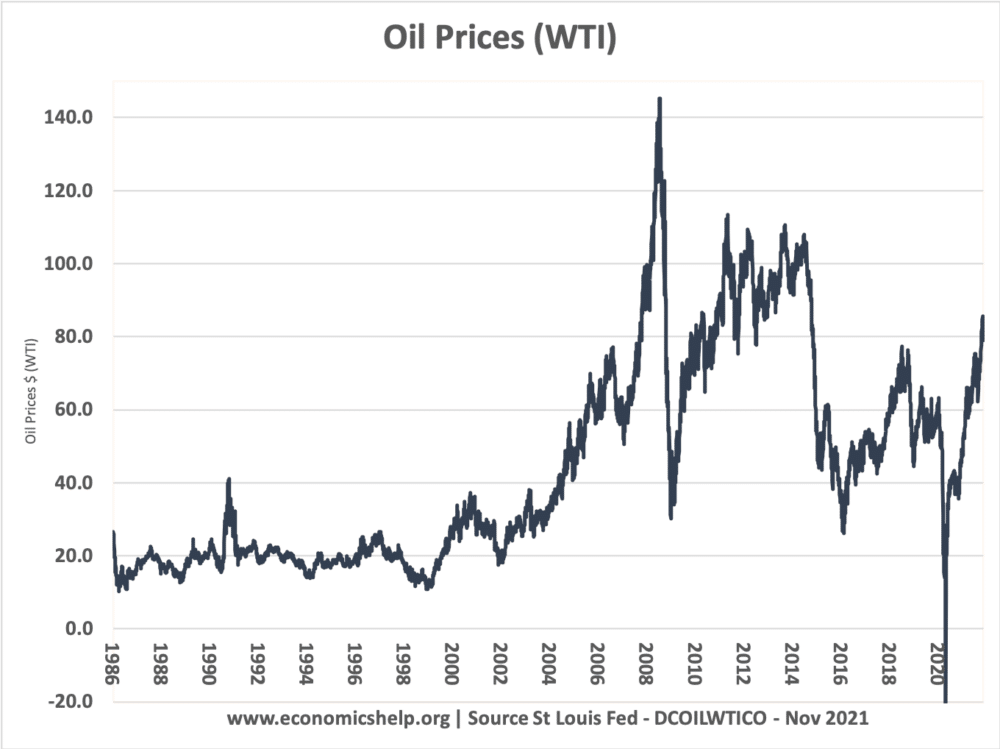

What is the best way to deal with high oil prices?

As both a motorist and cyclist, high oil prices are a mixed blessing. It now costs £6o to fill a tank of petrol; I have seen the proportion of my income spent on petrol rise considerably. However, rising oil prices have helped reduce the remorseless rise of traffic growth on the UK’s crowded roads.

Dealing With Higher Oil Prices

Cycling / Walking. As a consumer, higher oil prices increase the incentive to look for alternatives. 50% of all car journeys are under 4 miles. As an alternative to driving, walking or cycling can save considerable sums of money. In many city centres with high levels of congestion, cycling to work can also be much quicker. On this cycling blog, a former motorist tries cycling to work. As well as saving money, it was noticeably quicker. (try cycling to work) Also, cycling and walking will help improve the nations fitness and lead to lower levels of obesity.

Public Transport. For longer journeys, trains and coach travel provide alternatives. However, in UK train fares have increased above the rate of inflation. It is still cheaper to drive for most journeys. Nevertheless, if you book in advance, you can still save money on long journeys. Also, train travel gives you chance to relax or work – something you can’t do when driving.