Supply is price inelastic if a change in price causes a smaller percentage change in supply.

(PES of less than one)

Example of inelastic supply –

Price of rents falls by 20%; Q.Supply declines by 1%. PES = 0.05

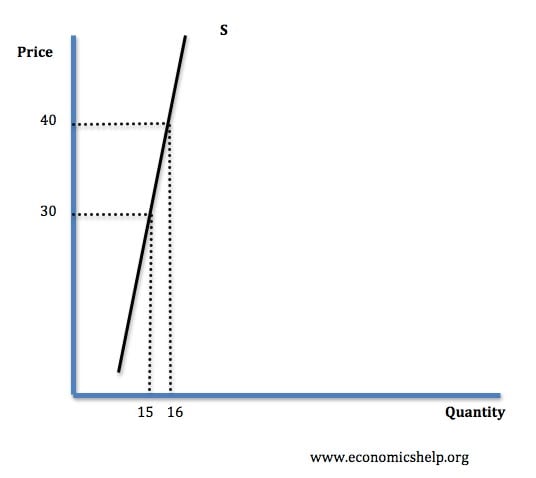

Diagram of inelastic supply

In this case, an increase in price from £30 to £40 has led to an increase in quantity supplied from 15 to 16.

- % change in price = 10/30 = 33.3%

- % change in supply = 1/15 = 6.66%

- Therefore price elasticity of supply (PES) = 6.6/33.3 = 0.2

With a PES of 0.2, it is inelastic because PES is less than one.

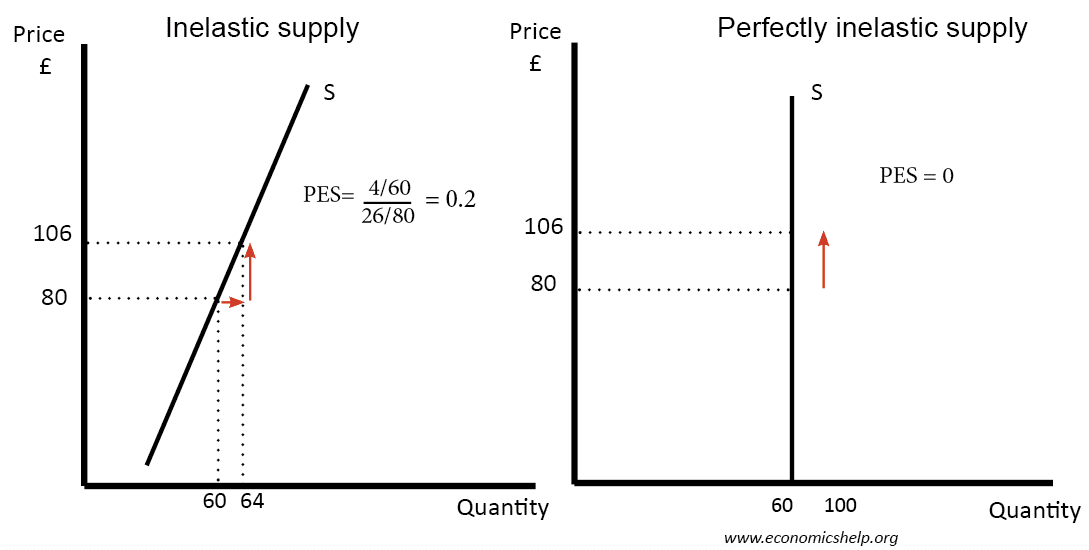

Example 2

Supply curve on right – perfectly inelastic

Supply on left PES = 0.2 (inelastic

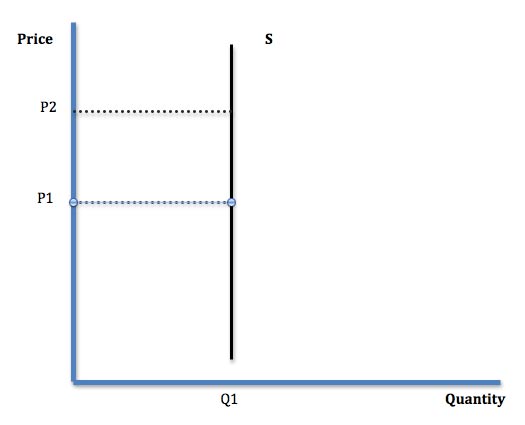

Perfectly inelastic supply

Perfectly inelastic supply occurs when a change in price does not affect the quantity supplied.

Factors that make supply inelastic

Usually if the price increases, the firm would like to supply more. The good becomes more profitable. However, there may be several factors which make it difficult for the firm to supply more. Therefore supply is price inelastic.

- Firm operating close to full capacity. If a firm is operating close to full capacity, then it has limited ability to increase the supply. It may be able to get workers to do some overtime, but at some point, it will meet capital limits, and it cannot increase supply without long-term capital investment.

