The essential element of Keynesian economics is the idea the macroeconomy can be in disequilibrium (recession) for a considerable time. To help recover from a recession, Keynesian economics advocates higher government spending (financed by government borrowing) to kickstart an economy in a slump.

Keynesian economics includes

- Disequilibrium in macroeconomy (insufficient demand)

- Imperfect labour markets (e.g. sticky wages)

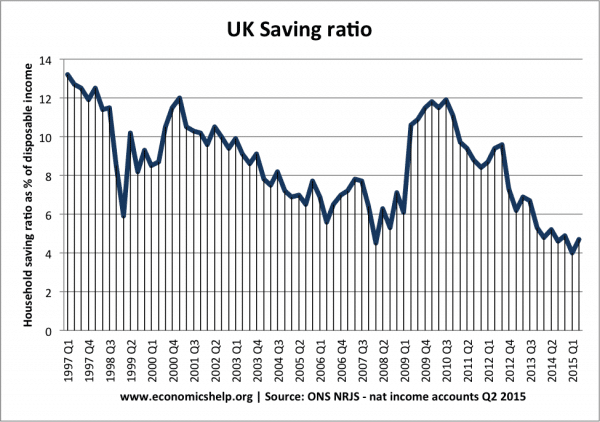

- Paradox of thrift (in recession, individuals save more, but this worsens the economic downturn

- Liquidity trap. When low-interest rates fail to boost demand.

- Importance of confidence to the economic cycle.

- Deficit spending. In a recession, Keynes advocated government borrowing to provide an injection of demand into the economy.

What Keynesian economic is not

- Keynes did not advocate a Socialist state, where government-controlled the means of production

- Keynes did not advocate allowing higher inflation. During periods of growth, Keynes argued inflation should be kept under control.

- Welfare State. Keynes did not necessarily advocate higher government spending as a % of GDP. He argued spending should increase only in an economic downturn.

Theory behind Keynesian economics

1. If saving exceeds investment, we get a recession

Classical theory suggested any fall in investment would lead to lower interest rates; this fall in interest rates would reduce saving, increase investment and cause the economy to return to a new equilibrium of full employment. However, Keynes’ analysis suggests this is unlikely to occur, due to a number of factors, such as a liquidity trap and the general glut of savings.

Why Keynes felt recessions could last a long time

- Liquidity Trap. A liquidity trap is when low-interest rates fail to boost demand. For example, if confidence is very low, people won’t borrow – even though it is cheap. Also, very low-interest rates can make banks unprofitable, so they reduce lending.

- General glut. If saving is high and consumer spending low, firms will have a lot of unsold goods. In this climate, they will cut back on investment.

- Animal spirits. If there is an initial fall in investment, businessmen may have negative confidence. Their ‘animal spirits fear recession and lower profits, so they cut back on investment. Consumer confidence may be adversely affected, and they spend less too. Thus Keynes emphasised the importance of expectations and confidence.

- Negative multiplier effect. Keynes popularised the idea of a multiplier effect. The idea that a fall in injections into the economy has a knock-on effect and the final impact may be greater than the initial. If a firm reduces investment, people lose their jobs, and this higher unemployment leads to lower spending and affects everyone in the economy.

- A paradox of thrift. In a recession, people take a rational approach to be risk-averse – fearing a possible recession, they increase savings and spend less. When this lower spending is aggregated, it leads to lower overall demand in the economy.

- Lower interest rates may not increase consumption very much because – the income effect of lower interest rates mean people have less income.

2. Sticky wages

According to classical economic theory, labour markets should clear. In this model, any unemployment is due to wages being artificially kept above the equilibrium through minimum wages e.t.c. (real wage unemployment) According to classical theory, the solution to unemployment is to cut wages and allow wages to clear. However, Keynes argued this was unsatisfactory.

- Firstly, even in the absence of unions and minimum wages, workers would resist nominal wage cuts.

- Secondly, a cut in wages wouldn’t necessarily solve disequilibrium. Lower wages would further depress income and spending, leading to lower aggregate demand, and therefore lower demand for labour.

Keynes’ contribution was to show the interaction between labour markets and the national economy, and not treat the labour market in isolation (e.g. from micro perspective). It is this macro perspective on savings and labour markets that led to the creation of macroeconomics.

Keynes theory on impact of falling wages was to a large extent supported by Irving Fisher in his Debt-Deflation Theory of Great Depressions (1933)

3. Importance of Aggregate Demand (AD)

An important classical assumption of the day was Say’s law. This stated that supply creates demand. However, Keynes believed the opposite was true. Keynes argued – demand determines the level of national output.

Policy implications of Keynesianism

1. Governments should provide counter-cyclical demand management.

Keynes was critical of the UK 1931 budget, which cut wages for hospital workers, and cut back spending on roads and new houses. He argued this would depress demand further and make the recession worse. Instead, he advocated higher government spending financed by higher borrowing.