Readers Question. EVALUATE THE LIKELY ECONOMIC EFFECTS OF A FALL IN THE UK’S COMPETITIVENESS.

I know some points, such as deficit on current account, slower economics growth etc. However, I don’t know how to evaluate and write a conclusion on this one. Can you please help me?

This is definitely the more difficult part of the exam. I think most A2 students will find some of these ideas harder to think of in an exam. Some evaluation ideas could include

1. Lower economic Growth.

Lower competitiveness makes exports less attractive, therefore there will be a fall in exports causing lower economic growth.

However.

- Economic Growth could still occur due to strong consumer demand. The UK’s manufacturing export sector has been decreasing in importance; now, it only contributes a relatively small % to the UK’s growth. In recent years, it has been consumer spending which has kept growth high (despite an increasing current account deficit)

- Does the fall in competitiveness extend to all sectors of the economy? Maybe the UK is losing competitivenes in manufacturing exports, but retains a competitive advantage in financial sector. Therefore, there is still room for growth from these other sectors.

- The fall in growth will effect some sectors and regions of the economy more than others.

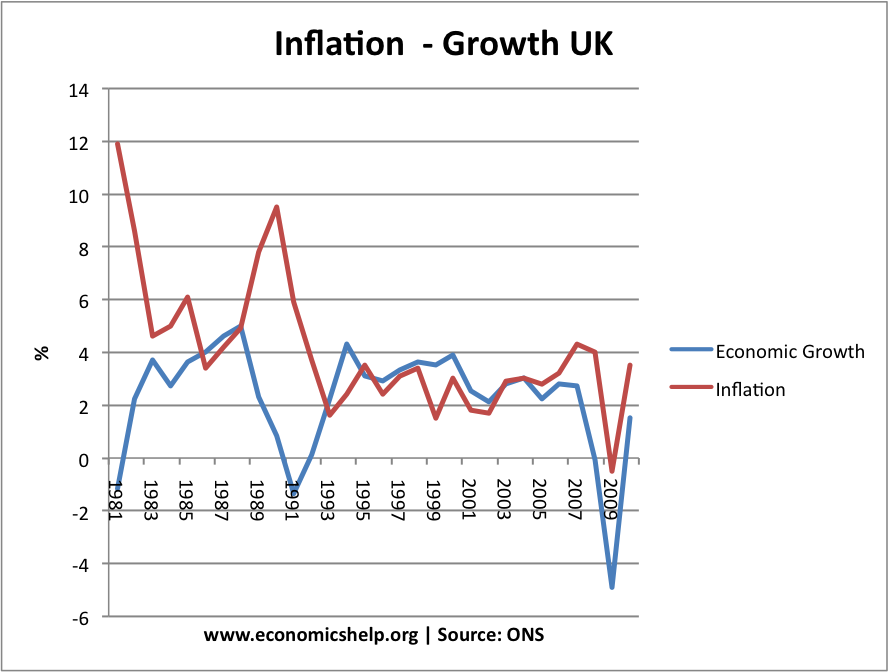

% annual change in growth and inflation.

% annual change in growth and inflation.