Readers Question: What do people mean by countries/society/financial implosion?

Financial implosion implies a serious financial crisis where a country experiences a severe economic and financial crisis. The concept of implosion suggests that a crisis in one part of the economy would have a knock on effects to other parts as well – leading to a significant decline in living standards and creating a serious of economic problems such as inflation, unemployment and rapid decline in living standards. A financial implosion could come in various forms. For example:

1. Sovereign debt crisis. If a countries government debt becomes unmanageable and the government are unable to pay back the debt, it would have to default on repayments or print money to pay back debt. If it defaulted on debt, investors would lose money and would be much more unwilling to hold onto future government bonds. If the government dealt with insolvency by printing money (e.g. Weimar Germany 1922), then it would create inflation and likely hyper-inflation. This would cause an effective default for those holding bonds.

Negative Impact of a Sovereign Debt Crisis

If a country experiences a sovereign debt crisis, it could have a serious knock-on effects for the rest of the economy.

- Individuals and financial bodies who held bonds would see a fall in the value of their savings.

- Hyperinflation – if the country responds by printing money. Hyperinflation would cause instability and wipe away people’s savings

- Capital Flight. If a country is insolvent, there is likely to be capital flight away from the country. For example, foreign investors wouldn’t want to hold on to the countries bonds any more. Even domestic investors would fear losing the value of their money and make seek to save money abroad. Therefore, there could be a sharp fall in the exchange rate and a fall in living standards as imports become more expensive.

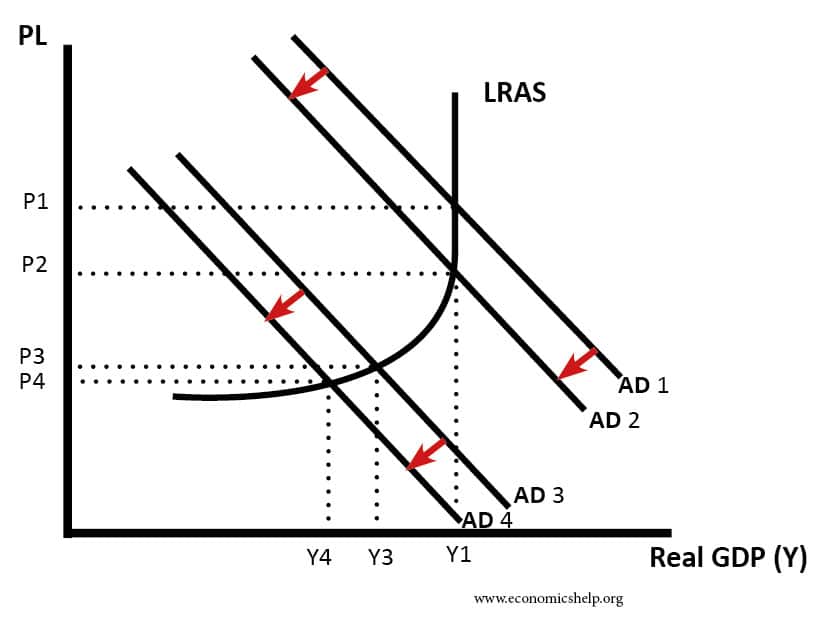

- Austerity policies. As a consequence of a sovereign debt crisis, the government would be forced to cut government spending rapidly and or increase taxes. This would lead to unemployment and a fall in aggregate demand. Therefore, it could push the economy into recession – making the government’s budget position worse (due to falling tax revenues). To a large extent, Eurozone economies are facing this kind of deflationary debt spiral – efforts to slash budget deficits are causing a rapid fall in economic growth. In a country like Greece, there is a strong element of economic implosion – policies to deal with the crisis are only making it worse – it is hard to see a way out. (the tragedy of Greece)