- Running out of raw materials. There will come a time when we run out of raw materials – oil, natural gas. When this occurs, the supply will be inelastic because it is physically impossible to increase supply.

- Short term. Supply will be more inelastic in the short-term. In the short-term capital is fixed. It takes time to invest and increase the size of a factory. However, in the long-term, farmers can cultivate more land or firms can increase the size of their factory and supply will become more responsive.

- Limited factors of production. Some firms may come across labour constraints, especially if the work requires highly skilled labour. For example, the supply of extra maths lessons may be limited by the ability to employ sufficiently skilled maths teachers.

- Low levels of stocks. If firms can stockpile goods, then they can respond to increases in demand and price. However, some goods cannot be stored, e.g. intangible services or food with short shelf-life like tomatoes and bananas.

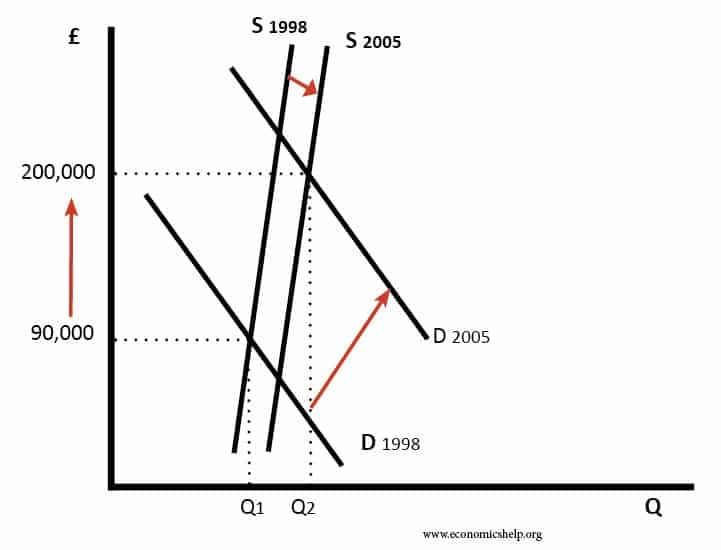

- Planning restrictions. Homes are often supply inelastic because in certain areas it is hard to find suitable land or get planning permission to build more houses.

Importance of inelastic supply

- High prices. If supply is inelastic, it may be easier for firms to put up prices. For example, the supply of rented accommodation in London is inelastic because it is hard to find new places to build property. But, with inelastic supply and rising demand, this has pushed up the price of housing and rented accommodation.

- Planning. Supply is usually inelastic in the short-term. Therefore, it requires forward planning by the firm to increase supply in anticipation of future demand. However, this can be difficult to do, and there is a risk that a firm invests, but the demand fails to materialise.

- Volatile prices. In markets where supply and demand are inelastic, we are likely to see more volatile prices. This may require government intervention to stabilise prices, through a scheme, such as buffer stocks. See: Volatile prices.

Related

please make revisions

which can be more helpful to cope with

economics syllabus of Uganda

????

powerful good information

Why is supply of housing inelastic?

Because people must have a place to live, so if the price rises it doesn’t really affect the demand because people would (in theory) spend less in other goods to keep their homes. =)

No ! It is because the land is very limited as a resource. So, when the resources are very limited like land, then the supply is usually inelastic as they can’t simply produce more.

The first answer by Lala is still correct! Land is not the same as housing. Land is a production factor (input) for housing. Housing is an output which has land, capital and labor (technology) as inputs. The supply of land may be fixed and limited, but it still may not have significant effect on the supply of housing if we assumed that some sort of technology exist. For example, with advanced engineering and building technology more housing units can be produced in a fixed piece of land (such as high-rise apartment buildings). In this case, the elasticity of house prices is determined more by the demand for housing rather than the supply of the factor inputs such as land.

And the supply is inelastic because landlords would prefer to rent for less than not rent at all, therefore the supply is not very affected by pricing.

Also, increasing housing supply much (building a neighborhood of houses or an apartment building) is a complicated and expensive process that can be quite time consuming and resource-heavy, so it’s very difficult to increase supply much in the short term.

I wish you added the solutions to how government could attempt to make supply more responsive to price and demand changes and the ineffectiveness of those attempts.

If there are less substitutes in market then price inelastic or elastic?

what are the measures that can be used to increase price elasticity of supply?

what are the measures that can be used to increase price elasticity of supply of essential products?

would insulin be in the inelastic supply category?

Can I use it as an example for both inelastic supply and demand? If not do you have any examples of goods which have inelastic supply and demand?

The https://www.economicshelp.org is the best among http://www.economicsdiscussion.net, courses.lumenlearning.com, http://www.insvestopedia.com, and the http://www.tutor2u.net!